India Online Insurance Market Size, Share, Trends and Forecast by Insurance Type, Enterprise Size, and Region, 2025-2033

India Online Insurance Market Overview:

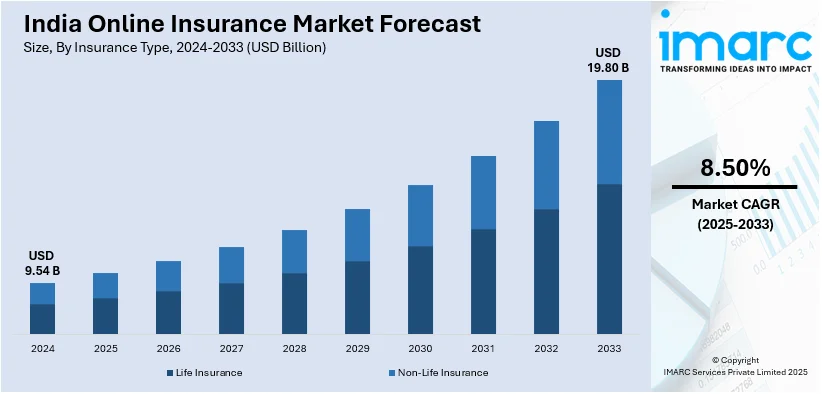

The India online insurance market size reached USD 9.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.80 Billion by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The market is propelled by rising internet penetration, growing smartphone adoption, and a consumer shift toward digital platforms. Additionally, factors such as convenience, policy transparency, regulatory support, and innovative digital solutions further drive the transition to online insurance purchases.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.54 Billion |

| Market Forecast in 2033 | USD 19.80 Billion |

| Market Growth Rate 2025-2033 | 8.50% |

India Online Insurance Market Trends:

Rise of Embedded Insurance Solutions

Embedded insurance is reshaping India’s online insurance market by integrating policies within digital platforms like e-commerce, ride-hailing, travel, and fintech services. This seamless approach enables users to purchase insurance during transactions, providing contextual coverage at the point of need. The ease of one-click purchase, low premiums, and personalized offerings make it attractive to India’s digitally engaged consumers. Additionally, it enhances customer acquisition and streamlines distribution for insurers. India, the second-largest Insurtech market in the Asia-Pacific region, accounts for 35% of the $3.66 billion in venture investments across the sector. As more digital ecosystems adopt embedded insurance, it is becoming a key growth driver, increasing penetration in underserved segments, improving accessibility, and integrating insurance seamlessly into everyday digital interactions. This trend is expanding market reach and accelerating financial inclusion.

To get more information on this market, Request Sample

Growth in Usage-Based and Personalized Insurance Products

Usage-based insurance (UBI) and customized insurance products are making headlines in the Indian online insurance sector. Facilitated by telematics, artificial intelligence (AI), and big data analytics, insurers are now able to gauge individual behavior and provide premiums based on customer risk profiles. For instance, with motor insurance, driving behavior like speed, braking intensity, and distance covered decides the policy price. In the same vein, health and life insurance companies are including wellness metrics and lifestyle information to create dynamic policies. This personalization trend raises customer interaction, promotes healthier living, and supports fairness in premium charges. It also assists insurers in managing risks more effectively and increasing customer loyalty. The increased need for customized, data-driven insurance products is transforming conventional underwriting practices and fueling digital innovation.

Expansion of Digital Ecosystem Partnerships and Insurtech Collaboration

Strategic collaborations between insurers and insurtech startups are transforming India’s online insurance market. Traditional insurers are integrating AI chatbots, paperless KYC, claim automation, and smart underwriting through partnerships with technology-driven startups. These alliances enhance efficiency, reduce turnaround times, and improve customer experience. The Indian insurtech sector has grown 12-fold, reaching $750 million in 2023, with the top nine startups contributing 85% of sector revenue. Insurers are also expanding into digital ecosystems such as neobanks, e-wallets, and financial super apps to increase reach and offer bundled services. This ecosystem-driven approach boosts product visibility and accessibility. The synergy between legacy insurers and insurtech players is accelerating digital transformation, fostering innovation, and creating agile business models aligned with India’s tech-savvy insurance buyers.

India Online Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on insurance type and enterprise size.

Insurance Type Insights:

- Life Insurance

- Non-Life Insurance

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes life insurance, and non-life insurance.

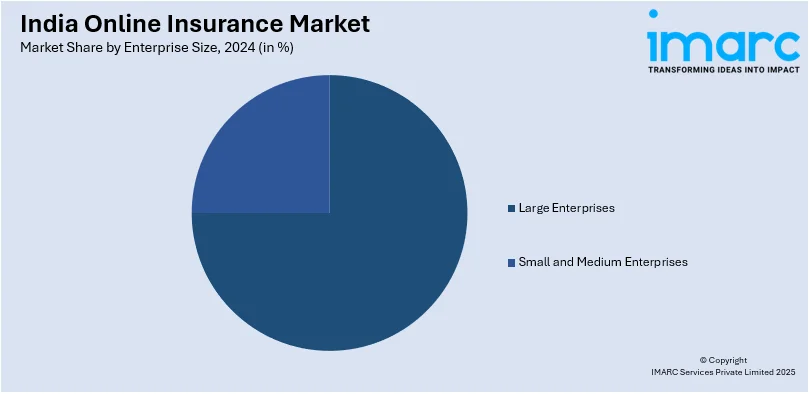

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises, and small and medium enterprises.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Online Insurance Market News:

- In October 2024, Bima Sugam, a comprehensive digital insurance platform, is set for launch, according to IRDAI Chairperson Debasish Panda. Announced on Tuesday, the initiative aims to streamline insurance services and enhance customer convenience through a unified digital interface. Designed to simplify policy purchases, claims, and renewals, Bima Sugam is expected to transform the insurance ecosystem by offering seamless access to multiple insurers and products under one platform.

- In October 2024, InsuranceDekho is reportedly in advanced talks to merge with RenewBuy in a cash-and-stock deal, potentially valuing the combined entity at ₹8,000 crore. The merger aims to create a dominant player in the online insurance distribution space. InsuranceDekho may be valued at ₹5,000 crore and RenewBuy at ₹3,000 crore. RenewBuy stated that discussions are at an early stage, but the merger could establish a category-leading, consolidated insurance platform.

India Online Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Life Insurance, Non-Life Insurance |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India online insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India online insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India online insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online insurance market in India was valued at USD 9.54 Billion in 2024.

The India online insurance market is projected to exhibit a CAGR of 8.50% during 2025-2033, reaching a value of USD 19.80 Billion by 2033.

The growth of India online insurance market is fueled by increasing internet and smartphone usage, consumer preference for digital convenience, supportive regulations, and innovative digital solutions enhancing accessibility and transparency in policy management.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)