India Nitrobenzene Market Size, Share, Trends and Forecast by Form, Application, and Region, 2025-2033

India Nitrobenzene Market Overview:

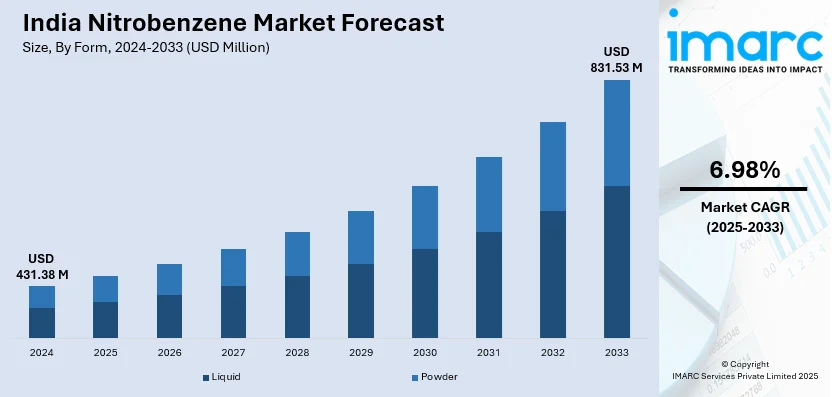

The India nitrobenzene market size reached USD 431.38 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 831.53 Million by 2033, exhibiting a growth rate (CAGR) of 6.98% during 2025-2033. The market is driven by rising demand from the agrochemical sector for pesticide production and the pharmaceutical industry for drug synthesis. Government initiatives supporting agriculture and healthcare, coupled with increasing awareness of crop protection and healthcare needs, are key factors augmenting the India nitrobenzene market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 431.38 Million |

| Market Forecast in 2033 | USD 831.53 Million |

| Market Growth Rate 2025-2033 | 6.98% |

India Nitrobenzene Market Trends:

Growing Demand from the Agrochemical Sector

The rise in demand, primarily driven by the agrochemical sector is significantly supporting the India nitrobenzene market growth. The agricultural sector of India grew exponentially, with food grain production peaking at 332.3 million tonnes in 2023–24. The budgetary allocation has crossed INR 1.22 lakh crore (approximately USD 14,878 Million), including INR 52,738 crore (approximately USD 6,430.24 Million) for infrastructure development and INR 3.46 lakh crore (approximately USD 42,195.12 Million) through the PM-KISAN scheme. High increases in Minimum Support Prices (MSP), coupled with the purchase of 7.8 million tonnes of millet, are benefiting farmers' incomes. Concurrently, the integration of 1,400 mandis into the e-NAM platform is easing trade. These developments are benefiting the demand for agricultural inputs, including nitrobenzene, a major plant growth developer in the expanding harvest production sector of India. Nitrobenzene is a key raw material in the production of aniline, which is further used to manufacture pesticides, herbicides, and fungicides. With India being an agriculture-dominated economy, the need for crop protection chemicals has risen substantially to enhance agricultural productivity and meet food security goals. Government initiatives promoting the use of advanced agrochemicals and the increasing adoption of high-yield crop varieties have further fueled this demand. Additionally, the growing awareness among farmers about the benefits of agrochemicals in improving crop yields is contributing to the expansion of the nitrobenzene market. As a result, manufacturers are focusing on increasing production capacities to cater to the rising demand, making the agrochemical sector a major growth driver for the nitrobenzene market in India.

To get more information on this market, Request Sample

Rising Applications in the Pharmaceutical Industry

The increasing utilization of nitrobenzene in the pharmaceutical industry is creating a positive India nitrobenzene market outlook. A research report released by IMARC Group indicates that the pharmaceutical market in India was valued at USD 61.36 Billion in 2024. It is projected to grow to USD 174.31 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 11.32% from 2025 to 2033. Nitrobenzene serves as a crucial intermediate in the synthesis of various pharmaceutical compounds, including paracetamol and other analgesics. The Indian pharmaceutical sector, which is one of the largest globally, is experiencing robust growth due to rising healthcare needs, increasing exports, and government support for domestic drug manufacturing. This growth has led to a higher demand for nitrobenzene as a key chemical feedstock. Furthermore, the COVID-19 pandemic has underscored the importance of a strong pharmaceutical supply chain, prompting investments in the production of active pharmaceutical ingredients (APIs) and intermediates. As the pharmaceutical industry continues to expand, the demand for nitrobenzene is expected to rise, positioning it as a critical component in India's chemical and healthcare sectors.

India Nitrobenzene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on form and application.

Form Insights:

- Liquid

- Powder

The report has provided a detailed breakup and analysis of the market based on the form. This includes liquid and powder.

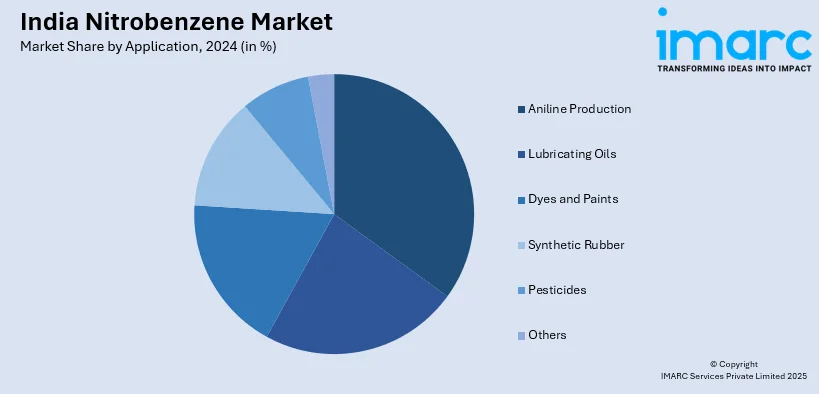

Application Insights:

- Aniline Production

- Lubricating Oils

- Dyes and Paints

- Synthetic Rubber

- Pesticides

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes aniline production, lubricating oils, dyes and paints, synthetic rubber, pesticides, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Nitrobenzene Market News:

- November 11, 2024: Sadhana Nitro Chem Ltd. (SNCL) received the approval of the National Company Law Tribunal (NCLT) for the acquisition of Calchem Industries for INR 9.5 crore (approximately USD 1.16 Million). This acquisition will bring a facility with 78,000 TPA capacity to SNCL at a distance of 250 meters from its existing MIDC Roha plant. The acquisition will enhance SNCL's production capacity to manufacture nitrobenzene-based intermediates, including for pharma and specialty chemicals industries in India, such as para amino phenol (PAP). The transaction, which is likely to be completed by January 27, 2025, will enhance operational efficiency, lower logistics costs, and strengthen the position of SNCL in the growing nitrobenzene market in India.

India Nitrobenzene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Liquid, Powder |

| Applications Covered | Aniline Production, Lubricating Oils, Dyes and Paints, Synthetic Rubber, Pesticides, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India nitrobenzene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India nitrobenzene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India nitrobenzene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nitrobenzene market in India was valued at USD 431.38 Million in 2024.

The India nitrobenzene market is projected to exhibit a CAGR of 6.98% during 2025-2033, reaching a value of USD 831.53 Million by 2033.

The market is influenced by increasing demand for aniline in dye, pharmaceuticals, and rubber chemicals manufacturing. Rising agricultural uses, particularly for cotton farming with the use of nitrobenzene-based plant growth promoters—fuel consumption further. Agrochemical growth along with import reliance and domestic production drive is driving market growth in both northern and western Indian agricultural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)