India Mobile Phone Insurance Market Size, Share, Trends and Forecast by Phone Type, Coverage, Distribution Channel, End User, and Region, 2025-2033

India Mobile Phone Insurance Market Overview:

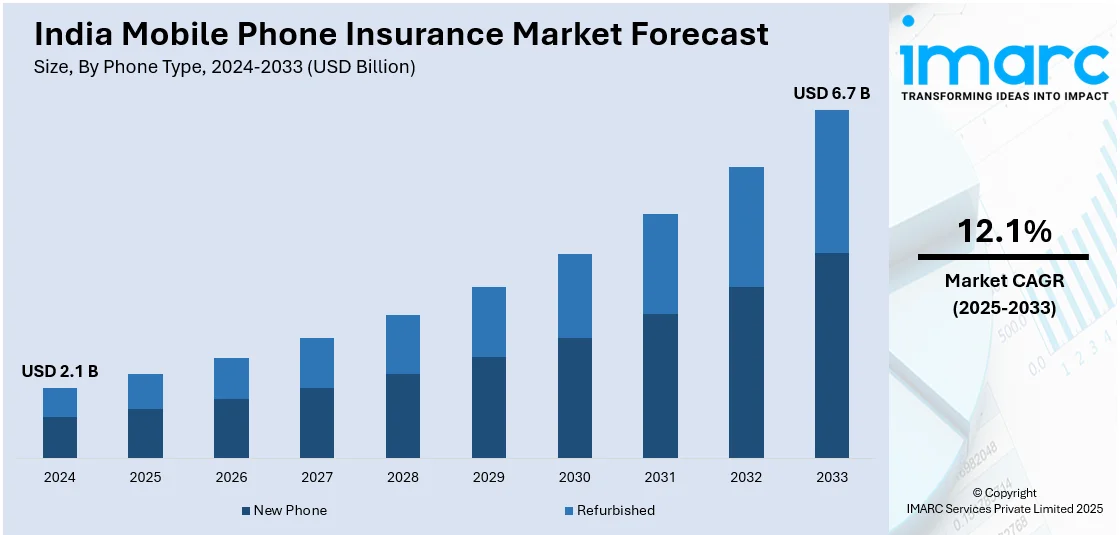

The India mobile phone insurance market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.1% during 2025-2033. The market is driven by the widespread adoption of smartphones, rising consumer awareness of device protection, proliferating sales of premium smartphones, availability of affordable insurance plans, expansion of online distribution channels, partnerships between insurers and mobile brands, and the growing need for financial security against accidental damage and theft.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Market Growth Rate 2025-2033 | 12.1% |

India Mobile Phone Insurance Market Trends:

Proliferation of Smartphones

India's mobile phone insurance industry is also heavily driven by the mass dissemination of smartphones, which has dramatically changed consumer trends and demand for device protection. India had an estimated 750 million smartphone subscribers as of 2021, a figure anticipated to reach more than 1 billion by the year 2026. The reach of smartphones has grown in both urban and rural regions owing to low-cost models by local as well as foreign companies, aggressive pricing policies, and government policies encouraging digital connectivity. As more people went digital, smartphones became imperative for communication, entertainment, financial transactions, learning, and business processes. With smartphones becoming a necessity, the requirement to protect them has resulted in an increased tendency toward mobile phone insurance. Consumers understand the importance of safeguarding their devices from accidental damage, technical faults, and theft, driving demand for insurance services. Moreover, the increasing ownership of high-end premium smartphones has also boosted this trend. Most users spend money on flagship devices that come with superior technology, thus insurance coverage is an important component of ownership. With device makers and telecom companies offering insurance plans as part of device purchases, policy uptake is becoming more integrated. This coupling of rising smartphone penetration and consumer awareness guarantees a promising future for India's mobile phone insurance sector, setting the stage for more complete and formalized treatment of device security.

To get more information on this market, Request Sample

Wide Availability of Diverse Mobile Phone Insurance Plans

India's mobile phone insurance industry is growing rapidly, with various coverage offerings suited to meet a wide range of consumer requirements. Insurance policies mostly belong to segments such as accidental damage protection, theft and loss, extended warranty, and device protection plans coupled with telecom plans. One of the most popular covers is accidental damage insurance, which includes protection for screen damage, spillage of liquids, and physical damage. Loss and theft coverage, although less popular owing to rigorous claim conditions, is becoming more popular, particularly for expensive smartphones. Whereas, extended warranties, which cover devices beyond the manufacturer's warranty duration, find favor with customers seeking long-term protection against technical faults. Further, telecom providers and smartphone manufacturers increasingly combine insurance with phone sales, providing smooth coverage at the point of purchase. In light of the escalating price range of premium smartphones and heightened financial security awareness, mobile phone insurance is gaining prominence as a necessary investment for Indian consumers to gain extended protection against unexpected risks.

India Mobile Phone Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on phone type, coverage, distribution channel, and end user.

Phone Type Insights:

- New Phone

- Refurbished

The report has provided a detailed breakup and analysis of the market based on the phone type. This includes new phone and refurbished.

Coverage Insights:

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

A detailed breakup and analysis of the market based on the coverage have also been provided in the report. This includes physical damage, electronic damage, virus protection, data protection, and theft protection.

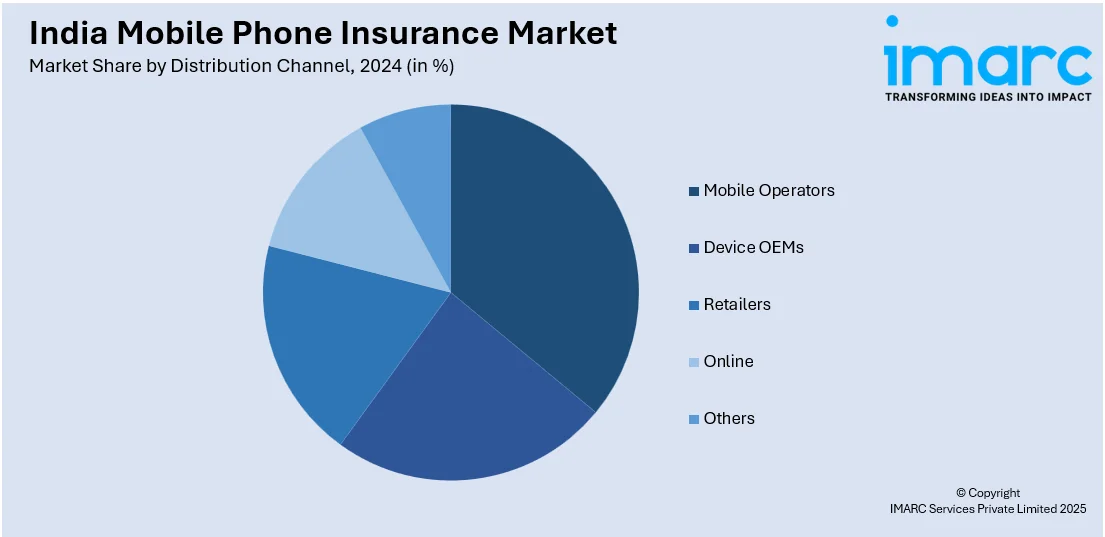

Distribution Channel Insights:

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes mobile operators, device OEMs, retailers, online, and others.

End User Insights:

- Corporate

- Personal

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes corporate and personal.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mobile Phone Insurance Market News:

- September 2024: Apple launched iPhone 16 Pro in September 2024 in India. On account of this, DigitInsure launched specialized mobile insurance policies for iPhone 16 Pro and Pro Max, which targeted customers investing in high-end smartphones. These policies offered end-to-end protection against accidental damage, theft, and technical issues. This move helped widen the mobile phone insurance market in India by catering to the propelling demand for safeguarding high-value devices.

- September 2024: Truecaller has launched Fraud Insurance in association with HDFC ERGO Cyber Sachet Insurance to enable customers to recover losses from financial implications of frauds, which is a part of the annual premium subscription of the caller ID app for Android and iOS users in India. The insurance provides payment for monetary losses up to ₹10,000 in case of scams initiated with the user's Truecaller mobile number and is offered as an add-on with Truecaller Premium subscriptions, strictly for individual use.

India Mobile Phone Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phone Types Covered | New Phone, Refurbished |

| Coverages Covered | Physical Damage, Electronic Damage, Virus Protection, Data Protection, Theft Protection |

| Distribution Channels Covered | Mobile Operators, Device OEMs, Retailers, Online, Others |

| End Users Covered | Corporate, Personal |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobile phone insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mobile phone insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile phone insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile phone insurance market in India was valued at USD 2.1 Billion in 2024.

The India mobile phone insurance market is projected to exhibit a CAGR of 12.1% during 2025-2033, reaching a value of USD 6.7 Billion by 2033.

The growth of India’s mobile phone insurance market is driven by increasing smartphone usage, growing consumer awareness about device protection, rising repair costs, collaborations between insurers, manufacturers, and retailers, and the convenience of digital platforms for policy purchase and claims, making insurance an attractive option for mobile users.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)