India Metal Fabrication Market Size, Share, Trends and Forecast by Material Type, Service Type, End User Industry, and Region, 2025-2033

India Metal Fabrication Market Overview:

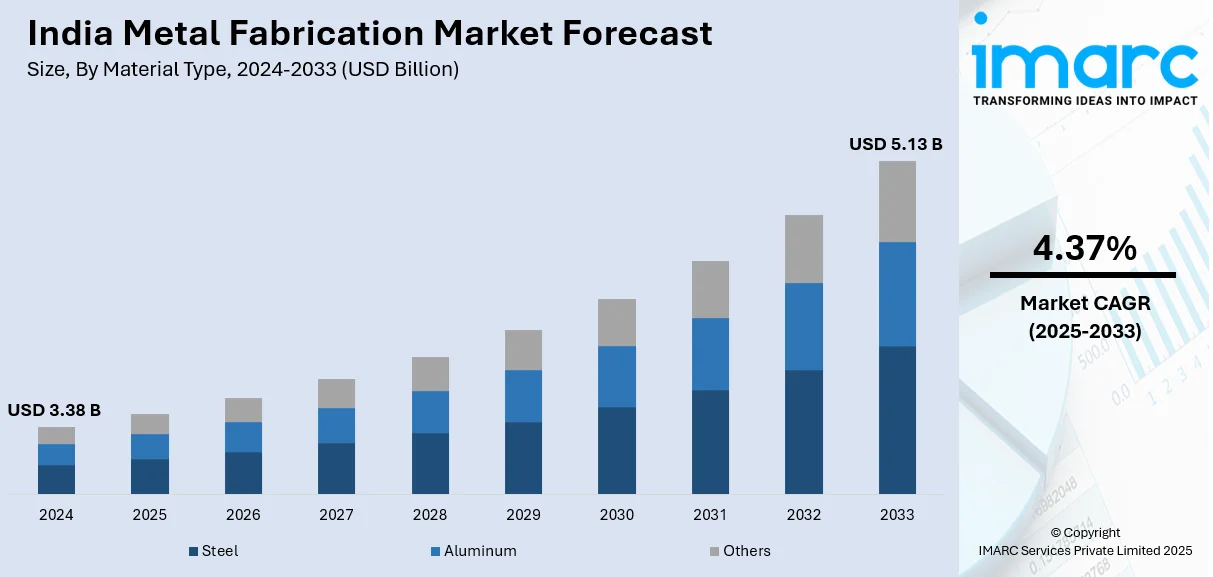

The India metal fabrication market size reached USD 3.38 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.13 Billion by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025-2033. The expanding infrastructure projects, increasing demand from the automotive, aerospace, and construction sectors, and government initiatives like Make in India and investments in smart manufacturing and automation are propelling the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.38 Billion |

| Market Forecast in 2033 | USD 5.13 Billion |

| Market Growth Rate (2025-2033) | 4.37% |

India Metal Fabrication Market Trends:

Digital Transformation and Automation in Metal Fabrication

The rapid digital transformation in manufacturing is reshaping the metal fabrication landscape in India. The expanding adoption of Industry 4.0 technologies, such as advanced CNC machinery, robotics, the Internet of things (IoT)-driven process monitoring, and artificial intelligence (AI) is enabling manufacturers to achieve higher precision, reduced production times, and improved product quality. These technologies streamline production by minimizing human error and optimizing workflow through real-time data analytics, resulting in significant cost savings and energy efficiency. Moreover, digital twins and simulation software are becoming standard tools for process optimization, facilitating predictive maintenance, and reducing downtime. As competition intensifies in the global market, Indian manufacturers are increasingly investing in smart factories to meet both domestic and international quality standards. Government initiatives such as SAMARTH Udyog Bharat 4.0, Make in India 2.0, and Digital India are key drivers of Industry 4.0 adoption. These programs support advanced manufacturing, offer financial incentives, and strengthen digital infrastructure, accelerating technological integration and boosting market growth across various industrial sectors.

To get more information on this market, Request Sample

Shift Toward Sustainable and Eco-Friendly Fabrication Processes

Environmental sustainability has become a key driver in the metal fabrication market, as manufacturers pivot toward greener practices to reduce their carbon footprints. A PwC report reveals that 93% of Indian manufacturers are prioritizing sustainability as a core objective, leveraging Industry 5.0 practices to drive 2-3 times profitable growth. This highlights a strong commitment to industrial sustainability, as companies integrate advanced technologies and eco-friendly strategies to enhance efficiency and long-term profitability. As a result, companies are investing in energy-efficient machinery, waste recycling systems, and environmentally safe lubricants and coolants, which not only comply with stricter emissions standards but also reduce overall production costs by up to 15%. Recycling and reusing metal scrap is another critical focus area, with initiatives showing that up to 30% of metal waste is currently being recycled, a figure expected to reach 40% by 2025. Additionally, advancements in low-emission and solvent-free fabrication techniques have reduced harmful byproducts, supporting sustainability goals and enhancing workplace safety. The drive towards sustainability is also backed by global partnerships and collaborations that bring new eco-friendly technologies to market. With increasing investments in renewable energy and green process innovation, Indian fabricators are well-positioned to meet the demands of both environmentally conscious consumers and stringent regulatory frameworks.

India Metal Fabrication Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material type, service type, and end user industry.

Material Type Insights:

- Steel

- Aluminum

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes steel, aluminum, and others.

Service Type Insights:

- Casting

- Forging

- Machining

- Welding and Tubing

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes casting, forging, machining, welding and tubing, and others.

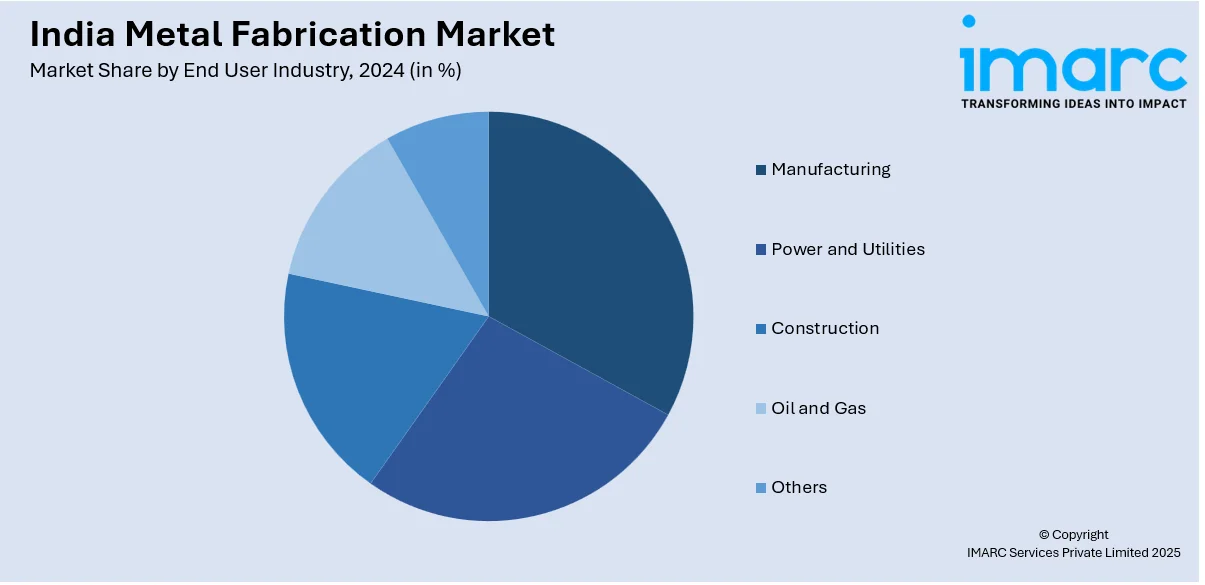

End User Industry Insights:

- Manufacturing

- Power and Utilities

- Construction

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end user industry. This includes manufacturing, power and utilities, construction, oil and gas, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Metal Fabrication Market News:

- August 2024: Fabrication Bazar received $3 million in funding, led by Physis Capital, with support from Japan-based ICMG and existing investor Inflection Point Ventures. This investment validates the company’s asset-light model for tackling steel fabrication challenges in India, focusing on efficiency, cost-effectiveness, and high-quality standards to drive industry innovation.

India Metal Fabrication Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Steel, Aluminum, Others |

| Service Types Covered | Casting, Forging, Machining, Welding and Tubing, Others |

| End User Industries Covered | Manufacturing, Power and Utilities, Construction, Oil and Gas, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India metal fabrication market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India metal fabrication market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India metal fabrication industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal fabrication market in India was valued at USD 3.38 Billion in 2024.

The India metal fabrication market is projected to exhibit a CAGR of 4.37% during 2025-2033, reaching a value of USD 5.13 Billion by 2033.

India’s metal fabrication market is driven by rapid infrastructure growth, expansion of the automotive and renewable energy sectors, and increasing demand from aerospace and defense industries. Government initiatives encouraging domestic manufacturing, along with the adoption of advanced technologies like automation and precision fabrication, further boost the sector’s development and opportunities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)