India Mining Equipment Market Size, Share, Trends and Forecast by Type, Equipment, Application, and Region, 2025-2033

India Mining Equipment Market Overview:

The India mining equipment market size reached USD 6.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.34 Billion by 2033, exhibiting a growth rate (CAGR) of 6.05% during 2025-2033. The rising mineral production, infrastructure projects, government initiatives, demand for automation, and sustainability-focused technologies are the factors propelling the growth of the market. Increasing coal, iron ore, and bauxite extraction, along with foreign investments and digitalization, further boost equipment demand across surface and underground mining operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.4 Billion |

| Market Forecast in 2033 | USD 11.34 Billion |

| Market Growth Rate (2025-2033) | 6.05% |

India Mining Equipment Market Trends:

Expanding Demand for Advanced Mining Equipment

Rising mineral extraction activities and infrastructure development are driving the demand for technologically advanced machinery. Automation, electrification, and digital monitoring solutions are becoming integral to mining operations, improving efficiency and safety. Growing investments in underground and open-pit mining are fueling the adoption of high-performance drilling rigs, loaders, and haulage systems. Sustainable practices, including emission-reducing equipment, are gaining prominence as the industry moves toward greener operations. Increasing exploration of rare earth elements and critical minerals is further contributing to higher equipment sales. The market is experiencing steady expansion, supported by industrialization, rising commodity demand, and government policies promoting resource extraction. Continuous innovation and regional manufacturing capabilities are playing a crucial role in meeting the evolving needs of the sector. The global mining equipment market size reached USD 156.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 232.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.3% during 2025-2033.

To get more information on this market, Request Sample

Growing Localization in Mining Equipment Manufacturing

Mining operations are increasingly prioritizing domestically manufactured machinery to enhance efficiency and reduce dependency on imports. The shift aligns with government-led initiatives promoting local production, fostering industrial self-reliance. Advanced drilling rigs and haulage solutions are being integrated into large-scale extraction sites, optimizing performance and sustainability. Equipment manufacturers are expanding production facilities within key regions to meet rising demand, ensuring faster deployment and streamlined maintenance support for large mining projects. For instance, in June 2024, Epiroc secured a significant mining equipment order worth approximately SEK 215 Million from Hindustan Zinc Limited, the world's second-largest zinc producer. The equipment, including mine trucks and drilling rigs, would be deployed across various mines in Rajasthan, India. Notably, over half of these machines will be manufactured at Epiroc's Nashik facility, aligning with the "Make in India" initiative.

India Mining Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, equipment, and application.

Type Insights:

- Excavators

- Loaders

- Dozers

- Motor Graders

- Dump Trucks

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes excavators, loaders, dozers, motor graders, dump trucks, and others.

Equipment Insights:

- Underground Mining

- Surface Mining

- Crushing, Pulverizing and Screening

- Drills and Breakers

- Others

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes underground mining, surface mining, crushing, pulverizing and screening, drills and breakers, and others.

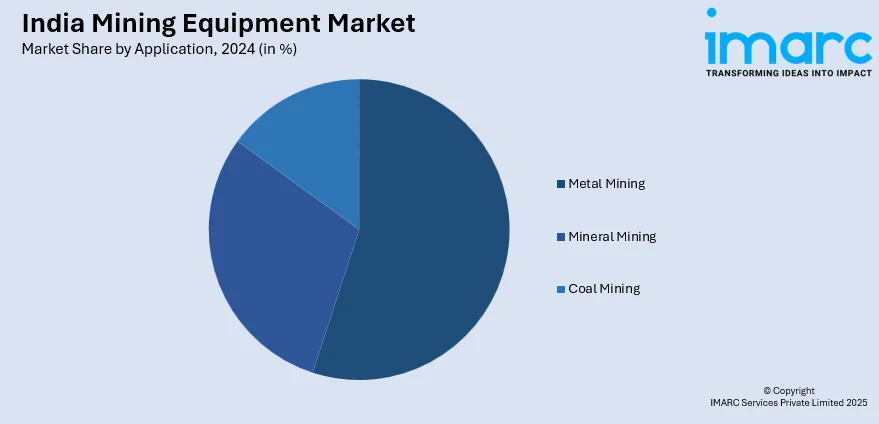

Application Insights:

- Metal Mining

- Mineral Mining

- Coal Mining

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes metal mining, mineral mining, and coal mining.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mining Equipment Market News:

- In February 2025, India and Saudi Arabia collaborated to enhance the mining sector. Union Minister met Saudi Minister in New Delhi to discuss critical minerals, investments, and technology. The Geological Survey of India Training Institute was designated as a Centre of Excellence under the Future Minerals Forum, offering specialized training for geologists from Saudi Arabia, Africa, and Central Asia.

- In May 2024, Sandvik secured a significant order valued at approximately SEK 345 Million from Hindustan Zinc Limited to supply underground mining equipment, including development drills, production drills, trucks, and loaders. This contract, building on their longstanding partnership, aims to enhance productivity, safety, and sustainability in Hindustan Zinc's operations.

India Mining Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Excavators, Loaders, Dozers, Motor Graders, Dump Trucks, Others |

| Equipments Covered | Underground Mining, Surface Mining, Crushing, Pulverizing and Screening, Drills and Breakers, Others |

| Applications Covered | Metal Mining, Mineral Mining, Coal Mining |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mining equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mining equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mining equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mining equipment market in India was valued at USD 6.4 Billion in 2024.

The India mining equipment market is projected to exhibit a CAGR of 6.05% during 2025-2033, reaching a value of USD 11.34 Billion by 2033.

The India mining equipment market is driven by rising demand for minerals from the infrastructure, energy, and steel sectors. Government reforms, including mineral auctions and FDI, boost industry confidence. Additionally, growing adoption of automation, smart technologies, and sustainable practices, along with local manufacturing initiatives like “Make in India,” further accelerates market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)