India Mobile Middleware Market Size, Share, Trends and Forecast by Type, Deployment, End-User Industry, and Region, 2025-2033

India Mobile Middleware Market Overview:

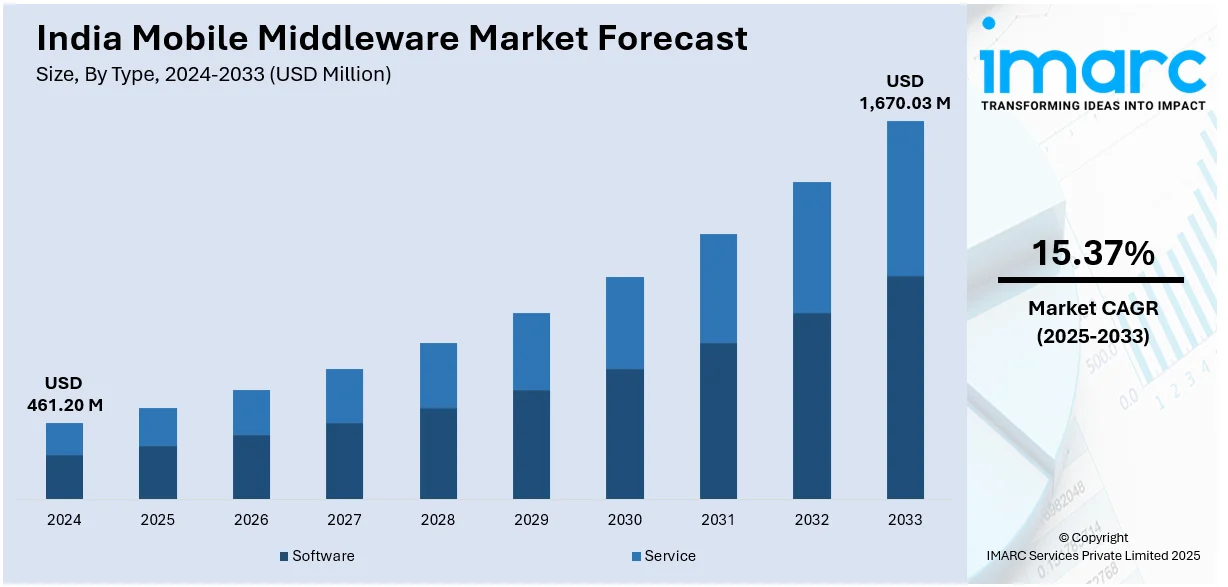

The India mobile middleware market size reached USD 461.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,670.03 Million by 2033, exhibiting a growth rate (CAGR) of 15.37% during 2025-2033. The market is driven by growing mobile app adoption, rising need for seamless integration between apps and backend systems, and heightened demand for real-time synchronization of data. Cloud computing, IoT integration, and increased security demands are also accelerating the India mobile middleware market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 461.20 Million |

| Market Forecast in 2033 | USD 1,670.03 Million |

| Market Growth Rate 2025-2033 | 15.37% |

India Mobile Middleware Market Trends:

Rise of Cloud-Based Mobile Middleware Solutions

Cloud-based mobile middleware solutions are gaining momentum in India, providing businesses with scalability, flexibility, and cost-efficiency. These platforms facilitate the smooth integration of mobile applications with backend systems, enabling real-time data synchronization and enhanced operational efficiency. As per industry reports, 95% of systems are projected to be cloud native by the year 2025. This transition produces considerably more data than earlier technology generations, making scaling increasingly difficult. As cloud technology gains increasing popularity, firms are using cloud-based mobile middleware to simplify the development of apps and minimize the complexity of infrastructure management. Cloud offerings do away with hardware requirements on-site, so deploying, managing, and upgrading mobile apps becomes simpler. For startups and small businesses looking to keep upfront investment and maintenance expenses as low as possible while having access to top-of-the-line middleware functionality, this trend is highly advantageous. In addition, cloud platforms also ensure enhanced data security, disaster recovery, and deployment time, which are significant for industries such as e-commerce, banking, and healthcare. With cloud usage continuing to increase, cloud-based mobile middleware will be a deciding factor in defining the future of mobile app development in India.

To get more information on this market, Request Sample

Increased Adoption of IoT Integration in Mobile Middleware

Internet of Things (IoT) functionality in mobile middleware is a major trend in India's mobile middleware space. With increasing IoT device proliferation across industries, companies are looking for solutions that can connect and manage such devices through mobile apps with ease. Mobile middleware platforms are adapting to facilitate IoT integration, which supports real-time data transmission, device management, and automation through mobile phones. For instance, in manufacturing, logistics, and smart cities, middleware solutions are enabling mobile-based management of IoT devices, enhancing operational effectiveness and decision-making. With IoT-enabled devices becoming more common, mobile middleware solutions are assisting companies in processing and examining the data from these devices, opening up new avenues for service improvement. The integration of IoT and mobile middleware will fuel innovation, especially in automation and smart device management, and hence will be a major trend in India's mobile middleware market.

Focus on Enhanced Security Features in Mobile Middleware

India Mobile Middleware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, deployment, and end-user industry.

Type Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the type. This includes software and service.

Deployment Insights:

- On-Premise

- On-Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes on-premise and on-cloud.

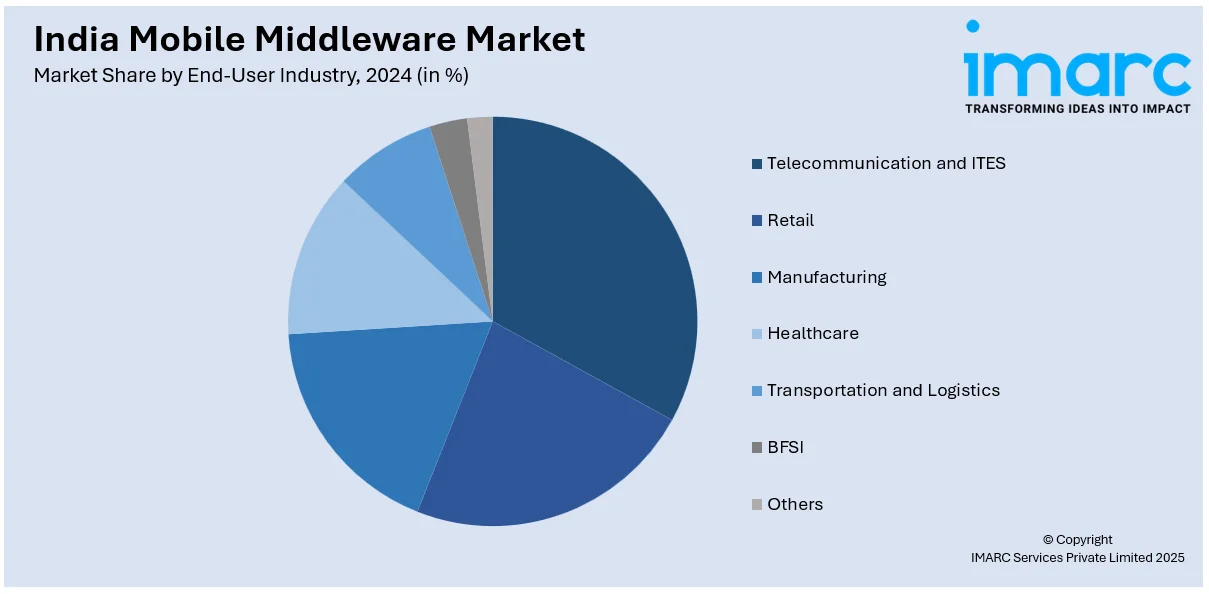

End-User Industry Insights:

- Telecommunication and ITES

- Retail

- Manufacturing

- Healthcare

- Transportation and Logistics

- BFSI

- Others

The report has provided a detailed breakup and analysis of the market based on the end- user industry. This includes telecommunication and ITES, retail, manufacturing, healthcare, transportation and logistics, BFSI, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mobile Middleware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Software, Service |

| Deployments Covered | On-Premise, On- Cloud |

| End-User Industries Covered | Telecommunication and ITES, Retail, Manufacturing, Healthcare, Transportation and Logistics, BFSI, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India mobile middleware market performed so far and how will it perform in the coming years?

- What is the breakup of the India mobile middleware market on the basis of type?

- What is the breakup of the India mobile middleware market on the basis of deployment?

- What is the breakup of the India mobile middleware market on the basis of end-user industry?

- What is the breakup of the India mobile middleware market on the basis of region?

- What are the various stages in the value chain of the India mobile middleware market?

- What are the key driving factors and challenges in the India mobile middleware market?

- What is the structure of the India mobile middleware market and who are the key players?

- What is the degree of competition in the India mobile middleware market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobile middleware market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mobile middleware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile middleware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)