India Nutritional Bars Market Size, Share, Trends, and Forecast by Type, Sales Channel, and Region, 2025-2033

India Nutritional Bars Market Overview:

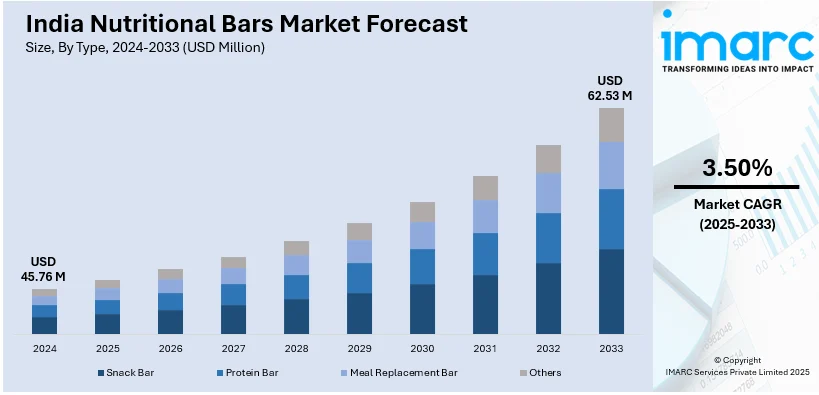

The India nutritional bars market size reached USD 45.76 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 62.53 Million by 2033, exhibiting a growth rate (CAGR) of 3.50% during 2025-2033. The market is driven by rising health consciousness, increasing demand for convenient and protein-rich snacks, and growing fitness trends. Urbanization, busy lifestyles, and expanding retail channels further fuel the India nutritional bars market share, alongwith innovations in flavors, ingredients, and functional benefits catering to diverse consumer needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 45.76 Million |

| Market Forecast in 2033 | USD 62.53 Million |

| Market Growth Rate 2025-2033 | 3.50% |

India Nutritional Bars Market Trends:

Growing Popularity of Fitness and Active Lifestyles

The expanding fitness culture in India, driven by gym memberships, sports participation, and home workout trends, has significantly boosted demand for nutritional bars. Fitness enthusiasts and athletes seek protein-rich snacks for muscle recovery and sustained energy. The rise of yoga, marathon participation, and cycling has also contributed to increased consumption of energy and protein bars. Additionally, social media and fitness influencers play a crucial role in promoting these products, further fueling market growth. Brands are responding by introducing specialized bars catering to pre-workout, post-workout, and endurance nutrition needs, aligning with the evolving fitness preferences of Indian consumers, thus creating a positive India nutritional bars market outlook. For instance, in November 2024, Bollywood actor Ranveer Singh revealed the introduction of SuperYou, a brand for protein foods and supplements that he co-founded with Nikunj Biyani. The company launched the first protein wafer bar in India, using fermented yeast protein technology to provide a healthy and tasty snack option. To celebrate the launch, SuperYou introduced a campaign starring Ranveer Singh, demonstrating his distinctive energy and emphasizing the significance of accessible, nutritious protein choices for every age group. The initiative highlights a novel perspective on protein snacks, coinciding with Singh's vibrant character and dedication to fitness.

To get more information on this market, Request Sample

Rising Health Consciousness and Focus on Nutrition

Increasing awareness about health and wellness is a key driver of the India nutritional bars market growth. Consumers are becoming more conscious of their dietary choices, preferring snacks that provide essential nutrients, protein, and fiber. With growing concerns over obesity, diabetes, and lifestyle-related diseases, many individuals are replacing traditional high-calorie snacks with healthier alternatives like nutritional bars. The demand for plant-based, organic, and gluten-free options is also rising, reflecting a shift toward mindful eating. This trend is further reinforced by increasing knowledge about the benefits of functional foods, encouraging brands to introduce bars with added vitamins, minerals, and superfoods. For instance, in March 2023, an Indian breakfast cereal and health food company with headquarters in New Delhi, Bagrrys India, announced the release of "The Mighty Muesli Bars." The company produces unique, honest, and healthful items like bran, nut butters, corn flakes, oats, and mueslis. Rich in fruits, nuts, multigrains, and honey, these muesli bars also have a high fiber content. Granola bars were first introduced by Bagrry's in 1998, and they have since made a comeback to the cereal bar market with the introduction of Bagrry's Mighty Muesli Bars.

India Nutritional Bars Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and sales channel.

Types Insights:

- Snack Bar

- Protein Bar

- Meal Replacement Bar

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes snack bar, protein bar, meal replacement bar, and others.

Sales Channel Insights:

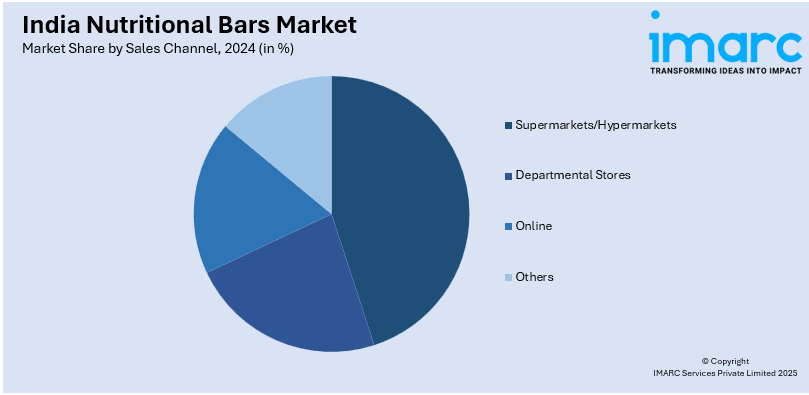

- Supermarkets/Hypermarkets

- Departmental Stores

- Online

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets/hypermarkets, departmental stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Nutritional Bars Market News:

- In September 2024, a leader in nutrition and well-being worldwide, Forever Living Products (India) presented its newest creation, the Forever New Protein and Nut Energy Bars. These bars were intended to support the contemporary, fast-paced lifestyle by providing a tasty, nutritious, and handy snack.

- In March 2023, Nutrizoe, a wellness firm based in Mumbai, introduced Zoe Bars, India's first energy bar specifically designed for women. Compared to men, women have slightly differing nutritional needs and are genetically distinct from birth. In essence, they need more vitamins and minerals to combat everyday fatigue. Zoe Bars are specially made to give women immediate energy and help them resist their need for sweets.

India Nutritional Bars Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Snack Bar, Protein Bar, Meal Replacement Bar, Others |

| Sales Channels Covered | Supermarkets/Hypermarkets, Departmental Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India nutritional bars market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India nutritional bars market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India nutritional bars industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nutritional bars market in India was valued at USD 45.76 Million in 2024.

The India nutritional bars market is projected to exhibit a CAGR of 3.50% during 2025-2033, reaching a value of USD 62.53 Million by 2033.

The India nutritional bars market is growing due to rising health awareness, busy urban lifestyles, and the demand for convenient, on-the-go nutrition. Consumers are increasingly seeking protein-rich, low-sugar, and functional bars that support fitness goals and dietary needs. Innovations in flavors and ingredients, along with the expansion of online retail channels, are further fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)