India Non-Ferrous Metals Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Market Overview:

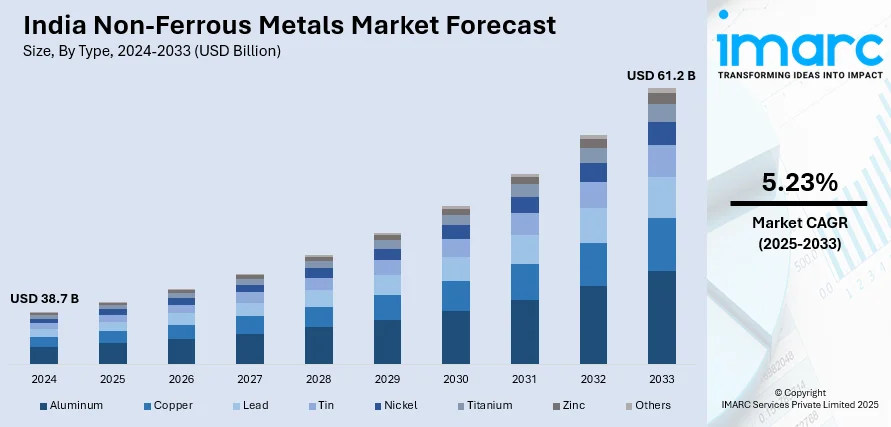

India non-ferrous metals market size reached USD 38.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 61.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.23% during 2025-2033. The increasing prevalence of infrastructure projects, such as construction of buildings, bridges, and transportation systems, which contribute significantly to the demand for non-ferrous metals like aluminum and copper, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 38.7 Billion |

|

Market Forecast in 2033

|

USD 61.2 Billion |

| Market Growth Rate 2025-2033 | 5.23% |

Non-ferrous metals are metallic elements or alloys that do not contain iron as a primary component. These metals are prized for their unique properties, including corrosion resistance, conductivity, and malleability. Common examples of non-ferrous metals include aluminum, copper, zinc, lead, and precious metals such as gold and silver. Non-ferrous metals play a crucial role in various industries, from construction and transportation to electronics and renewable energy. Due to their resistance to rust and other forms of corrosion, non-ferrous metals are often preferred in applications where durability and longevity are essential. Recycling of non-ferrous metals is also economically and environmentally significant, as it helps conserve resources and reduces the energy required for primary metal production, making them key players in sustainable materials management.

To get more information on this market, Request Sample

India Non-Ferrous Metals Market Trends:

Non-ferrous metals, comprising alloys like aluminum, copper, lead, nickel, tin, and zinc, are pivotal players in the regional market, and their dynamics are steered by multifaceted drivers. Primarily, the burgeoning demand for lightweight materials across diverse industries propels the non-ferrous metals market forward. This trend, fueled by a growing emphasis on fuel efficiency and sustainability, has led to an increased adoption of aluminum in automotive and aerospace applications. Additionally, the escalating demand for electrical conductivity in the electronics sector bolsters the market, with copper emerging as a key beneficiary. Furthermore, geopolitical factors exert a significant influence on the non-ferrous metals landscape. Trade tensions and tariff impositions can disrupt supply chains and impact prices. In tandem, the green energy revolution propels the market as non-ferrous metals are integral to renewable energy technologies. Lithium-ion batteries, essential for electric vehicles and energy storage, underscore the critical role of metals like lithium and cobalt. Moreover, innovations in metal recycling technologies contribute to sustainable practices and influence market dynamics. The circular economy mindset, emphasizing resource efficiency, encourages the recycling of non-ferrous metals, reducing dependence on primary sources and mitigating environmental impacts. In sum, the non-ferrous metals market in India is intricately woven into a complex web of drivers, reflecting the interplay between technological advancements, geopolitical shifts, and environmental consciousness.

India Non-Ferrous Metals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Aluminum

- Copper

- Lead

- Tin

- Nickel

- Titanium

- Zinc

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes aluminum, copper, lead, tin, nickel, titanium, zinc, and others.

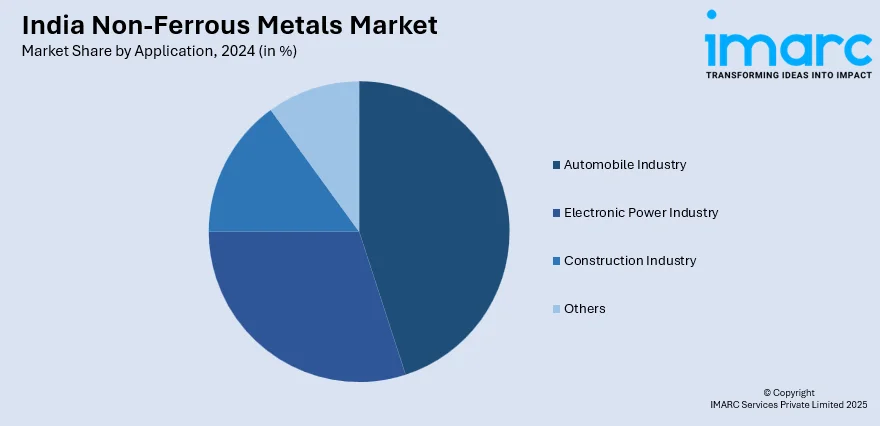

Application Insights:

- Automobile Industry

- Electronic Power Industry

- Construction Industry

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automobile industry, electronic power industry, construction industry, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Non-Ferrous Metals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Aluminum, Copper, Lead, Tin, Nickel, Titanium, Zinc, Others |

| Applications Covered | Automobile Industry, Electronic Power Industry, Construction Industry, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India non-ferrous metals market performed so far and how will it perform in the coming years?

- What is the breakup of the India non-ferrous metals market on the basis of type?

- What is the breakup of the India non-ferrous metals market on the basis of application?

- What are the various stages in the value chain of the India non-ferrous metals market?

- What are the key driving factors and challenges in the India non-ferrous metals?

- What is the structure of the India non-ferrous metals market and who are the key players?

- What is the degree of competition in the India non-ferrous metals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India non-ferrous metals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India non-ferrous metals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India non-ferrous metals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)