India Online Video Platform Market Size, Share, Trends and Forecast by Model Type, Application, Product Type, and Region, 2025-2033

Market Overview:

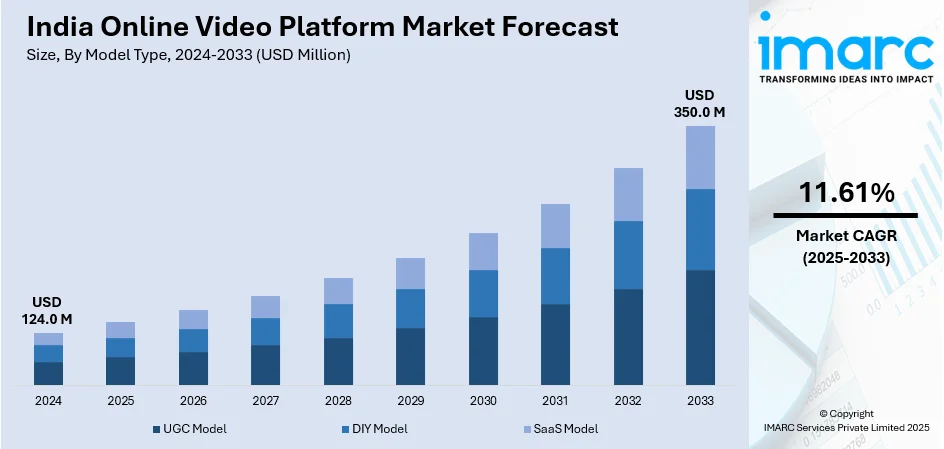

The India online video platform market size reached USD 124.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 350.0 Million by 2033, exhibiting a growth rate (CAGR) of 11.61% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 124.0 Million |

|

Market Forecast in 2033

|

USD 350.0 Million |

| Market Growth Rate (2025-2033) | 11.61% |

Online video platform (OVP) is a digital solution that enables users to stream video content and upload self-produced material over the cloud or the internet. It also manages the uninterrupted delivery of content to the audience around the world. A considerable amount of OVP viewership is generated through various mobile devices, like smartphones and tablets, using dynamic HTML players that allow viewers to access live or pre-uploaded material.

To get more information on this market, Request Sample

In India, the rising internet penetration and increasing usage of smartphones, smart televisions, tablets and personal computers are propelling the market growth. The rapid digitization, coupled with the growing popularity of on-demand online video streaming, is also contributing to the growth of the market. Besides this, with the advent of digital marketing, OVP has become one of the most common advertising means around the country. It is extensively used by various brands to create a market presence in India while providing information to the consumers in an interactive manner. Moreover, the emerging trend of live streaming is aiding the management and delivery of video content to the targeted audience in a cost-effective way. Due to this, several e-commerce companies are utilizing live videos on platforms such as Facebook, YouTube and Instagram to endorse their products. Furthermore, the growing adoption of technologies, such as blockchain, artificial intelligence and cloud-based video streaming solutions, has helped improve video streaming, thereby providing a positive impact on the industry.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India online video platform market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on model type, application and product type.

Breakup by Model Type:

- UGC Model

- DIY Model

- SaaS Model

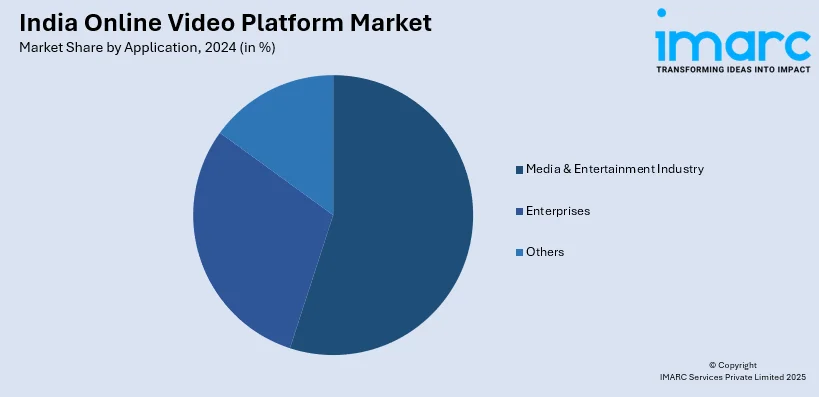

Breakup by Application:

- Media & Entertainment Industry

- Enterprises

- Others

Breakup by Product Type:

- Software

- Services

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Model Type, Application, Product Type, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India online video platform market was valued at USD 124.0 Million in 2024.

We expect the India online video platform market to exhibit a CAGR of 11.61% during 2025-2033.

The increasing internet penetration, along with the rising need for online video platforms by brands to create a market presence and provide information to their customers in an interactive manner, is primarily driving the India online video platform market.

The sudden outbreak of the COVID-19 pandemic has led to the elevating adoption of numerous online video platforms, such as YouTube, Netflix, Amazon Prime, etc., as a means of indoor entertainment, during the lockdown scenario across the nation.

Based on the model type, the India online video platform market can be categorized into UGC model, DIY model, and SaaS model. Currently, UGC model accounts for the majority of the total market share.

Based on the application, the India online video platform market has been segregated into media & entertainment industry, enterprises, and others. Among these, enterprises currently exhibit a clear dominance in the market.

Based on the product type, the India online video platform market can be bifurcated into software and services. Currently, services hold the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where North India currently dominates the India online video platform market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)