India Material Testing Market Size, Share, Trends and Forecast by Type, Material, End Use Industry, and Region, 2025-2033

India Material Testing Market Size and Share:

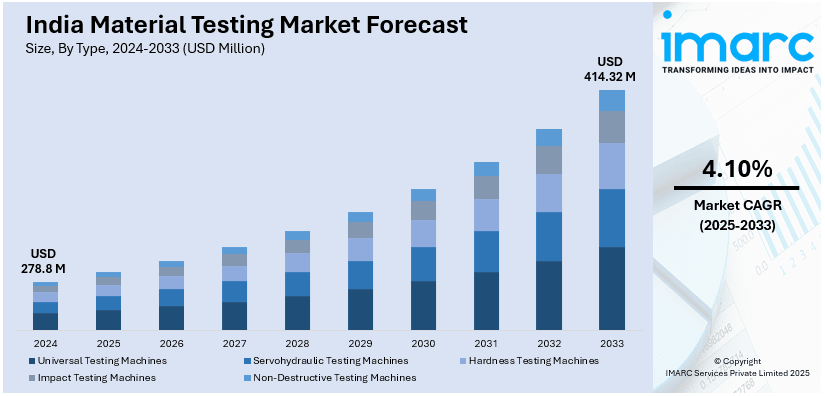

The India material testing market size was valued at USD 278.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 414.32 Million by 2033, exhibiting a CAGR of 4.10% from 2025-2033. The increasing industrialization, rapid infrastructure development, growing demand for high-performance materials, regulatory compliance, advancements in testing technologies, expanding manufacturing sectors, rising safety concerns, and a focus on sustainable construction practices are some of the major factors positively impacting the India material testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 278.8 Million |

| Market Forecast in 2033 | USD 414.32 Million |

| Market Growth Rate (2025-2033) | 4.10% |

The market is driven by the rapid growth in industrialization, particularly in the automotive, construction, and aerospace industries, stimulating demand for material testing for product quality and safety. Moreover, the increasing manufacturing hub of India is creating demand for strict quality control and certification processes, further propelling India material testing market growth. In addition to this, support from the government for industrial growth through programs is creating avenues for testing service providers. For example, the National Industrial Corridor Development Programme is an initiative that aims to establish "Smart Cities" and advanced industrial clusters. A significant step in this revolutionary endeavor was recently taken when the cabinet authorized 12 new project proposals with an anticipated investment of INR 28,602 crore.

To get more information on this market, Request Sample

Apart from this, the country's focus on green industrialization and sustainability is driving the need for material testing. According to industry reports, with targets to cut emissions intensity by 45% by 2030 and reach net-zero emissions by 2070, industries need to ensure materials meet environmental standards, particularly in construction, automotive, and manufacturing. Besides this, the rising adoption of advanced materials, such as composites and alloys, across industries is contributing to the demand for specialized testing. In line with this, growing awareness of the need for quality standards in manufacturing is pressuring enterprises to invest in effective material testing solutions.

India Material Testing Market Trends:

Growth of the Construction Sector

The growth of the construction sector in India is leading to an increasing Indian material testing market demand. This is due to the increasing urbanization and infrastructure development requirement for high-quality, durable materials. According to the Economic Survey 2023-24, more than 40% of population in India is predicted to reside in cities by 2030. The expansion of smart cities, transportation networks, and industrial infrastructure requires materials that can withstand various environmental stresses and meet stringent safety standards. As a result, there is a rising need for comprehensive material testing to assess properties like strength, durability, and compliance with building codes. Additionally, with the government's focus on large-scale infrastructure projects, the need for reliable material testing services to ensure quality and compliance is more critical than ever.

Adoption of Advanced Testing Technologies

The increasing use of cutting-edge testing technologies, such as machine learning (ML), automated systems, and artificial intelligence (AI), to enhance testing precision and speed is a significant India material testing market trend. According to an industry report, 23% of Indian businesses have already adopted AI, outpacing other survey markets, and 73 percent anticipate expanding AI use in 2025, significantly higher than the survey average of 52 percent. AI and ML algorithms are being incorporated into material testing procedures to analyze vast amounts of data, predict material behavior under different conditions, and optimize testing processes. Automated testing systems, such as robotic arms and digital instruments, are reducing human error and improving repeatability in tests. This technological shift is helping industries achieve better performance, reduce operational costs, and meet rigorous standards efficiently.

Expansion of Testing Facilities

The expansion of testing facilities across India is India enhancing the India material testing market outlook. As industries continue to scale, the demand for specialized material testing services results in the establishment of new laboratories and testing centers. These facilities are increasingly equipped with advanced testing equipment, enabling more advanced and precise analysis of materials. Additionally, government policies in the form of incentives and funding are promoting the growth of these centers, making the testing services more available and accessible in different regions. For example, on September 6, 2024, Volvo Group India and BMS College of Engineering (BMSCE) inaugurated the 'BMSCE and Volvo Group Centre for Flexible Material Research' in Bangalore. The center is the result of a memorandum of understanding between the two firms in 2023, with an emphasis on the development of advanced testing machines to study the behavior of flexible materials like high-voltage EV cables and safety-critical hoses.

India Material Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India material testing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, material, and end use industry.

Analysis by Type:

- Universal Testing Machines

- Servohydraulic Testing Machines

- Hardness Testing Machines

- Impact Testing Machines

- Non-Destructive Testing Machines

Non-destructive testing (NDT) machine is a key component in the Indian material testing market due to its ability to test structures and materials without destructive testing. This equipment is a key factor in the construction, aerospace, automotive, and manufacturing industries where performance, quality assurance, and safety requirements are high. NDT equipment assists in detecting potential defects like cracks, corrosion, or weakness in structures at early production stages or while conducting routine check-ups, hence ensuring high material and equipment durability and reliability. The need to develop advanced manufacturing capability and infrastructure in India and increasing safety demands are fueling the use of NDT equipment. NDT equipment offers effective, efficient, and cost-effective alternatives that preclude high repair costs and downtime. As the nation's industrial sectors develop, NDT equipment is an essential tool to ensure high-quality standards and optimized overall efficiency levels.

Analysis by Material:

- Metals and Alloys

- Plastics

- Rubber and Elastomers

- Ceramics and Composites

- Others

Metals and alloys play major roles in the Indian material testing market due to the pervasiveness of their use in the construction, automotive, aerospace, and manufacturing sectors. The materials are tested rigorously to check if they meet the strength, hardness, and performance standards. The growing demand for superior infrastructure, heavy machinery, and high-performance components is the major cause of the surge in demand for precise metal. The rise in alloy testing is to determine potential defects, such as cracks, corrosion, or structural weaknesses. Material testing processes like tensile, fatigue, and hardness testing are vital to the determination of the strength of metals and alloys under varied conditions. As India industrializes and invests in the most technologically advanced innovations, demand for high-quality, dependable metal products is increasing.

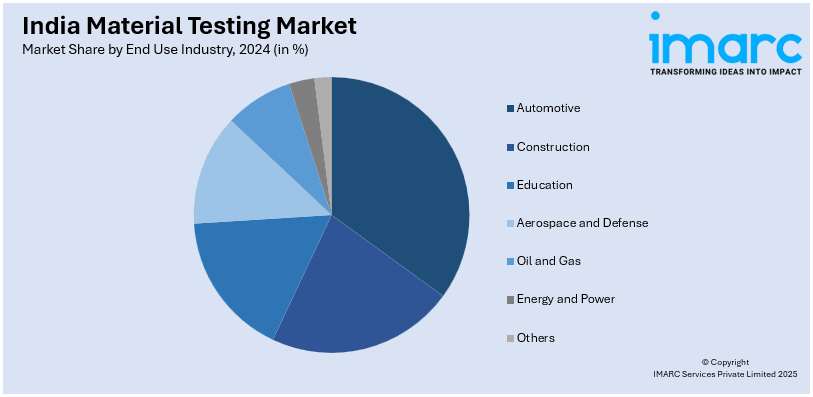

Analysis by End Use Industry:

- Automotive

- Construction

- Education

- Aerospace and Defense

- Oil and Gas

- Energy and Power

- Others

The construction sector leads the Indian material testing market due to the increased demand for superior materials that ensure the safety and durability of infrastructure projects. Construction materials, such as concrete, steel, and composites, are extensively tested to meet industry standards and regulatory tests. With India's fast urbanization, increasing government investment in infrastructure, and multi-billion-dollar construction projects, the requirement for material testing is on the rise. Testing compressive strength, durability, and fire resistance is critical in ensuring construction material so that it can be used optimally under extreme conditions, such as heavy loads, temperature extremes, and envirnmental stress. As the Indian construction market grows, the demand for advanced testing technology, which averts failures, reduces maintenance expenses, and ensures the long-term buildings' life.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

West and Central India are dominant regions in the material testing market in India due to the presence of manufacturing and industrial hubs. The region possesses large-scale industries like the automotive, engineering, and construction sectors, all requiring stringent material testing to validate the safety, quality, and global standards of products. The region's powerful states, such as Maharashtra, Gujarat, and Madhya Pradesh, contribute immensely to industrial production, infrastructure development, and power generation. Mumbai, Pune, and Ahmedabad's growing construction and infrastructure developments further stimulate material testing demands, particularly for concrete strength, steel integrity, and soil analysis. The focus on industrialization in the region, expanding manufacturing plants, and growing automobile industry also increases the need for advanced material testing solutions. Therefore, West and Central India are leading the material testing market, with quality materials provided to various industries.

Competitive Landscape:

The Indian market for material testing is extremely competitive, with a vast number of regional and international players. The key players in the market offer a wide variety of testing solutions, from non-destructive testing to mechanical and chemical testing. Companies compete on the dimensions of quality, technological innovation, and the ability to cater to diverse industry requirements, from manufacturing and construction to automotive and aerospace. Furthermore, strategic collaborations between manufacturers and distribution channels and government programs enhance the India material testing market outlook. For example, on November 25, 2024, a MoU was signed by the Confederation of Real Estate Developers' Associations of India (CREDAI) and the National Accreditation Board for Testing and Calibration Laboratories (NABL) to accredit temporary site testing laboratories for civil engineering works. The partnership is to enhance the quality and reliability of on-site material testing to ensure proper testing of construction materials, thus generating confidence in their quality. The program will enhance overall construction standards, leading to safer and stronger buildings in India.

The report provides a comprehensive analysis of the competitive landscape in the India material testing market with detailed profiles of all major companies including:

- Ametek India

- MTS Systems Corporation

- ZwickRoell Pvt. Ltd

- Powercap Capacitors Pvt. Ltd

- Instron India Private Limited

- L&T Technology Services Limited

- Tinius Olsen India Pvt. Ltd

- Shimadzu Corporation

- Hegewald & Peschke

- Mitutoyo

Latest News and Developments:

- January 22, 2024: To fortify their strategic alliance, Center Testing International Group Co., Ltd. (CTI) and Testtex India Laboratories Pvt. Ltd. (Testtex) revised their memorandum of understanding (MoU). The goal of this improved partnership is to increase both companies' market presence and service offerings by utilizing their respective strengths in testing, inspection, and certification services. The updated MoU demonstrates a dedication to providing clients in a range of industries with top-notch solutions.

- June 10, 2024: In order to establish the Uttar Pradesh Defence Industrial Corridor's Lucknow node for the advanced materials (defense) testing foundation, PTC Industries announced a partnership with prominent defense organizations. With an estimated cost of INR 53 crore, the Government of India will provide 75% of the funding for this greenfield defense testing center, while the Special Purpose Vehicle members would contribute 25%. The initiative's goal is to improve India's defense ecosystem by offering cutting-edge testing capabilities for advanced materials.

India Material Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Universal Testing Machines, Servohydraulic Testing Machines, Hardness Testing Machines, Impact Testing Machines, Non-Destructive Testing Machines |

| Materials Covered | Metals and Alloys, Plastics, Rubber and Elastomers, Ceramics and Composites, Others |

| End Use Industries Covered | Automotive, Construction, Education, Aerospace and Defense, Oil and Gas, Energy and Power, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Ametek India, MTS Systems Corporation, ZwickRoell Pvt. Ltd, Powercap Capacitors Pvt. Ltd, Instron India Private Limited, L&T Technology Services Limited, Tinius Olsen India Pvt. Ltd, Shimadzu Corporation, Hegewald & Peschke, Mitutoyo, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India material testing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India material testing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India material testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The material testing market in India was valued at USD 278.8 Million in 2024.

The key factors driving the market are increasing industrialization, rising demand for high-quality materials in construction and manufacturing, stringent quality standards, and government initiatives promoting infrastructure development. The growing emphasis on product safety, environmental concerns, and technological advancements in testing equipment also contribute to market expansion.

The material testing market in India is projected to exhibit a CAGR of 4.10% during 2025-2033, reaching a value of USD 414.32 Million by 2033.

Non-destructive testing machines dominate the market due to their ability to assess material properties without causing damage. Their rising adoption across industries like aerospace, automotive, and construction, driven by safety and cost-efficiency concerns, further boosts their market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)