India Off-the-Road Tire Market Size, Share, Trends and Forecast by Vehicle Type, Tire Type, End Use, Distribution Channel, Rim Size, and Region, 2025-2033

Market Overview:

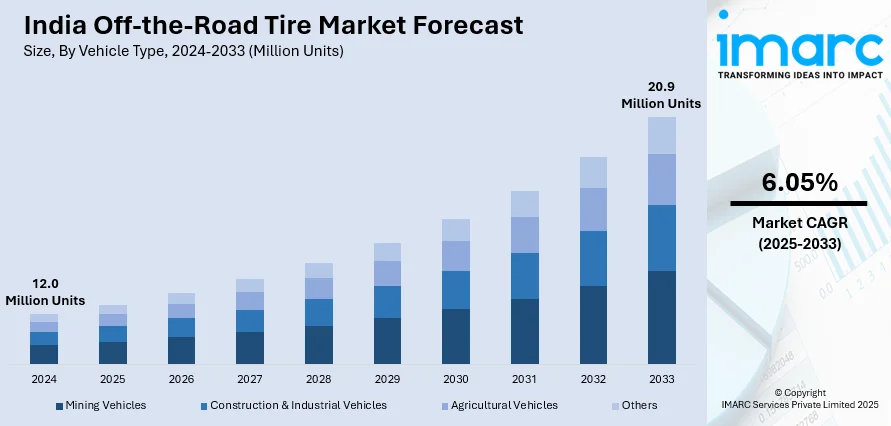

The India off-the-road tire market size reached 12.0 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 20.9 Million Units by 2033, exhibiting a growth rate (CAGR) of 6.05% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 12.0 Million Units |

| Market Forecast in 2033 | 20.9 Million Units |

| Market Growth Rate (2025-2033) | 6.05% |

Off-the-road (OTR) tires refer to the deeply treaded tires that provide high traction over uneven surfaces, including rock, mud, loose dirt, or gravel. These tires are widely installed in numerous vehicles, including cranes, wheel loaders, telescopic handlers, tractors, all-terrain vehicles (ATVs), military trucks, specialized purpose vehicles, etc. OTR tires provide high heat and rolling resistance, better durability, enhanced vehicular performance, optimum stability, easy mobility, and reduced contact patch area. As a result, they are widely adopted across various sectors, including construction, mining, recreation, agriculture, etc.

To get more information on this market, Request Sample

In India, a significant growth in the construction industry has led to increasing infrastructural development activities across diverse geographic locations. Owing to this, there is a growing demand for heavy-duty construction vehicles which is further catalyzing the market for OTR tires. Additionally, the Indian government is heavily investing in the development of various commercial infrastructures across the country, such as highways, power supply grids, bridges, dams, etc., thereby augmenting the demand for OTR tires. In line with this, the elevating levels of urbanization are also driving the adoption of OTR-based cranes, lorries, trucks, etc., in the construction of modern housing complexes, corporate offices, educational facilities, retail centers, etc. Moreover, the expanding agriculture industry in the country has led to the increasing penetration of automated machinery and farm mechanization solutions. The growing adoption of OTR tire-based tractors and loaders in agricultural farms is positively influencing the market in India. Apart from this, a significant growth in the recreational sector has led to the rising deployment of OTR tires in dirt bikes, quads, ATVs, etc. Moreover, the increasing integration of advanced sensor-based technologies with OTR tires for monitoring tire pressure and temperature is further expected to drive the market growth in India over the forecast period.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India off-the-road tire market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on vehicle type, tire type, end use, distribution channel and rim size.

Breakup by Vehicle Type:

- Mining Vehicles

- Construction & Industrial Vehicles

- Agricultural Vehicles

- Others

Breakup by Tire Type:

- Radial Tire

- Bias Tire

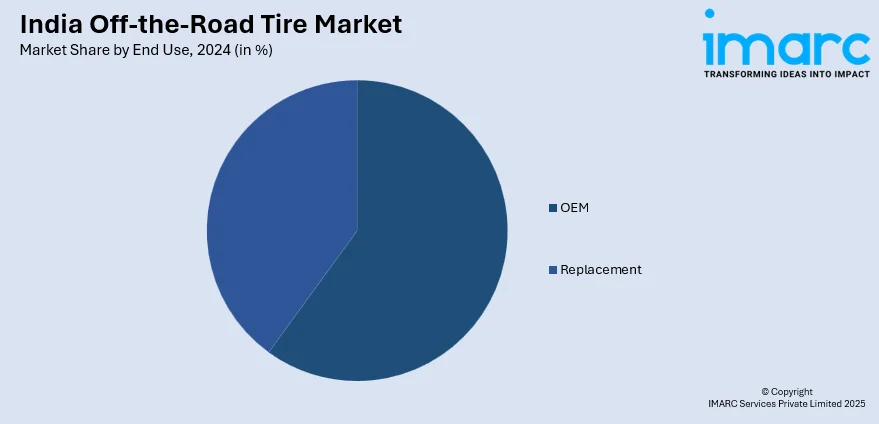

Breakup by End Use:

- OEM

- Replacement

Breakup by Distribution Channel:

- Online

- Offline

Breakup by Rim Size:

- Below 24 inches

- 24-30 inches

- 31-35 inches

- 36-39 inches

- 40-50 inches

- 51-55 inches

- Above 56 inches

Breakup by Region:

- North India

- South India

- East India

- West & Central India

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players being Apollo Tyres Limited, Balkrishna Industries Limited, Bridgestone Corporation, CEAT Limited, Continental AG, JK Tyre & Industries Limited, Michelin, MRF Limited, The Goodyear Tyre & Rubber Company and The Yokohama Rubber Co. Ltd.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, Million Units |

| Segment Coverage | Vehicle Type, Tire Type, End Use, Distribution Channel, Rim Size, Region |

| Region Covered | North India, South India, East India, West & Central India |

| Companies Covered | Apollo Tyres Limited, Balkrishna Industries Limited, Bridgestone Corporation, CEAT Limited, Continental AG, JK Tyre & Industries Limited, Michelin, MRF Limited, The Goodyear Tyre & Rubber Company and The Yokohama Rubber Co. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India off-the-road tire market reached a volume of 12.0 Million Units in 2024.

We expect the India off-the-road tire market to exhibit a CAGR of 6.05% during 2025-2033.

The increasing integration of numerous sensor-based technologies with OTR tires, as they proactively address any potential hazards by providing real-time data analysis, is primarily driving the India off-the-road tire market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of various manufacturing units for vehicles, thereby negatively impacting the Indian market for off-the-road tires.

Based on the vehicle type, the India off-the-road tire market has been divided into mining vehicles, construction & industrial vehicles, agricultural vehicles, and others. Among these, construction & industrial vehicles currently hold the majority of the total market share.

Based on the tire type, the India off-the-road tire market can be segmented into radial tire and bias tire. Currently, bias tire exhibits a clear dominance in the market.

Based on the end use, the India off-the-road tire market has been categorized into OEM and replacement, where OEM currently accounts for the largest market share.

Based on the rim size, the India off-the-road tire market can be bifurcated into below 24 inches, 24-30 inches, 31-35 inches, 36-39 inches, 40-50 inches, 51-55 inches, and above 56 inches. Currently, 24-30 inches exhibit a clear dominance in the market.

On a regional level, the market has been classified into North India, South India, East India, and West & Central India, where North India currently dominates the India off-the-road tire market.

Some of the major players in the India off-the-road tire market include Apollo Tyres Limited, Balkrishna Industries Limited, Bridgestone Corporation, CEAT Limited, Continental AG, JK Tyre & Industries Limited, Michelin, MRF Limited, The Goodyear Tyre & Rubber Company, and The Yokohama Rubber Co. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)