India Molecular Diagnostics Market Size, Share, Trends and Forecast by Product, Technology, Application, End User, and Region, 2026-2034

India Molecular Diagnostics Market Size and Share:

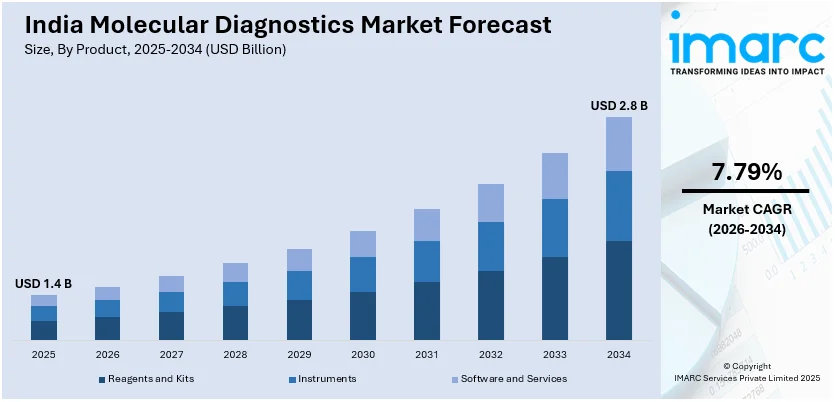

The India molecular diagnostics market size was valued at USD 1.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 2.8 Billion by 2034, exhibiting a CAGR of 7.79% from 2026-2034. The heightened frequency of chronic and infectious diseases is driving the need for molecular diagnostics in India. This trend, along with technological advancements in diagnostic tools, is enhancing test accuracy and accessibility. Additionally, government initiatives are playing a crucial role in improving healthcare infrastructure and enhancing the availability of advanced diagnostic technologies, further expanding the India molecular diagnostics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.4 Billion |

| Market Forecast in 2034 | USD 2.8 Billion |

| Market Growth Rate (2026-2034) | 7.79% |

The Indian market for molecular diagnostics is experiencing rapid growth, driven by a variety of key drivers and trends. Rising demand for reliable, speedy, and minimally invasive diagnostic technologies represent one of the foremost growth drivers of the market. Growth in chronic conditions like cancer, diabetes, and cardiovascular disease is catalyzing the requirement for sophisticated diagnostic methods capable of delivering precise and timely diagnoses. In addition, the rising incidence of infectious diseases, such as tuberculosis and hepatitis, is driving the uptake of molecular diagnostic tests in healthcare facilities. Advances in molecular diagnostic equipment are improving the sensitivity and efficiency of the tests, making them increasingly available to patients and healthcare providers.

To get more information on this market Request Sample

Businesses are launching new, innovative platforms and test kits that are enhancing the speed and affordability of diagnosis. The heightened usage of machine learning (ML) and artificial intelligence (AI) in diagnosis is also impelling the market growth by facilitating improved interpretation of test results and simplified workflows in healthcare organizations. The Government of India’s continuous efforts towards the development of healthcare infrastructure are propelling the market growth. The efforts involve the enhancement of investment in healthcare centers, enhancing diagnostic service accessibility, and providing subsidies for healthcare technologies. In addition, the growing awareness among healthcare professionals and the masses about the advantages of early detection of diseases is increasing the use of molecular diagnostic tools.

India Molecular Diagnostics Market Trends:

Rising Incidences of Chronic and Infectious Diseases

The high occurrence of lifestyle diseases, including diabetes, cancer, and cardiovascular diseases, is driving the demand for molecular diagnostics in India. As of March 5, 2025, 42.01 million people are treated for hypertension, and 25.27 million are treated for diabetes, reaching 89.7% of the target. Early detection and accurate diagnosis are necessary to manage and treat these diseases effectively. At the same time, infectious diseases like tuberculosis and hepatitis are causing a rise in the use of molecular diagnostics in medical treatment. Hospitals and diagnostic laboratories are constantly extending their testing abilities to accommodate the increasing demand for precise, timely diagnosis. Molecular diagnostics are found to be pivotal in detecting markers of disease at the genetic level, enabling treatment plans tailored to individual needs and better patient care. As the healthcare infrastructure continues to grapple with these increased issues, demand for sophisticated diagnostic technologies is increasing, thereby contributing to the market growth.

Technological Advancements in Diagnostic Tools

Continued advances in molecular diagnostic technology are transforming the Indian healthcare landscape. Firms are continually bringing more precise, quicker, and affordable diagnostic platforms, which are gaining interest among healthcare providers. Advances in next-generation sequencing (NGS), polymerase chain reaction (PCR), and digital diagnostics are making molecular testing more reliable and accessible. These technologies are also improving the accuracy of disease diagnosis, shortening testing time, and offering a better understanding of disease mechanisms. Moreover, AI and ML integration into molecular diagnostics are enhancing result interpretation, boosting working efficiency, and facilitating faster decision-making. The growth of point-of-care (POC) diagnostic devices is also increasing the need for rapid, non-invasive, and on-site testing, further fueling the India molecular diagnostics market growth. The IMARC Group predicts that the India polymerase chain reaction (PCR) devices industry size is projected to attain USD 1.04 Million by 2033.

Government Support and Healthcare Initiatives

The Government of India is constantly making efforts to enhance the healthcare infrastructure of the country, which is having a strong impact on the development of molecular diagnostics. The government has sanctioned INR 95,957.87 crore to the healthcare segment for FY26 (Fiscal Year), a 9.46% raise from the FY25 budget estimates. Government initiatives to enhance access to healthcare and diagnostic services in rural and urban areas are broadening the accessibility of molecular diagnostic tests. Initiatives like the National Health Mission (NHM) and economic incentives for healthcare innovations are encouraging the use of advanced diagnostic technologies. In addition, the government is encouraging domestic production of diagnostic equipment, which is lowering costs and making molecular diagnostics more accessible. All these are making more healthcare centers, particularly in remote areas, incorporate molecular diagnostics into their services.

India Molecular Diagnostics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India molecular diagnostics market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, technology, application, and end user.

Analysis by Product:

- Reagents and Kits

- Instruments

- Software and Services

Reagents and kits stand as the largest component in 2025, holding 65.38% of the market. The need for diagnostic reagents and kits is rising as healthcare professionals are consistently embracing advanced testing solutions for precise and effective disease detection. These products are crucial for conducting molecular tests, such as PCR assays, NGS, and various genetic testing methods. Reagents such as enzymes, buffers, and other chemicals are created to enhance the sensitivity and specificity of tests, providing more dependable results. Furthermore, ready-to-use diagnostic kits are gaining traction for their convenience and simplicity of use. These kits offer healthcare facilities convenient solutions that are ready to use, minimizing the need for specialized training and streamlining laboratory procedures. With the increasing demand for molecular diagnostics, the kits and reagents segment is experiencing significant growth, as companies are consistently innovating to address the changing market requirements.

Analysis by Technology:

- Polymerase Chain Reactions (PCR)

- Hybridization

- DNA Sequencing

- Microarray

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Others

Polymerase chain reaction (PCR) leads the market with 75.4% market share in 2025. It is gaining traction as it is widely used for detecting a variety of diseases, including infectious and genetic disorders. PCR-based tests are continuously gaining traction owing to their ability to amplify minute amounts of deoxyribonucleic acid (DNA) or ribonucleic acid (RNA), making them highly sensitive and accurate. This technology is particularly valuable for early disease detection and monitoring, as it enables healthcare providers to identify pathogens and genetic mutations with great precision. Hospitals and diagnostic laboratories are increasingly adopting PCR platforms, as they are enabling faster diagnostic results, which is critical for timely treatment decisions. Innovations in PCR technology, such as real-time PCR and digital PCR, are further enhancing the capabilities of these tests by providing more detailed and quantifiable results. As PCR continues to evolve and improve, its role in molecular diagnostics is expanding, offering a favorable India molecular diagnostics market outlook.

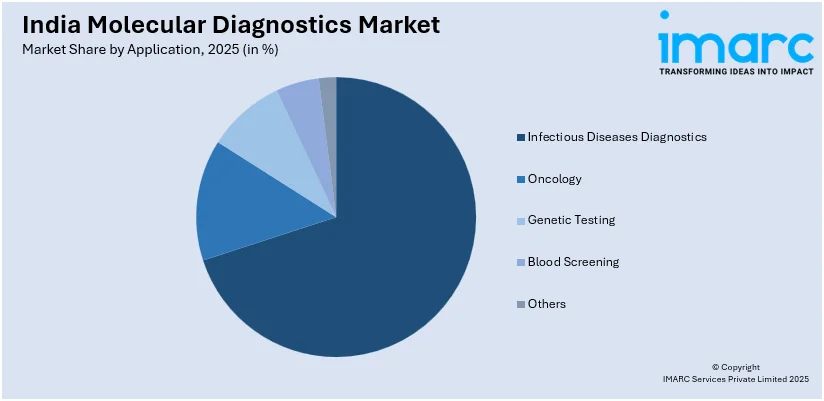

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Infectious Diseases Diagnostics

- Oncology

- Genetic Testing

- Blood Screening

- Others

Infectious disease diagnostics lead the market with 96.5% of market share in 2025. The increasing need for accurate and rapid detection of infections is contributing to the market growth. The ongoing rise in infectious diseases is motivating healthcare providers to adopt advanced diagnostic technologies that can quickly identify pathogens at the molecular level. Molecular diagnostic tests, such as PCR and nucleic acid amplification tests (NAATs), are playing a pivotal role in improving the accuracy and speed of disease detection. Hospitals, diagnostic centers, and public health authorities are actively implementing these technologies to control the spread of infections and ensure timely interventions. According to the India molecular diagnostics market forecasts, the growing focus on antibiotic resistance will be driving the demand for molecular diagnostics, as these tests help identify resistant strains and guide appropriate treatment options.

Analysis by End User:

- Hospitals

- Laboratories

- Others

Hospitals lead the market with 60.5% of market share in 2025. They are increasingly embracing molecular diagnostics to support better patient care and improved clinical outcomes. As the need for precise, rapid, and reliable diagnostic tools is rising, healthcare organizations are increasingly incorporating sophisticated molecular technologies into their diagnostic processes. Hospitals are emphasizing the use of molecular tests for numerous applications, ranging from the detection of infectious diseases and genetic conditions to cancer identification. By using effective technologies hospitals are enhancing their capacity to diagnose diseases at earlier stages, making treatments more effective. Additionally, the growing practice of personalized medicine is encouraging hospitals to focus more on molecular diagnostics to personalize treatments based on specific genetic profiles thereby driving the India molecular diagnostics market demand.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

North India holds 35.4% of the market share. The market for molecular diagnostics in the North Indian region is growing substantially due to various drivers and trends. Among the main drivers is the growing need for precise, quick diagnostic tests within healthcare facilities. The region's hospitals and diagnostic centers are increasingly implementing sophisticated molecular diagnostic technologies for enhanced detection of diseases and patient outcomes. The increase in the incidence of chronic ailments, including cancer, cardiovascular diseases, and diabetes, is driving the demand for more accurate and early-stage diagnostic techniques. Technological innovations are bolstering the market growth in India. Emerging new technologies in PCR technology and real-time diagnostic technologies are enhancing test precision and minimizing turnaround times. These innovations are allowing healthcare providers to provide faster, more accurate results, which is crucial for timely disease management.

Competitive Landscape:

Major market players are constantly emphasizing product innovation to grow their business. Firms are deploying research and development (R&D) efforts to launch innovative diagnostic technologies, which enhance test accuracy and shorten turnaround time. These developments are contributing to the growing need for accurate and timely diagnostics in both urban and rural healthcare environments. By associating with hospitals and diagnostic laboratories, leading players are making sure that their products suit local needs and are available everywhere in the country. Additionally, India molecular diagnostics market companies are enhancing their domestic manufacturing strengths, which decreases cost, increases supply chain effectiveness, and suits the Indian government's initiative to make things domestically. These strategies are assisting market participants to become more competitive.

The report provides a comprehensive analysis of the competitive landscape in the India molecular diagnostics market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Vgenomics and Meril Genomics partnered to expand molecular diagnostics in India. Their alliance focused on NIPT, TB detection via tNGS, and rare disease diagnosis using WES.

- April 2025: Sterling Accuris acquired Gujarat & Maha Gujarat Pathology Laboratories to strengthen its molecular diagnostics and lab services in Ahmedabad. The move expanded its network and service capabilities, marking the firm’s fourth acquisition in two years.

- December 2024: Co-Diagnostics and CoSara Diagnostics inaugurated a new oligonucleotide facility in Ranoli. The plant will reportedly manufacture co-primers for molecular diagnostic tests, augmenting in-house PCR test production and advancing efforts in infectious disease diagnostics.

- November 2024: Molbio Diagnostics invested USD 30 Million in OptraSCAN to expand AI-powered digital pathology solutions. The partnership aimed to improve diagnostic access in underserved areas by integrating molecular diagnostics with cloud-based slide analysis and secure data tools.

- October 2024: Redcliffe Labs acquired Celara Diagnostics to expand its South India presence. The integration enhanced its diagnostic services, including molecular and genomic testing, advanced radiology, and pathology.

India Molecular Diagnostics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Reagents and Kits, Instruments, Software and Services |

| Technologies Covered | Polymerase Chain Reactions (PCR), Hybridization, DNA Sequencing, Microarray, Isothermal Nucleic Acid Amplification Technology (INAAT), Others |

| Applications Covered | Infectious Diseases Diagnostics, Oncology, Genetic Testing, Blood Screening, Others |

| End Users Covered | Hospitals Laboratories, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India molecular diagnostics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India molecular diagnostics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India molecular diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India molecular diagnostics market in the region was valued at USD 1.4 Billion in 2025.

The heightened prevalence of chronic and infectious diseases, advancements in molecular diagnostic technologies, and government support for healthcare initiatives are key factors driving the market. Increasing requirement for accurate and rapid analytical tools is further fueling market expansion.

The India molecular diagnostics market is projected to exhibit a CAGR of 7.79% during 2026-2034, reaching a value of USD 2.8 Billion by 2034.

The polymerase chain reaction (PCR) segment accounted for the largest India molecular diagnostics technology market share, with 75.4% in 2025. PCR is widely used for detecting infectious and genetic disorders due to its high sensitivity and accuracy.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)