India Malaria Diagnostics Market Size, Share, Trends and Forecast by Technology, Molecular Diagnostic Tests, and Region, 2025-2033

India Malaria Diagnostics Market Overview:

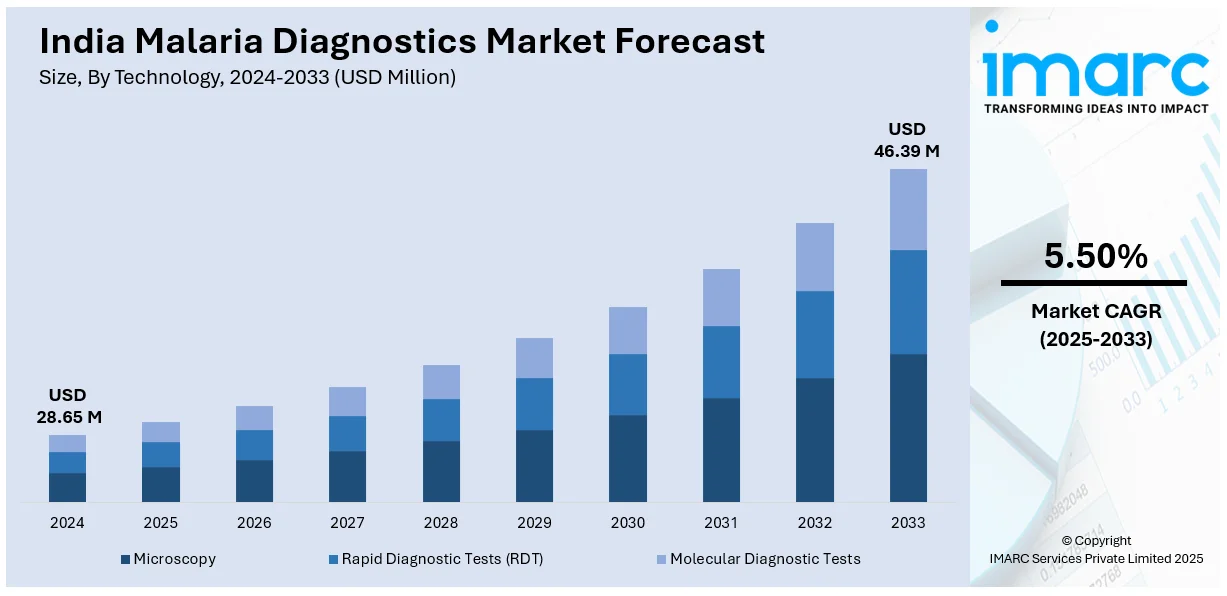

The India malaria diagnostics market size reached USD 28.65 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 46.39 Million by 2033, exhibiting a growth rate (CAGR) of 5.50% during 2025-2033.The implementation of favourable government initiatives, continual technological advancements, and increased awareness about early disease detection are some of the major factors expanding the India malaria diagnostics market share. The adoption of rapid diagnostic tests (RDTs) and molecular diagnostics is expanding, driven by efforts to achieve malaria elimination, further contributing to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.65 Million |

| Market Forecast in 2033 | USD 46.39 Million |

| Market Growth Rate 2025-2033 | 5.50% |

India Malaria Diagnostics Market Trends:

Growing Preference for Rapid Diagnostic Tests (RDTs) in Malaria Detection

The India malaria diagnostics market growth is driven by a significant shift toward rapid diagnostic tests (RDTs) due to their ease of use, affordability, and quick results. RDTs help detect malaria within minutes without the need for specialized equipment or trained technicians, making them ideal for use in rural and remote areas. According to an industry report, persistent efforts over the decades have severely reduced these figures by almost 97%, with cases declining to just 2 million and deaths plummeting to just 83 by 2023. According to an industry report, persistent efforts over the decades have severely reduced these figures by almost 97%, with cases declining to just 2 million and deaths plummeting to just 83 by 2023. The significant reduction in malaria cases and deaths significantly impacts the malaria diagnostics market in India. Also, the implementation of government initiatives like Malaria Elimination Goal 2030 encourages the adoption of RDTs. Additionally, continual advancements in RDT technology are improving accuracy and sensitivity, reducing the chances of false positives or negatives. The rising awareness of early malaria detection, coupled with an increase in point-of-care testing, is fueling the demand for these tests. With ongoing efforts, RDTs are expected to play a critical role in strengthening India’s diagnostic infrastructure, ensuring faster detection, and ultimately helping to control the spread of the disease in endemic areas.

To get more information on this market, Request Sample

Government and Private Sector Collaboration Boosting Malaria Diagnostics

The market in India is benefiting from strategic collaborations between the government, private healthcare providers, and global organizations. Government programs like the National Strategic Plan for Malaria Elimination (2017-2030) are significantly increasing access to diagnostic tools across the country. Additionally, partnerships with private diagnostic companies are ensuring a steady supply of affordable and high-quality malaria test kits. International organizations, such as the World Health Organization (WHO) and the Global Fund, are also providing financial and technical support to enhance malaria detection efforts. Investments in modern diagnostic technologies, such as molecular testing and mobile health solutions, are further strengthening surveillance and early detection, which is positively impacting the India malaria diagnostics market outlook. These collaborations are not only improving malaria testing facilities but also ensuring that even the most underserved regions receive timely and effective diagnostic support. According to an industry report, India aims to achieve zero indigenous malaria cases by 2027. Initiatives like the Intensified Malaria Elimination Project-3 (IMEP-3) specifically target vulnerable populations across 159 districts in 12 states, driving the need for robust diagnostic tools to ensure early detection and treatment. The government is also allocating resources for strengthening surveillance systems, advancing entomological research, and distributing long-lasting insecticidal nets (LLINs), which enhance the effectiveness and sustainability of malaria eradication efforts. To further accelerate progress, public-private partnerships are formed to expand diagnostic access, particularly in underserved regions. These collaborations are fostering innovation and ensuring accurate and timely identification of cases. As a result, India is making steady progress toward reducing malaria cases and moving closer to its elimination goals.

India Malaria Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology and molecular diagnostic tests.

Technology Insights:

- Microscopy

- Rapid Diagnostic Tests (RDT)

- Molecular Diagnostic Tests

The report has provided a detailed breakup and analysis of the market based on the technology. This includes microscopy, rapid diagnostic tests (RDT), and molecular diagnostic tests.

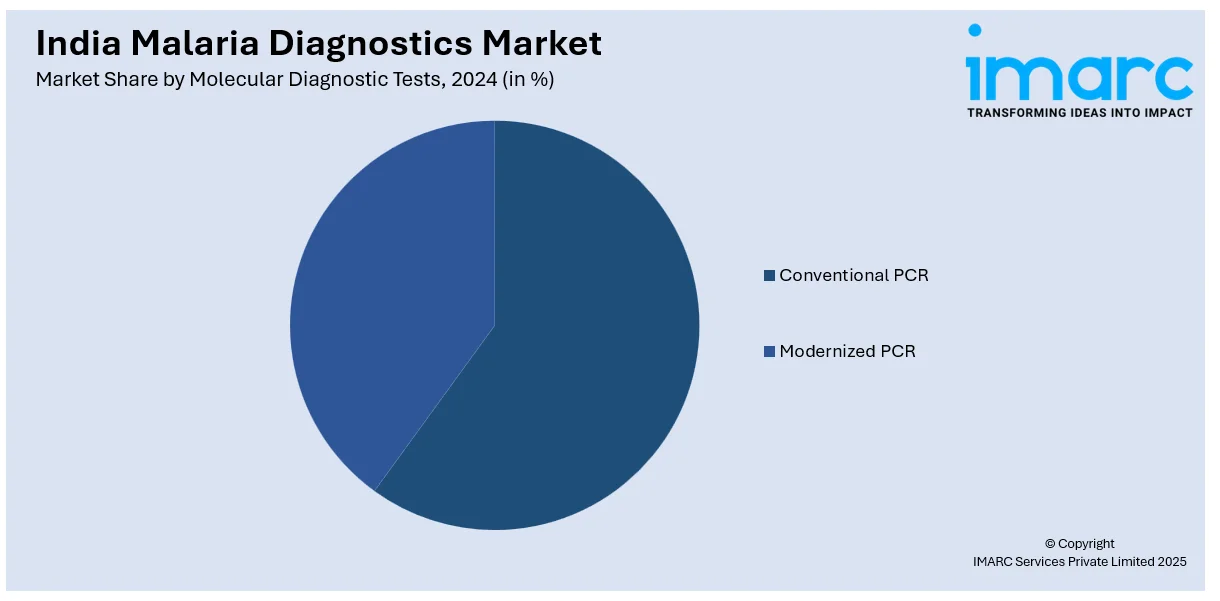

Molecular Diagnostic Tests Insights:

- Conventional PCR

- Modernized PCR

A detailed breakup and analysis of the market based on the molecular diagnostic tests have also been provided in the report. This includes conventional PCR and modernized PCR.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Malaria Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Microscopy, Rapid Diagnostic Tests (RDT), Molecular Diagnostic Tests |

| Molecular Diagnostic Tests Covered | Conventional PCR, Modernized PCR |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India malaria diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India malaria diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India malaria diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The malaria diagnostics market in India was valued at USD 28.65 Million in 2024.

The India malaria diagnostics market is projected to exhibit a (CAGR) of 5.50% during 2025-2033, reaching a value of USD 46.39 Million by 2033.

The India malaria diagnostics market is growing on the back of persistent incidence of the disease in rural and semi-urban regions. Eradication initiatives by the government, better healthcare penetration, and increased awareness fuel diagnostic uptake. Technological innovation in rapid testing kit development and point-of-care solutions is driving diagnostics to become more accessible, dependable, and mainstreamed in public health policies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)