India Metal Injection Molding Market Size, Share, Trends and Forecast by Material Type, End Use Industry, and Region, 2025-2033

India Metal Injection Molding Market Overview:

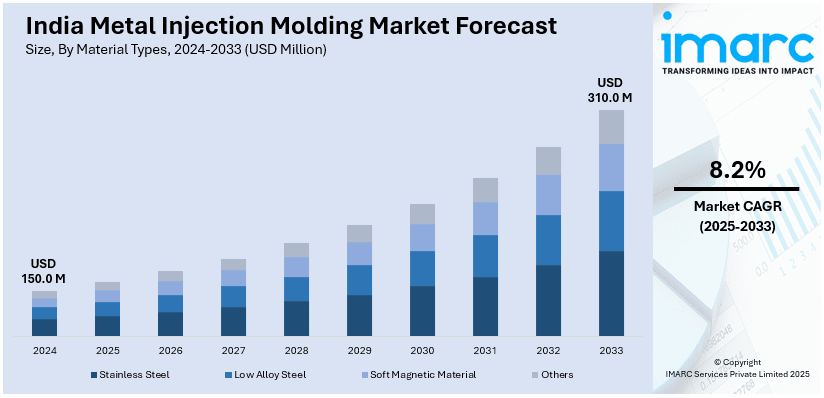

The India metal injection molding market size reached USD 150.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 310.0 Million by 2033, exhibiting a growth rate (CAGR) of 8.2% during 2025-2033. The rising demand in automotive, healthcare, and electronics industries, advancements in manufacturing technologies, cost-effective mass production, growing investments in defense, rapid industrialization, expanding consumer goods sector, government initiatives, and a shift toward high-performance metal parts are some of the major factors positively impacting the India metal injection molding market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 150.0 Million |

| Market Forecast in 2033 | USD 310.0 Million |

| Market Growth Rate 2025-2033 | 8.2% |

India Metal Injection Molding Market Trends:

Increased Adoption in Medical and Aerospace Applications

The demand for complex, biocompatible, and lightweight components is driving the adoption of metal injection molding (MIM) in medical and aerospace industries, which is enhancing the India metal injection molding market outlook. In the medical field, MIM is utilized in the manufacture of surgical instruments, orthopedic devices, and dental braces because of its capacity to create very complex shapes with high accuracy. The technique accommodates the utilization of biocompatible metals like titanium and stainless steel in that it extends the material's long-term strength and the safety of the patient. Moreover, MIM facilitates large-scale production of medical parts with respect to high quality requirements. According to industry reports, the Indian aerospace and defense sector is projected to expand by USD 70 Billion by 2030. In aerospace, there is an increased use of MIM for manufacturing fuel system components, brackets, and fasteners. The growth of the industry further increases demand for MIM, due to its capacity to create intricate geometries while satisfying high-performance requirements. Furthermore, temperature-resistant alloys treated using MIM promote long-term durability in harsh environments while maintaining reliability and performance in mission-critical aerospace applications. With industries looking for affordable manufacturing options for precision-engineered parts, MIM is increasingly attracting consumers, being an effective substitute for conventional metalworking methods in high-performance industries.

To get more information on this market, Request Sample

Expansion in Automotive and Consumer Goods Sectors

Metal injection molding (MIM) is increasingly being used in the automotive and consumer goods industries due to its ability to produce complex, high-strength components with precision. Automotive manufacturers benefit from MIM’s capability to create lightweight yet durable parts such as gears, fuel system components, and turbocharger components. The Automotive Mission Plan 2016–2026 states that the automotive sector will increase by 3.5–4 times its current worth of USD 74 Billion to USD 260 billion to USD 300 Billion, placing the nation in the major three automotive industries globally. This growth drives the demand for high-precision manufacturing technologies like MIM, which ensures consistency in large-scale production while reducing material wastage and machining requirements. In consumer goods, MIM is preferred for manufacturing intricate and miniaturized parts, particularly in electronics, watches, eyewear, and premium hardware. The technique allows for the creation of aesthetically refined and functional designs without compromising strength. As companies seek greater efficiency, MIM is becoming a strategic choice for industries requiring high precision, complex geometries, and superior surface finishes, which is strengthening India metal injection molding market growth.

India Metal Injection Molding Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on material type and end use industry.

Material Types Insights:

- Stainless Steel

- Low Alloy Steel

- Soft Magnetic Material

- Others

The report has provided a detailed breakup and analysis of the market based on the material types. This includes stainless steel, low alloy steel, soft magnetic material, and others.

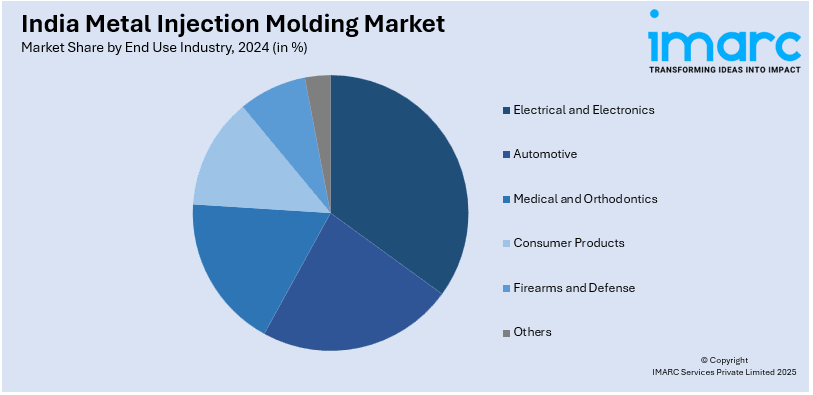

End Use Industry Insights:

- Electrical and Electronics

- Automotive

- Medical and Orthodontics

- Consumer Products

- Firearms and Defense

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes electrical and electronics, automotive, medical and orthodontics, consumer products, firearms and defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Metal Injection Molding Market News:

- On July 2023, Indo-MIM, a leading global metal injection molding (MIM) and metal additive manufacturing components supplier based in Bangalore, India, acquired CMG Technologies to strengthen its presence in the UK and European markets. The acquisition enhances Indo-MIM’s capabilities in defense, medical, and consumer sectors while maintaining CMG’s existing management and operations. Indo-MIM plans further global expansion through acquisitions and greenfield investments across the EU, USA, South America, and Southeast Asia.

India Metal Injection Molding Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Canned Meat and Seafood, Canned Fruit and Vegetables, Canned Ready Meals, Others |

| End Use Industry Covered | Electrical and Electronics, Automotive, Medical and Orthodontics, Consumer Products, Firearms and Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India metal injection molding market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India metal injection molding market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India metal injection molding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal injection molding market in India was valued at USD 150.0 Million in 2024.

The India metal injection molding market is projected to exhibit a CAGR of 8.2% during 2025-2033, reaching a value of USD 310.0 Million by 2033.

Growing demand for complex and miniaturized metal components in industries like automotive, medical, and electronics is driving the India metal injection molding market. Advantages such as high precision, reduced material waste, and cost-effective mass production make the process increasingly attractive for manufacturers seeking advanced production solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)