India Mobile Gaming Market Size, Share, Trends and Forecast by Monetization Type, Platform, Game Type, and Region, 2025-2033

India Mobile Gaming Market Size and Share:

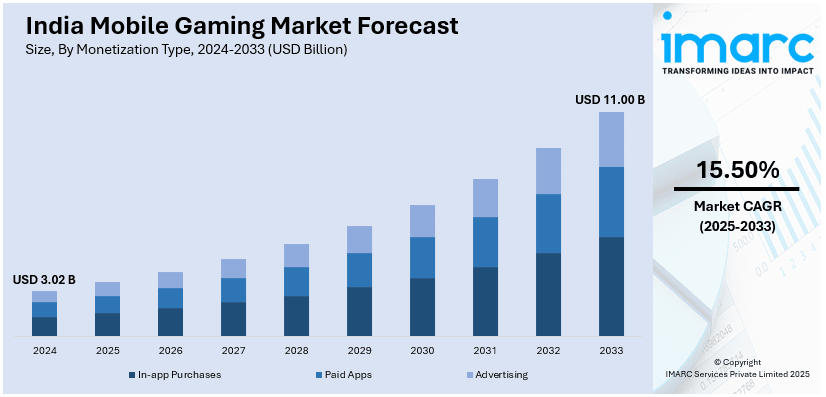

The India mobile gaming market size was valued at USD 3.02 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.00 Billion by 2033, exhibiting a CAGR of 15.50% from 2025-2033. The market is experiencing rapid growth, impacted by increased smartphone ownership, cost-effective data plans, and heightening disposable incomes. The market is fueled by a young, tech-savvy population, a surge in esports popularity, and localized game content, making mobile gaming a dominant entertainment medium in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.02 Billion |

|

Market Forecast in 2033

|

USD 11.00 Billion |

| Market Growth Rate (2025-2033) | 15.50% |

The heightening elevation in smartphone penetration is a crucial factor that is notably boosting the growth of mobile gaming market across India. For instance, industry reports indicate that as of 2024, India secured second rank in smartphone ownership, with 659 Million owners. Consequently, since a huge number of budget-convenient devices are easily accessible in the nation, mobile gaming has become available to a wide range of demographic, encompassing those in rural zones. In line with this, cost-effacement data plans for mobile users, particularly with the notable proliferation of 5G or 4G networks, have made it comparatively convenient for customers to avail magnified-speed internet, facilitating seamless gaming experiences. Furthermore, the amalgam of affordable data packages and smartphones aids the mass utilization of mobile games, contributing to the expansion of India mobile gaming market share.

To get more information on this market, Request Sample

The rise in disposable income, especially among India’s elevating middle class, has contributed significantly to the mobile gaming market’s growth. For instance, as per industry reports, disposable income in India is anticipated to rise to INR 305 Million during 2024, from INR 296 Million in 2023. As more consumers have the financial capability to spend on digital entertainment, mobile gaming has emerged as a popular recreational activity. Additionally, changing entertainment preferences, with a shift towards on-demand, interactive experiences over traditional forms of media, further support the adoption of mobile games. This trend is coupled with the increasing acceptance of in-app purchases and microtransactions, which fuel revenue generation and player engagement within the gaming ecosystem.

India Mobile Gaming Market Trends:

Rising Popularity of Esports

Esports is rapidly gaining traction in India, becoming a key market trend within mobile gaming. The surge in mobile esports tournaments, supported by platforms like PUBG Mobile and Free Fire, has attracted substantial investments from both local and international stakeholders. For instance, in April 2024, Garena announced active plans to initiate its operations in India post the re-launch of Free Fire across the nation. Garena is shifting its game server to India, which will be deployed in Mumbai premises of Yotta Data Services. Moreover, the growing presence of esports events, sponsorships, and professional teams fosters a competitive gaming environment, further engaging a large audience. This trend is also supported by the increasing internet penetration and mobile device capabilities, which enhance the gaming experience. As a result, mobile esports is emerging as a viable career option for many young gamers in India.

Localization and Regional Content

Localization is a significant trend in the India mobile gaming market, with developers tailoring games to suit regional languages, cultures, and preferences. Games offering content in Hindi, Tamil, Telugu, and other vernacular languages have seen increased adoption among a diverse demographic. This trend is driven by India's vast and varied linguistic landscape, which creates an opportunity for game developers to engage a broader audience. In addition to this, by incorporating local themes, stories, and culturally relevant elements, developers are able to increase player retention and broaden their reach, ensuring higher engagement across different regions of the country. For instance, as per industry reports, a survey revealed that 70% of the businesses associated to Indian mobile gaming segment believe that local languages, culture-based content, and localized themes will emerge as a crucial factor fostering market growth in the year 2025.

Cloud Gaming Expansion

Cloud gaming is gaining momentum in India as mobile devices become more capable of supporting high-quality gaming experiences. The growth of 4G and 5G networks has enabled seamless cloud gaming, allowing players to access high-end games without requiring powerful hardware. For instance, according to the Press Information Bureau, India has achieved the fastest 5G implementation globally, with above 99% of the districts having 5g networks through the deployment of 4.62 Lakhs base transceiver stations for 5G. In addition, new cloud services such are currently beginning to enter the Indian market, providing customers with availability to a comprehensive range of games at lower upfront costs. As the adoption of cloud gaming increases, it is expected to expand the market's reach to more players in both tier- 3 and 2 cities, regularizing access to high-end mobile gaming content.

India Mobile Gaming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India mobile gaming market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on monetization type, platform, and game type.

Analysis by Monetization Type:

- In-app Purchases

- Paid Apps

- Advertising

In-app purchases are prominent in the India mobile gaming market's monetization model, accounting for a substantial share. Games offer virtual goods, such as characters, skins, and power-ups, to enhance player experience. This model appeals to the broad demographic, with many users opting for microtransactions rather than upfront payments. The affordability and low entry barriers of IAPs make it accessible, particularly for India’s price-sensitive market, driving consistent revenue streams and sustaining long-term engagement.

Paid apps contribute a smaller, yet significant, portion of the market share in India’s mobile gaming sector. While consumers are generally more inclined toward free-to-play games, certain premium games, offering a unique or high-quality experience, successfully capitalize on the paid model. The growing acceptance of premium mobile content, coupled with the increasing availability of secure payment methods, is enhancing the potential of paid games, particularly in niche genres with loyal user bases.

Advertising is an increasingly dominant revenue generator in the Indian mobile gaming market, driven by the growing number of free-to-play games. In-game ads, including display ads, rewarded videos, and interstitial ads, enable developers to monetize without charging players directly. As mobile gaming user engagement increases, advertisers are keen to reach India’s large mobile-first audience. This model offers substantial scalability and benefits developers, especially in a market where consumers are highly responsive to free content supported by ads.

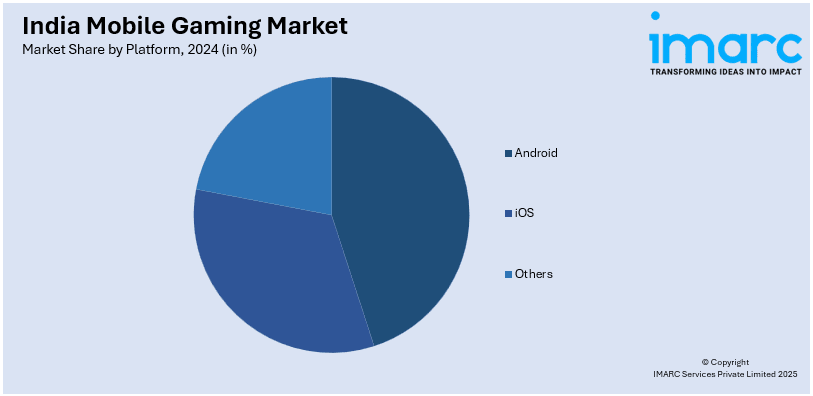

Analysis by Platform:

- Android

- iOS

- Others

Android dominates the India mobile gaming market, holding the largest share mainly because of its extensive adoption and accessibility. The platform’s open-source nature enables diverse smartphone manufacturers to offer cost-effective devices, making gaming accessible to a broad consumer base. Furthermore, the Google Play Store provides a vast range of gaming options, from casual to hardcore games, which appeals to various demographics. The affordability of Android devices, coupled with increasing mobile internet penetration and affordable data plans, further drives gaming adoption across urban and rural areas. As the platform continues to expand its reach and integrates advanced technologies like augmented reality (AR) and cloud gaming, Android’s position as the leading platform remains unchallenged. This growth is also supported by Android’s seamless integration with payment gateways, facilitating microtransactions within games, which enhances player engagement and monetization for developers.

Analysis by Game Type:

- Sports

- Strategy

- Action

- Adventure

Strategy games are the largest market segment in India’s mobile gaming industry, driven by their deep engagement and tactical gameplay. This genre appeals to both casual and competitive gamers, offering a broad range of experiences from real-time strategy to turn-based games. The increasing popularity of esports in India, particularly in strategy-based games such as Clash of Clans and PUBG Mobile, has contributed significantly to the genre's dominance. Strategy games often require skill, critical thinking, and team collaboration, which resonates with India’s young and highly competitive gaming population. The rise of mobile internet penetration, better smartphones, and affordable data plans has made this segment more accessible. Additionally, the growth of in-game tournaments and local events further fuels the segment’s growth, as players seek competitive platforms for both entertainment and professional aspirations. With frequent updates and community-driven content, strategy games continue to attract and retain a loyal user base.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

North India holds a significant market share in the India mobile gaming sector, driven by its large, tech-savvy population and increasing internet penetration. Urban centers like Delhi, Gurgaon, and Chandigarh are witnessing substantial growth in mobile game adoption. The region’s rapid digital transformation, coupled with a rising disposable income, has developed a beneficial ecosystem for both casual and esports gaming. Additionally, the prevalence of mobile gaming-friendly devices further boosts market expansion in North India.

West and Central India exhibit strong potential in the mobile gaming market, fueled by the region's high smartphone penetration and increasing access to affordable data plans. Maharashtra, Gujarat, and Madhya Pradesh lead the region in mobile game consumption, particularly in urban areas. Both young professionals and students are key players, contributing to the demand for mobile games, especially in tier-1 and tier-2 cities. The growing trend of local content development and partnerships with telecom providers further strengthens the market's position in these regions.

South India represents a substantial portion of the India mobile gaming market, with states like Tamil Nadu, Karnataka, and Telangana emerging as key growth hubs. The region's high smartphone usage, combined with strong tech infrastructure, supports the adoption of mobile gaming platforms. In particular, the increasing popularity of regional language-based games and esports tournaments has fostered further engagement. The presence of major game development companies and esports startups in cities like Bengaluru enhances South India's prominence in the market.

East India is experiencing steady growth in the mobile gaming market, with states such as West Bengal, Odisha, and Bihar showing increasing adoption. Urban centers like Kolkata are seeing rapid digitalization, which drives mobile gaming engagement among the youth. While historically slower than other regions, the rise of cost-effective internet services and the popularity of online multiplayer games are boosting market growth. Regional content development and localized gaming experiences are gradually strengthening the appeal of mobile games in East India.

Competitive Landscape:

The competitive landscape is highly fragmented, with international as well as domestic firms striving intensely for market share. Major global companies are competing alongside local giants. Mobile game developers focus on catering to the growing demand for casual and esports games, with an emphasis on localized content and regional languages. Additionally, partnerships with telecom providers and streaming platforms, along with investment in cloud gaming infrastructure, are intensifying the competition, driving innovation, and attracting a diverse player base. For instance, in April 2024, Vodafone Idea, an India-based telecom company, in partnership with CareGame, a major mobile cloud gaming firm based in Paris, developed and unveiled its new cloud gaming platform. This platform provides a selection of high-end and high-budget games for its subscribers.

The report provides a comprehensive analysis of the competitive landscape in the India mobile gaming market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, realme, a smartphone company, entered into a collaboration with KRAFTON India to become its official alliance for 2025 game series named BATTLEGROUNDS MOBILE INDIA PRO and BATTLEGROUNDS MOBILE INDIA. This partnership highlights realme's tactical efforts to expand its presence in e-sports segment of India.

- In October 2024, SuperGaming, an India-based game developer, launched its new mobile game Indus Battle Royale. This game will be available on Android as well as iOS.

- In August 2024, JetSynthesys' Nautilus Mobile announced tactical partnership with IPL teams, encompassing Lucknow Super Giants, Rajasthan Royals, and Mumbai Indians to boost its mobile cricket game, named Real Cricket, globally.

- In June 2024, Nazara Publishing together with nCore Games announced a strategic collaboration with FAU-G Domination, an India-based mobile game. Nazara will become the global publishing partner of this game.

India Mobile Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Monetization Types Covered | In-app Purchases, Paid Apps, Advertising |

| Platforms Covered | Android, Ios, Others |

| Game Types Covered | Sports, Strategy, Action, Adventure |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobile gaming market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India mobile gaming market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India mobile gaming market was valued at USD 3.02 Billion in 2024.

Key drivers encompass the magnifying smartphone penetration, affordable data plans, increase in internet access, elevating disposable incomes, the popularity of esports, and a young, tech-savvy population. In addition, the proliferation of digital payment systems and localized content further boost the market's demand.

IMARC estimates the India mobile gaming market to reach USD 11.00 Billion by 2033, exhibiting a CAGR of 15.50% from 2025-2033.

Android accounted for the largest platform market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)