India Modular Furniture Market Size, Share, Trends and Forecast by Product Type, Material, End User and Region, 2025-2033

India Modular Furniture Market Overview:

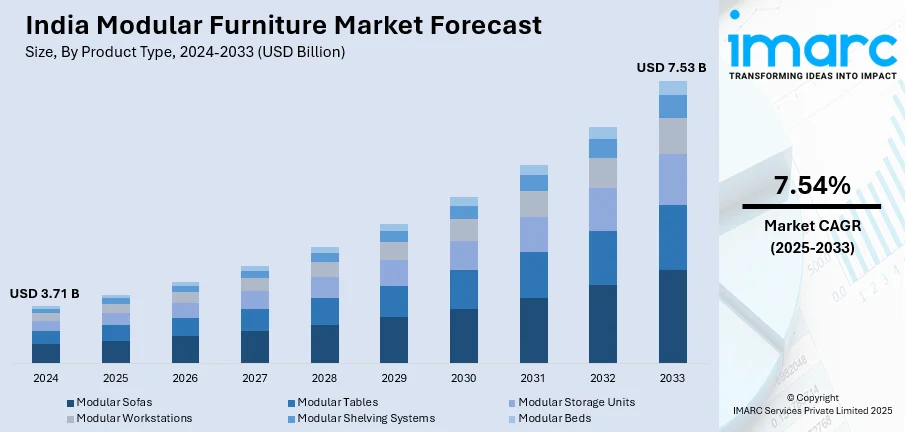

The India modular furniture market size reached USD 3.71 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.53 Billion by 2033, exhibiting a growth rate (CAGR) of 7.54% during 2025-2033. The market is driven by rapid urbanization, real estate growth, rising demand for customization, increasing e-commerce penetration, and sustainability trends. Additionally, expanding organized retail, technological advancements, and eco-friendly materials further impel the India modular furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.71 Billion |

| Market Forecast in 2033 | USD 7.53 Billion |

| Market Growth Rate (2025-2033) | 7.54% |

India Modular Furniture Market Trends:

Rapid Urbanization and Growing Real Estate Sector

India's rapid urbanization and expanding real estate sector are key drivers of the India modular furniture market growth. According to the IBEF, by the year 2040, the real estate market is projected to expand to US$ 9.30 billion from US$ 1.72 billion in the year 2019. The real estate industry in India is projected to attain a market size of US$ 1 trillion by 2030, increasing from US$ 200 billion in 2021, and is set to contribute 13% to the nation’s GDP by 2025. Retail, hospitality, and commercial real estate are expanding considerably as they offer the essential infrastructure for India's increasing demands. The Indian real estate sector is expected to undergo significant growth, possibly attaining a worth of US$ 5-7 trillion by 2047, and could even exceed US$ 10 trillion. With increasing urban migration, demand for compact, space-saving furniture is rising, particularly in metro cities. Real estate developers and homeowners prefer modular solutions for their flexibility, aesthetic appeal, and efficient space utilization. Market growth receives additional support from the increased construction activity for both residential and commercial sectors which includes initiatives for smart cities and co-working spaces. Additionally, rising disposable incomes and changing lifestyle preferences are encouraging consumers to invest in modern, customizable furniture that enhances both functionality and design, boosting the modular furniture industry in India.

To get more information on this market, Request Sample

Rising Demand for Customization and Aesthetic Appeal

Consumers in India are increasingly seeking personalized and aesthetically appealing furniture that aligns with their interior preferences, thus creating a positive India modular furniture market outlook. Modular furniture offers customization in design, color, material, and functionality, making it highly desirable for both residential and commercial spaces. With evolving lifestyle trends, younger generations prefer furniture that is sleek, multifunctional, and adaptable to different spaces. Online furniture retailers and established brands are catering to this demand by offering tailor-made solutions with a variety of finishes and configurations. The ability to modify, expand, or reconfigure furniture according to changing needs further enhances its appeal among modern consumers. For instance, in January 2025, Raj Air Cooler Group made a noteworthy entry into the modular furniture sector by introducing its new line, 'Raj Modular Furniture.' To emphasize the product's resilience and robustness, the company enlisted the famous figure The Great Khali as its brand ambassador. "The company confirmed that The Great Khali remains the brand ambassador and continues to promote the new product line." The products feature stylish, lightweight, and environmentally friendly designs, offered in various colors and styles, with prices starting at Rs. 200 rupees. 5,000, which makes them available to both mid-market and high-end clients.

India Modular Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, material, and end user.

Product Type Insights:

- Modular Sofas

- Modular Tables

- Modular Storage Units

- Modular Workstations

- Modular Shelving Systems

- Modular Beds

The report has provided a detailed breakup and analysis of the market based on the product type. This includes modular sofas, modular tables, modular storage units, modular workstations, modular shelving systems, and modular beds.

Material Insights:

- Wood

- Metal

- Plastic

- Glass

- Upholstery

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes wood, metal, plastic, glass, and upholstery.

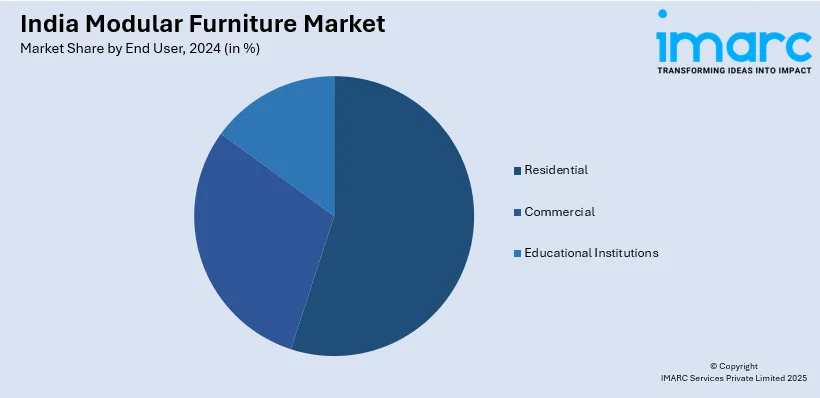

End User Insights:

- Residential

- Commercial

- Offices

- Hotels

- Retail Spaces

- Restaurants

- Educational Institutions

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, (offices, hotels, retail spaces, restaurants), and educational institutions.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Modular Furniture Market News:

- In April 2023, DesignCafé introduced its Direct-to-Consumer (D2C) brand, Qarpentri, focused on offering affordable home interior solutions at groundbreaking prices, along with the quickest delivery times, throughout India today. Qarpentri provides a 5-year guarantee, alongside a 15-day delivery commitment for all its modular units, at unmatched prices beginning at just Rs 49,999. Qarpentri’s customized solutions, design philosophy, and quality assurance, along with their exceptional delivery speed, create a groundbreaking proposition for the Indian modular furniture sector.

- In October 2024, Pepperfry and Infra.Market revealed a strategic alliance aimed at improving customer experience and providing a broader selection of products and services. Pepperfry's presence in Infra.Market locations, combined with the accessibility of IVAS in Pepperfry outlets, will establish a single destination for all home requirements. Shoppers will find a diverse selection of items and services, including furniture, mattresses, home decor, renovation services, and construction materials, all conveniently housed in a single location. Moreover, IVAS intends to enhance Pepperfry’s modular furniture line in current Pepperfry locations throughout Mumbai, Pune, Baroda, Ahmedabad, Chandigarh, and Kolkata.

India Modular Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Modular Sofas, Modular Tables, Modular Storage Units, Modular Workstations, Modular Shelving Systems, Modular Beds |

| Materials Covered | Wood, Metal, Plastic, Glass, Upholstery |

| End Users Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India modular furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the India modular furniture market on the basis of product type?

- What is the breakup of the India modular furniture market on the basis of material?

- What is the breakup of the India modular furniture market on the basis of end user?

- What is the breakup of the India modular furniture market on the basis of regions?

- What are the various stages in the value chain of the India modular furniture market?

- What are the key driving factors and challenges in the India modular furniture market?

- What is the structure of the India modular furniture market and who are the key players?

- What is the degree of competition in the India modular furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India modular furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India modular furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India modular furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)