India Off-Road Vehicles Market Size, Share, Trends and Forecast by Product, and Region, 2025-2033

India Off-Road Vehicles Market Size and Share:

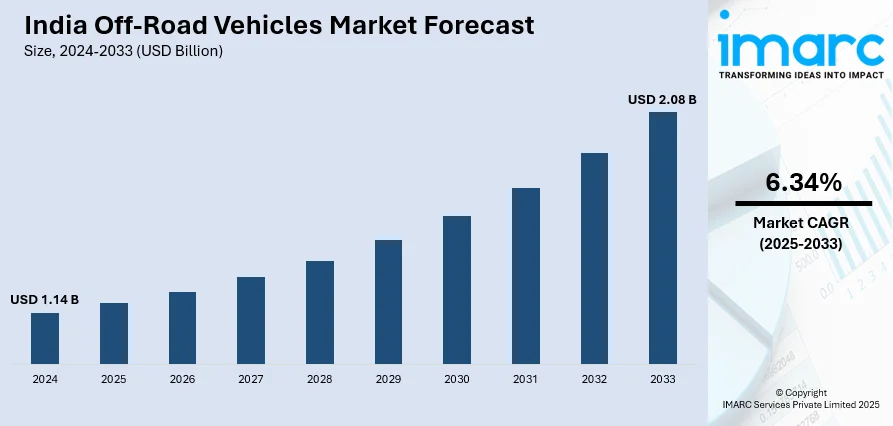

The India off-road vehicles market size reached USD 1.14 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.08 Billion by 2033, exhibiting a growth rate (CAGR) of 6.34% during 2025-2033. The market is expanding due to the rising demand in agriculture, construction, and adventure tourism. Increasing infrastructure projects and government initiatives for rural mobility drive growth. Key players focus on technological advancements and electric off-road vehicle development to enhance market competitiveness, thereby contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.14 Billion |

| Market Forecast in 2033 | USD 2.08 Billion |

| Market Growth Rate (2025-2033) | 6.34% |

India Off-Road Vehicles Market Trends:

Growing Demand for Utility and Recreational Off-Road Vehicles

India’s off-road vehicles (ORV) market is witnessing rising demand for both utility and recreational applications. The expansion of infrastructure projects, mining operations, and agricultural mechanization is driving the adoption of all-terrain vehicles (ATVs) and utility task vehicles (UTVs). For instance, as per the Press Information Bureau, National Highway network across India witnessed expansion of 1,46,145 km during 2024, up from 91,287 km in 2014. In line with this, 18,926 km of roads are successfully completed under the Bharatmala Pariyojana by 2024 November. Moreover, farmers and industrial users are increasingly investing in ORVs to enhance efficiency in rough terrains. Additionally, recreational off-roading is gaining popularity, particularly in tourism hubs and adventure sports destinations. The rise in disposable income, growing interest in motorsports, and the availability of organized off-roading events are further fueling sales. The introduction of technologically advanced ORVs with improved suspension systems, safety features, and fuel efficiency is also attracting consumers. Government regulations supporting off-road tourism and subsidies for mechanized farming equipment are likely to boost market growth. However, high import dependency for premium ORVs and regulatory restrictions on on-road usage remain key challenges for manufacturers and buyers.

To get more information on this market, Request Sample

Electrification and Technological Advancements in Off-Road Vehicles

Electrification is rising as a notable trend in India’s off-road vehicles market, with manufacturers investing in electric ATVs and UTVs to address sustainability concerns and reduce operational costs. Rising fuel prices and stringent emission norms are pushing demand for electric ORVs, particularly in industrial and agricultural applications. Electric ORVs offer benefits such as reduced costs of maintenance, minimized noise levels, and improved energy efficiency, positioning them as suitable choice for eco-sensitive zones, including forests and mining areas. For instance, in March 2025, Ultraviolette launched Shockwave, its first electric motorcycle, developed for both off-road and on-road situation, across India. Commercial sale is anticipated to initiate in first quarter of 2026. Furthermore, companies are focusing on battery performance improvements, extended range capabilities, and fast-charging solutions to enhance adoption. Technological advancements, including GPS tracking, terrain adaptability features, and autonomous driving assistance, are also reshaping the market. The increasing presence of global players in India, along with domestic startups innovating in electric off-road mobility, is expected to accelerate market growth. However, limited charging infrastructure in rural and remote areas poses a barrier to widespread adoption.

India Off-Road Vehicles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product.

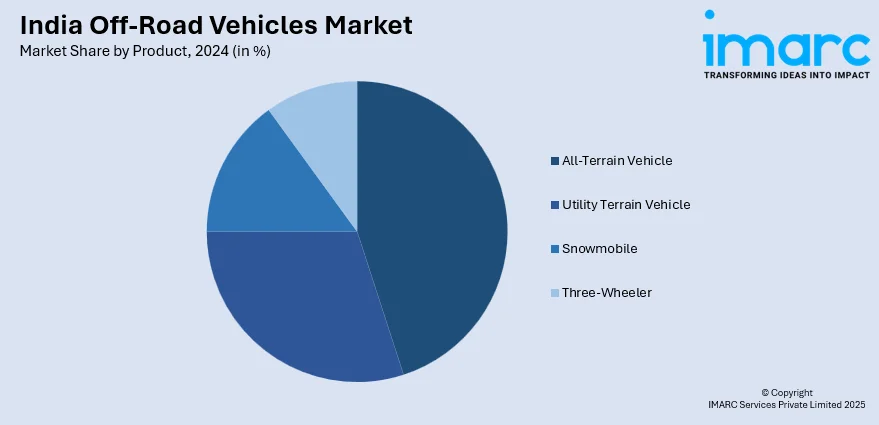

Product Insights:

- All-Terrain Vehicle

- Utility Terrain Vehicle

- Snowmobile

- Three-Wheeler

The report has provided a detailed breakup and analysis of the market based on the product. This includes all-terrain vehicle, utility terrain vehicle, snowmobile, and three-wheeler.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Off-Road Vehicles Market News:

- In April 2024, Jeep Wrangler was launched in India with two variants, including, Rubicon and Unlimited. These upgraded models are integrated with leading-edge off-road technology and offer high-end cabin.

- In May 2024, Force Motors unveiled its 5-door Gurkha for Indian market with off-road attributes like factory-fitted snorkel, manual rear and front differential locks, offering a 700mm of water-wading depth.

India Off-Road Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | All-Terrain Vehicle, Utility Terrain Vehicle, Snowmobile, Three-Wheeler |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India off-road vehicles market performed so far and how will it perform in the coming years?

- What is the breakup of the India off-road vehicles market on the basis of product?

- What is the breakup of the India off-road vehicles market on the basis of region?

- What are the various stages in the value chain of the India off-road vehicles market?

- What are the key driving factors and challenges in the India off-road vehicles market?

- What is the structure of the India off-road vehicles market and who are the key players?

- What is the degree of competition in the India off-road vehicles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India off-road vehicles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India off-road vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India off-road vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)