India Metal Cutting Tools Market Size, Share, Trends and Forecast by Tool Type, Product Type, Application, and Region, 2025-2033

India Metal Cutting Tools Market Overview:

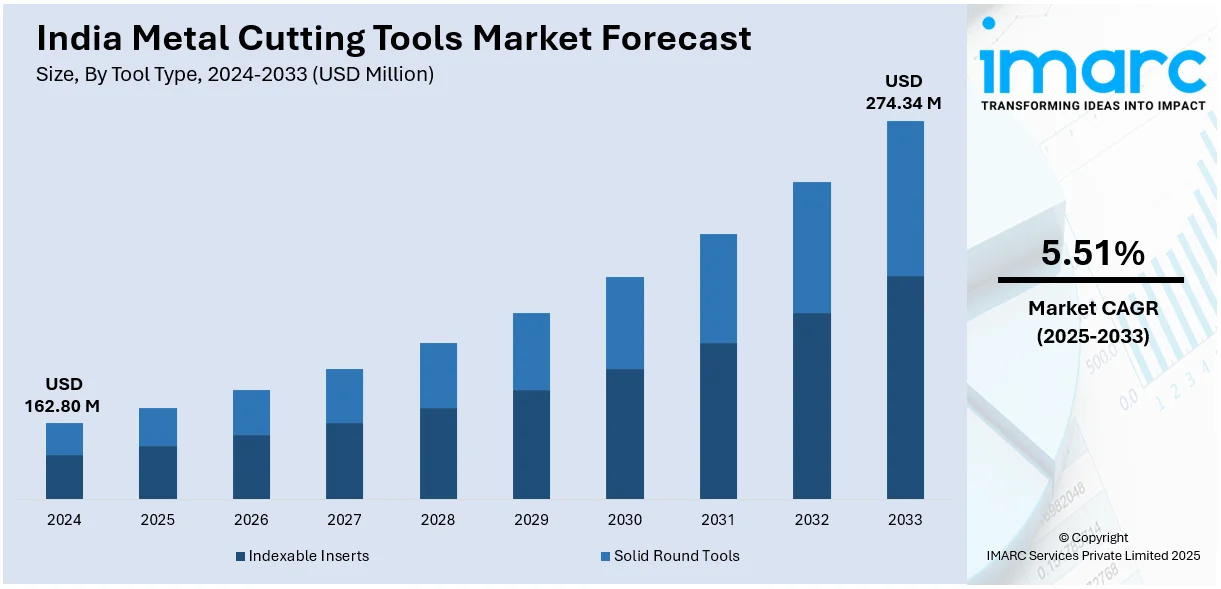

The India metal cutting tools market size reached USD 162.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 274.34 Million by 2033, exhibiting a growth rate (CAGR) of 5.51% during 2025-2033. The rising demand for precision engineering, increasing adoption of computer numerical control (CNC) machinery, government initiatives like Make in India and investments in aerospace and infrastructure are boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 162.80 Million |

| Market Forecast in 2033 | USD 274.34 Million |

| Market Growth Rate (2025-2033) | 5.51% |

India Metal Cutting Tools Market Trends:

Increasing Adoption of CNC and Automation-Driven Cutting Tools

The growing use of CNC technology and automation is transforming India's metal cutting tools industry. CNC-based cutting tools are becoming increasingly important in industries, such as automotive, aerospace, and general manufacturing as they provide greater precision, efficiency, and cost effectiveness. Furthermore, the Indian automotive sector, which accounts for roughly 40% of metal cutting tool demand, is expected to rise by 10% each year, boosting the need for advanced CNC tools. Government policies such as the Make in India and the Production Linked Incentive (PLI) plan are enticing international companies to establish manufacturing units, boosting the need for precise cutting equipment. With labor costs rising and the focus shifting towards lean manufacturing, businesses are increasingly investing in automated, AI-driven cutting solutions that minimize errors and improve productivity. As companies continue to embrace Industry 4.0, the integration of IoT-enabled cutting tools and real-time monitoring systems will further enhance production efficiency, thereby strengthening the market growth.

To get more information on this market, Request Sample

Rising Demand for High-Performance Coated and Carbide Cutting Tools

The rising demand for carbide and coated cutting tools is driving market growth, as manufacturers target longer tool life, increased wear resistance, and faster machining speed. The increase in electric vehicle (EV) production is exacerbating this trend, as EV components need high-precision machining with little tolerance for mistakes. India has set lofty EV adoption goals, aiming for 30% of private cars, 70% of commercial vehicles, 40% of buses, and 80% of two- and three-wheelers to be electric by 2030. This aim translates into an estimated 80 million EVs on Indian roads, propelling the need for sophisticated manufacturing, battery technology, and sustainable transportation solutions. To meet these demands, manufacturers are increasingly using cubic boron nitride (CBN) and polycrystalline diamond (PCD) tools for machining lightweight aluminum and composite materials, essential for both EVs and aerospace applications. Additionally, India is emerging as a global hub for auto component sourcing, with over 25% of production exported annually. In this context, nanotechnology-based coatings are proving to be a game-changer, offering self-lubricating properties that reduce friction and enhance cutting speeds. Companies investing in high-performance carbide and super-hard materials are gaining a competitive edge, optimizing production costs, and improving throughput in an increasingly competitive manufacturing landscape.

India Metal Cutting Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on tool type, product type, and application.

Tool Type Insights:

- Indexable Inserts

- Solid Round Tools

The report has provided a detailed breakup and analysis of the market based on the tool type. This includes indexable inserts and solid round tools.

Product Type Insights:

- Lathe

- Drilling Machine

- Milling Machine

- Grinding Machine

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes lathe, drilling machine, milling machine, grinding machine, and others.

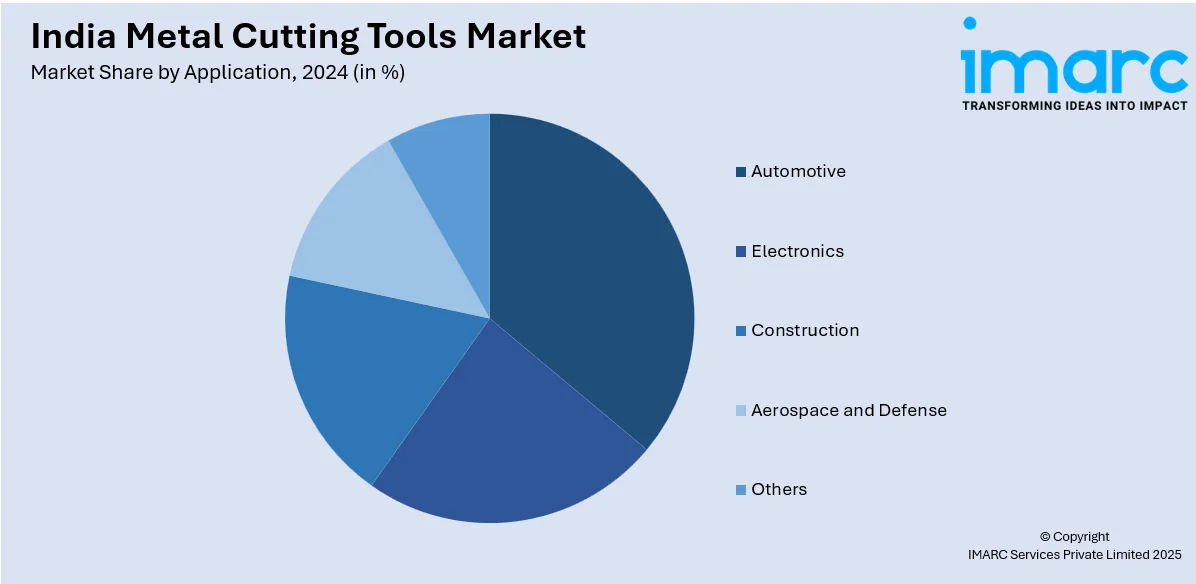

Application Insights:

- Automotive

- Electronics

- Construction

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, electronics, construction, aerospace and defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Metal Cutting Tools Market News:

- March 2024: Korloy introduced Star Series Endmills, designed to cater to a diverse range of machining applications. This series includes five key variants: H-Star, U-Star, G-Star, A-Star, and S-Star. Among them, the U-Star Endmill stands out for its versatility, supporting various cutting methods such as roughing, medium cutting, and precision finishing for molds and dies.

- March 2024: Dormer Pramet, a leading metal cutting tool manufacturer under the Sandvik Group, unveiled the Dormer R003 and R023 drills, versatile solid carbide jobber, and stub drills designed for a wide range of applications. These drills offer low cost per hole, reduced thrust force, and consistent tool life, making them ideal for efficient and precise machining operations.

India Metal Cutting Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tool Types Covered | Indexable Inserts Tools, Solid Round Tools |

| Product Types Covered | Lathe, Drilling Machine, Milling Machine, Grinding Machine, Others |

| Applications Covered | Automotive, Aerospace and Defense, Construction, Electronics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India metal cutting tools market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India metal cutting tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India metal cutting tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal cutting tools market in the India was valued at USD 162.80 Million in 2024.

The India metal cutting tools market is projected to exhibit a CAGR of 5.51% during 2025-2033, reaching a value of USD 274.34 Million by 2033.

The India metal cutting tools market is driven by increasing demand from automotive, aerospace, and general manufacturing sectors. Support from the government under programs such as Make in India and Production Linked Incentive (PLI) schemes fosters capital investment. Automation, computer numerical control (CNC) machining, and focus on precision engineering are revolutionizing the manufacturing environment and driving cutting tool uptake.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)