India Metallurgical Equipment Market Size, Share, Trends and Forecast by Type, Equipment, Application, and Region, 2025-2033

India Metallurgical Equipment Market Overview:

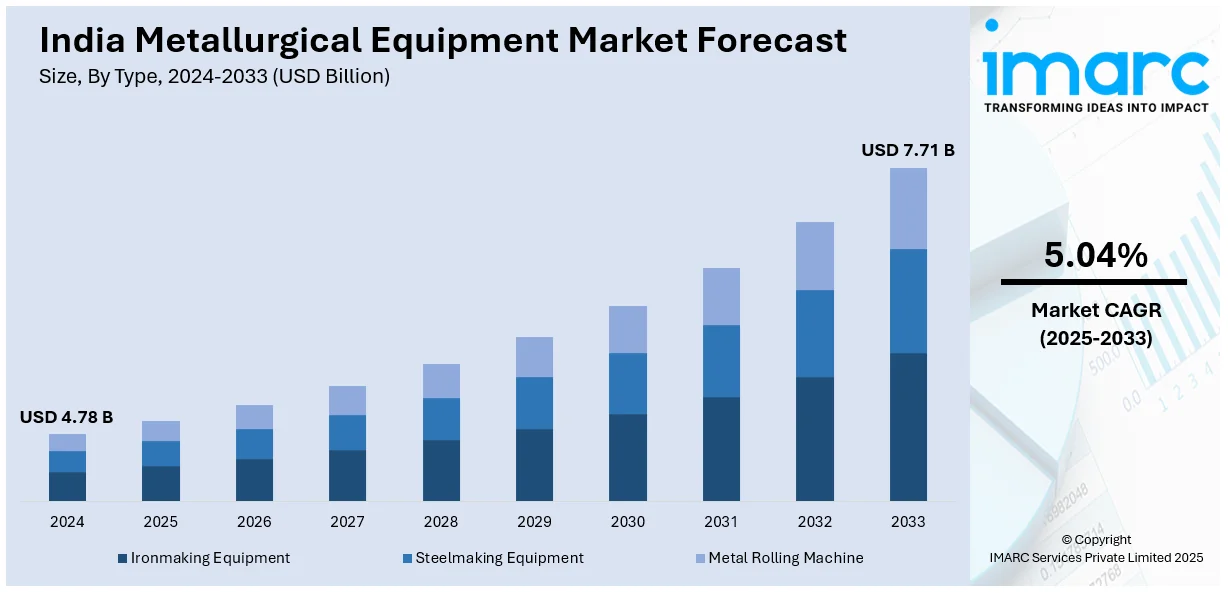

The India metallurgical equipment market size reached USD 4.78 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.71 Billion by 2033, exhibiting a growth rate (CAGR) of 5.04% during 2025-2033. The market is witnessing significant growth, driven by the technological advancements in process automation and smart manufacturing and the increase in domestic steel production and capacity expansion initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.78 Billion |

| Market Forecast in 2033 | USD 7.71 Billion |

| Market Growth Rate 2025-2033 | 5.04% |

India Metallurgical Equipment Market Trends:

Technological Advancements in Process Automation and Smart Manufacturing

India’s metallurgical equipment market is experiencing a significant transformation driven by the integration of advanced automation technologies and smart manufacturing practices. The adoption of Industry 4.0 principles, such as IoT-enabled machinery, predictive maintenance systems, and real-time monitoring platforms, is becoming increasingly common across both public and private sector steel and non-ferrous metal producers. These technologies are aimed at improving operational efficiency, reducing downtime, and enhancing product quality while optimizing energy consumption. Equipment manufacturers are responding by offering digitally integrated solutions, including automated casting systems, robotics for material handling, and intelligent control systems for furnaces and rolling mills. For instance, in June 2024, Tata Steel Meramandali ordered India’s first Paul Wurth COG Injection Technology, enabling 0.65 kg coke savings per kg of COG injected, reducing OPEX costs and significantly improving the blast furnace’s CO₂ footprint. The shift toward data-driven decision-making is also encouraging the use of advanced analytics to optimize production parameters and detect process anomalies. This trend aligns with broader national goals of improving competitiveness, reducing environmental impact, and meeting global quality standards. With increasing investments in brownfield and greenfield projects, as well as the rising demand for customized and scalable equipment, the role of advanced manufacturing technologies is expected to deepen, making automation and smart systems a central pillar in the long-term development of India’s metallurgical equipment sector.

To get more information on this market, Request Sample

Rise in Domestic Steel Production and Capacity Expansion Initiatives

The metallurgical equipment market in India is strongly influenced by the expansion of domestic steel production capacity, supported by both public and private sector investments. Government-led initiatives, such as the National Steel Policy and Production Linked Incentive (PLI) schemes, are encouraging large-scale upgrades, modernization of existing facilities, and the development of new integrated plants. For instance, in March 2024, about 35 companies expressed interest in the second PLI round for specialty steel, with Rs 25,200 crore investment commitments. The Steel Ministry is finalizing selections and MoU signings. As India targets a significant increase in crude steel output to meet infrastructure and export demands, there is a parallel surge in demand for high-efficiency, heavy-duty metallurgical machinery, including blast furnaces, continuous casting machines, sintering equipment, and rolling mills. Equipment manufacturers are benefiting from this capital expenditure cycle, with a growing emphasis on indigenization and reduced dependence on imports. Furthermore, increasing participation from global players through joint ventures and technology transfers is contributing to improvements in equipment design, performance, and cost-efficiency. The expansion in end-use sectors—such as construction, automotive, and renewable energy reinforces the need for consistent and high-quality metal production, which in turn drives investment in state-of-the-art metallurgical equipment. This capacity-driven trend is expected to support long-term market growth, particularly as India positions itself as a global hub for metal production and processing.

India Metallurgical Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, equipment, and application.

Type Insights:

- Ironmaking Equipment

- Steelmaking Equipment

- Metal Rolling Machine

The report has provided a detailed breakup and analysis of the market based on the type. This includes ironmaking equipment, steelmaking equipment, and metal rolling machine.

Equipment Insights:

- Milling Machines

- Broaching Machines

- Grinding Machines

- Drilling Machines

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes milling machines, broaching machines, grinding machines, and drilling machines.

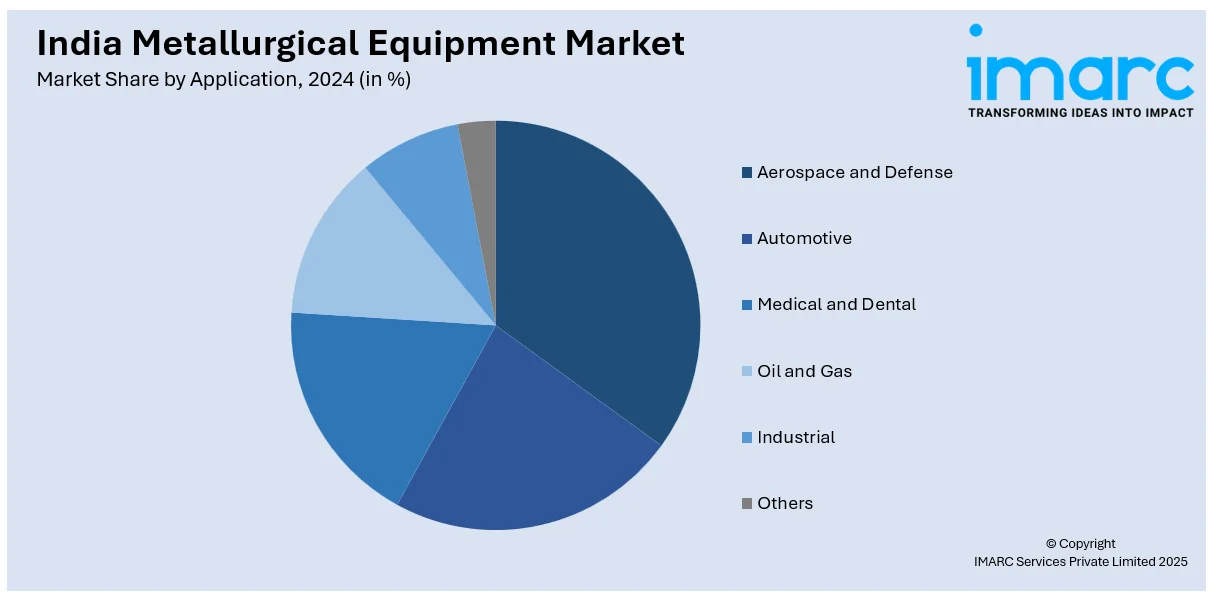

Application Insights:

- Aerospace and Defense

- Automotive

- Medical and Dental

- Oil and Gas

- Industrial

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes aerospace and defense, automotive, medical and dental, oil and gas, industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Metallurgical Equipment Market News:

- In March 2025, The Competition Commission of India approved Peabody MNG and Peabody SMC’s acquisition of a portion of Anglo American’s Australian steel-making coal assets. This strategic move enhances Peabody’s global presence in metallurgical coal and strengthens its supply chain, reinforcing its position as a key exporter of steel-making coal to India.

India Metallurgical Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ironmaking Equipment, Steelmaking Equipment, Metal Rolling Machine |

| Equipments Covered | Milling Machines, Broaching Machines, Grinding Machines, Drilling Machines |

| Applications Covered | Aerospace and Defense, Automotive, Medical and Dental, Oil and Gas, Industrial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India metallurgical equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India metallurgical equipment market on the basis of type?

- What is the breakup of the India metallurgical equipment market on the basis of equipment?

- What is the breakup of the India metallurgical equipment market on the basis of application?

- What is the breakup of the India metallurgical equipment market on the basis of region?

- What are the various stages in the value chain of the India metallurgical equipment market?

- What are the key driving factors and challenges in the India metallurgical equipment ?

- What is the structure of the India metallurgical equipment market and who are the key players?

- What is the degree of competition in the India metallurgical equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India metallurgical equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India metallurgical equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India metallurgical equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)