India Membranes Market Size, Share, Trends and Forecast by Material Type, Technology, Application, and Region, 2026-2034

India Membranes Market Overview:

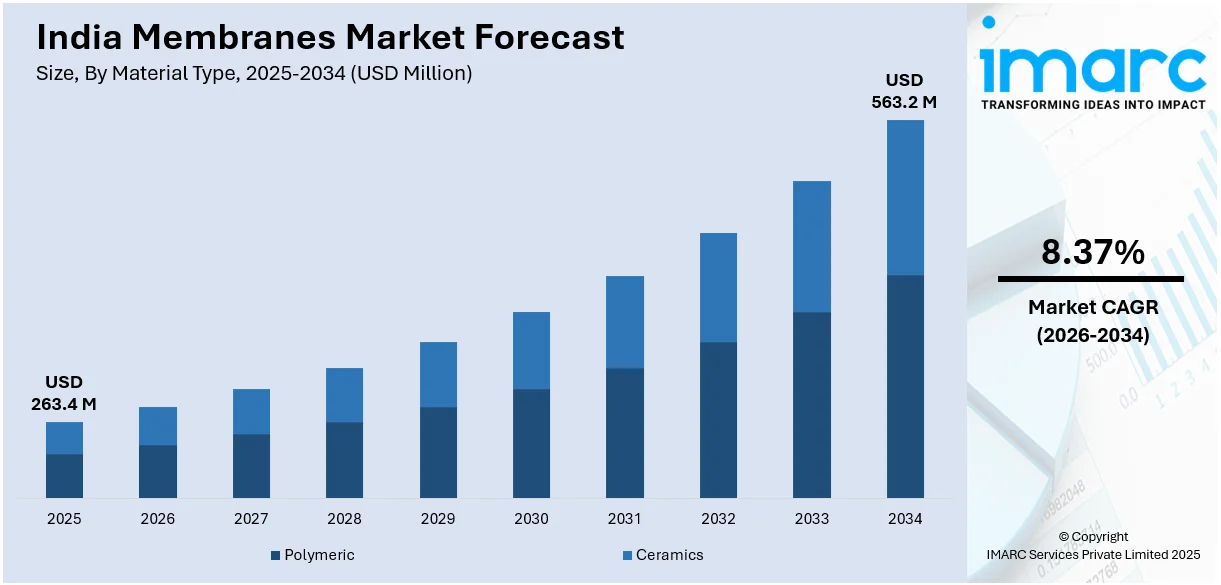

The India membranes market size reached USD 263.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 563.2 Million by 2034, exhibiting a growth rate (CAGR) of 8.37% during 2026-2034. The market is expanding mainly because of escalating need for water and wastewater treatment, industrial filtration, and healthcare applications. Growth is further driven by urbanization, government initiatives, and technological advancements in membrane materials, enhancing efficiency and sustainability across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 263.4 Million |

| Market Forecast in 2034 | USD 563.2 Million |

| Market Growth Rate (2026-2034) | 8.37% |

India Membranes Market Trends:

Elevating Need for Water and Wastewater Treatment Applications

The India membranes market is experiencing significant growth due to the magnifying requirement for water and wastewater treatment solutions. Rapid urbanization, population growth, and industrialization have led to a surge in water consumption, straining existing water resources. For instance, as per industry reports, India surpassed China to emerge as the most populated nation globally in 2023 and anticipated to sustain its dominance through 2100. In parallel, India's population was estimated at 1.45 Billion during 2024, and is expected to peak during 2054, reaching 1.69 Billion. As a result, the government is implementing stringent regulations to ensure water conservation and pollution control, driving the adoption of membrane technologies, mainly like microfiltration (MF), reverse osmosis (RO), and ultrafiltration (UF). Additionally, initiatives like the Jal Jeevan Mission and Namami Gange program are promoting advanced filtration solutions to improve water quality. The industrial sector, particularly power plants, pharmaceuticals, and food processing, is also expanding its use of membrane-based treatment systems to comply with environmental norms and achieve sustainable operations. Technological advancements, including high-efficiency membranes with improved fouling resistance and longer lifespans, are further enhancing market growth. These factors are expected to sustain the increasing adoption of membranes in India’s water and wastewater management sector.

To get more information on this market Request Sample

Growth in Industrial Filtration and Process Separation Technologies

The increasing demand for membranes in industrial filtration and process separation applications is a key trend shaping the India membranes market. For instance, as per industry reports, industrial wastewater infrastructure across India is anticipated to grow to USD 4.65 Billion by the year 2030, further strengthening membranes requirement. Sectors such as pharmaceuticals, chemicals, food and beverage, and electronics manufacturing are investing in membrane-based filtration technologies to enhance product quality and process efficiency. Ultrafiltration (UF) and nanofiltration (NF) are gaining traction in applications like protein separation, enzyme recovery, and solvent purification. In the food and beverage industry, membranes are widely used for dairy processing, beverage clarification, and sugar concentration. Additionally, the pharmaceutical industry is leveraging membrane technology for drug purification, sterile filtration, and biopharmaceutical production. The push toward sustainability and resource efficiency is prompting industries to adopt advanced membranes that reduce energy consumption and operational costs. Innovations in membrane materials, such as polymeric and ceramic membranes with enhanced chemical resistance and durability, are further driving industrial adoption, solidifying India’s position as a growing market for membrane technologies.

India Membranes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on material type, technology, and application.

Material Type Insights:

- Polymeric

- Ceramics

The report has provided a detailed breakup and analysis of the market based on the material type. This includes polymeric, and ceramics.

Technology Insights:

- Reverse Osmosis (RO)

- Ultrafiltration (UF)

- Microfiltration (MF)

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes reverse osmosis (RO), ultrafiltration (UF), and microfiltration (MF).

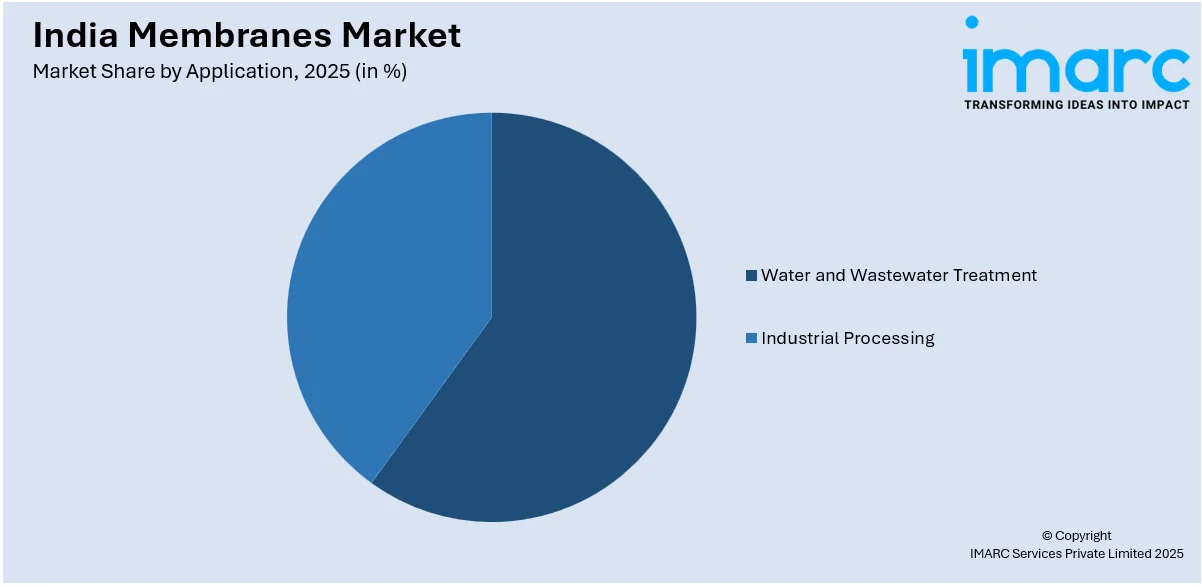

Application Insights:

Access the comprehensive market breakdown Request Sample

- Water and Wastewater Treatment

- Industrial Processing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes water and wastewater treatment and industrial processing.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Membranes Market News:

- In April 2024, QUA unveiled its new, cutting-edge production facility for membranes in India. This new plant will address the rising need and aid the manufacturing of QUA's comprehensive product line, encompassing Q-SEP Q-Connect hollow fiber ultrafiltration membranes, EnviQ RF submerged ultrafiltration membranes, etc.

- In November 2024, Toyobo MC Corporation, a global company specializing in reverse osmosis, announced its launch in Indian market by unveiling its Spiral Wound RO Membranes in partnership with BI Marketing and Services Pvt. Ltd., an India-based firm.

India Membranes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Polymeric, Ceramics |

| Technologies Covered | Reverse Osmosis (RO), Ultrafiltration (UF), Microfiltration (MF) |

| Applications Covered | Water and Wastewater Treatment, Industrial Processing |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India membranes market performed so far and how will it perform in the coming years?

- What is the breakup of the India membranes market on the basis of material type?

- What is the breakup of the India membranes market on the basis of technology?

- What is the breakup of the India membranes market on the basis of application?

- What is the breakup of the India membranes market on the basis of region?

- What are the various stages in the value chain of the India membranes market?

- What are the key driving factors and challenges in the India membranes?

- What is the structure of the India membranes market and who are the key players?

- What is the degree of competition in the India membranes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India membranes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India membranes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India membranes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)