India Microwave Oven Market Size, Share, Trends and Forecast by Type, Capacity, End-User, Distribution Channel, and Region, 2025-2033

India Microwave Oven Market Overview:

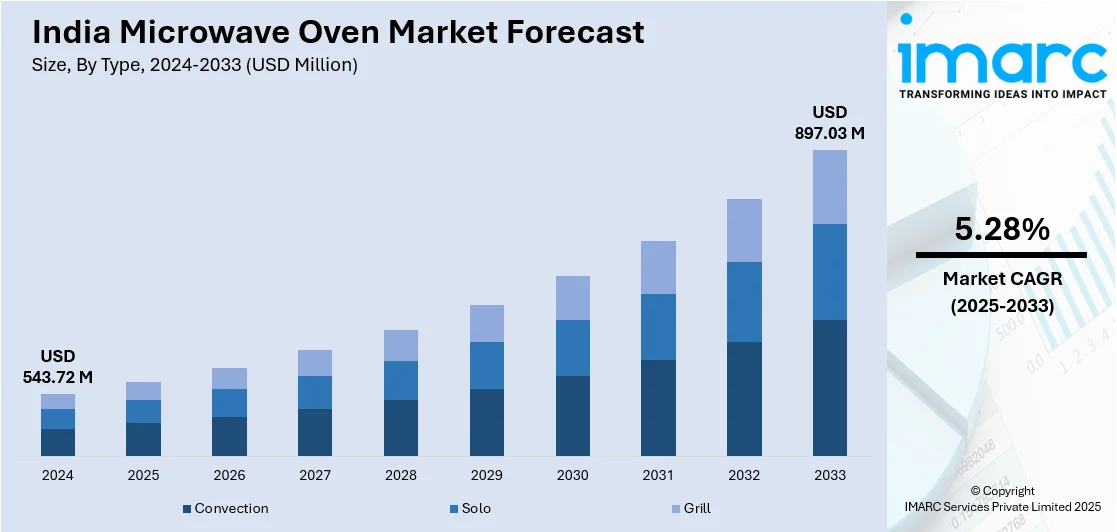

The India microwave oven market size reached USD 543.72 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 897.03 Million by 2033, exhibiting a growth rate (CAGR) of 5.28% during 2025-2033. India's microwave oven market is growing as a result of increased urbanization, hectic lifestyles, and increased demand for intelligent kitchen appliances. Also, higher preference for multiple-feature and energy-saving models, online shopping growth, and accessibility of solo and convection microwaves are major trends fueling market adoption in urban and semi-urban areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 543.72 Million |

| Market Forecast in 2033 | USD 897.03 Million |

| Market Growth Rate (2025-2033) | 5.28% |

India Microwave Oven Market Trends:

Rising Demand for Smart Microwave Ovens

The demand for advanced and easy-to-use kitchen equipment is driving growth in the Indian microwave oven market. The demand for quicker and more effective cooking solutions is being driven by urbanization and hectic lifestyles. Households are choosing high-end equipment that improves convenience and cuts down on cooking time as their disposable money rises. The advent of smart microwave ovens with Wi-Fi and voice control capabilities is a significant advancement in the sector. Through smartphone applications, consumers can now specify exact cooking conditions thanks to brands' integration of AI-powered cooking aids. Moreover, businesses are also implementing energy-efficient devices to cut down on power usage. Further, consumers searching for multipurpose appliances are increasingly drawn to multifunctional models that combine grilling, convection, and air frying. Retail expansion and e-commerce growth are further supporting the market. Brands are leveraging digital platforms to offer exclusive product lines, discounts, and financing options, attracting a wider customer base. This trend is expected to continue as manufacturers focus on enhancing automation and connectivity features in microwave ovens.

To get more information on this market, Request Sample

Growth in Solo and Convection Models

The Indian microwave oven market is growing as a result of changing cooking habits and greater use of new-age kitchen appliances. Demand is growing in urban and semi-urban India as more consumers look at convenient and affordable cooking solutions. Consumers prefer microwaves over conventional cooking techniques for reheating, defrosting, and baking. Solo and convection microwave models are observing good demand based on recent trends. Solo microwaves are gaining popularity among first-time consumers because of their affordability and simplicity of use. Convection microwaves, with extra baking and grilling capabilities, are increasingly favored by users seeking a wider variety of cooking applications. Manufacturers are launching compact and budget-friendly models to target small families and individuals. Retailers and online platforms are playing a crucial role in market penetration. Brands are focusing on strategic pricing, bundling offers, and extended warranty services to attract consumers. As energy-efficient and user-friendly designs continue to evolve, the Indian microwave oven market is expected to see sustained growth in the coming years.

India Microwave Oven Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, capacity, end-user, and distribution channel.

Type Insights:

- Convection

- Solo

- Grill

The report has provided a detailed breakup and analysis of the market based on the type. This includes convection, solo, and grill.

Capacity Insights:

- Below 25 Liters

- 25-30 Liters

- Above 30 Liters

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes below 25 liters, 25-30 liters, and above 30 liters.

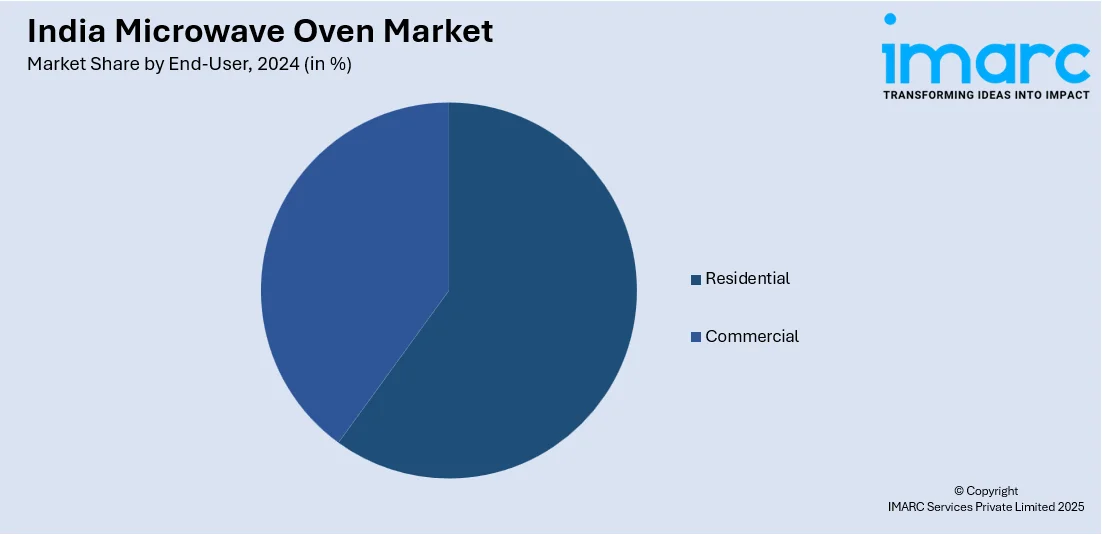

End-User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes residential and commercial.

Distribution Channel Insights:

- Multi-Branded Store

- Supermarkets/Hypermarkets

- Exclusive Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes multi-branded store, supermarkets/hypermarkets, exclusive stores, online, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Microwave Oven Market News:

- June 2024: LG Electronics launched nine new microwave ovens in India, including seven Scan to Cook models and two premium Objet series with ThinQ connectivity and charcoal heating. This innovation drives demand for smart, Wi-Fi-enabled appliances, reinforcing LG’s market dominance in India.

- April 2024: Samsung launched its Bespoke AI-powered microwave in India, featuring personalized diet recipes, SmartThings connectivity, and AI-driven cooking automation. This innovation enhances convenience and energy efficiency, strengthening Samsung’s position in the premium microwave segment and driving demand for smart kitchen appliances.

India Microwave Oven Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Distribution Channel |

| Capacities Covered | Below 25 Liters, 25-30 Liters, Above 30 Liters |

| End-Users Covered | Residential, Commercial |

| Distribution Channels Covered | Multi-Branded Store, Supermarkets/Hypermarkets, Exclusive Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India microwave oven market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India microwave oven market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India microwave oven industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India microwave oven market was valued at USD 543.72 Million in 2024.

The India microwave oven market is projected to exhibit a CAGR of 5.28% during 2025-2033, reaching a value of USD 897.03 Million by 2033.

The India microwave oven market is driven by rising urbanization, increasing disposable income, changing lifestyles, and a growing preference for convenience in cooking. Expanding nuclear families, working professionals, and awareness of modern kitchen appliances also boost demand, alongside e-commerce growth and product innovations enhancing accessibility and appeal.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)