India Mining Truck Market Size, Share, Trends and Forecast by Type, Application, Payload Capacity, Drive, and Region, 2025-2033

India Mining Truck Market Overview:

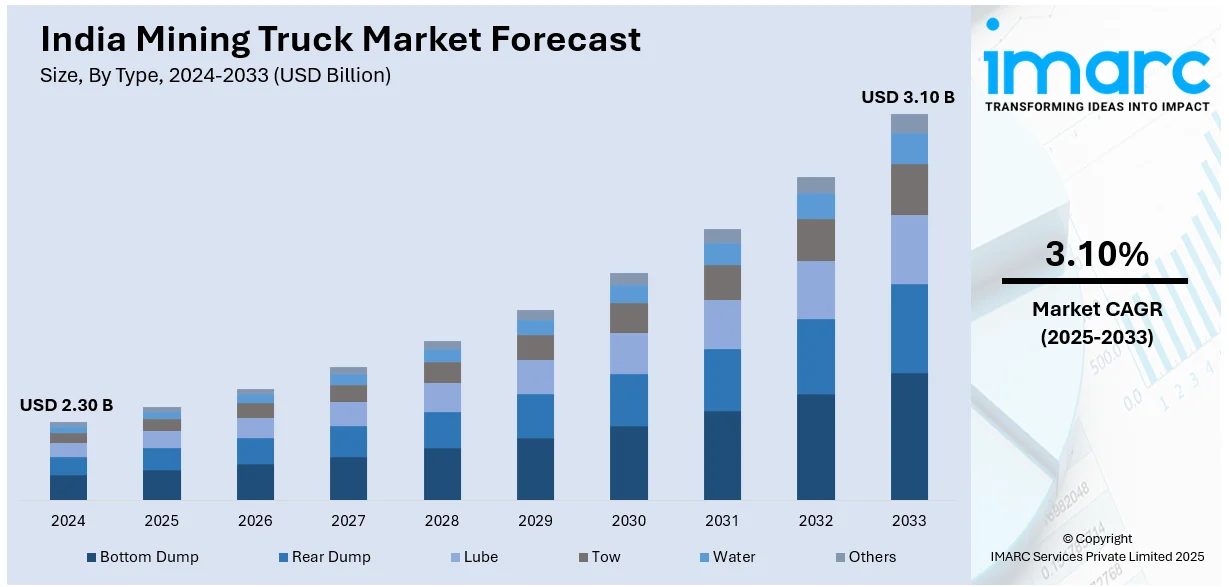

The India mining truck market size reached USD 2.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.10 Billion by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. The market is driven by rising demand for minerals, growing foreign investments, increasing infrastructure projects, expansion of coal and metal extraction, and government initiatives like Make in India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.30 Billion |

| Market Forecast in 2033 | USD 3.10 Billion |

| Market Growth Rate 2025-2033 | 3.10% |

India Mining Truck Market Trends:

Integration of Autonomous Vehicle Technologies

The adoption of autonomous vehicle technologies is revolutionizing the mining industry in India by improving efficiency, safety, and productivity. Mining companies are increasingly utilizing autonomous trucks equipped with AI, GPS, and advanced sensors to navigate complex terrains without human intervention. These vehicles operate 24/7, minimizing downtime and maximizing material haulage, leading to optimized fleet utilization. Additionally, by eliminating human drivers from hazardous environments, autonomous mining trucks significantly enhance safety, reducing accident risks and aligning with industry safety standards. Their precision-driven systems ensure consistent operations, adapting to real-time data for optimal route and speed adjustments, ultimately boosting productivity. This shift aligns with a broader trend toward automation in mining, reflected in the rapid growth of the autonomous vehicle market in India. Projected to reach USD 23.3 billion by 2033, the sector is expected to grow at a CAGR of 24.3% from 2025 to 2033. As automation gains traction, autonomous mining solutions will play a crucial role in streamlining operations, improving workplace safety, and driving the future of the mining industry.

To get more information on this market, Request Sample

Adoption of LNG-Powered Trucks

The mining sector is progressively shifting to liquefied natural gas (LNG) as a cleaner substitute for diesel, prompted by growing environmental concerns and stricter emission mandates. LNG-powered trucks produce significantly fewer greenhouse gases, aligning with global sustainability goals and regulatory mandates. In addition to environmental benefits, LNG offers cost efficiency, as it is often more stable and affordable than diesel, making it a viable option for large-scale mining operations with high fuel consumption. Industry leaders are actively supporting this transition, with companies like GreenLine Mobility Solutions deploying LNG-powered trucks in collaboration with major corporations. For instance, GreenLine partnered with Flipkart to introduce 25 LNG trucks for goods transportation across India, marking a crucial step towards sustainable logistics. Reflecting a national commitment to cleaner energy, India aims to convert approximately one-third of its 7 million heavy trucks to LNG within the next five to seven years. This transition underscores the growing emphasis on reducing emissions in heavy transportation while enhancing economic and operational efficiencies in the mining sector.

India Mining Truck Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, application, payload capacity, and drive.

Type Insights:

- Bottom Dump

- Rear Dump

- Lube

- Tow

- Water

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bottom dump, rear dump, lube, tow, water, and others.

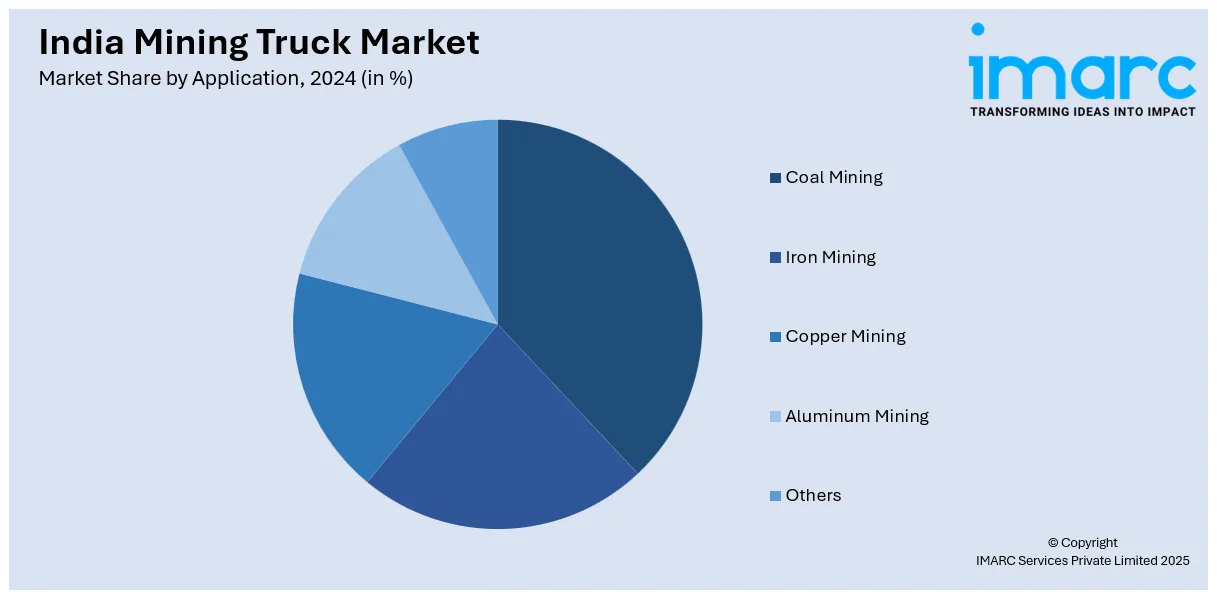

Application Insights:

- Coal Mining

- Iron Mining

- Copper Mining

- Aluminum Mining

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes coal mining, iron mining, copper mining, aluminum mining, and others.

Payload Capacity Insights:

- <90 Metric Tons

- 90≤149 Metric Tons

- 150≤290 Metric Tons

- >290 Metric Tons

The report has provided a detailed breakup and analysis of the market based on the payload capacity. This includes <90 metric tons, 90≤149 metric tons, 150≤290 metric tons, and >290 metric tons.

Drive Insights:

- Mechanical Drive

- Electrical Drive

A detailed breakup and analysis of the market based on the drive have also been provided in the report. This includes mechanical drive and electrical drive.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mining Truck Market News:

- November 2024: Daimler India Commercial Vehicles (DICV) officially launched the BharatBenz heavy-duty truck series, 'Torqshift', with 80 units of 3532CM mining tippers supplied to a single client. The heavy-duty trucks include a 12-speed Automated Manual Transmission (AMT), which not only increases vehicle productivity but also contributes significantly to road safety.

- October 2024: The International Centre for Automotive Technology (ICAT) granted approval for the I-Board Elecy V3525 tipper. This heavy-duty electric tipper, designed in Faridabad and produced in Palwal, Haryana, is excellent for mining applications because of its one-hour charging time. The I-Board Elecy V3525 tipper offers various distinguishing characteristics, including a 35-tonne payload capacity, quick charging capabilities, and smart battery placement.

- April 2024: Sany India introduced the SKT105E Electric Dump Truck, the first of its type to be made domestically in India. This completely electric off-highway dump truck is engineered to withstand the harsh conditions of open-cast mining operations while providing remarkable energy efficiency and cost-effectiveness. With a remarkable payload capacity of 70 tons, it is a valuable tool for mining operations around the country.

India Mining Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bottom Dump, Rear Dump, Lube, Tow, Water, Others |

| Applications Covered | Coal Mining, Iron Mining, Copper Mining, Aluminum Mining, Others |

| Payload Capacities Covered | <90 Metric Tons, 90≤149 Metric Tons, 150≤290 Metric Tons, >290 Metric Tons |

| Drives Covered | Mechanical Drive, Electrical Drive |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India mining truck market performed so far and how will it perform in the coming years?

- What is the breakup of the India mining truck market on the basis of type?

- What is the breakup of the India mining truck market on the basis of application?

- What is the breakup of the India mining truck market on the basis of payload capacity?

- What is the breakup of the India mining truck market on the basis of drive?

- What are the various stages in the value chain of the India mining truck market?

- What are the key driving factors and challenges in the India mining truck market?

- What is the structure of the India mining truck market and who are the key players?

- What is the degree of competition in the India mining truck market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mining truck market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mining truck market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mining truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)