India Non-Poultry Meat Market Size, Share, Trends and Forecast by Product, and States, 2025-2033

Market Overview:

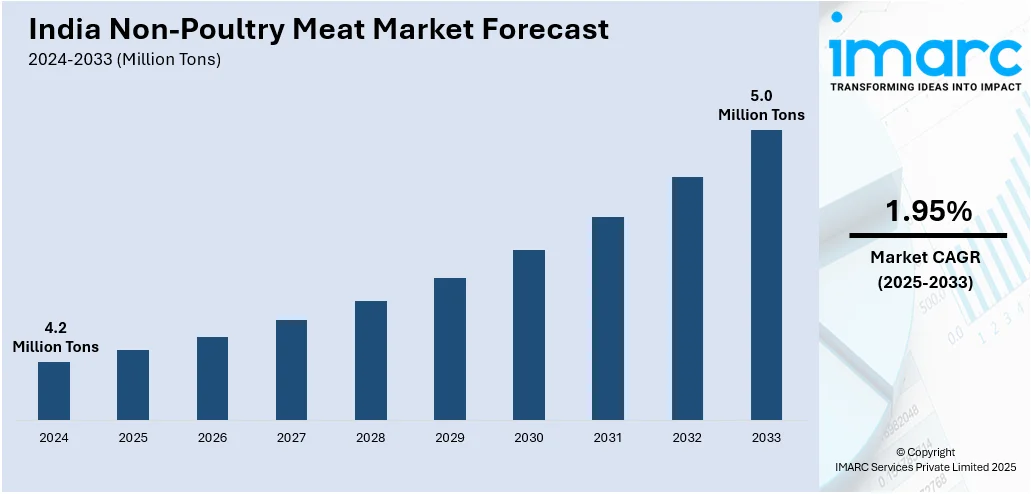

The India non-poultry meat market size reached 4.2 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 5.0 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.95% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

4.2 Million Tons |

|

Market Forecast in 2033

|

5.0 Million Tons |

| Market Growth Rate (2025-2033) | 1.95% |

Non-poultry refers to rearing, breeding, and processing of livestock, such as cattle, buffalo, goat, sheep, and pig, that are primarily raised for meat. The meat products contain a higher level of protein myoglobin content than poultry meat. Non-poultry meat also comprise of a rich amount of essential nutrients, including niacin, riboflavin, vitamins B6 and B12, omega-6 fatty acids. As a result, it helps in supporting muscle growth, reducing fatigue, boosting immunity, maintaining hemoglobin levels, etc.

To get more information on this market, Request Sample

India Non-Poultry Meat Market Trends:

In India, the rising consumer preferences for high-protein food products represent one of the key factors driving the non-poultry meat market. Furthermore, the elevating levels of globalization, coupled with the increasing penetration of western food culture, including beef- and pork-based dishes, are also propelling the market growth. Besides this, changing consumer food habits and growing adoption of a non-vegetarian diet are further augmenting the demand for non-poultry meat. Additionally, improving consumer living standards, along with the escalating preferences for healthy lifestyles, are catalyzing the sales of premium-quality, non-poultry meat products. Moreover, the evolving socio-economic scenario in the country and diminishing stigma associated with the consumption of beef and pork are further bolstering the market growth in India. Apart from this, the launch of numerous initiatives undertaken by the Indian government for encouraging livestock cultivation is acting as another significant growth-inducing factor. Additionally, the rising popularity of pre-cut, canned, and frozen meat products, particularly among the consumers with hectic lifestyles, is positively influencing the regional market. In line with this, the expanding meat processing sector, along with the increasing preferences for ready-to-eat meat items, such as sausages, salami, beef jerky, smoked meat, etc., are further fueling the market growth in the country. Additionally, the emergence of organic product variants that are free from preservatives, GMOs, antibiotics, etc., is expected to drive the India non-poultry meat market in the coming years.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India non-poultry meat market report, along with forecasts at the country and state levels from 2025-2033. Our report has categorized the market based on product.

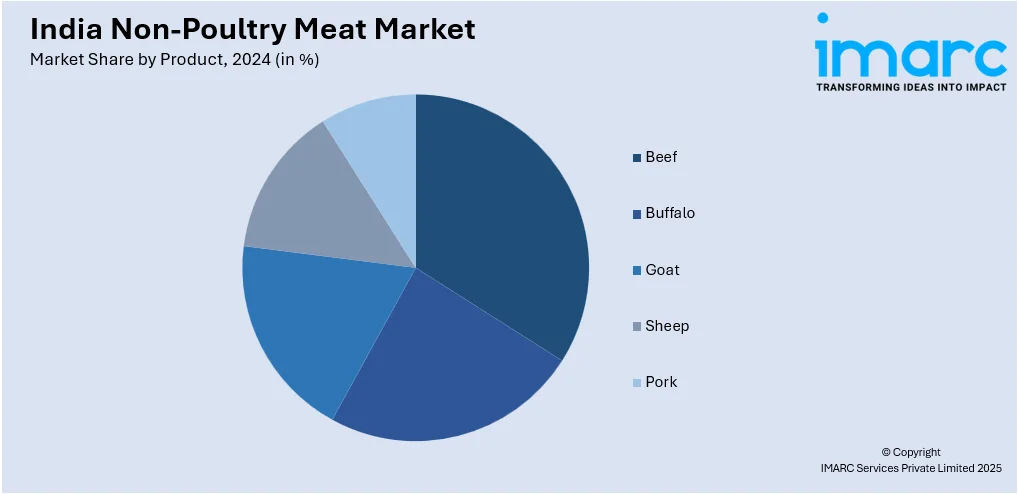

Breakup by Product:

- Beef

- Buffalo

- Goat

- Sheep

- Pork

Breakup by States:

- Uttar Pradesh

- Telangana

- Maharashtra

- West Bengal

- Andhra Pradesh

- Bihar

- Kerala

- Rajasthan

- Tamil Nadu

- Karnataka

- Punjab

- Orissa

- Madhya Pradesh

- Haryana

- Gujrat

Competitive Landscape:

The report has also analysed the competitive landscape of the market with some of the key players being Al Marzia Agro Foods, Al-Hamd Agro Foods Products Pvt. Ltd., ALM Industries Limited, AOV Agro Foods Private Limited, Fair Export (India) Private Limited, Frigerio Conserva Allana Private Limited, HMA Agro Industries Limited, India Frozen Foods, Mayur Piggery Farm, Mirha Exports Private Limited, MK Overseas Pvt Ltd and Rustam Foods Pvt. Ltd.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Segment Coverage | Product, States |

| States Covered | Uttar Pradesh, Telangana, Maharashtra, West Bengal, Andhra Pradesh, Bihar, Kerala, Rajasthan, Tamil Nadu, Karnataka, Punjab, Orissa, Madhya Pradesh, Haryana, Gujrat |

| Companies Covered | Al Marzia Agro Foods, Al-Hamd Agro Foods Products Pvt. Ltd., ALM Industries Limited, AOV Agro Foods Private Limited, Fair Export (India) Private Limited, Frigerio Conserva Allana Private Limited, HMA Agro Industries Limited, India Frozen Foods, Mayur Piggery Farm, Mirha Exports Private Limited, MK Overseas Pvt Ltd and Rustam Foods Pvt. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India non-poultry meat market reached a volume of 4.2 Million Tons in 2024.

We expect the India non-poultry meat market to exhibit a CAGR of 1.95% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic has led to the shifting consumer preferences from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of non-poultry meat products.

The rising consumer preferences for high-protein food products, along with the growing popularity of ready-to-eat, pre-cut, canned, and frozen meat items, are primarily driving the India non-poultry meat market.

Based on the product, the India non-poultry meat market can be bifurcated into beef, buffalo, goat, sheep, and pork. Currently, beef accounts for the majority of the total market share.

On a regional level, the market has been classified into Uttar Pradesh, Telangana, Maharashtra, West Bengal, Andhra Pradesh, Bihar, Kerala, Rajasthan, Tamil Nadu, Karnataka, Punjab, Orissa, Madhya Pradesh, Haryana, and Gujrat, where Uttar Pradesh currently dominates the India non-poultry meat market.

Some of the major players in the India non-poultry meat market include Al Marzia Agro Foods, Al-Hamd Agro Foods Products Pvt. Ltd., ALM Industries Limited, AOV Agro Foods Private Limited, Fair Export (India) Private Limited, Frigerio Conserva Allana Private Limited, HMA Agro Industries Limited, India Frozen Foods, Mayur Piggery Farm, Mirha Exports Private Limited, MK Overseas Pvt Ltd, and Rustam Foods Pvt. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)