India Makhana Market Size, Share, Trends and Forecast by Pack Size, Packaging Type, Distribution Channel, and Region, 2026-2034

India Makhana Market Summary:

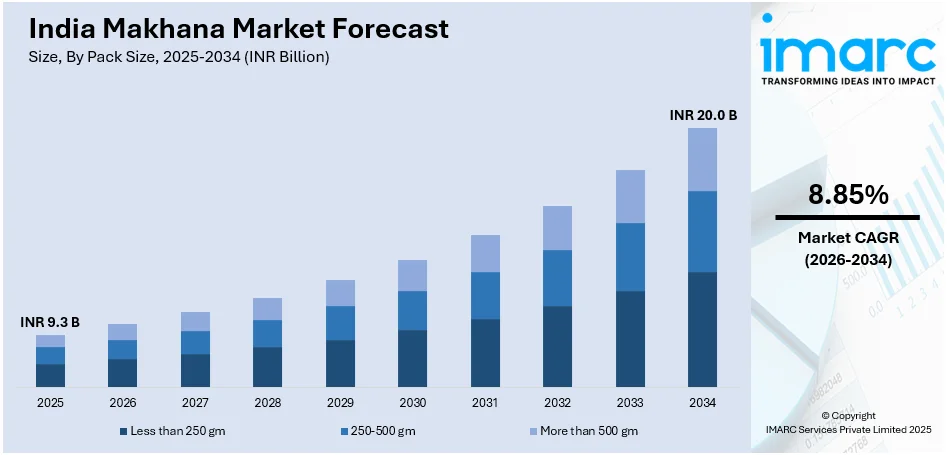

The India makhana market size was valued at INR 9.29 Billion in 2025 and is projected to reach INR 19.95 Billion by 2034, growing at a compound annual growth rate of 8.85% from 2026-2034.

The India makhana market is witnessing robust expansion driven by escalating health consciousness among urban and semi-urban consumers seeking nutritious snacking alternatives. Rising disposable incomes, growing awareness about the nutritional benefits of fox nuts, and expanding organized retail networks are accelerating market penetration. The proliferation of e-commerce platforms and innovative product offerings are further strengthening the India makhana market share.

Key Takeaways and Insights:

- By Pack Size: 250-500 gm dominates the market with a share of 46% in 2025, owing to its alignment with household consumption patterns, optimal pricing for family-sized portions, and consumer preference for convenient quantity offerings. This segment appeals to health-conscious families seeking regular snacking options.

- By Packaging Type: Pouches lead the market with a share of 50% in 2025. This dominance is driven by superior moisture protection, lightweight portability, resealable convenience features, and cost-effective production enabling competitive pricing. Extended shelf-life preservation capabilities strengthen consumer preference.

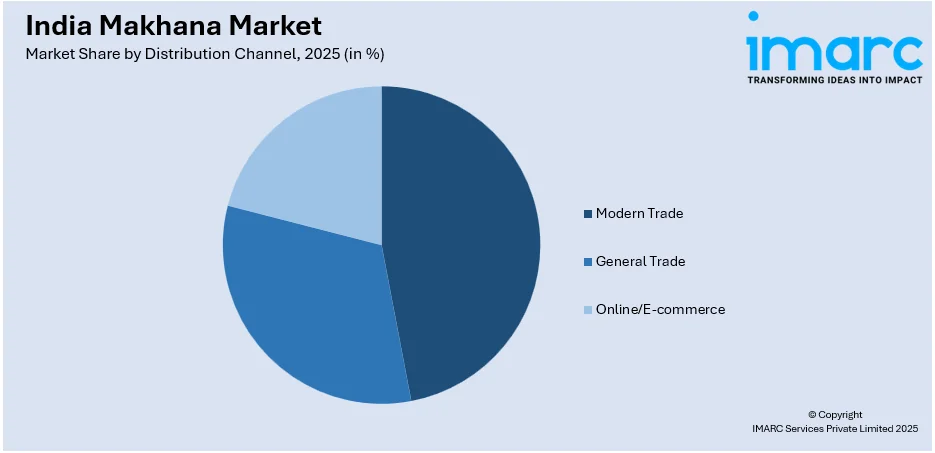

- By Distribution Channel: General trade holds the largest segment with a market share of 39% in 2025, reflecting the extensive reach of traditional Kirana stores across India, established consumer trust relationships, and accessibility in tier-2 and tier-3 cities where organized retail penetration remains limited.

- By Region: North India represents the largest region with 25% share in 2025, driven by Bihar's dominance in makhana production, traditional consumption patterns in the Mithilanchal region, and proximity to primary cultivation areas.

- Key Players: Key players drive the India makhana market by expanding flavored product portfolios, investing in premium packaging innovations, strengthening distribution networks, and establishing strategic partnerships with e-commerce platforms to enhance market penetration and brand visibility nationwide. Some of the leading players in the industry are Dharampal Premchand Limited (Snack Factory), Divinutty Products Private Limited, Farmley, Happilo, Harry Food Processing, Madhubani Makhana, Makhana Wala, Mithilia Naturals, Rishab Global Industries Private Ltd. (Mr. Makhana), Sattviko, Snackible, Sun Organic Industries Private Limited, Sunirav Impex, Swastik Food Group and VKC Nuts Pvt. Ltd. (Nutraj).

To get more information on this market Request Sample

The India makhana market is experiencing transformative growth as consumers increasingly prioritize health-conscious snacking alternatives over conventional options. Rising urbanization and changing dietary preferences have positioned fox nuts as a mainstream superfood, attracting attention from major FMCG players and startups alike. The nutritional profile of makhana, characterized by high protein content, low calories, and gluten-free properties, resonates strongly with fitness enthusiasts and diabetic-friendly dietary requirements. Government initiatives supporting makhana cultivation and processing infrastructure are creating favorable conditions for industry expansion. The growing influence of social media platforms and food vlogging channels has significantly boosted consumer awareness, while innovations in flavored variants and premium packaging solutions continue attracting younger demographics seeking healthier snacking alternatives with enhanced taste experiences.

India Makhana Market Trends:

Proliferation of Flavored Makhana Variants

The India makhana market is witnessing significant product innovation through diverse flavor introductions catering to evolving consumer palates. Manufacturers are expanding beyond traditional plain roasted offerings to include tangy, spicy, and savory variants that appeal to younger demographics seeking novel taste experiences. This premiumization trend enables brands to command higher price points while differentiating themselves in increasingly competitive retail environments. Companies are also introducing fusion flavors combining regional spices with international taste profiles to capture broader consumer segments nationwide.

E-Commerce and Direct-to-Consumer Expansion

Digital retail channels are fundamentally reshaping makhana distribution dynamics as brands increasingly leverage online platforms for broader market reach and enhanced consumer engagement. The convenience of doorstep delivery, subscription-based purchasing models, and comprehensive product information availability are driving e-commerce adoption among health-conscious consumers seeking nutritious snacking alternatives. This significant channel shift enables manufacturers to access previously underserved geographic segments while reducing dependence on traditional intermediaries. Direct-to-consumer strategies further strengthen brand relationships and enable personalized marketing approaches that resonate with digitally savvy younger demographics nationwide.

Geographic Indication Recognition Strengthening Premium Positioning

The recognition of regional makhana varieties through geographic indication certification is elevating product positioning and consumer confidence in quality assurance. This intellectual property protection enables producers to command premium pricing while safeguarding traditional cultivation practices and regional identity from unauthorized usage. The certification framework establishes quality benchmarks that differentiate authentic products from generic alternatives in domestic and international markets. Furthermore, geographic indication recognition enhances export competitiveness by providing credible quality assurance to international buyers seeking verified origin-specific products with traceable provenance and consistent quality standards.

Market Outlook 2026-2034:

The India makhana market outlook remains strongly positive as multiple growth catalysts converge to drive sustained expansion. Increasing health awareness, rising disposable incomes in tier-2 and tier-3 cities, and expanding organized retail presence create favorable conditions for market penetration. Government policy support through dedicated development boards and cultivation subsidies will strengthen supply-side infrastructure. Continued product innovation in flavors and packaging formats, combined with enhanced distribution networks, will accelerate consumer adoption across demographic segments. The market generated a revenue of INR 9.29 Billion in 2025 and is projected to reach a revenue of INR 19.95 Billion by 2034, growing at a compound annual growth rate of 8.85% from 2026-2034.

India Makhana Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Pack Size |

250-500 gm |

46% |

|

Packaging Type |

Pouches |

50% |

|

Distribution Channel |

General Trade |

39% |

|

Region |

North India |

25% |

Pack Size Insights:

- Less than 250 gm

- 250-500 gm

- More than 500 gm

250-500 gm dominates with a market share of 46% of the total India makhana market in 2025.

The 250-500 gm pack size segment maintains dominant market position due to its optimal alignment with Indian household consumption patterns and family-oriented purchasing behavior. This quantity range offers an ideal value proposition for regular snacking needs without concerns about product staleness or excessive storage requirements. Middle-class consumers particularly favor this segment as it balances affordability with sufficient quantity for multiple family members, making it the preferred choice for weekly household purchases across urban and semi-urban areas.

The segment benefits from manufacturer focus on optimizing production efficiency and packaging economics at this quantity level. Brands leverage the 250-500 gm format as their primary SKU for promotional activities and new product launches, establishing strong consumer familiarity. The pack size enables competitive pricing strategies while maintaining adequate profit margins for distribution channel partners. Urban consumers seeking convenient healthy snacking options between meals find this quantity appropriate for weekly household requirements, driving repeat purchase cycles and brand loyalty development across demographic segments nationwide.

Packaging Type Insights:

- Pouches

- Jars

- Others

Pouches leads with a share of 50% of the total India makhana market in 2025.

Pouch packaging dominates the India makhana market due to superior functional attributes combining moisture protection, lightweight portability, and cost-effective manufacturing. The flexible packaging format enables nitrogen flushing for extended shelf-life preservation while maintaining product crunchiness that consumers value highly. Stand-up pouches with resealable zip-lock features address consumer convenience requirements for portion control and product freshness retention between consumption occasions. Industry reports indicate that pouch packaging costs approximately thirty percent less than rigid alternatives while offering comparable or superior barrier properties.

Manufacturers increasingly invest in premium pouch designs featuring transparent windows that showcase product quality and attract shelf-level consumer attention. Advanced printing technologies enable vibrant branding and nutritional information display that supports purchase decision-making. The lightweight nature of pouches reduces transportation costs and enables efficient distribution across India's diverse geographic landscape. Modern packaging innovations including eco-friendly materials and recyclable laminates address growing environmental consciousness among consumers, particularly urban millennials who evaluate sustainability credentials alongside product attributes when making snacking choices.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

General trade exhibits a clear dominance with a 39% share of the total India makhana market in 2025.

General trade maintains market leadership through its unparalleled reach across India's vast geographic expanse, comprising traditional retail outlets including kirana stores, neighborhood groceries, and local provision shops. This channel offers established consumer trust relationships built over decades of community-based commerce. Price-sensitive consumers in tier-2, tier-3 cities and rural areas predominantly purchase through general trade due to convenient accessibility, credit facilities, and personalized service. The channel enables brands to achieve deeper market penetration in regions where organized retail infrastructure remains underdeveloped or economically unviable.

Traditional retailers benefit from strong relationships with regional makhana suppliers and processors, enabling competitive pricing and consistent product availability. The general trade channel accommodates diverse consumer purchasing patterns including small quantity purchases, loose sales, and flexible payment arrangements that organized retail cannot replicate efficiently. Manufacturers recognize general trade importance through dedicated distribution programs, trade promotions, and retailer incentive schemes that maintain channel loyalty. Despite e-commerce growth and modern trade expansion, general trade remains indispensable for achieving nationwide market coverage and serving India's predominantly value-conscious consumer segments.

Regional Insights:

- North India

- West & Central India

- South India

- East India

- Northeast India

North India represents the leading region with a 25% share of the total India makhana market in 2025.

North India dominates the makhana market owing to Bihar's position as the production heartland, contributing to national output from the Mithilanchal region. Traditional consumption patterns embedded in religious and festive occasions drive sustained demand throughout the year. The region benefits from established supply chain infrastructure connecting key production districts including Darbhanga, Madhubani, Purnea, and Katihar with major consumption centers across northern states, ensuring consistent product availability and competitive pricing for consumers.

Consumer familiarity with makhana as a traditional ingredient and health food strengthens market penetration across North Indian households. Urban centers including Delhi, Chandigarh, and Lucknow exhibit strong demand for premium branded products, driven by higher disposable incomes and health-conscious consumer preferences. The region's expanding processing infrastructure development and proximity to cultivation areas enable competitive pricing and fresh product availability throughout the year, reinforcing market leadership position against other geographic regions and supporting sustained growth nationwide.

Market Dynamics:

Growth Drivers:

Why is the India Makhana Market Growing?

Rising Health Consciousness and Lifestyle Disease Prevalence

The escalating burden of lifestyle diseases including diabetes, cardiovascular conditions, and obesity is fundamentally reshaping Indian snacking preferences toward healthier alternatives. Makhana's nutritional profile featuring low calories, high protein content, low glycemic index, and gluten-free properties positions it ideally for health-conscious consumers and diabetic-friendly diets. Growing awareness about the detrimental health impacts of conventional fried snacks and processed foods accelerates consumer transition toward natural, nutrient-dense alternatives. Urban professionals and fitness enthusiasts increasingly incorporate makhana into daily dietary routines as guilt-free snacking options that align with wellness objectives.

Government Policy Support and Institutional Development

Strategic government interventions are creating favorable conditions for makhana industry expansion through dedicated institutional frameworks, financial support, and infrastructure development initiatives. Policy focus on agricultural diversification and rural income enhancement positions makhana as a priority commodity for development investment. Cultivation subsidies, processing unit establishment support, and export promotion schemes are strengthening industry fundamentals across the value chain. The establishment of coordinating bodies brings together farmers, processors, exporters, and researchers to address sectoral challenges systematically. The Union Budget 2025-26 announced the establishment of a National Makhana Board with an initial allocation of ₹476-crore, demonstrating high-level government commitment to transforming the sector into a globally competitive industry.

Expanding Retail Infrastructure and Distribution Networks

The rapid expansion of organized retail formats and e-commerce platforms is dramatically improving makhana accessibility across diverse geographic and demographic segments. Modern trade outlets provide enhanced product visibility, promotional opportunities, and consumer education that traditional channels cannot match effectively. Supermarket and hypermarket chains dedicate increasing shelf space to healthy snacking categories, elevating makhana prominence among consumers exploring nutritious alternatives. E-commerce penetration enables brands to reach previously underserved markets while offering convenience benefits that drive repeat purchases. The proliferation of quick-commerce platforms facilitating rapid delivery further accelerates urban adoption patterns. India's organized food retail sector is expanding, creating substantial distribution opportunities for makhana manufacturers seeking nationwide market penetration.

Market Restraints:

What Challenges the India Makhana Market is Facing?

Labor-Intensive Production and Processing Constraints

Makhana cultivation and processing remain heavily dependent on manual labor, limiting scalability and increasing production costs. Traditional harvesting methods requiring farmers to navigate thorny leaves and manually collect seeds from ponds create physical hardships and safety concerns. Processing involves labor-intensive extraction, drying, and high temperature popping stages that restrict mechanization adoption. The declining agricultural workforce availability threatens production capacity expansion despite growing market demand.

Limited Processing Infrastructure and Value Addition Capacity

Bihar's makhana processing infrastructure remains inadequate relative to production volumes, forcing raw material transportation to other states for value addition. The absence of integrated processing facilities results in income leakage from producing regions and limits farmer bargaining power. Cold storage deficiencies contribute to post-harvest losses and quality deterioration during storage and transportation. These infrastructural gaps prevent the industry from capturing premium pricing opportunities available through enhanced value addition and quality certification.

Supply Chain Fragmentation and Market Inefficiencies

The makhana supply chain suffers from fragmentation involving multiple intermediaries between farmers and end consumers, compressing producer margins. Absence of organized marketing channels means farmers often receive prices significantly below retail values. Price volatility and lack of transparent market information create uncertainty for cultivation planning decisions. Limited farmer awareness about modern agricultural practices, quality standards, and available government schemes further constrains productivity improvements and market access opportunities.

Competitive Landscape:

The India makhana market features a competitive landscape comprising established FMCG players, specialized health food brands, and regional processors. Leading manufacturers differentiate through product innovation, brand building, and distribution network expansion. Companies invest significantly in flavored variant development, premium packaging solutions, and digital marketing strategies to capture health-conscious consumer segments. Strategic partnerships with e-commerce platforms and modern retail chains strengthen market presence. Competition intensifies as new entrants recognize growth opportunities, driving continued investment in quality improvement, production capacity expansion, and nationwide distribution infrastructure development.

Some of the key players operative in the industry include:

- Dharampal Premchand Limited (Snack Factory)

- Divinutty Products Private Limited

- Farmley

- Happilo

- Harry Food Processing

- Madhubani Makhana

- Makhana Wala

- Mithilia Naturals

- Rishab Global Industries Private Ltd. (Mr. Makhana)

- Sattviko

- Snackible

- Sun Organic Industries Private Limited

- Sunirav Impex

- Swastik Food Group

- VKC Nuts Pvt. Ltd (Nutraj)

Recent Developments:

- In December 2024, the Bihar government organized a two-day 'Makhana Mahotsav' in Bengaluru to promote and expand the market for Bihar's makhana and other food products. The event aimed to build awareness about makhana's nutritional benefits and connect producers with potential buyers across Southern India.

- In March 2024, the Central University of South Bihar (CUSB) received funding for research on makhana cultivation, scheduled for completion within three years. The research primarily focuses on improving makhana species through tissue culture techniques to enhance yield and quality characteristics.

India Makhana Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Billion |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Pack Sizes Covered | Less Than 250 gm, 250-500 gm, More Than 500 gm |

| Packaging Types Covered | Pouches, Jars, and Others |

| Distribution Channels Covered | Modern Trade, General Trade, Online/E-Commerce |

| Regions Covered | North India, West and Central India, South India, East India, Northeast India |

| Companies Covered | Dharampal Premchand Limited (Snack Factory), Divinutty Products Private Limited, Farmley, Happilo, Harry Food Processing, Madhubani Makhana, Makhana Wala, Mithilia Naturals, Rishab Global Industries Private Ltd. (Mr. Makhana), Sattviko, Snackible, Sun Organic Industries Private Limited, Sunirav Impex, Swastik Food Group, VKC Nuts Pvt. Ltd (Nutraj), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India makhana market size was valued at INR 9.29 Billion in 2025.

The India makhana market is expected to grow at a compound annual growth rate of 8.85% from 2026-2034 to reach INR 19.95 Billion by 2034.

250-500 gm dominated the market with a share of 46%, driven by its alignment with household consumption patterns, optimal family-sized portions, and convenient quantity offerings for regular healthy snacking needs.

Key factors driving the India makhana market include rising health consciousness, increasing lifestyle disease prevalence, government policy support, expanding organized retail infrastructure, growing e-commerce penetration, and rising consumer demand for nutritious snacking alternatives.

Major challenges include labor-intensive production methods, limited processing infrastructure in producing regions, supply chain fragmentation, inadequate cold storage facilities, price volatility, and limited farmer awareness about modern practices and market opportunities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)