India Mobility Aid Medical Devices Market Size, Share, Trends and Forecast by Product, End User, and Region, 2026-2034

India Mobility Aid Medical Devices Market Overview:

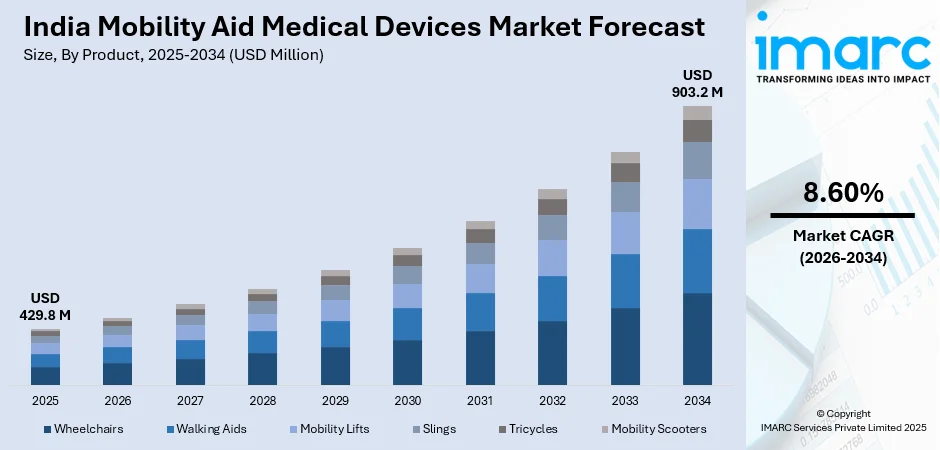

The India mobility aid medical devices market size reached USD 429.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 903.2 Million by 2034, exhibiting a growth rate (CAGR) of 8.60% during 2026-2034. India's mobility aid medical devices market is growing with a rising population, disability cases, and greater access to healthcare. Moreover, the growth is boosted by technological developments, government efforts, and higher demand for mobility scooters and electric wheelchairs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 429.8 Million |

| Market Forecast in 2034 | USD 903.2 Million |

| Market Growth Rate (2026-2034) | 8.60% |

India Mobility Aid Medical Devices Market Trends:

Increasing Demand for Smart Mobility Devices

The need for smart mobility aids in India is on the rise as a result of an expanding geriatric population and an increased number of mobility-impaired people. Arthritis, spinal cord injury, and neuromuscular disorders have increased the demand for assistive devices that enhance mobility and independence. Along with this, improved medical technology is enhancing access to electric wheelchairs, intelligent canes, and powered scooters, especially in urban settings. As per IMARC projection, the global smart mobility market size reached USD 68.5 Billion in 2024 and is expected to reach USD 233.6 Billion by 2033, reflecting the rising adoption of advanced mobility solutions worldwide. With changing lifestyles and improved affordability, more people are opting for customized and technology-driven solutions for mobility challenges. Manufacturers are incorporating IoT, AI-driven navigation, and fall sensors in mobility aids. For instance, voice-controlled smart wheelchairs with obstacle detection and app-based monitoring systems to improve user experience. Foldable and lightweight mobility aids are also gaining popularity, as they are convenient to carry and store. Manufacturers are emphasizing ergonomic designs and long-lasting materials to make them usable for a longer period. In addition, online portals are broadening their products to enable users to purchase a vast array of personalized mobility devices at home.

To get more information on this market, Request Sample

Rising Government Support and Local Manufacturing

Government initiatives promoting domestic production of mobility aids are significantly influencing the market. Policies such as ‘Make in India’ and the Assistance to Disabled Persons for Purchase/Fitting of Aids and Appliances (ADIP) scheme are encouraging local manufacturing while reducing dependency on imports. The Indian government is also supporting subsidies, tax incentives, and funding for assistive technology innovations, leading to an increase in the availability of cost-effective mobility solutions. The demand for locally manufactured mobility aids is growing, particularly in tier-2 and tier-3 cities, where affordability plays a crucial role in product adoption. Recent developments include the establishment of local manufacturing units by domestic and international players, ensuring faster production and supply chain efficiency. The introduction of government-backed insurance coverage and reimbursement policies for mobility aids has made these devices more accessible to people with disabilities. Additionally, corporate partnerships and non-governmental initiatives are playing a role in providing affordable assistive devices to economically weaker sections. With continuous efforts to improve the availability and affordability of mobility solutions, the Indian market is witnessing a steady rise in demand for locally produced medical mobility aids.

India Mobility Aid Medical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product and end user.

Product Insights:

- Wheelchairs

- Walking Aids

- Mobility Lifts

- Slings

- Tricycles

- Mobility Scooters

The report has provided a detailed breakup and analysis of the market based on the type. This includes wheelchairs, walking aids, mobility lifts, slings, tricycles, and mobility scooters.

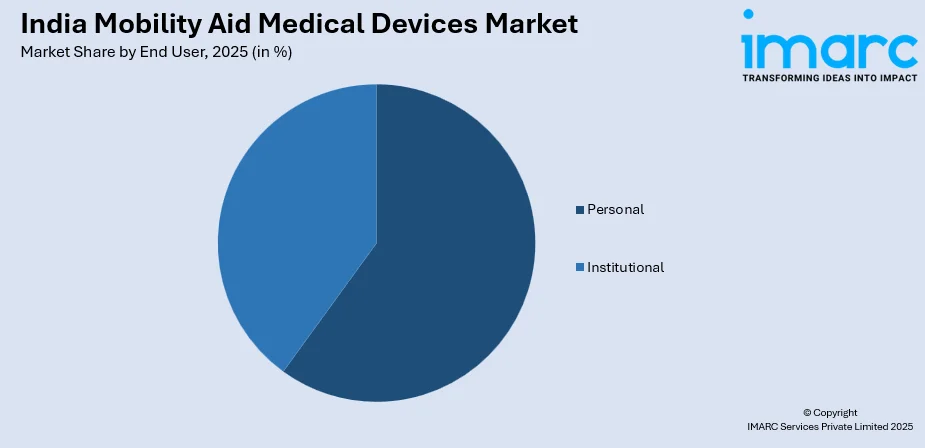

End User Insights:

- Personal

- Institutional

The report has provided a detailed breakup and analysis of the market based on the lease type. This includes personal and institutional.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mobility Aid Medical Devices Market News:

- August 2024: GreenPioneer Mobility launched ‘NonStop’ retail stores to provide mobility aids, rehabilitation equipment, and assistive devices across India. With international brands and nationwide expansion, this development enhances accessibility, boosts product availability, and strengthens the mobility aid medical devices market, improving support for elderly and disabled individuals.

- March 2024: IIT Madras developed NeoStand, India’s first customizable electric standing wheelchair, enabling seamless sitting-to-standing transitions. This innovation enhances independence, accessibility, and health benefits for users, driving technological advancements in the India mobility aid medical devices market and expanding opportunities for assistive technology adoption nationwide.

India Mobility Aid Medical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Wheelchairs, Walking Aids, Mobility Lifts, Slings, Tricycles, Mobility Scooters |

| End Users Covered | Personal, Institutional |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobility aid medical devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mobility aid medical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobility aid medical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobility aid medical devices market in India was valued at USD 429.8 Million in 2025.

The India mobility aid medical devices market is projected to exhibit a CAGR of 8.60% during 2026-2034, reaching a value of USD 903.2 Million by 2034.

Rising geriatric population and mobility-impaired individuals, increased cases of arthritis and neuromuscular disorders, technological advancements in electric wheelchairs and smart mobility aids, government initiatives like Make in India and ADIP scheme, subsidies and tax incentives for assistive technology, growing local manufacturing, and government-backed insurance coverage are driving the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)