India Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2025-2033

India Online Travel Market Overview:

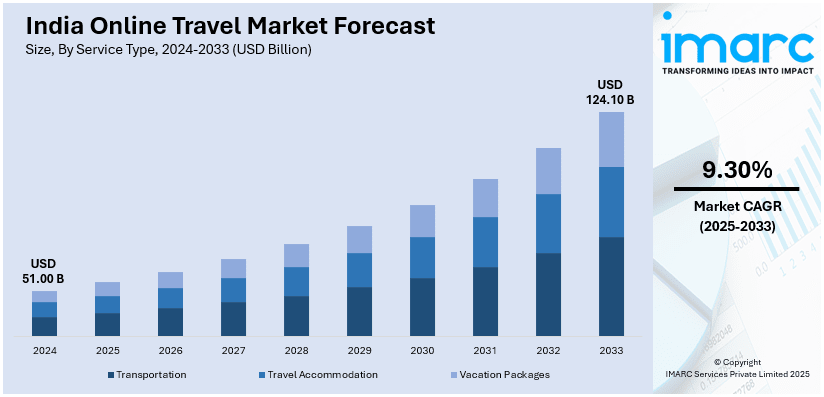

The India online travel market size reached USD 51.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 124.10 Billion by 2033, exhibiting a growth rate (CAGR) of 9.30% during 2025-2033. The market is growing rapidly driven by mobile-first usage, rising internet access in smaller cities, and demand for personalized experiences. Flexible bookings, digital payments, and app-based convenience are shaping consumer behavior and platform competition.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 51.00 Billion |

| Market Forecast in 2033 | USD 124.10 Billion |

| Market Growth Rate 2025-2033 | 9.30% |

India Online Travel Market Trends:

Rise in Hyper-Personalization

Hyper-personalization is becoming central to user engagement in the online travel ecosystem. Platforms are using machine learning algorithms to analyze browsing patterns, past bookings travel duration and budget preferences to offer tailored suggestions in real-time. This trend is significantly influencing the India online travel market share as users increasingly expect experiences that match their specific interests. For instance, in March 2025, MakeMyTrip launched ‘Collections’ an AI-powered feature that personalizes hotel and homestay recommendations. Available in over 30 major destinations it categorizes accommodations based on user preferences, past searches and booking patterns ensuring tailored suggestions for different traveler types from luxury to budget-conscious options. Personalized homepages, dynamic pricing and customized travel packages based on individual behavior are improving conversion rates and customer retention. Some platforms are also integrating user-generated content, social media inputs and peer reviews to refine recommendations further. Weekend getaway prompts, loyalty-based upgrades and trip extensions based on predictive analytics are boosting average order value. As travel becomes more experience-driven hyper-personalization helps platforms reduce churn and increase wallet share.

To get more information on this market, Request Sample

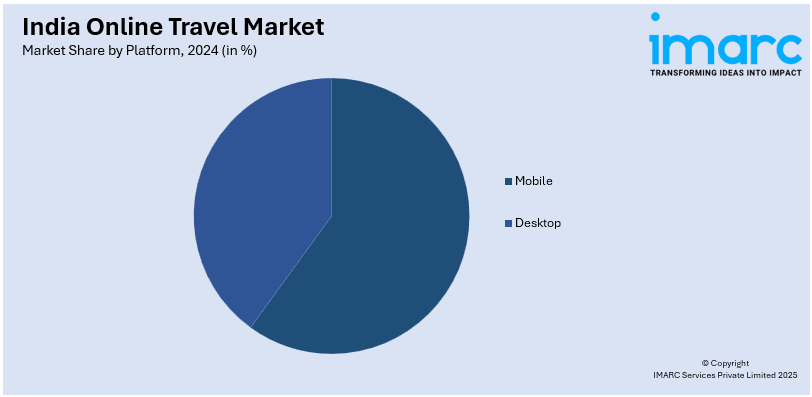

Increase in Mobile-First Bookings

Mobile-first bookings are redefining how Indian consumers plan and manage their travel. The surge in smartphone usage and affordable data is directly contributing to India online travel market growth making apps the preferred interface for bookings. From flights and hotels to last-minute train tickets and local experiences travelers are completing transactions entirely through mobile platforms. For instance, in March 2025, Country Holidays Travel India launched an innovative travel portal and Hotels & Flights API transforming vacation planning. The user-friendly platform integrates advanced technologies like AI and blockchain for secure personalized travel experiences. It also enhances mobile access and customer support promoting convenience for both travelers and industry partners. Features like instant payment, real-time updates, one-click rebooking, and mobile-only discounts are increasing user stickiness. Travel companies are investing heavily in optimizing app interfaces with voice search, vernacular language support and AI chatbots to serve a broader audience. Push notifications for flash sales and location-based offers further enhance engagement. With digital penetration rising in tier 2 and tier 3 cities mobile platforms are enabling travel access at scale. As app-based services become the industry norm they are expected to create a positive India travel market outlook.

India Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

A detailed breakup and analysis of the market based on the mode of booking have also been provided in the report. This includes online travel agencies (OTAs), and direct travel suppliers.

Age Group Insights:

- 22–31 Years

- 32–43 Years

- 44–56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22–31 years, 32–43 years, 44–56 years, and above 56 years.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Online Travel Market News:

- In February 2025, Stayflexi launched Bookflexi, a mobile app tailored for last-minute travelers, allowing users to secure hotel rooms at up to 50% off within three days. The app features secret deals and negotiation options, helping hotels fill unsold inventory while providing affordable options for travellers in major Indian cities.

- In August 2024, Thomas Cook India and SOTC Travel launched a Customer Self-Service (CSS) app enhancing the post-booking experience for travelers. Available on iOS and Android the app simplifies access to booking details, travel documents and real-time updates, achieving 50% customer adoption since its pilot in April 2024.

India Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Booking Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22–31 Years, 32–43 Years, 44–56 Years, Above 56 Years. |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India online travel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online travel market in India was valued at USD 51.00 Billion in 2024.

The India online travel market is projected to exhibit a CAGR of 9.30% during 2025-2033, reaching a value of USD 124.10 Billion by 2033.

The market is driven by lifestyle shifts favoring independent planning, ease of digital access, and the appeal of instant bookings. Consumers are increasingly valuing flexibility, personalization, and convenience in travel arrangements. Growing trust in online platforms and simplified interfaces is encouraging more users to plan trips, compare options, and transact through web and mobile apps.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)