India Material Handling Equipment Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

India Material Handling Equipment Market Overview:

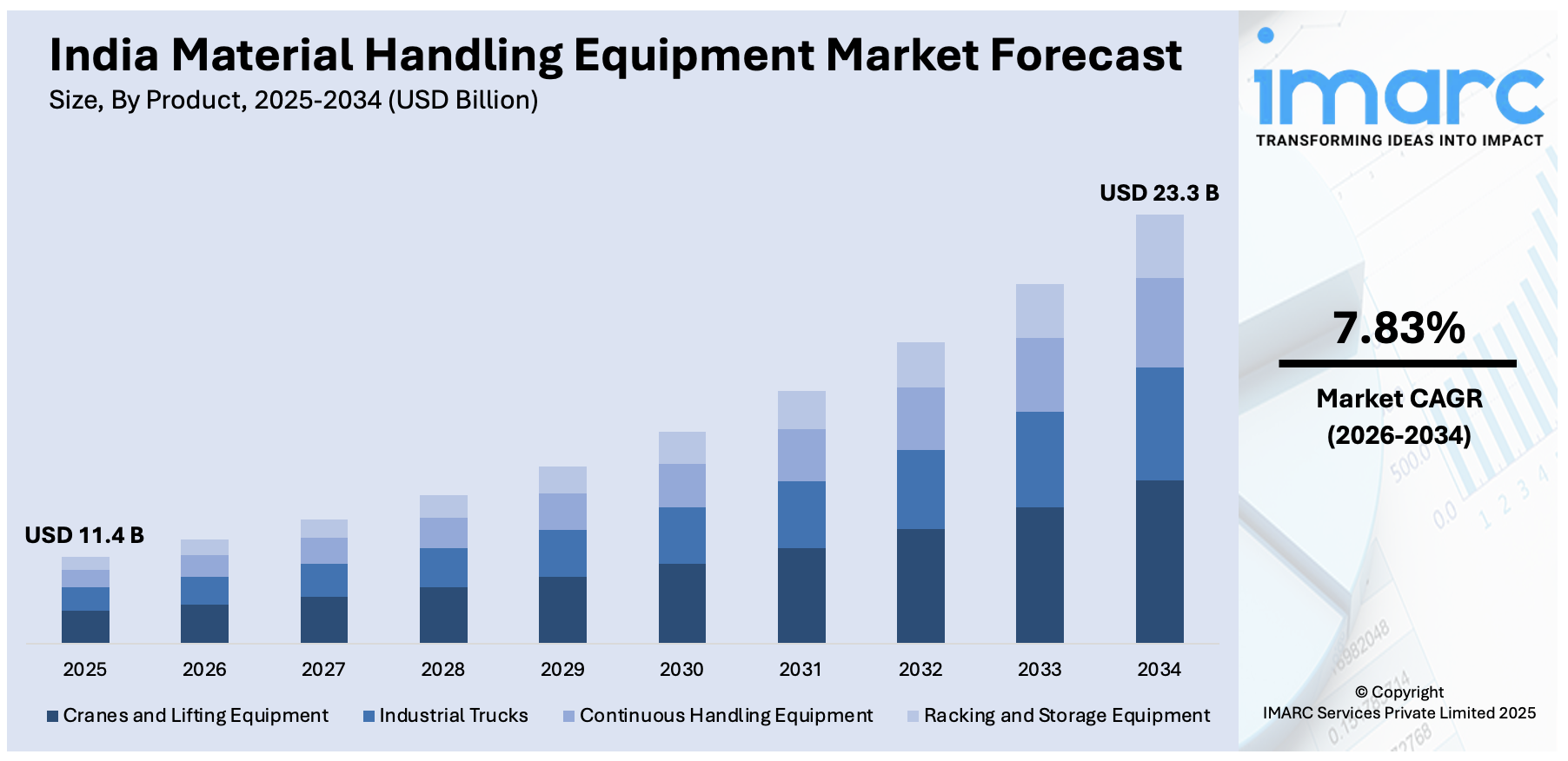

The India material handling equipment market size reached USD 11.4 Billion in 2025. The market is expected to reach USD 23.3 Billion by 2034, exhibiting a growth rate (CAGR) of 7.83% during 2026-2034. The market growth is attributed to rapid industrialization, expanding manufacturing activities, government initiatives like the Production-Linked Incentive (PLI) scheme, rising e-commerce logistics, and increasing infrastructure development, all contributing to higher demand for advanced automation, efficient warehousing solutions, and technologically upgraded handling systems across industries.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of product, the market has been divided into cranes and lifting equipment, industrial trucks, continuous handling equipment, and racking and storage equipment.

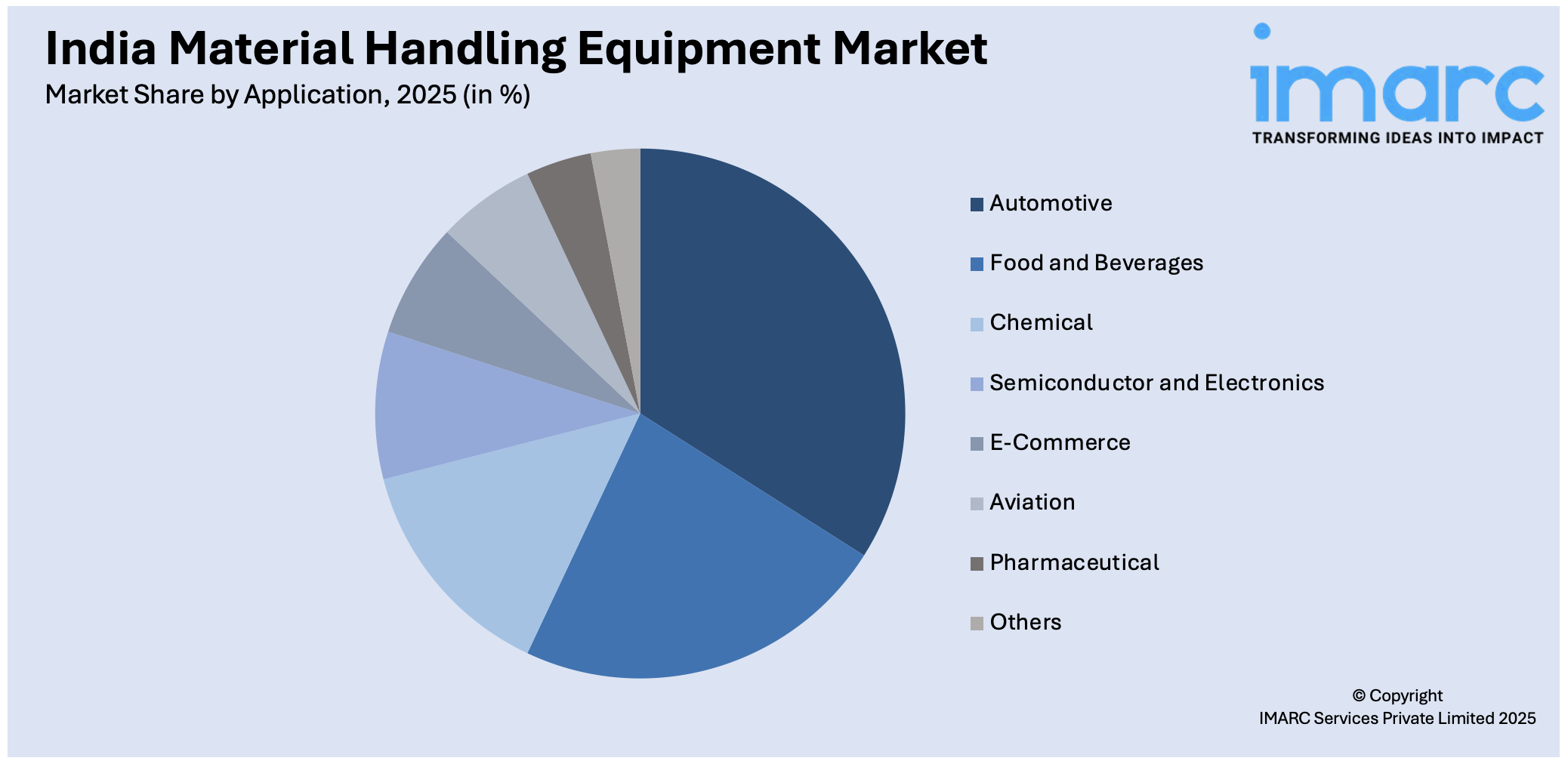

- On the basis of application, the market has been divided into automotive, food and beverages, chemical, semiconductor and electronics, e-commerce, aviation, pharmaceutical, and others.

Market Size and Forecast:

- 2025 Market Size: USD 11.4 Billion

- 2034 Projected Market Size: USD 23.3 Billion

- CAGR (2026-2034): 7.83%

India Material Handling Equipment Market Trends:

Expansion of the Manufacturing Sector

The manufacturing sector is the backbone of India's economy, and its expansion has a direct impact on the demand for material handling equipment. As per the Annual Survey of Industries (ASI) 2021-22, the Gross Value Added (GVA) in manufacturing surged by 26.6% compared to the earlier year, reflecting a robust recovery after the pandemic. These sectors were propelled by industries like basic metals, refined petroleum products, drugs and pharmaceuticals, automobiles, food products, and chemicals, which all contributed around 56% to the overall GVA in manufacturing. The rise in manufacturing production requires effective material handling solutions to deal with higher production levels, reduce operations, and provide timely delivery. This, in turn, is augmenting the India material handling equipment market share. For example, the machine tool industry provides machinery that is vital for the entire manufacturing sector. The industry consists of primarily small and medium-sized enterprises (SMEs), with some mid-sized producers reporting annual turnovers of INR 300-500 crores. Increased expansion of such businesses highlights the growing demand for cutting-edge material handling equipment to be competitive and function efficiently. Additionally, the National Manufacturing Innovation Survey (NMIS) 2021-22 indicated that innovation among manufacturing companies plays a crucial role in improving productivity and competitiveness. The survey, conducted jointly by the Department of Science and Technology (DST) and the United Nations Industrial Development Organization (UNIDO), analyzed the innovation performance of Indian manufacturing companies. The research indicates that companies that are investing in innovative technologies and processes, such as advanced material handling systems, are well placed to enhance efficiency and output.

To get more information on this market Request Sample

Infrastructure Development and Government Initiatives

The development of infrastructure in India has been the mainstay of economic development, with tremendous investments in upgrading transportation, logistics, and manufacturing facilities. Building strong infrastructure has been the government's priority, and as a result, there is high demand for material handling equipment to facilitate construction and the subsequent use of these facilities, supporting the India material handling equipment market growth. The capital goods industry, which includes material handling equipment, has been aided by production-linked incentive (PLI) programs in industries such as automobiles and electric vehicles (EVs). Indirectly, these programs promote demand for capital goods through their focus on manufacturing excellence and expanding capacity. Incidentally, industries for heavy electrical and power equipment, earthmoving and mining equipment, and process plant equipment jointly contribute to 85% of India's entire capital goods export, demonstrating the strength of the sector. Also, the Index of Industrial Production (IIP), which captures the performance of different industrial sectors, has been positive. The Office of the Economic Advisor, Ministry of Commerce and Industry, started compiling and publishing the IIP, covering major industries that contribute a large share of total production. A rise in the IIP reflects higher industrial activity, which translates to greater demand for material handling solutions to control the movement of goods within and among facilities.

Digital Transformation and Smart Automation Integration

The industry is experiencing a major shift with the integration of digital technologies and smart automation systems. Integration of Internet of Things (IoT) sensors, artificial intelligence (AI), and machine learning (ML) algorithms is making it possible for companies to streamline operations, improve equipment utilization, and reduce unplanned downtime. These technologies enable real-time performance monitoring of equipment, predictive maintenance, and data-informed decision-making, resulting in enhanced productivity and lower operating expenses. This trend significantly enhances the India material handling equipment market outlook. Smart automation also inspires the creation of internet-of-things-enabled warehouses, where forklifts, conveyors, and robotic cells connect and communicate flawlessly to automate logistics processes. Furthermore, AI-driven analytics enable insights into inventory management, demand forecasting, and energy consumption, allowing organizations to attain greater levels of efficiency. The expansion of e-commerce, automotive, and manufacturing sectors is further speeding up the implementation of these innovations. With India moving toward Industry 4.0, digital transformation and intelligent automation will be at the core of achieving scalability, competitiveness, and long-term operational excellence.

Sustainability and Energy-Efficient Solutions

Sustainability is becoming a major force in expanding the material handling equipment market size in India as companies and producers alike more and more see the importance of energy efficiency and green-based solutions. With increased sensitivity to environmental effects and an environment of tightened government regulation, firms are moving towards electric-powered forklifts, pallet trucks, and automated guide vehicles (AGVs) as a means of carbon reduction. Logistics and warehousing facilities are also embracing alternative energy sources like solar-charging stations in addition to promoting green building certifications to meet sustainability objectives. Improvements in battery technologies, including lithium-ion technologies, are also enhancing energy efficiency, minimizing charging time, and increasing equipment longevity. Corporate sustainability initiatives are also promoting equipment investment that harmonizes operational performance and environmental stewardship. This is especially so with multinational firms and sectors such as retail, e-commerce, and pharma, where brand reputation is linked to sustainability commitments. Therefore, innovation in green equipment and energy management systems is poised to fuel long-term market expansion.

Growth, Opportunities, Challenges in the India Material Handling Equipment:

- Growth Drivers: The rapid expansion of India's manufacturing sector, supported by government initiatives like the Production-Linked Incentive (PLI) scheme, is driving significant demand for advanced material handling equipment. Rising e-commerce activities and increasing infrastructure development projects across the country are creating substantial growth opportunities for equipment manufacturers. The focus on automation and technological upgrades in industrial operations is further accelerating market expansion across various sectors.

- Market Opportunities: As per the India material handling equipment market analysis, the growing emphasis on warehouse automation and smart logistics solutions presents significant opportunities for equipment manufacturers to develop innovative products. Expansion of pharmaceutical and food processing industries creates demand for specialized material handling equipment with enhanced safety and hygiene features. The government's focus on infrastructure development and manufacturing excellence provides opportunities for both domestic and international players to establish stronger market presence.

- Market Challenges: High initial investment costs for advanced material handling equipment may limit adoption among small and medium-sized enterprises (SMEs). Skilled workforce shortage for operating and maintaining sophisticated equipment poses operational challenges for end-users. According to the India material handling equipment market forecast, intense competition among manufacturers and pricing pressures from low-cost alternatives is expected to impact profit margins and market positioning strategies.

India Material Handling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product and application.

Product Insights:

- Cranes and Lifting Equipment

- Industrial Trucks

- Continuous Handling Equipment

- Racking and Storage Equipment

The report has provided a detailed breakup and analysis of the market based on the product. This includes cranes and lifting equipment, industrial trucks, continuous handling equipment, and racking and storage equipment.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Food and Beverages

- Chemical

- Semiconductor and Electronics

- E-Commerce

- Aviation

- Pharmaceutical

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. According to the India material handling equipment market research report, the segment includes automotive, food and beverages, chemical, semiconductor and electronics, E-commerce, aviation, pharmaceutical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Material Handling Equipment Market News:

- July 2025: SILA announced the launch of its Material Handling Equipment (MHE) Rental Solutions business in partnership with Nilkamal, aimed at supporting the manufacturing and warehousing sectors. The collaboration will introduce an all-electric fleet of forklifts and specialized rental equipment, leveraging SILA’s technology-driven approach and extensive operator base alongside Nilkamal’s manufacturing expertise and distribution network.

- December 2024: Action Construction Equipment (ACE) introduced the BS-V AX124 Backhoe Loader, among seven new innovative products, that emphasize on advanced technology and efficiency. The expansion includes enhancing domestic manufacturing capability and enabling large-scale infrastructure initiatives. Introducing high-performance equipment bolsters India's material handling equipment market by enhancing productivity and operational efficiency.

- December 2024: TIL launched the Snorkel A62JRT boom lift at Bauma Conexpo India 2024, highlighting cutting-edge aerial work platform technology. The launch reflects India's rising need for productive and safe material handling solutions in construction and industrial uses. The innovation enhances the India Material Handling Equipment market by growing productivity and operational safety across sectors.

India Material Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cranes and Lifting Equipment, Industrial Trucks, Continuous Handling Equipment, Racking and Storage Equipment |

| Applications Covered | Automotive, Food and Beverages, Chemical, Semiconductors and Electronics, E-Commerce, Aviation, Pharmaceutical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India material handling equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India material handling equipment market on the basis of product?

- What is the breakup of the India material handling equipment market on the basis of application?

- What are the various stages in the value chain of the India material handling equipment market?

- What are the key driving factors and challenges in the India material handling equipment market?

- What is the structure of the India material handling equipment market and who are the key players?

- What is the degree of competition in the India material handling equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India material handling equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India material handling equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India material handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)