India Modular Construction Market Size, Share, Trends and Forecast by Type, Module Type, Material, End Use, and Region, 2025-2033

Market Overview:

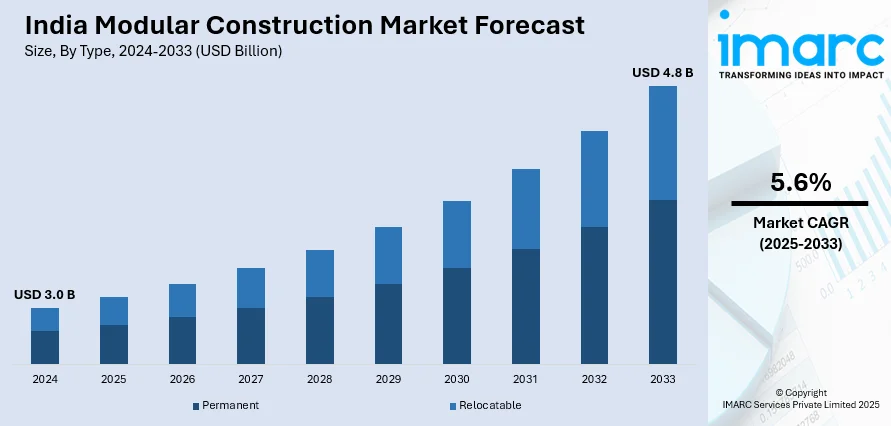

India modular construction market size reached USD 3.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033. The increasing advances in technology, including Building Information Modeling (BIM) and improved manufacturing processes, which have enhanced the precision and efficiency of modular construction, making it more appealing to stakeholders, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Market Growth Rate (2025-2033) | 5.6% |

Modular construction is a contemporary building method that involves constructing structures using pre-manufactured, standardized components known as modules. These modules are produced off-site in controlled factory conditions, allowing for increased precision and efficiency. The process entails assembling these modules on-site to create a complete building. This approach offers numerous advantages, including reduced construction time, cost-effectiveness, and improved quality control. The modular construction process promotes sustainability by minimizing waste and optimizing resource usage. Additionally, it provides flexibility in design, enabling customization for various purposes, such as residential, commercial, or industrial applications. The method's popularity has grown due to its ability to streamline construction processes, enhance safety, and address challenges associated with traditional construction methods, making it an innovative solution for meeting the evolving demands of the construction industry.

To get more information on this market, Request Sample

India Modular Construction Market Trends:

The modular construction market in India is experiencing significant growth, primarily driven by several key factors. Firstly, the rising regional population and urbanization trends have propelled the demand for rapid and efficient construction solutions. Consequently, modular construction, with its ability to expedite project timelines and reduce on-site labor requirements, has emerged as a preferred choice for developers and builders. Additionally, the cost-effectiveness of modular construction has become a pivotal driver, as it offers savings in both time and expenses compared to traditional construction methods. Furthermore, advancements in technology and design innovation have played a crucial role in shaping the modular construction landscape. The integration of digital tools, BIM, and other cutting-edge technologies has enhanced precision, quality control, and overall project efficiency. Moreover, sustainability concerns are driving the market, with modular construction's inherent ability to minimize waste and optimize resource usage aligning with the increasing emphasis on eco-friendly building practices. In summary, the modular construction market in India is buoyed by a confluence of factors, including urbanization, cost-effectiveness, technological advancements, and sustainability considerations. As these drivers continue to gain prominence, the modular construction industry is poised for sustained growth in the foreseeable future.

India Modular Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, module type, material, and end use.

Type Insights:

- Permanent

- Relocatable

The report has provided a detailed breakup and analysis of the market based on the type. This includes permanent and relocatable.

Module Type Insights:

- Four Sided

- Open Sided

- Partially Open Sided

- Mixed Modules and Floor Cassettes

- Modules Supported by a Primary Structure

- Others

A detailed breakup and analysis of the market based on the module type have also been provided in the report. This includes four sided, open sided, partially open sided, mixed modules and floor cassettes, modules supported by a primary structure, and others.

Material Insights:

- Steel

- Concrete

- Wood

- Plastic

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes steel, concrete, wood, plastic, and others.

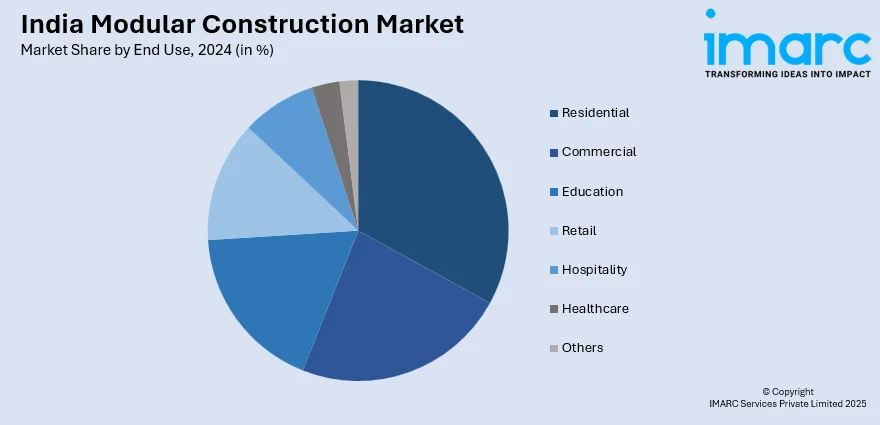

End Use Insights:

- Residential

- Commercial

- Education

- Retail

- Hospitality

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, education, retail, hospitality, healthcare, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Modular Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Permanent, Relocatable |

| Module Types Covered | Four Sided, Open Sided, Partially Open Sided, Mixed Modules and Floor Cassettes, Modules Supported by a Primary Structure, Others |

| Materials Covered | Steel, Concrete, Wood, Plastic, Others |

| End Uses Covered | Residential, Commercial, Education, Retail, Hospitality, Healthcare, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India modular construction market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India modular construction market?

- What is the breakup of the India modular construction market on the basis of type?

- What is the breakup of the India modular construction market on the basis of module type?

- What is the breakup of the India modular construction market on the basis of material?

- What is the breakup of the India modular construction market on the basis of end use?

- What are the various stages in the value chain of the India modular construction market?

- What are the key driving factors and challenges in the India modular construction?

- What is the structure of the India modular construction market and who are the key players?

- What is the degree of competition in the India modular construction market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India modular construction market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India modular construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India modular construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)