India Mobile Hospital Market Size, Share, Trends and Forecast by Function, Bed Capacity, Application, and Region, 2025-2033

India Mobile Hospital Market Overview:

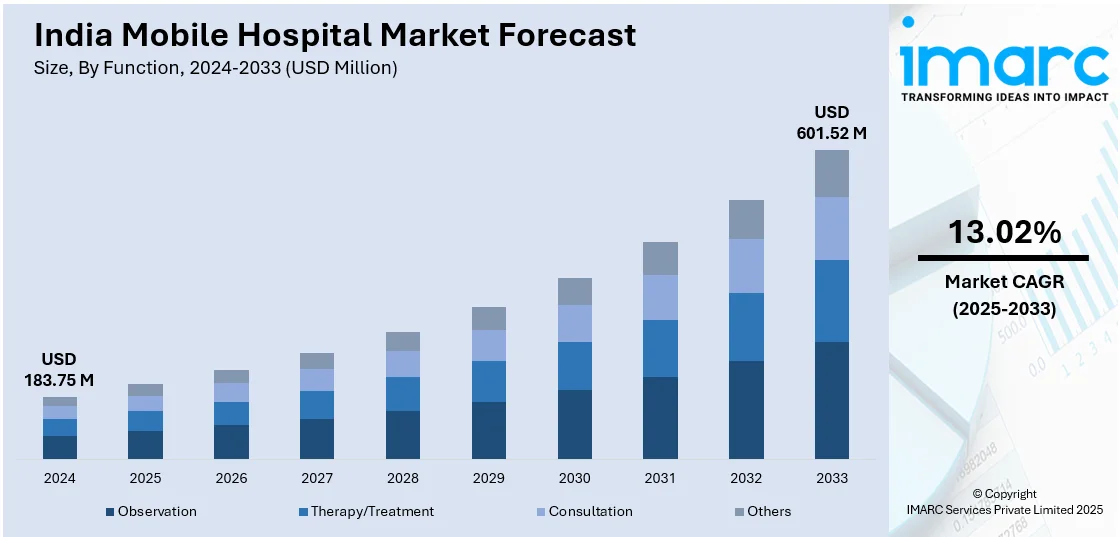

The India mobile hospital market size reached USD 183.75 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 601.52 Million by 2033, exhibiting a growth rate (CAGR) of 13.02% during 2025-2033. The market is experiencing growth due to increasing healthcare accessibility needs, especially in rural areas. Government initiatives, advancements in medical technology, and rising demand for emergency medical services are key drivers. Cost-effectiveness and quick deployment also contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 183.75 Million |

| Market Forecast in 2033 | USD 601.52 Million |

| Market Growth Rate 2025-2033 | 13.02% |

India Mobile Hospital Market Trends:

Advancement in Emergency Healthcare Solutions

Advancements have significantly influenced the growth of the Indian mobile hospital market in emergency healthcare infrastructure. The emphasis on quick response and efficient medical management has accelerated the demand for portable healthcare solutions. Mobile hospitals equipped with innovative technologies are addressing critical healthcare needs, particularly during natural disasters and emergencies. In May 2024, the Indian Air Force successfully tested the Aarogya Maitri Cube under Project BHISHMA, an air-lifted portable hospital designed for rapid emergency response. Equipped with AI-powered monitoring systems, advanced medical facilities, and data analytics, it demonstrated operational readiness within 12 minutes. The cube's compact, air-droppable design makes it ideal for remote and disaster-prone areas, ensuring timely medical assistance. This development has reinforced India's capability to manage emergencies effectively, contributing to the market growth of mobile hospitals. By offering robust medical support with technological integration, the Aarogya Maitri Cube has set a benchmark in disaster response infrastructure. The increased focus on portable hospital units has also encouraged further investment and innovations in mobile healthcare systems, enhancing the overall healthcare landscape.

To get more information on this market, Request Sample

Expansion of Virtual Healthcare Accessibility

The increasing reliance on virtual healthcare platforms has emerged as a significant driver in the Indian mobile hospital market. Telemedicine, remote diagnostics, and virtual consultations are redefining how healthcare is delivered, ensuring wider access to medical services across urban and rural regions. The growing demand for cost-effective and accessible healthcare solutions has accelerated the adoption of virtual hospital models. In December 2024, Mulk International and Ajeenkya DY Patil Group launched the first large-scale virtual hospital across MENA and the Asia-Pacific region. With AED 100 million in funding and a network of 20,000 doctors, the virtual hospital platform integrated telehealth consultations, mobile clinics, and AI-based diagnostic services. Additionally, the introduction of smart ambulances and 24/7 remote care strengthened emergency medical response capabilities. This initiative has significantly impacted the Indian mobile hospital market by encouraging the use of digital healthcare systems. It has enhanced patient access to quality healthcare while reducing operational costs for providers. The collaboration's focus on expanding telemedicine services has further stimulated market growth, promoting technology-driven medical solutions for a more inclusive and efficient healthcare ecosystem.

India Mobile Hospital Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on function, bed capacity, and application.

Function Insights:

- Observation

- Therapy/Treatment

- Consultation

- Others

The report has provided a detailed breakup and analysis of the market based on the function. This includes observation, therapy/treatment, consultation, and others.

Bed Capacity Insights:

- Less than 20 Beds

- 20-30 Beds

- Up to 50 Beds

The report has provided a detailed breakup and analysis of the market based on the bed capacity. This includes less than 20 beds, 20-30 beds, and up to 50 beds.

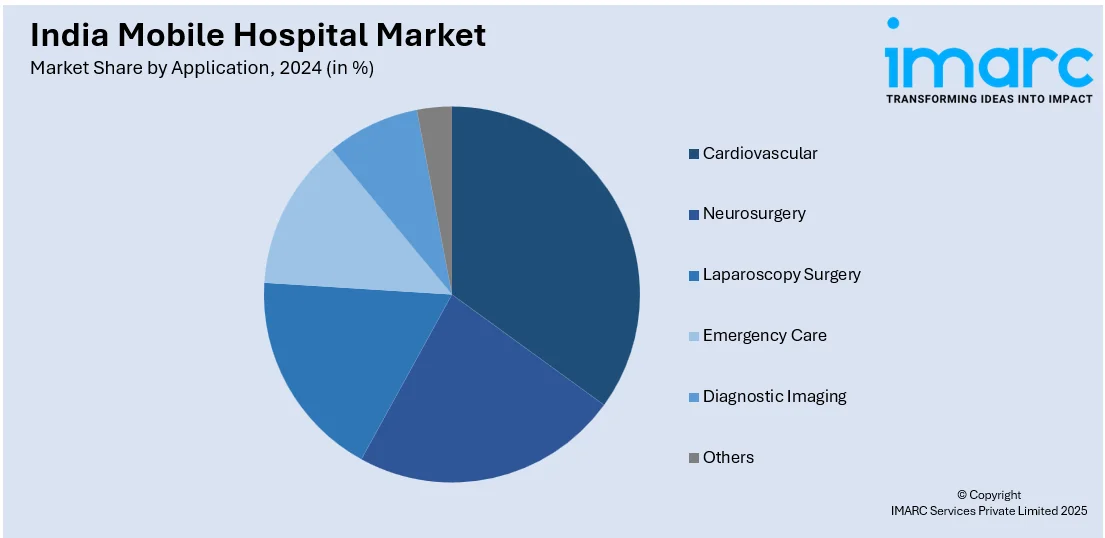

Application Insights:

- Cardiovascular

- Neurosurgery

- Laparoscopy Surgery

- Emergency Care

- Diagnostic Imaging

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes cardiovascular, neurosurgery, laparoscopy surgery, emergency care, diagnostic imaging, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mobile Hospital Market News:

- January 2025: Artemis Hospital collaborated with Signature Global Foundation and launched AarogyaRise, a mobile health clinic enhancing rural healthcare access. Equipped with ICU services, cancer screening, and telemedicine, it expanded healthcare reach, positively impacting the mobile hospital sector by increasing demand for innovative mobile solutions.

- November 2024: The BHISHM Cube, a portable mobile hospital, was introduced during the Maha Kumbh for medical emergencies. Equipped with AI, diagnostic tools, and surgical facilities, it enhanced healthcare preparedness. This innovation accelerated the mobile hospital industry, driving advancements in emergency healthcare solutions.

India Mobile Hospital Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Observation, Therapy/Treatment, Consultation, Others |

| Bed Capacities Covered | Less than 20 Beds, 20-30 Beds, Up to 50 Beds |

| Applications Covered | Cardiovascular, Neurosurgery, Laparoscopy Surgery, Emergency Care, Diagnostic Imaging, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobile hospital market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mobile hospital market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile hospital industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile hospital market in India was valued at USD 183.75 Million in 2024.

The India mobile hospital market is projected to exhibit a (CAGR) of 13.02% during 2025-2033, reaching a value of USD 601.52 Million by 2033.

Mobile hospitals enable healthcare access in rural, underprivileged, and disaster-stricken regions. Integrated diagnostic, treatment, and emergency services are provided by these units. Mobile deployment is facilitated by government health programs like Ayushman Bharat and disaster policies. Expanded demand for telemedicine, cost-efficient outreach, and movable care infrastructure fuels applications by non-governmental organizations (NGOs), states, and health startups.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)