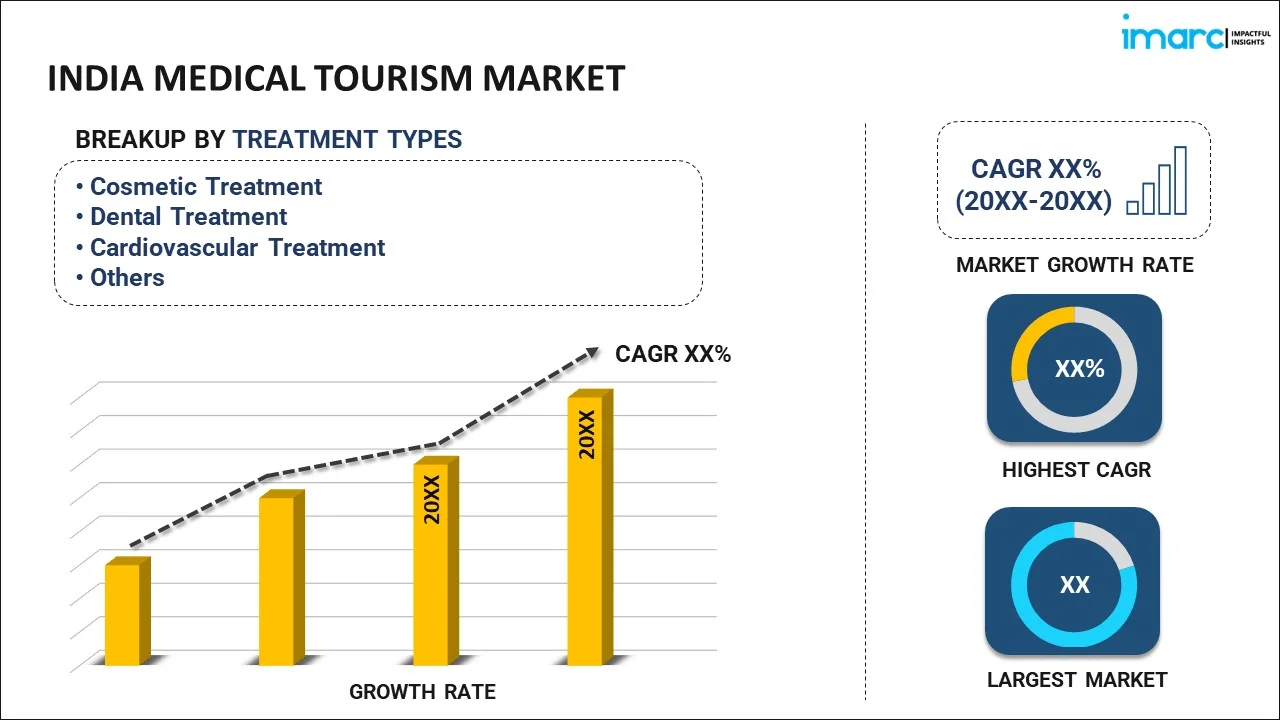

India Medical Tourism Market Report by Treatment Type (Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, and Others), and Region 2026-2034

Market Overview:

India medical tourism market size reached USD 23.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 72.1 Billion by 2034, exhibiting a growth rate (CAGR) of 13.09% during 2026-2034. The lower cost of medical treatments in this country as compared to many developed nations, thereby making it an attractive option for individuals seeking quality healthcare without incurring exorbitant expenses, is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 23.8 Billion |

|

Market Forecast in 2034

|

USD 72.1 Billion |

| Market Growth Rate 2026-2034 | 13.09% |

Access the full market insights report Request Sample

Medical tourism involves traveling to a different country to undergo medical treatments or procedures, and it has become increasingly popular as people search for healthcare options that are both cost-effective and prompt. This trend offers several benefits, such as access to specialized treatments, reduced waiting times, and financial savings compared to domestic healthcare services. Individuals frequently opt for medical tourism for a range of procedures, including cosmetic surgery, dental treatments, fertility interventions, and intricate surgeries. As the demand for affordable and easily accessible healthcare continues to grow, medical tourism is likely to persist as a viable option for individuals seeking specialized treatments and cost-effective solutions beyond the confines of their home countries.

India Medical Tourism Market Trends:

The India medical tourism market has emerged as a thriving sector, drawing increasing numbers of international patients seeking high-quality healthcare services at cost-effective rates. This trend has gained significant traction due to India's reputation for offering advanced medical facilities, skilled healthcare professionals, and affordable healthcare solutions. One of the primary attractions for medical tourists coming to India is the accessibility of specialized treatments. The country boasts state-of-the-art hospitals and clinics equipped with cutting-edge technology, providing a comprehensive range of medical services. Patients often seek treatments such as cosmetic surgery, dental procedures, organ transplants, fertility treatments, and cardiac surgeries, among others. Additionally, affordability is a key driver for the growth of medical tourism in India. Moreover, India's medical tourism offerings are not confined to healthcare alone. Many medical facilities collaborate with tourism services to provide patients with a holistic experience. Besides this, patients can avail themselves of medical treatments while also exploring India's rich cultural heritage and scenic landscapes, creating a unique blend of healthcare and tourism. The Indian government has recognized the potential of medical tourism and has taken steps to facilitate the entry of international patients As the demand for affordable and high-quality healthcare services continues to grow, the India medical tourism market is poised for sustained expansion in the coming years.

India Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on treatment type.

Treatment Type Insights:

To get detailed segment analysis of this market Request Sample

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

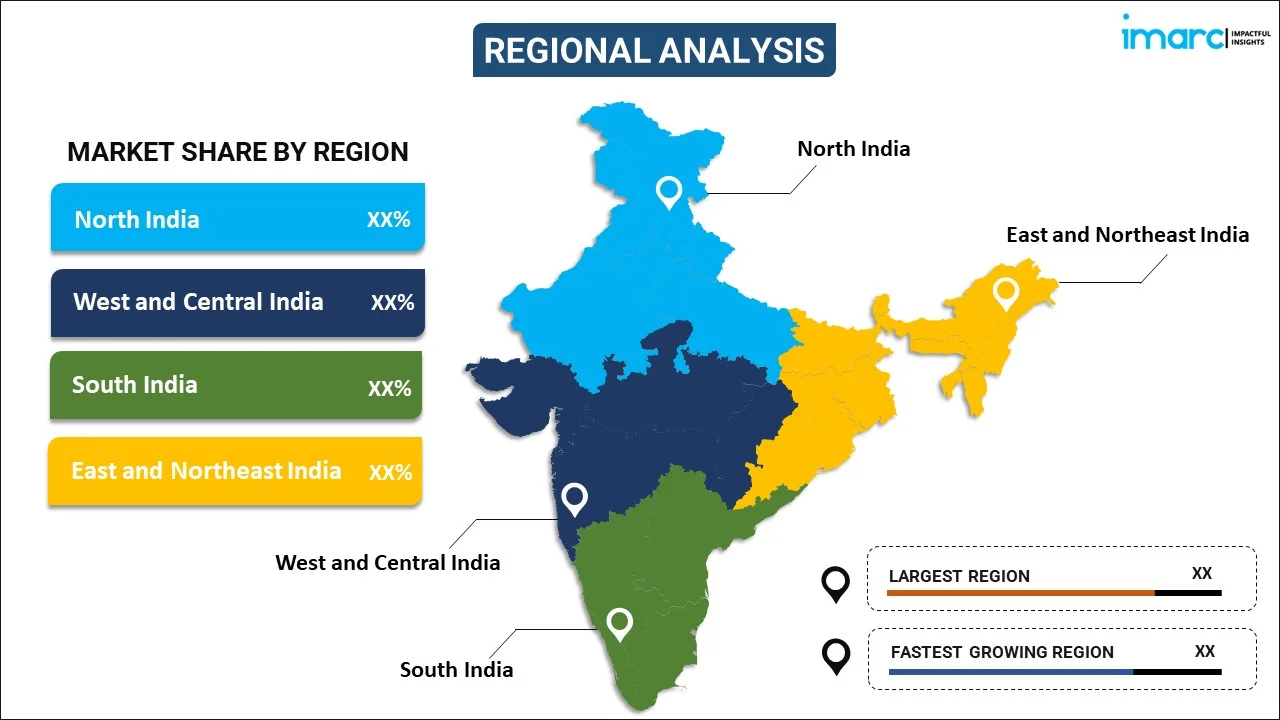

Regional Insights:

To get detailed regional analysis of this market Request Sample

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The companies in the market are adopting various strategic initiatives including new product launches and business alliances to gain a significant India medical tourism market share.

India Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medical tourism market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical tourism market in India was valued at USD 23.8 Billion in 2025.

The India medical tourism market is projected to exhibit a CAGR of 13.09% during 2026-2034, reaching a value of USD 72.1 Billion by 2034.

The India medical tourism market is propelled by affordable treatment costs, skilled healthcare professionals, and advanced medical infrastructure. Patients from neighboring and western countries seek India for procedures like cardiac surgery, orthopedics, and fertility treatments. Additionally, minimal waiting times and alternative healing options like Ayurveda enhance the country's appeal.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)