India Mammography Market Size, Share, Trends and Forecast by Technology, Product, and Region, 2025-2033

India Mammography Market Overview:

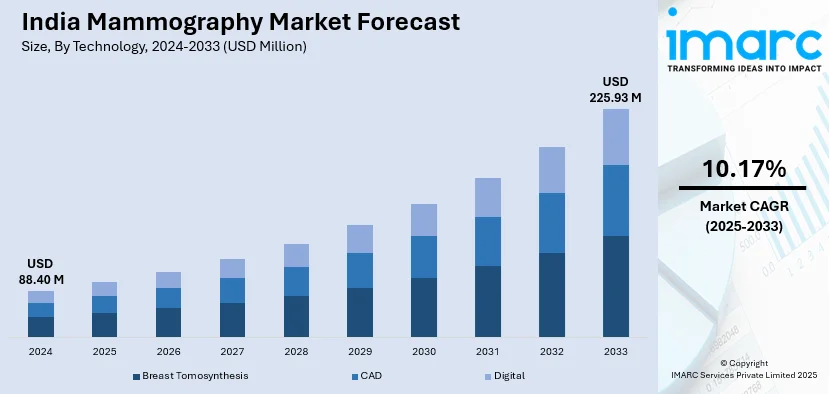

The India mammography market size reached USD 88.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 225.93 Million by 2033, exhibiting a growth rate (CAGR) of 10.17% during 2025-2033. Government-led healthcare initiatives, higher public awareness about early breast cancer detection, advancements in diagnostic technology, expanding healthcare infrastructure, mobile screening programs, and collaborations between public and private sectors are key factors driving the India mammography market, enhancing accessibility and encouraging proactive health measures among women across urban and rural regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 88.40 Million |

| Market Forecast in 2033 | USD 225.93 Million |

| Market Growth Rate (2025-2033) | 10.17% |

India Mammography Market Trends:

Government Initiatives and National Health Programs

The Government of India has put in place broad strategies to promote cancer screening and early detection services, which have a great influence on the mammography industry. One such initiative includes population-based screening under the National Health Mission (NHM), where women above 30 years of age are targeted for prevalent non-communicable diseases (NCDs) like breast cancer. Early detection through frequent screenings is the focus of this program, hence boosting the demand for mammography services. Also, the National Cancer Control Programme (NCCP) places emphasis on preventing cancer, detecting cancer early, and cancer treatment facilities. Its successes in the last 50 years are having regional cancer centers established and including cancer control in primary healthcare. All these efforts have resulted in better accessibility and use of mammography services at the national level. In addition, the Ministry of Health and Family Welfare's Annual Report 2021-22 brings out the government's initiative to enhance healthcare infrastructure, such as the rise in diagnostic services like mammography. Investments in health and wellness centers with screening facilities have increased the reach of mammography, especially in rural areas.

To get more information on this market, Request Sample

Rising Awareness and Emphasis on Preventive Healthcare

There has been a strong move toward preventive healthcare in India, with more awareness regarding the need for early detection of conditions such as breast cancer. Educational campaigns by government and non-governmental agencies have been instrumental in making the public aware of the advantages of regular screening. The National Institute of Cancer Prevention and Research (NICPR) provides an online tutorial series in oncology to offer education to medical professionals and the general public on cancer prevention and early detection techniques. The National Health Profile (NHP) of India-2021, released by the Central Bureau of Health Intelligence, offers in-depth information on health indicators, including cancer prevalence. This information has played a significant role in shaping policy decisions and public awareness campaigns, resulting in an educated population that actively seeks preventive strategies such as mammography. Additionally, partnerships among stakeholders have enabled community outreach programs, seminars, and workshops that target women's health. Such programs have educated women on how to take their health seriously and use available screening facilities, thus helping to elevate demand for mammography. Overall, the efforts of the government through national health programs and the higher awareness among the public regarding preventive healthcare have been instrumental in propelling the mammography industry in India. This has resulted in improved infrastructure, accessibility, and utilization of mammography services, thus improving early detection and management of breast cancer across the country.

India Mammography Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on technology and product.

Technology Insights:

- Breast Tomosynthesis

- CAD

- Digital

The report has provided a detailed breakup and analysis of the market based on technology. This includes breast tomosynthesis, CAD, and digital.

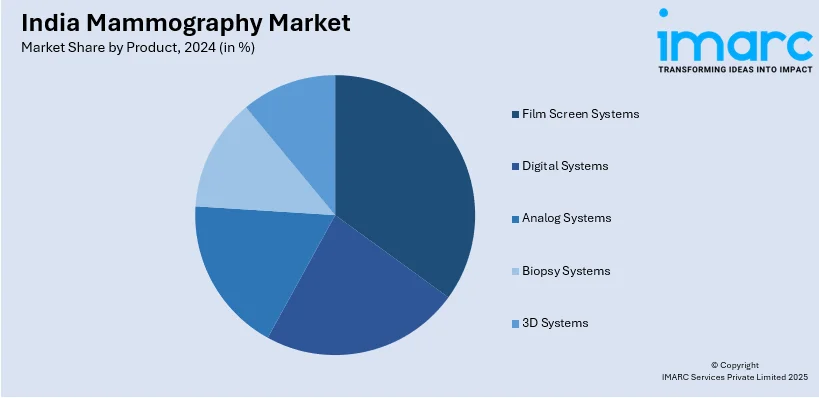

Product Insights:

- Film Screen Systems

- Digital Systems

- Analog Systems

- Biopsy Systems

- 3D Systems

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes film screen systems, digital systems, analog systems, biopsy systems, and 3D systems.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mammography Market News:

- January 2025: A mobile mammography van, the "Pink Bus," was launched at the Maha Kumbh by the Mata Amritanandamayi Math to screen for breast cancer in women. The move added to the access to mammography services, particularly in mass congregations. Efforts like this have helped broaden India's market for mammography by raising awareness and enabling early detection.

- December 2024: Deepak Phenolics Limited launched a Mobile Mammography Van (MMV) to aid early detection of breast cancer in Gujarat's rural areas. Fitted with high-tech mammography equipment, the van started work in Bharuch, Narmada, and Vadodara districts, with future expansion planned through health camps. Through easier access to diagnostic facilities, this project helps boost the development of mammography services in India.

India Mammography Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Breast Tomosynthesis, CAD, Digital |

| Products Covered | Film Screen Systems, Digital Systems, Analog Systems, Biopsy Systems, 3D Systems |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mammography market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mammography market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mammography industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mammography market in India was valued at USD 88.40 Million in 2024.

The India mammography market is projected to exhibit a CAGR of 10.17% during 2025-2033, reaching a value of USD 225.93 Million by 2033.

Rising incidence of breast cancer and emphasis on early detection are fueling demand for mammography solutions in India. Expansion of healthcare infrastructure and government screening initiatives are improving access. Technological advances in imaging quality and portability, along with growing public awareness and insurance coverage, are further boosting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)