India Methacrylate Monomers Market Size, Share, Trends and Forecast by Derivatives, Application, End-Use Industry, and Region, 2025-2033

India Methacrylate Monomers Market Overview:

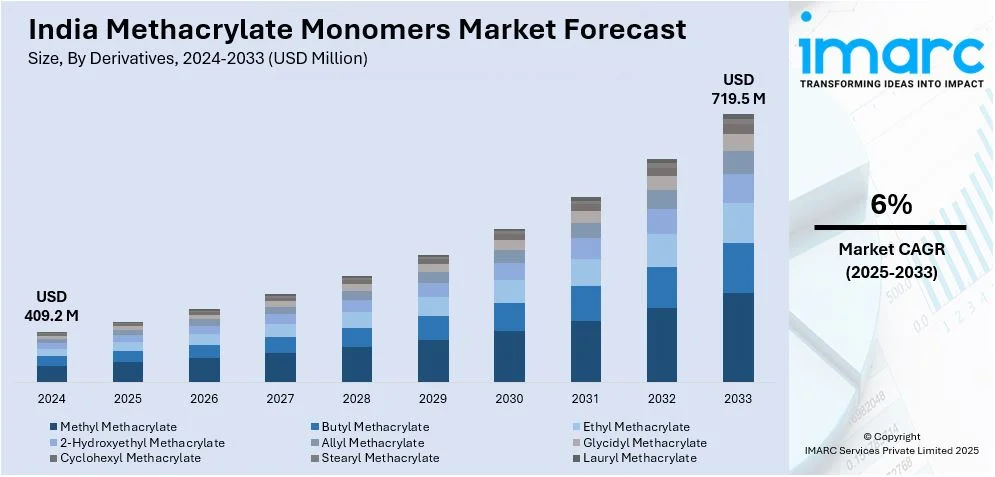

The India methacrylate monomers market size reached USD 409.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 719.5 Million by 2033, exhibiting a growth rate (CAGR) of 6% during 2025-2033. The market is growing as demand in the automotive, construction, and electronic industries rises. Along with this, the support of the government for environmentally friendly production is also favoring the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 409.2 Million |

| Market Forecast in 2033 | USD 719.5 Million |

| Market Growth Rate 2025-2033 | 6% |

India Methacrylate Monomers Market Trends:

Growing Demand for Sustainable Polymers

The growing focus on sustainability is transforming the methacrylate monomers market in India. Sectors like automotive, electronics, and construction are moving towards green materials, driving demand for recycled and bio-based methacrylate derivatives. Firms are making investments in sustainable production methods to comply with international regulatory requirements and minimize environmental footprint. Increasing consciousness towards carbon footprint minimization and efficiency of resources is compelling producers to embrace green alternatives, driving the shift towards circular economy models at a faster pace. In line with this, Sumitomo Chemical launched chemically recycled PMMA, applying cutting-edge recycling methods to deliver high-quality methacrylate monomers. This technology enables circular economy practices and promotes the utilization of recycled materials in car lighting, display electronics, and industrial coatings. In the same vein, organizations are looking at other raw materials, such as renewable feedstocks, to develop low-impact methacrylate products. The Indian government's initiative toward sustainable production and green industrial policies is also boosting the use of such materials.

To get more information on this market, Request Sample

Advancements in Chemical Recycling Technologies

The Indian methacrylate monomers market is experiencing dramatic technological changes, especially in chemical recycling. Organizations are embracing depolymerization technologies to reclaim high-purity monomers from acrylic waste, minimizing dependence on virgin raw materials. The technology boosts efficiency in production while minimally affecting the environment, thus providing an ideal solution for producers. The transition to circular economy approaches is fueling investment in recycling plants to ensure efficient use of resources and cost-saving production processes. The increasing focus on waste minimization and sustainability is further compelling businesses to include chemical recycling in their operations. Trinseo has recently commissioned a depolymerization plant in Europe, setting the industry benchmark for PMMA recycling. Success of these efforts is spurring Indian manufacturers to pursue similar solutions, incorporating circular economy into their supply chains. Also, collaborations between chemical companies and research institutions are promoting innovation in recycling methacrylate monomers, contributing to higher efficiency and quality of product. With the increasing demand for high-performance methacrylate monomers, investment in new recycling technologies will be instrumental in defining the future of the market.

India Methacrylate Monomers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on derivatives, application, and end-use industry.

Derivatives Insights:

- Methyl Methacrylate

- Butyl Methacrylate

- Ethyl Methacrylate

- 2-Hydroxyethyl Methacrylate

- Allyl Methacrylate

- Glycidyl Methacrylate

- Cyclohexyl Methacrylate

- Stearyl Methacrylate

- Lauryl Methacrylate

The report has provided a detailed breakup and analysis of the market based on the component. This includes methyl methacrylate, butyl methacrylate, ethyl methacrylate, 2-hydroxyethyl methacrylate, allyl methacrylate, glycidyl methacrylate, cyclohexyl methacrylate, stearyl methacrylate, and lauryl methacrylate.

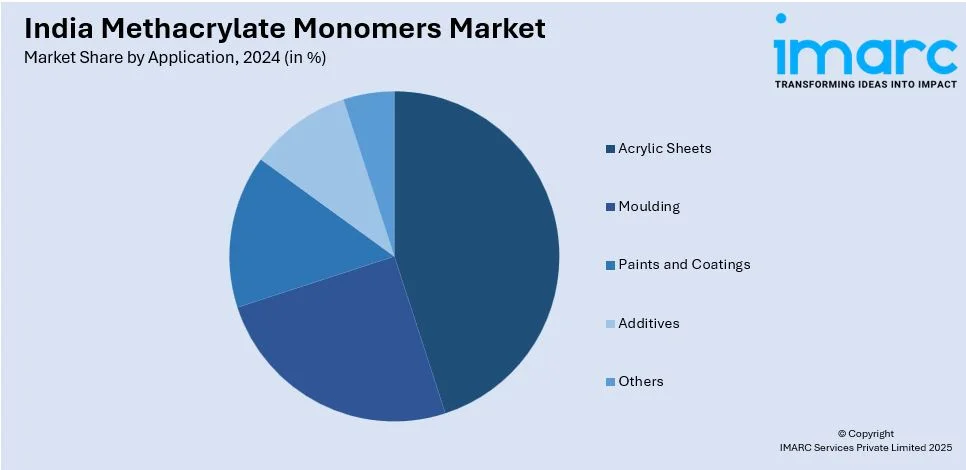

Application Insights:

- Acrylic Sheets

- Moulding

- Paints and Coatings

- Additives

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes acrylic sheets, moulding, paints and coatings, additives, and others.

End-Use Industry Insights:

- Architecture and Construction

- Advertisement and Communication

- Electronics

- Automotive

- Others

A detailed breakup and analysis of the market based on the end -use industry have also been provided in the report. This includes architecture and construction, advertisement and communication, electronics, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Methacrylate Monomers Market News:

- March 2025: Asia Poly’s EcoGreen Monomer signed an MoU with Sumitomo to supply 2,000 Tons of depolymerized methyl methacrylate (DMMA) monthly. This development strengthens sustainable MMA production, expanding supply to India and global markets, enhancing eco-friendly acrylic manufacturing, and promoting circular economy adoption in the industry.

- March 2025: Sumitomo Chemical's expansion in chemically recycled methyl methacrylate (MMA) strengthens the methacrylate monomers market by enhancing sustainability. Supplying recycled PMMA to LG Display and Nissan accelerates eco-friendly adoption in electronics and automotive sectors, promoting circular economy practices and reducing environmental impact in industrial applications.

India Methacrylate Monomers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Derivatives Covered | Methyl Methacrylate, Butyl Methacrylate, Ethyl Methacrylate, 2-Hydroxyethyl Methacrylate, Allyl Methacrylate, Glycidyl Methacrylate, Cyclohexyl Methacrylate, Stearyl Methacrylate, Lauryl Methacrylate |

| Applications Covered | Acrylic Sheets, Moulding, Paints and Coatings, Additives, Others |

| End-Use Industries Covered | Architecture and Construction, Advertisement and Communication, Electronics, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India methacrylate monomers market performed so far and how will it perform in the coming years?

- What is the breakup of the India methacrylate monomers market on the basis of derivatives?

- What is the breakup of the India methacrylate monomers market on the basis of application?

- What is the breakup of the India methacrylate monomers market on the basis of end-use industry?

- What are the various stages in the value chain of the India methacrylate monomers market?

- What are the key driving factors and challenges in the India methacrylate monomers?

- What is the structure of the India methacrylate monomers market and who are the key players?

- What is the degree of competition in the India methacrylate monomers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India methacrylate monomers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India methacrylate monomers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India methacrylate monomers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)