India Malaria Vaccine Market Size, Share, Trends and Forecast by Vaccine Type, Route of Administration, and Region, 2025-2033

India Malaria Vaccine Market Overview:

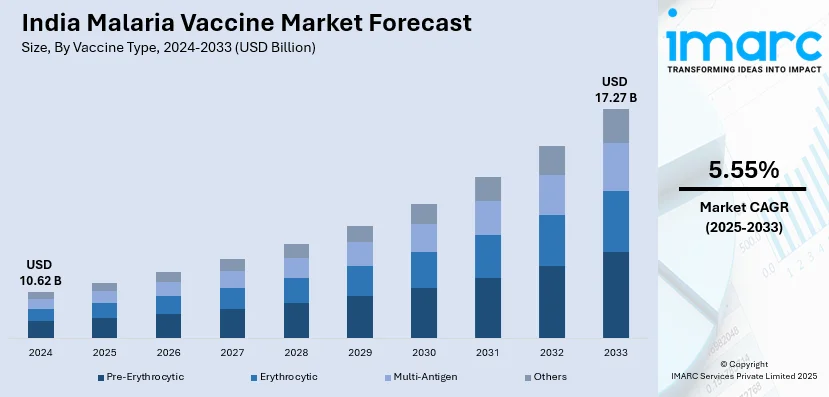

The India malaria vaccine market size reached USD 10.62 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.27 Billion by 2033, exhibiting a growth rate (CAGR) of 5.55% during 2025-2033. The market is experiencing significant growth mainly due to government-led immunization programs, rising malaria awareness and WHO-approved vaccines. Increasing research and development (R&D), public-private collaborations and improved healthcare infrastructure are also creating a positive market outlook across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.62 Billion |

| Market Forecast in 2033 | USD 17.27 Billion |

| Market Growth Rate 2025-2033 | 5.55% |

India Malaria Vaccine Market Trends:

Increasing Government Initiatives

The Indian government is actively implementing malaria elimination strategies through initiatives like the National Framework for Malaria Elimination (NFME) 2016-2030 and partnerships with organizations such as the WHO and GAVI. These efforts aim to increase vaccine accessibility, especially in high-burden regions, enhancing India malaria vaccine market growth. The introduction of WHO-approved vaccines like RTS,S/AS01 and R21/Matrix-M is being integrated into public immunization programs to reduce malaria incidence. Additionally, government funding and subsidies are improving affordability, ensuring broader coverage across rural and underserved areas. Collaboration with private healthcare providers and NGOs is further strengthening distribution channels. The expansion of cold chain logistics and vaccine storage infrastructure supports widespread immunization efforts. These initiatives have already yielded remarkable results, significantly reducing malaria prevalence and setting the stage for long-term eradication. As of December 2024, India is making significant progress toward a malaria-free future, having reduced malaria cases by over 97% since gaining independence. The country has officially exited the World Health Organization's High Burden to High Impact group, reporting zero cases in 122 districts. Initiatives such as the National Framework for Malaria Elimination aim to achieve total eradication by 2030. With continued policy support, increasing vaccine adoption, and a growing focus on disease eradication, the India malaria vaccine market outlook remains positive, with strong potential for sustained expansion.

To get more information on this market, Request Sample

Introduction of WHO-Approved Malaria Vaccines

The introduction of WHO-approved malaria vaccines, RTS,S/AS01 (Mosquirix) and R21/Matrix-M, is driving significant advancements in malaria prevention across India. These vaccines, designed to combat Plasmodium falciparum, the most deadly malaria strain, are being integrated into national immunization programs to reduce infection rates. Government agencies, in collaboration with global health organizations, are prioritizing large-scale vaccine deployment, particularly in high-burden regions. Expanded manufacturing by the Serum Institute of India ensures greater availability, improving accessibility and affordability. The regulatory push for effective malaria vaccines is accelerating their adoption and scaling up production capacity. For instance, in October 2023, the R21/Matrix-M™ malaria vaccine received WHO recommendation for use, paving the way for global distribution. Developed by the University of Oxford and Serum Institute of India, the vaccine shows high efficacy and safety, aiming to significantly reduce malaria-related deaths among children, with plans for mass production. The inclusion of R21/Matrix-M, with its higher efficacy and cost-effectiveness, is expected to accelerate adoption. Partnerships between the government, pharmaceutical firms, and NGOs are further strengthening distribution networks and vaccination campaigns. Rising awareness, increasing healthcare investments, and a structured rollout strategy are shaping the competitive landscape, positioning these vaccines as key contributors to India malaria vaccine market share.

India Malaria Vaccine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on vaccine type and route of administration.

Vaccine Type Insights:

- Pre-Erythrocytic

- Erythrocytic

- Multi-Antigen

- Others

The report has provided a detailed breakup and analysis of the market based on the vaccine type. This includes pre-erythrocytic, erythrocytic, multi-antigen and others.

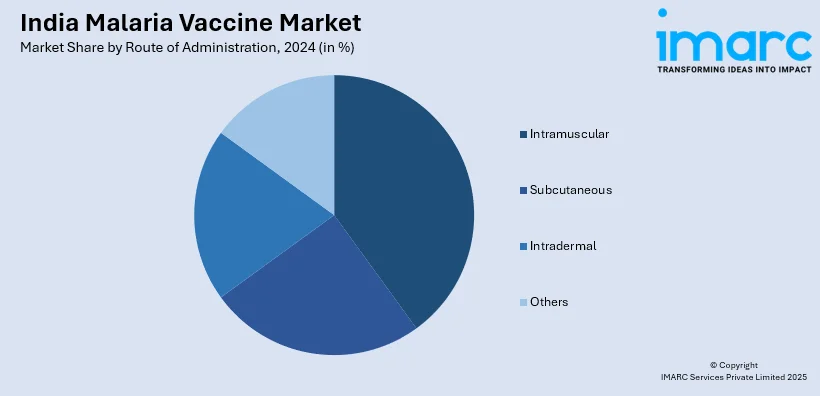

Route of Administration Insights:

- Intramuscular

- Subcutaneous

- Intradermal

- Others

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes intramuscular, subcutaneous, intradermal and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Malaria Vaccine Market News:

- In January 2025, the RH5.1/Matrix-M malaria vaccine exhibited 55% effectiveness in preventing clinical malaria, complementing existing vaccines. Developed by the University of Oxford in collaboration with India’s Serum Institute it targets the blood stage of the parasite. Ongoing trials in Burkina Faso aim to significantly reduce severe malaria cases and fatalities.

- In July 2024, the Serum Institute of India's R21/Matrix-M malaria vaccine, co-developed with the University of Oxford, launched in Cote d'Ivoire, offering high efficacy at under $4 per dose. With 25 million doses already manufactured, the initiative aims to reduce malaria's impact across Africa, benefiting millions of children.

India Malaria Vaccine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vaccine Types Covered | Pre-Erythrocytic, Erythrocytic, Multi-Antigen, Others |

| Route of Administrations Covered | Intramuscular, Subcutaneous, Intradermal, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India malaria vaccine market performed so far and how will it perform in the coming years?

- What is the breakup of the India malaria vaccine market on the basis of vaccine type?

- What is the breakup of the India malaria vaccine market on the basis of route of administration?

- What is the breakup of the India malaria vaccine market on the basis of region?

- What are the various stages in the value chain of the India malaria vaccine market?

- What are the key driving factors and challenges in the India malaria vaccine market?

- What is the structure of the India malaria vaccine market and who are the key players?

- What is the degree of competition in the India malaria vaccine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India malaria vaccine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India malaria vaccine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India malaria vaccine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)