India Marine Electric Vehicle Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Application, and Region, 2025-2033

India Marine Electric Vehicle Market Overview:

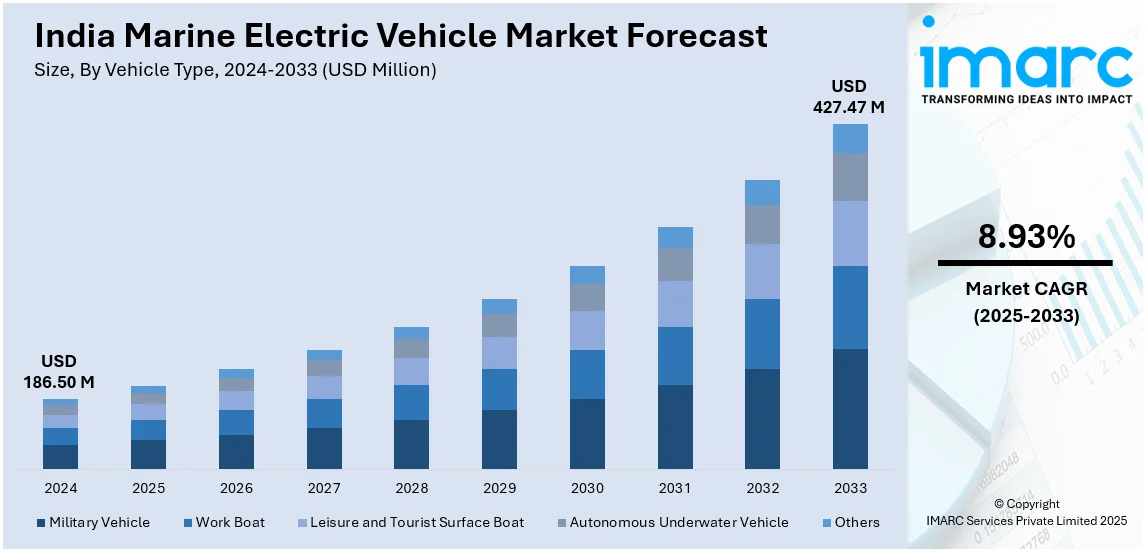

The India marine electric vehicle market size reached USD 186.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 427.47 Million by 2033, exhibiting a growth rate (CAGR) of 8.93% during 2025-2033. The rising environmental concerns, increasing government initiatives promoting green transportation, advancements in battery technologies, the growing maritime tourism industry, and the push for sustainable marine operations are fueling the demand for energy-efficient electric vessels in India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 186.50 Million |

| Market Forecast in 2033 | USD 427.47 Million |

| Market Growth Rate 2025-2033 | 8.93% |

India Marine Electric Vehicle Market Trends:

Rising Government Support and Green Maritime Policies

The Government of India’s increasing focus on sustainable marine transportation is a major driver for the growth of the marine electric vehicle (EV) market. As part of its commitment to reducing carbon emissions, India has launched several initiatives to promote eco-friendly marine solutions. For instance, the Sagarmala Project emphasizes port modernization and sustainability, fostering demand for electric and hybrid vessels. In 2023, India allocated over ₹500 crore for green maritime development, with a focus on electrifying port operations and introducing electric ferries. Additionally, the Ministry of Ports, Shipping, and Waterways has set a target to achieve 30% electrification of coastal and inland vessels by 2030. This proactive approach is encouraging vessel operators to invest in electric technologies. Moreover, the adoption of electric ferries has gained significant momentum, especially in regions like Kerala and Goa, where inland water transport is prominent, creating a positive outlook for market expansion. For instance, Kerala introduced its first solar-electric ferry, 'Aditya,' which has successfully reduced operational costs by 30% compared to diesel-powered alternatives.

To get more information on this market, Request Sample

Advancements in Battery Technology and Energy Efficiency

Continuous improvements in battery storage systems are also contributing to market growth. Improved battery efficiency, longer lifespan, and enhanced charging infrastructure are making electric marine vehicles more appealing for commercial use. Furthermore, the development of lithium-ion batteries with increased energy densities has resulted in greatly enhanced vessel range and performance. For instance, next-generation lithium-titanate batteries now offer charging times that are 60% faster and provide up to 25% greater energy storage capacity than earlier models. Moreover, Indian battery manufacturers invested over ₹1,200 crore in research and development (R&D) in 2023 to enhance battery performance for marine applications. This has resulted in improved energy management systems, allowing electric ferries and cargo ships to optimize power consumption and extend operational range. In line with this, the deployment of smart battery management systems (BMS) is gaining traction, ensuring optimal battery usage and enhancing safety. With India’s coastline spanning over 7,500 kilometers, such advancements are supporting reliable electric marine transportation in both inland waterways and coastal regions, thereby propelling the market forward.

India Marine Electric Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, propulsion type, and application.

Vehicle Type Insights:

- Military Vehicle

- Work Boat

- Leisure and Tourist Surface Boat

- Autonomous Underwater Vehicle

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes military vehicle, work boat, leisure and tourist surface boat, autonomous underwater vehicle, and others.

Propulsion Type Insights:

- Battery Electric Vehicle

- Plug-in Hybrid Vehicle

- Hybrid Electric Vehicle

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes battery electric vehicle, plug-in hybrid vehicle, and hybrid electric vehicle.

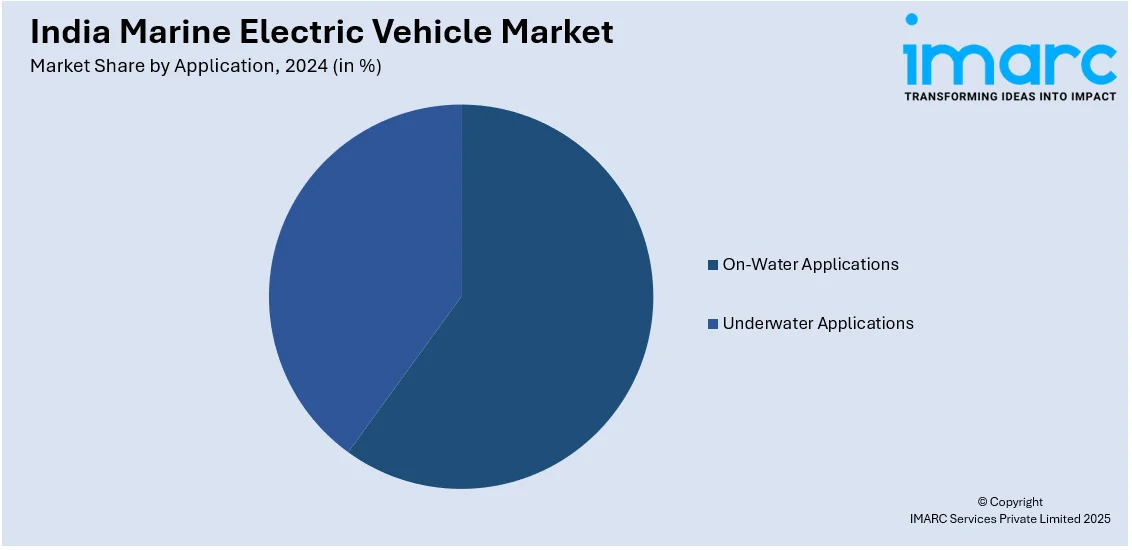

Application Insights:

- On-Water Applications

- Underwater Applications

The report has provided a detailed breakup and analysis of the market based on the application. This includes on-water applications and underwater applications.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Marine Electric Vehicle Market News:

- October 2024: The Indian Register of Shipping (IRS) entered into a memorandum of understanding (MoU) with Singapore-based naval architecture firm SeaTech Solutions International. This collaboration paves the way for Indian shipyards to construct electric-powered tugboats. The agreement encompasses design, engineering, and classification aspects of advanced green tugs and harbor vessels, with a focus on global deployment and manufacturing in India.

- February 2024: Garden Reach Shipbuilders and Engineers (GRSE) in India unveiled its first fully electric ferry, named Dheu, for the Government of West Bengal. This 24-meter catamaran vessel, designed to accommodate 150 passengers, is intended for inland waterway operations. Dheu marks GRSE's debut in fully electric ferries and is the second such vessel to operate in India. The project aims to enhance passenger transport efficiency along central waterways, with the ferry expected to complete around 40 trips each day.

India Marine Electric Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Military Vehicle, Work Boat, Leisure and Tourist Surface Boat, Autonomous Underwater Vehicle, Others |

| Propulsion Types Covered | Battery Electric Vehicle, Plug-in Hybrid Vehicle, Hybrid Electric Vehicle |

| Applications Covered | On-Water Applications, Underwater Applications |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India marine electric vehicle market performed so far and how will it perform in the coming years?

- What is the breakup of the India marine electric vehicle market on the basis of vehicle type?

- What is the breakup of the India marine electric vehicle market on the basis of propulsion type?

- What is the breakup of the India marine electric vehicle market on the basis of application?

- What are the various stages in the value chain of the India marine electric vehicle market?

- What are the key driving factors and challenges in the India marine electric vehicle?

- What is the structure of the India marine electric vehicle market and who are the key players?

- What is the degree of competition in the India marine electric vehicle market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India marine electric vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India marine electric vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India marine electric vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)