India Methanol Market Size, Share, Trends and Forecast by Distribution Channel, End Use, and Region, 2025-2033

India Methanol Market Overview:

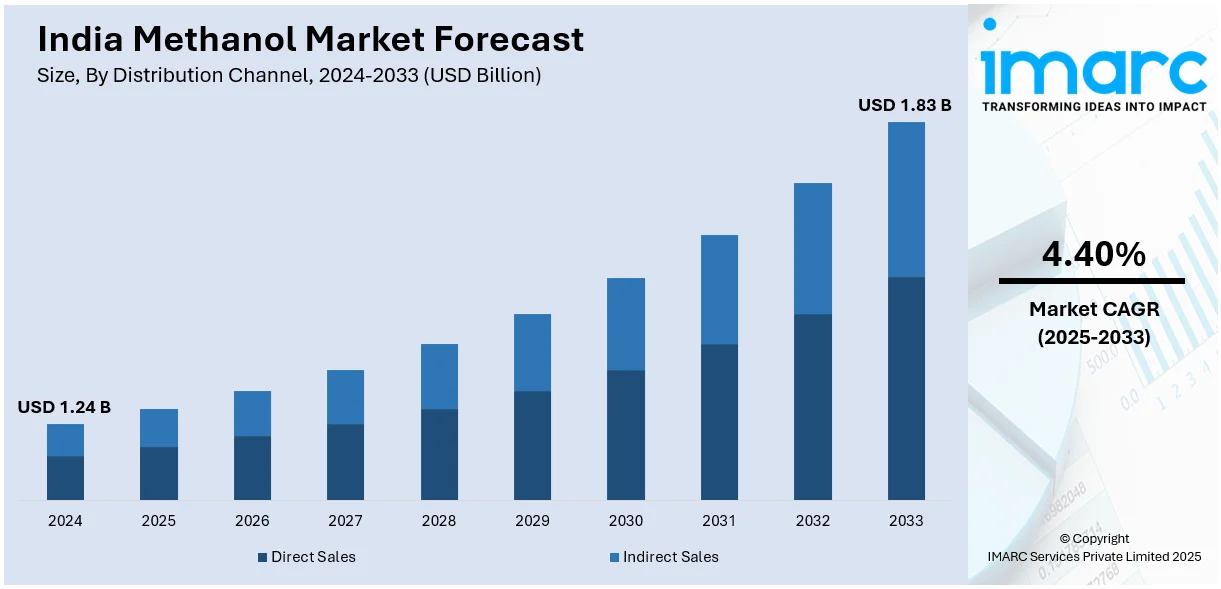

The India methanol market size reached USD 1.24 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.83 Billion by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. The market is driven by rising demand for clean fuel alternatives, implementation of government initiatives including the Methanol Economy program, and cost advantages over conventional fuels. Additionally, growth in methanol-based chemical manufacturing, expanding petrochemical and construction sectors, and investments in coal-to-methanol production are further expanding the India methanol market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.24 Billion |

| Market Forecast in 2033 | USD 1.83 Billion |

| Market Growth Rate 2025-2033 | 4.40% |

India Methanol Market Trends:

Rising Demand for Methanol as a Clean Fuel Alternative

The increasing demand for clean and sustainable fuel alternatives is significantly supporting the India methanol market growth. Methanol, a versatile chemical, is gaining traction as a blending component in gasoline and as a standalone fuel for transportation and industrial applications. The Indian government's push toward reducing carbon emissions and dependence on crude oil imports has led to initiatives such as the Methanol Economy program, which promotes methanol production from coal and biomass. Additionally, methanol's cost-effectiveness compared to conventional fuels makes it an attractive option for industries and consumers. With the expansion of methanol-based fuel infrastructure and supportive policies, the market is expected to grow steadily. The automotive and power generation sectors are key drivers, as methanol offers a cleaner combustion profile, reducing harmful emissions. According to an industry report, India is investing in carbon capture, utilization, and storage (CCUS) technologies to produce green methanol and reduce its yearly methanol import outgo of INR 7,400 Crore (approximately USD 890 Million). Based on estimates of the CO2 storage capacity of 400 to 600 gigatons around India, domestic methanol production could be catalyzed with investments of INR 8,980 Crore to INR 16,750 Crore (approximately USD 1,082 Million to USD 2,016 Million), contributing to energy security and a developing methanol economy. As India moves toward greener energy solutions, methanol is poised to play a crucial role in the country's energy transition.

To get more information on this market, Request Sample

Growth in Methanol-Based Chemical Manufacturing

The rising product use as a feedstock in chemical manufacturing is creating a positive India methanol market outlook. Methanol serves as a critical raw material for producing formaldehyde, acetic acid, and other derivatives used in plastics, adhesives, and pharmaceuticals. The expanding construction and automotive sectors are driving demand for methanol-based resins and polymers. Additionally, India's growing petrochemical industry is increasing methanol consumption for producing olefins through methanol-to-olefins (MTO) technology. Investments in new production facilities, such as coal-to-methanol plants, are further enhancing supply to meet industrial demand. With the government's focus on improving domestic manufacturing under initiatives including "Make in India," methanol-based chemical production is expected to rise. This trend is supported by advancements in production technologies and increasing foreign investments in India's chemical sector, positioning methanol as a vital component in the country's industrial growth. According to an industry report, a German chemical company announced intentions to invest in India worth USD 1.5 Billion and is trying to find 250 acres of land near a port. From April 2000 to December 2024, Germany came ninth on the list of foreign direct investment (FDI) with USD 15 Billion. In order to receive foreign investment in the chemicals segment, the Government of India is taking several steps to attract foreign investments and foreign companies to India, which will increase the potential in the growing methanol market.

India Methanol Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on distribution channel and end use.

Distribution Channel Insights:

- Direct Sales

- Indirect Sales

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and indirect sales.

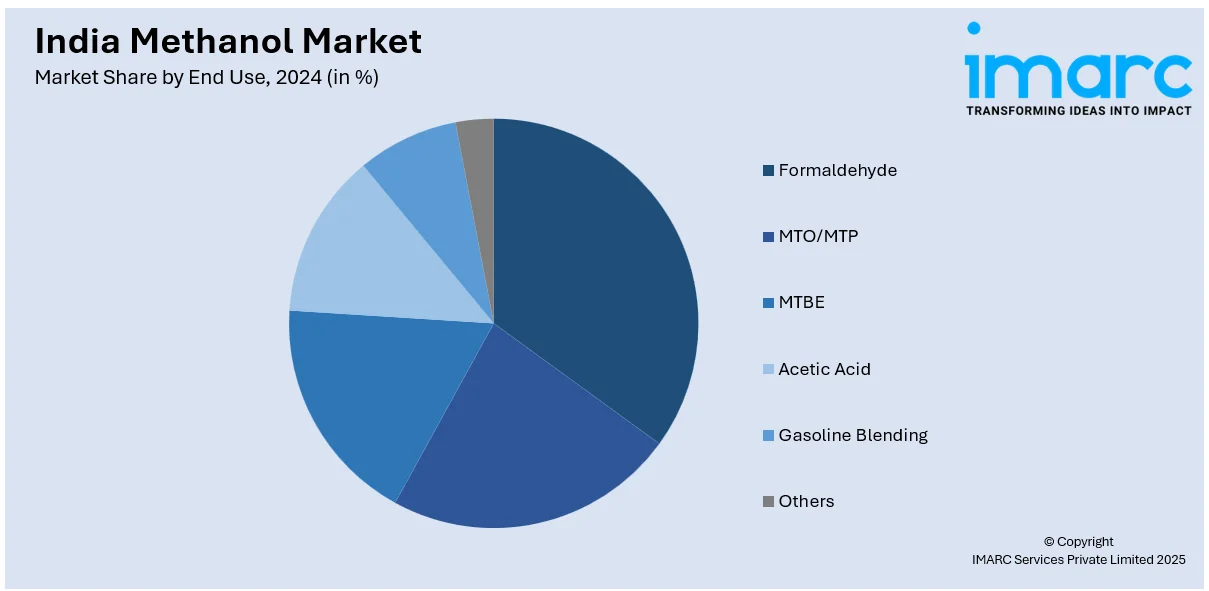

End Use Insights:

- Formaldehyde

- MTO/MTP

- MTBE

- Acetic Acid

- Gasoline Blending

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes formaldehyde, MTO/MTP, MTBE, acetic acid, gasoline blending, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Methanol Market News:

- November 14, 2024: Ohmium International, collaborating with JNCASR, Breathe Applied Sciences, and Spirare Energy, announced the launching of India's first green methanol factory that uses PEM electrolyzer technology. The initiative would provide green methanol for energy independence in India and help in the reduction of emissions by converting the CO2 emissions of the Singareni Thermal Power Plant into green methanol.

- June 26, 2024: Avaada Group announced plans to start taking the first steps towards green methanol projects in two Indian states in the next three years, as well as develop more green ammonia and other fuel projects. A project is underway with 0.5 MTPA capacity at Gopalpur Port, Odisha, at present. The company is actively expanding its renewable energy portfolio to 30 GW by 2030, thereby contributing to India's methanol market and its clean energy objectives.

India Methanol Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Distribution Channels Covered | Direct Sales, Indirect Sales |

| End Uses Covered | Formaldehyde, MTO/MTP, MTBE, Acetic Acid, Gasoline Blending, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India methanol market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India methanol market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India methanol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India methanol market was valued at USD 1.24 Billion in 2024.

The India methanol market is projected to exhibit a CAGR of 4.40% during 2025-2033, reaching a value of USD 1.83 Billion by 2033.

India's methanol market is driven by growing demand from chemical, pharmaceutical, and automotive industries. Government initiatives promoting methanol as a cleaner fuel alternative, along with increased focus on energy security and domestic production, are key factors. Technological advancements and alternative feedstock options also support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)