India Nutritional Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Consumer Group, Distribution Channel, and Region, 2025-2033

India Nutritional Supplements Market Overview:

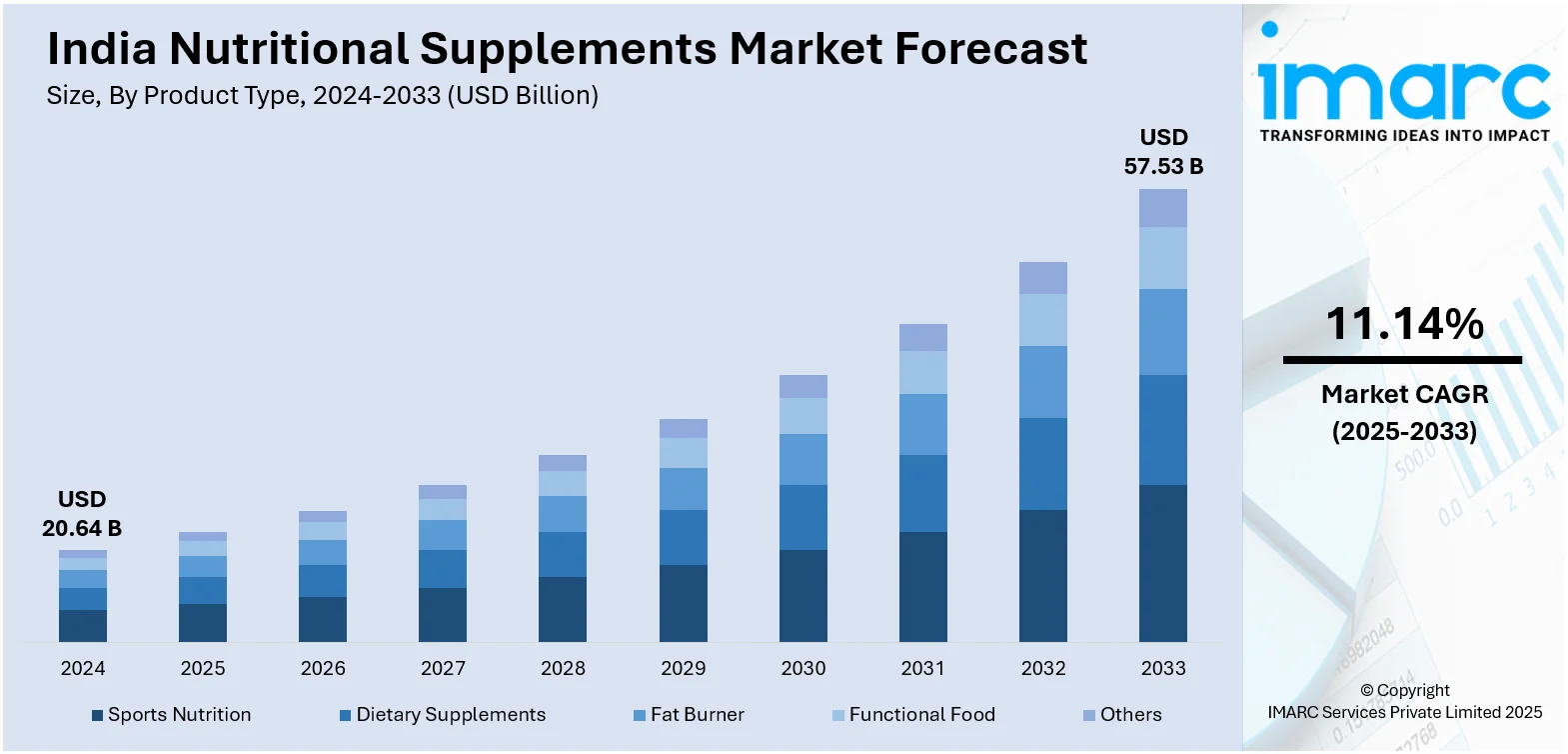

The India nutritional supplements market size reached USD 20.64 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 57.53 Billion by 2033, exhibiting a growth rate (CAGR) of 11.14% during 2025-2033. The India nutritional supplements market share is expanding, driven by the rising awareness about the long-term effects of poor nutrition, encouraging people to turn to immunity boosters, along with the ongoing efforts by government agencies to promote Ayurveda and herbal supplements through programs that support traditional medicine and research.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 20.64 Billion |

| Market Forecast in 2033 | USD 57.53 Billion |

| Market Growth Rate (2025-2033) | 11.14% |

India Nutritional Supplements Market Trends:

Growing incidence of lifestyle diseases

The increasing prevalence of lifestyle diseases is offering a favorable India nutritional supplements market outlook. Rising cases of diabetes, obesity, hypertension, and heart disease are encouraging people to adopt healthier diets and supplement their nutrition gaps. According to industry reports, heart-related claims rose from 9-12% in 2019-2020 to 18-20% in 2023-2024 in India, indicating a growing incidence of cardiac problems. Poor eating habits, lack of physical activity, and elevated stress levels lead to these conditions, making nutritional supplements a convenient way to manage health. Supplements like vitamins, minerals, and herbal extracts aid in controlling blood sugar, enhancing metabolism, and improving heart health, making them popular among individuals at risk. Doctors and nutritionists also recommend supplements as part of disease management plans, increasing their acceptance. Additionally, as awareness grows about the long-term effects of poor nutrition, more people turn to immunity boosters, protein supplements, and probiotics to support overall wellness. The availability of specialized supplements targeting lifestyle-related issues further drives the demand. As urbanization activities and fast-paced living continue, the reliance on nutritional supplements keeps rising, making them an important part of daily health routines.

To get more information on this market, Request Sample

Increasing implementation of government initiatives

The rising execution of government initiatives is impelling the India nutritional supplements market growth. Government agencies are promoting health awareness, regulating product quality, and supporting the nutraceutical industry. Programs like Poshan Abhiyan focus on reducing malnutrition, encouraging the use of fortified food items and dietary supplements. The Food Safety and Standards Authority of India (FSSAI) is taking initiatives and implementing strict guidelines to ensure the safety and efficacy of nutritional items, enhancing consumer confidence. In September 2024, FSSAI was set to organize the Global Food Regulators Summit (GFRS) 2024 in conjunction with the World Food India 2024 event at Bharat Mandapam, India, from September 19th to 21st. GFRS 2.0 aimed at emphasizing key issues like AMR mitigation, regulation of health supplements and nutraceuticals, and sustainable food packaging. National stakeholders intended to engage actively in the summit, showcasing India’s dedication to enhancing food safety standards. Additionally, governing agencies are promoting Ayurveda and herbal supplements through programs supporting traditional medicine and research. Subsidies and incentives for domestic supplement manufacturers encourage innovations and large-scale production, making supplements more affordable and accessible. Public health campaigns educate people about the benefits of essential vitamins, minerals, and immunity boosters, catalyzing the demand across urban and rural areas. The growing integration of nutritional supplements into government healthcare programs further strengthens the market growth.

India Nutritional Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, form, consumer group, and distribution channel.

Product Type Insights:

- Sports Nutrition

- Dietary Supplements

- Fat Burner

- Functional Food

- Others

The report has provided a detailed breakup and analysis of the market based on the product types. This includes sports nutrition, dietary supplements, fat burner, functional food, and others.

Form Insights:

- Powder

- Tablets

- Capsules

- Liquid

- Soft Gels

- Others

A detailed breakup and analysis of the market based on the forms have also been provided in the report. This includes powder, tablets, capsules, liquid, soft gels, and others.

Consumer Group Insights:

- Infants

- Children

- Adults

- Pregnant

- Geriatric

The report has provided a detailed breakup and analysis of the market based on the consumer groups. This includes infants, children, adults, pregnant, and geriatric.

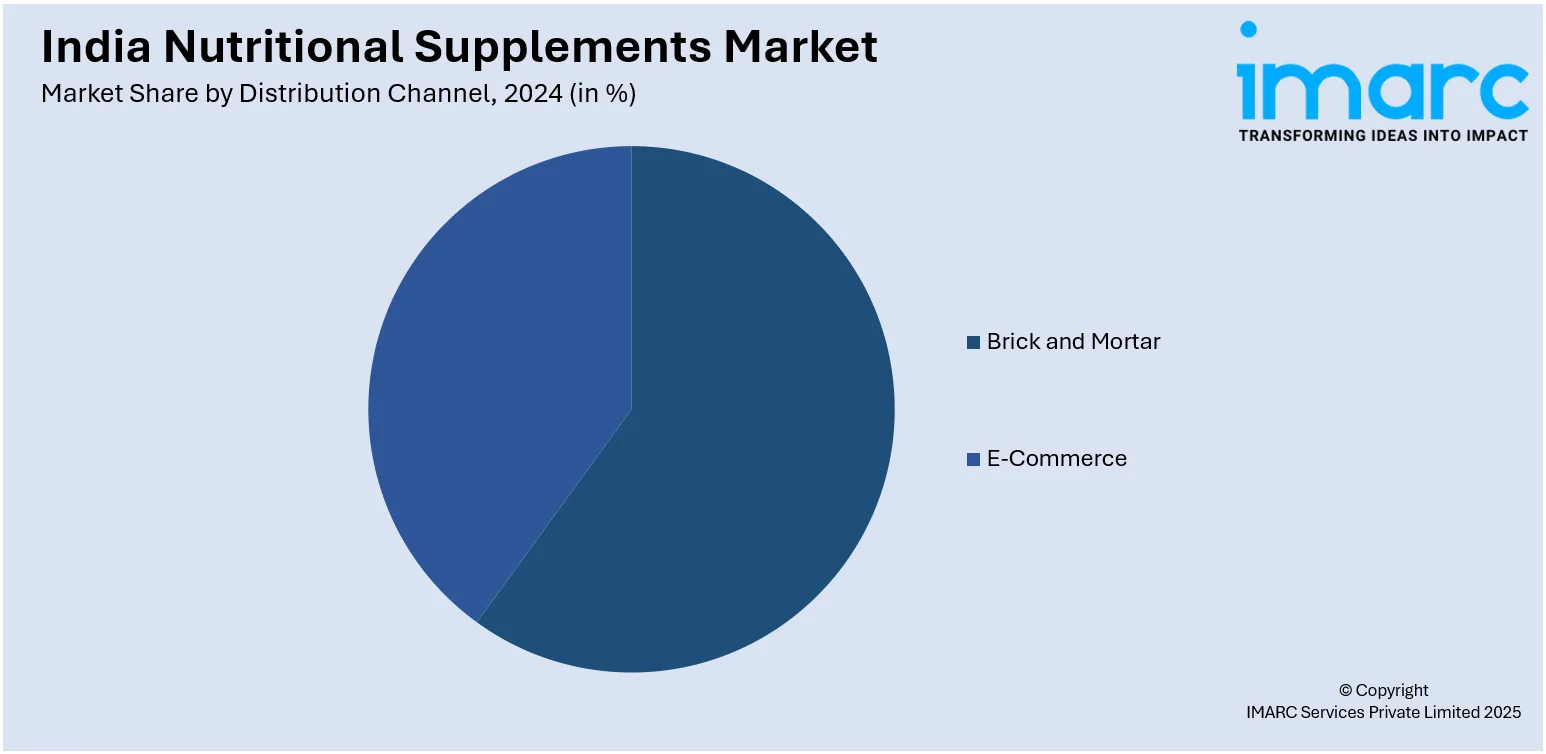

Distribution Channel Insights:

- Brick and Mortar

- E-Commerce

A detailed breakup and analysis of the market based on the distribution channels have also been provided in the report. This includes brick and mortar and e-commerce.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Nutritional Supplements Market News:

- In October 2024, Nutrabay, the prominent sports nutrition and wellness brand based in India, entered the Ayurvedic supplements market with the introduction of its first item in this category, Shilajit. This action was a component of the brand’s larger approach to expand its private-label product range and capitalize on the increasing need for natural and integrative wellness options in India's swiftly expanding nutritional supplements sector.

- In August 2024, Denzour Nutrition, a prominent Indian brand known for its dedication to natural and effective sports supplements, revealed its venture into the realm of organic nutraceuticals. The firm’s latest collection featured a thoughtfully chosen range of organic items aimed at meeting diverse health and wellness requirements.

India Nutritional Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sports Nutrition, Dietary Supplements, Fat Burner, Functional Food, Others |

| Forms Covered | Powder, Tablets, Capsules, Liquid, Soft Gels, Others |

| Consumer Groups Covered | Infants, Children, Adults, Pregnant, Geriatric |

| Distribution Channels Covered | Brick and Mortar, E-Commerce |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India nutritional supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India nutritional supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India nutritional supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in India was valued at USD 20.64 Billion in 2024.

The India nutritional supplements market is projected to exhibit a CAGR of 11.14% during 2025-2033, reaching a value of USD 57.53 Billion by 2033.

The market is primarily driven by the rising incidence of lifestyle diseases such as diabetes, hypertension, and heart disease, which encourage the adoption of nutritional supplements. Additionally, government initiatives promoting health awareness, quality standards, and Ayurveda are also fostering market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)