India Molecular Biology Reagents and Kits Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

India Molecular Biology Reagents and Kits Market Overview:

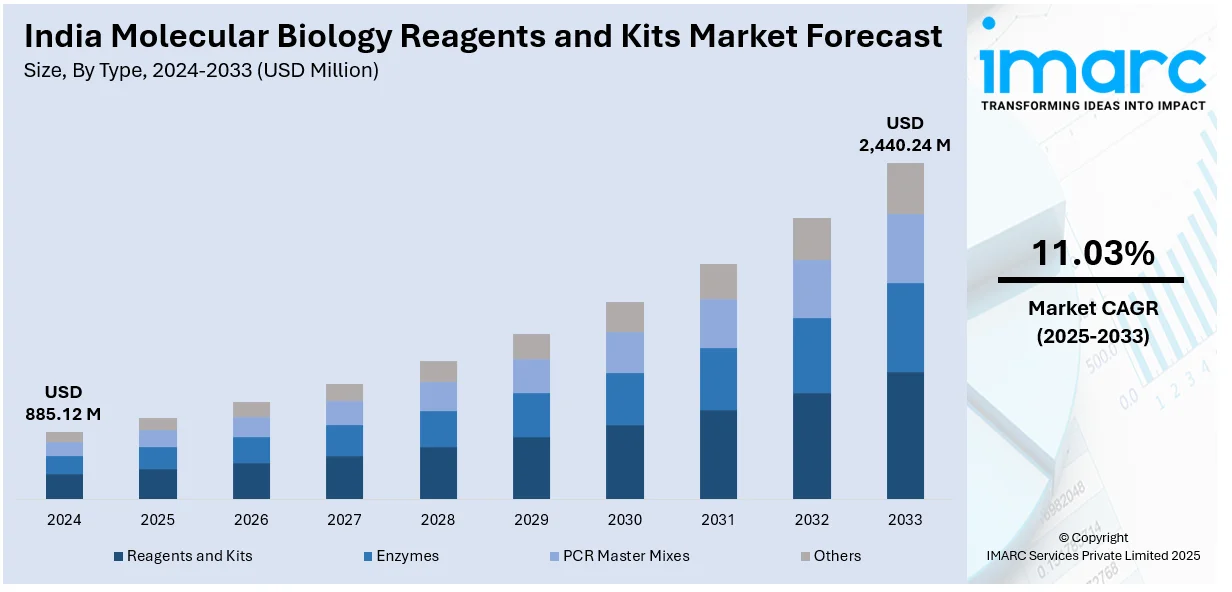

The India molecular biology reagents and kits market size reached USD 885.12 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,440.24 Million by 2033, exhibiting a growth rate (CAGR) of 11.03% during 2025-2033. The market is driven by rising demand for polymerase chain reaction (PCR) and quantitative polymerase chain reaction (qPCR) in diagnostics, expanding applications of next-generation sequencing (NGS), and increasing adoption of CRISPR gene editing. Government funding for genomic research, growing biotechnology investments, and advancements in personalized medicine further accelerate market growth across research and clinical sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 885.12 Million |

| Market Forecast in 2033 | USD 2,440.24 Million |

| Market Growth Rate 2025-2033 | 11.03% |

India Molecular Biology Reagents and Kits Market Trends:

Growing Adoption of PCR and qPCR Kits

The increasing use of PCR and quantitative PCR (qPCR) kits is a significant trend in India molecular biology reagents and kits market. These technologies are essential for applications in diagnostics, research, and drug development. The demand surged during the COVID-19 pandemic, leading to sustained investments in PCR-based diagnostics for infectious diseases, genetic testing, and oncology. The expansion of molecular diagnostics in clinical settings has driven the adoption of high-sensitivity reagents that enhance accuracy and efficiency. Additionally, the rise of portable and point-of-care PCR testing solutions is boosting market growth, particularly in decentralized healthcare settings. Government initiatives supporting genomic research and advancements in multiplex PCR are further propelling demand for PCR and qPCR reagents in India.

To get more information on this market, Request Sample

Expansion of Next-Generation Sequencing (NGS) Applications

Growth in research and clinical diagnostics applications of next-generation sequencing (NGS) is pushing demand for molecular biology reagents and kits in India. In applications related to cancer genomics, infectious disease surveillance, and personalized medicine, NGS technology needs customized reagents for library preparation, sequencing, and data analysis. The Ministry of Science and Technology has also planned to sequence 10 million genomes, further endorsing the nation's drive to pursue genomic research. Government support and partnerships between healthcare providers and biotech companies are also driving the adoption of NGS. Falling sequencing prices and the incorporation of sophisticated bioinformatics tools, such as artificial intelligence (AI), are making it more accessible. These advancements are driving demand for quality reagents, ensuring reproducibility and accuracy in sequencing-based diagnostics and research, and making India a stronger global player in genomic research.

Rising Demand for CRISPR and Gene Editing Kits

CRISPR gene editing technologies are gaining momentum in India's molecular biology industry, creating demand for customized reagents and kits. Academics and biotech firms are now employing CRISPR increasingly to modify genes, model disease, and produce therapies. The scope of genome editing in agriculture, biotechnology, and personalized medicine is also fueling market growth. Government policies supporting genetic research and partnerships between research institutions and global biotech companies are driving innovation in gene editing technologies. Also, developments in CRISPR efficiency, like high-fidelity Cas enzymes and base editing, are making it more precise and lowering off-target effects. With gene therapy and regenerative medicine on the upsurge, the demand for high-quality CRISPR reagents is likely to increase significantly.

India Molecular Biology Reagents and Kits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application and end user.

Type Insights:

- Reagents and Kits

- Enzymes

- PCR Master Mixes

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes reagents and kits, enzymes, PCR master mixes, and others.

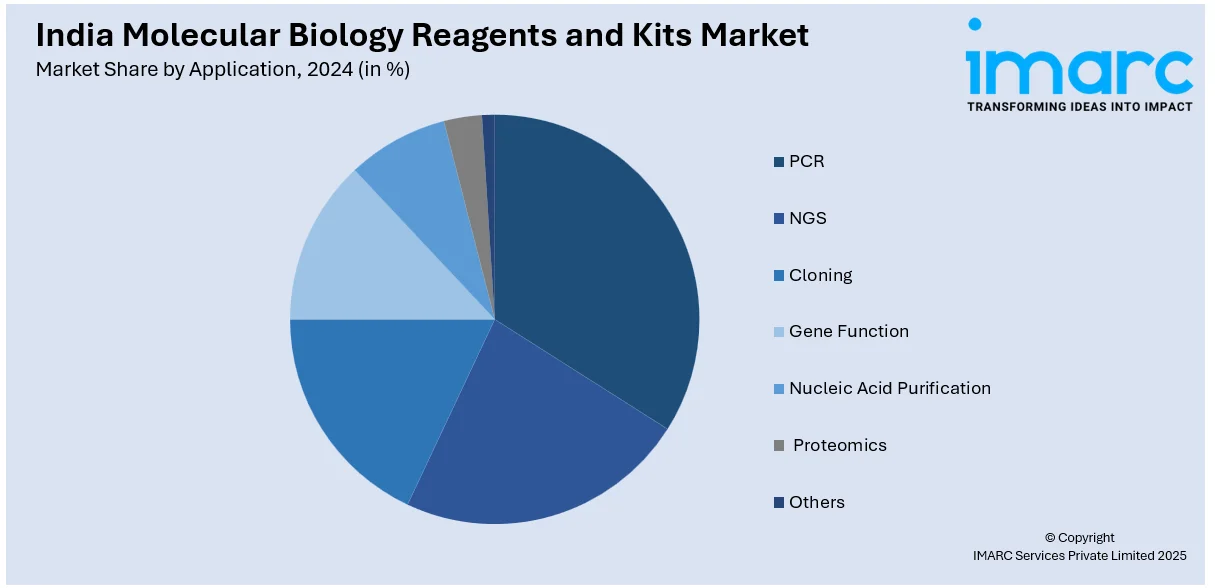

Application Insights:

- PCR

- NGS

- Cloning

- Gene Function

- Nucleic Acid Purification

- Proteomics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes PCR, NGS, cloning, gene function, nucleic acid purification, proteomics, and others.

End User Insights:

- Academic and Research Institutions

- Pharmaceutical and Biotechnology Companies

- Hospitals and Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes academic and research institutions, pharmaceutical and biotechnology companies, hospitals and clinics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Molecular Biology Reagents and Kits Market News:

- In January 2024, QIAGEN announced the launch of two new syndromic testing panels for its QIAstat-Dx instruments in India: the Gastrointestinal Panel 2 and the Meningitis/Encephalitis Panel. These panels join the Respiratory SARS-CoV-2 Panel, which received emergency use authorization in 2020. The new panels have been approved by the Central Drugs Standard Control Organization (CDSCO), enabling healthcare providers in India to diagnose patients more accurately, quickly, and easily. The QIAstat-Dx system is designed for laboratory use and employs cost-efficient, single-use cartridges that include all necessary reagents and built-in sample processing.

India Molecular Biology Reagents and Kits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Reagents and Kits, Enzymes, PCR Master Mixes, Others |

| Applications Covered | PCR, NGS, Cloning, Gene Function, Nucleic Acid Purification, Proteomics, Others |

| End Users Covered | Academic and Research Institutions, Pharmaceutical and Biotechnology Companies, Hospitals and Clinics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India molecular biology reagents and kits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India molecular biology reagents and kits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India molecular biology reagents and kits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The molecular biology reagents and kits market in India was valued at USD 885.12 Million in 2024.

The India molecular biology reagents and kits market is projected to exhibit a CAGR of 11.03% during 2025-2033, reaching a value of USD 2,440.24 Million by 2033.

Rising research activities in genomics, diagnostics, and personalized medicine are major growth factors. Demand is supported by government-funded biotech projects, academic research, and private R&D investments. Easy availability of reagents and expanding lab infrastructure enhance accessibility across educational and healthcare institutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)