India Next Generation Search Engines Market Size, Share, Trends and Forecast by Platform Type, Distribution Channel, End User, and Region, 2025-2033

India Next Generation Search Engines Market Overview:

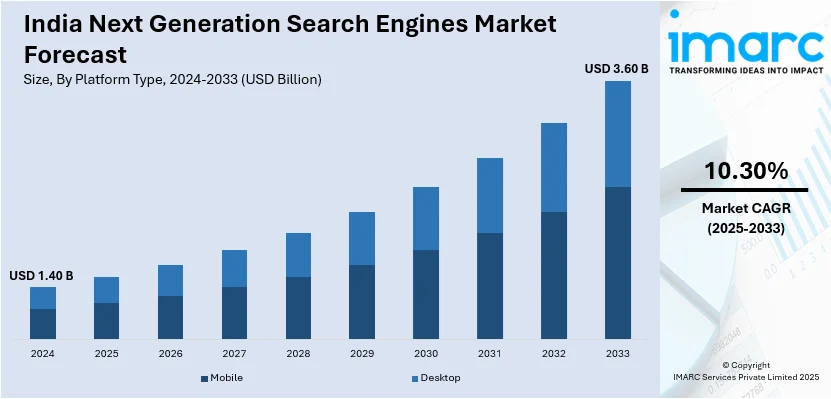

The India next generation search engines market size reached USD 1.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.60 Billion by 2033, exhibiting a growth rate (CAGR) of 10.30% during 2025-2033. The advancements in artificial intelligence (AI) and machine learning, increasing internet penetration, rising demand for personalized search experiences, government initiatives for digital transformation, the surge in voice and visual search adoption, and the expansion of e-commerce, fintech, and content-driven platform are some of the major factors augmenting the India next generation search engines market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.40 Billion |

| Market Forecast in 2033 | USD 3.60 Billion |

| Market Growth Rate (2025-2033) | 10.30% |

India Next Generation Search Engines Market Trends:

Artificial Intelligence (AI) Driven Personalization and Contextual Search

Next-generation search engines in India are increasingly leveraging artificial intelligence (AI) to deliver highly personalized and context-aware search experiences. For instance, on August 30, 2023, Google launched its search generative experience (SGE) in India, introducing AI-powered features to enhance search results. This initiative offers users AI-generated overviews in both English and Hindi, with functionalities such as language toggling and text-to-speech capabilities. The integration of advanced AI technologies improves user experience and facilitates India next generation search engine market growth. AI models process user behavior, past interactions, and preferences to refine search results, ensuring more relevant and intent-based outputs. This trend is particularly evident in e-commerce, fintech, and content-driven platforms, where precision in search results directly impacts engagement and conversion rates. Moreover, Natural Language Processing (NLP) advancements enable search engines to understand queries in multiple Indian languages and dialects, improving accessibility for diverse linguistic demographics. Furthermore, AI-based personalization is also impacting advertising strategies, enabling companies to target users with extremely relevant content based on their search histories. Widespread application of machine learning-based ranking algorithms is further optimizing search relevance, making sure users get relevant results that are specifically suited to their needs and desires.

To get more information on this market, Request Sample

Voice and Visual Search Adoption

The shift towards voice and visual search as consumers increasingly rely on hands-free, AI-driven assistants for information retrieval is positively influencing the India next generation search engine market outlook. The widespread adoption of smart speakers, chatbots, and voice assistants like Amazon Alexa, Google Assistant, and Apple's Siri further propels this trend. In India, the use of voice search is rapidly increasing. According to an industry report, 72% of Indian internet users conduct voice searches in languages other than English, and around 82% of smartphone users frequently utilize voice-activated technology. Voice search is particularly popular in mobile-first rural and semi-urban markets, where users prefer conversational interactions over traditional text-based searches. Businesses are optimizing their digital content for voice-based queries by incorporating conversational phrases and long-tail keywords that fit in with the patterns of natural speech. Similarly, visual search is gaining traction in sectors like fashion, retail, and home decor, where users can find products using image recognition technology. Companies are integrating AI-powered image search tools to enhance user experiences, enabling instant product discovery through smartphone cameras. These improvements, such as image recognition algorithms and visual search, are expected to transform e-commerce and digital marketing strategies in India.

India Next Generation Search Engines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on platform type, distribution channel, and end user.

Platform Type Insights:

- Mobile

- Desktop

The report has provided a detailed breakup and analysis of the market based on the platform type. This includes mobile and desktop.

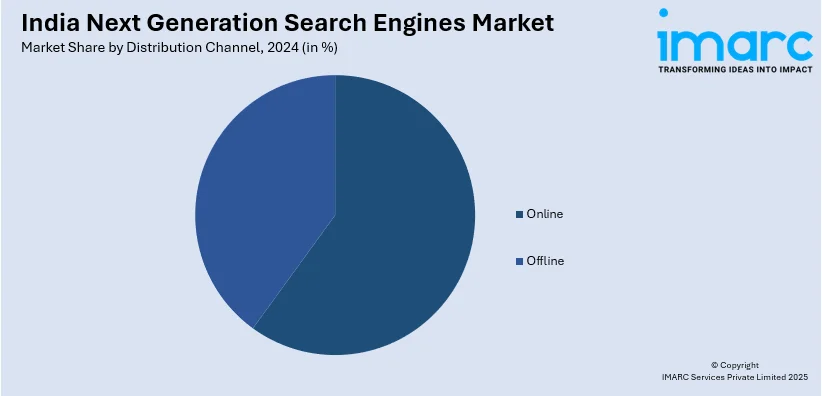

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End User Insights:

- Personal

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes personal and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Next Generation Search Engines Market News:

- September 1, 2024: Indian startup NoFrills AI introduced a new platform that combines search engine capabilities with AI chatbot functionalities. Co-founder Vinci Mathews describes it as a hybrid solution designed to provide users with efficient and straightforward information retrieval. This development positions NoFrills AI as a potential competitor to established search engines like Google.

- December 17, 2024: OpenAI expanded access to its AI search engine, ChatGPT, to all users, including those on the free tier. Initially exclusive to paid subscribers since October, this rollout introduces enhanced mobile search features, such as location-based results with images and ratings and a map for directions. Additionally, ChatGPT now offers quicker access to specific websites and, for paid users, an Advanced Voice Mode that provides up-to-date web information.

India Next Generation Search Engines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platform Types Covered | Mobile, Desktop |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Personal, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India next generation search engines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India next generation search engines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India next generation search engines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The next generation search engines market in India was valued at USD 1.40 Billion in 2024.

The India next generation search engines market is projected to exhibit a CAGR of 10.30% during 2025-2033, reaching a value of USD 3.60 Billion by 2033.

India’s next-generation search engines market is driven by AI and machine learning advancements, enabling more personalized and context-aware results. Growing use of voice, visual, and multilingual search enhances accessibility for diverse users. Additionally, the expansion of digital services, e-commerce, and content platforms fuels demand for faster, smarter, and more intuitive search solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)