India Magnet Market Size, Share, Trends and Forecast by Magnet Type, Application and Region, 2026-2034

India Magnet Market Size and Share:

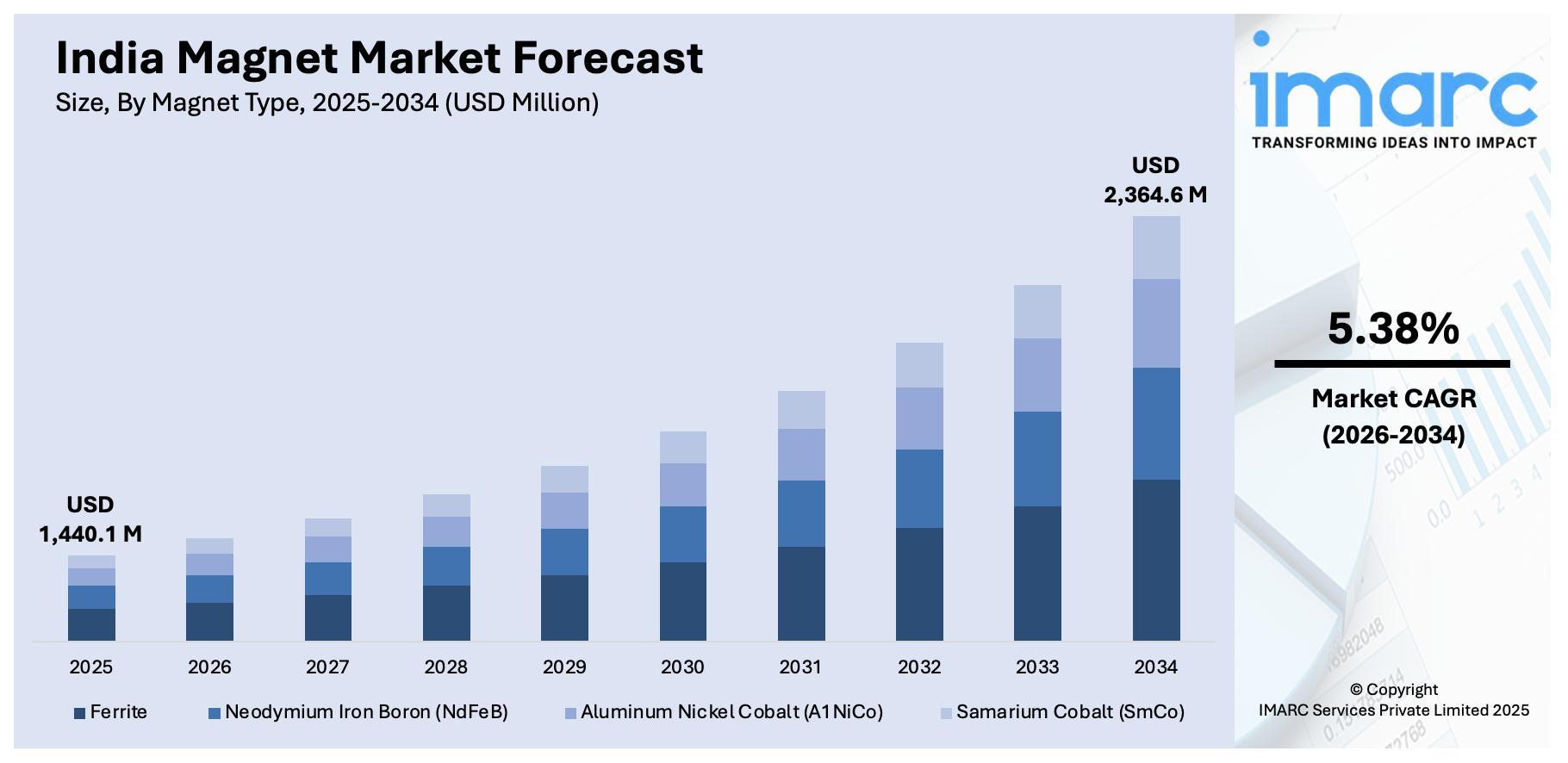

The India magnet market size was valued at USD 1,440.1 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 2,364.6 Million by 2034, exhibiting a CAGR of 5.38% from 2026-2034. Key drivers for India's magnet market include the increasing demand for electric vehicles (EVs), the rise of renewable energy installations, and expanding industrial automation. Additionally, growing electronics consumption, advancements in manufacturing technologies, and government initiatives to boost the domestic production of rare earth materials contribute to India magnet market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,440.1 Million |

| Market Forecast in 2034 | USD 2,364.6 Million |

| Market Growth Rate (2026-2034) | 5.38% |

The rapid adoption of EVs in India significantly drives the demand for magnets, particularly in electric motors. EVs require high-performance permanent magnets, such as neodymium-based magnets, for efficient power conversion and motor functionality. As India aims for cleaner transportation with the government's push for EVs, the demand for these magnets will continue to rise. Moreover, supporting infrastructure, like charging stations and battery production, is increasing, further elevating the need for magnets in EVs. The shift towards electric mobility aligns with India’s sustainability goals, making it a major driver for the magnet market.

To get more information on this market Request Sample

India's increasing focus on renewable energy, particularly wind and solar power, is another major driver for the magnet market. Wind turbines, in particular, use high-performance magnets in their generators to convert kinetic energy into electricity efficiently. As India works toward expanding its renewable energy capacity, including offshore and onshore wind projects, the demand for magnets will grow. In line with this, As of December 2024, India's cumulative installed wind power capacity was 48,163.16 MW, with 2,276.65 MW added in the first nine months of the fiscal year. The government’s efforts to meet renewable energy targets, coupled with global initiatives towards clean energy, ensure that the magnet market will continue to benefit from this shift, positioning it as a vital sector for sustainable energy production thus aiding the India magnet market demand.

India Magnet Market Trends:

Shift Towards Clean and Sustainable Energy

India's commitment to clean energy is one of the significant trends driving the magnet market. With ambitious renewable energy targets, especially in wind and solar power, the demand for magnets has increased. As of December 2024, India's installed renewable energy capacity stood at 162.48 GW, with wind power at 48.16 GW and solar power at 97.86 GW. Such magnets are essential for the rapidly increasing wind energy industry of India. Magazines also find applications in the development of energy storage systems and in electric vehicle motors. Generally, India aims at reducing carbon emissions and forming a diversified energy mix-a move that would contribute to an increasing demand for energy-efficient magnets. Chiefly, it is wind turbine and solar panel magnets that are in increasing demand. This momentum towards sustainability creates long-term demand for magnets that promotes the innovation and growth in technology.

Growing Electric Vehicle (EV) Adoption

The increased use of EVs is one more major factor promoting magnet adoption. Permanent magnets in electric motors have higher efficiency, lighter in weight, and require lesser material usage in general compared to the regular electromagnet system in most automobiles. With the push from the Indian government through incentives, subsidies, and stricter emission norms, demand for high-performance magnets will rise. More so, neodymium-based magnets will be in the demand list. Manufacturers of electric vehicles (EVs), battery producers, and infrastructure developers all alike need to ensure an uninterrupted supply of such magnets. With an increase in the number of Indian consumers moving towards electric mobility, the market for magnets will increase, which will lead to the innovation of new materials and manufacturing processes to meet the demand. This is coupled with the rise in EV production, which will result in a global shortage of NdFeB magnets, amounting to approximately 48,000 tonnes per year by 2030.

Advancement in Magnet Manufacturing Technologies

The current trend in the Indian magnet market is technological advancement in magnet manufacturing. Improved sintering techniques and alternative materials are making it easier to produce magnets that are not only more efficient but also cost-effective. Innovations in production methods are addressing the increasing need for high-performance magnets across industries such as electronics, automotive, and renewable energy. It increases competition in the magnet market as manufacturers in India are adopting new technologies to enhance magnetic properties with lower production costs.

India Magnet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India Magnet market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on magnet type and application.

Analysis by Magnet Type:

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (A1NiCo)

- Samarium Cobalt (SmCo)

Ferrite magnets are in demand due to their cost-effectiveness and high corrosion resistance, making them ideal for applications like motors, speakers, and sensors. Their widespread use in automotive and electronics sectors drives steady demand, especially as these industries expand in India.

In line with this, the neodymium iron boron magnets are prized for their high magnetic strength and compact size, essential for advanced electronics, renewable energy, and EV. Their increasing adoption in India’s EV and wind energy sectors supports market growth, driven by technological advancements and sustainability initiatives.

However, the aluminum nickel cobalt magnets offer excellent temperature stability, making them suitable for industrial, automotive, and aerospace applications. Although less commonly used compared to NdFeB, their role in specialized applications requiring durability under extreme conditions sustains market relevance.

Also, the samarium cobalt magnets, known for their high performance in extreme temperatures and corrosive environments, are used in aerospace, defense, and advanced electronics. Their demand in India grows with expanding high-tech industries, despite higher costs limiting their broader adoption.

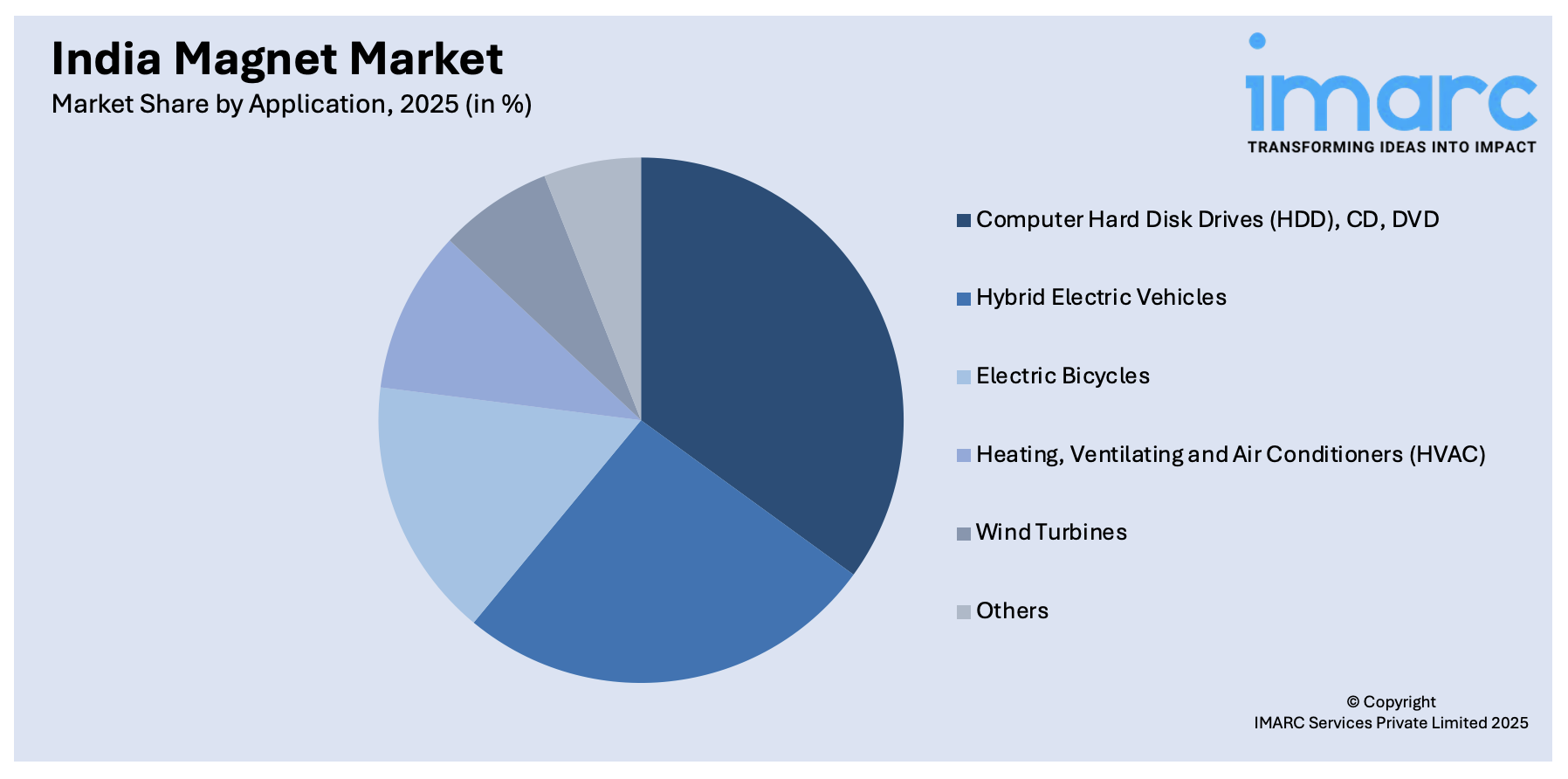

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Computer Hard Disk Drives (HDD), CD, DVD

- Hybrid Electric Vehicles

- Electric Bicycles

- Heating, Ventilating and Air Conditioners (HVAC)

- Wind Turbines

- Others

Magnets in HDDs, CDs, and DVDs are vital for data storage and retrieval, contributing to the growth of the electronics industry in the India magnet market share. As digital data storage expands in India, the demand for permanent magnets used in these devices remains steady, especially in the growing data storage and entertainment sectors.

Concurrently, the magnets, especially neodymium iron boron, are essential for electric motors in hybrid electric vehicles (HEVs), improving efficiency and performance. The push for cleaner transportation in India, driven by government incentives, has spurred the demand for magnets, making HEVs a significant growth area for the magnet market, particularly in urban centers.

Similarly, the electric bicycles (e-bikes) use magnets in their motors for efficient power conversion. With rising interest in sustainable transportation solutions in India, e-bikes have gained popularity, further driving the demand for high-performance magnets, particularly in urban areas where traffic congestion and pollution are concerns.

Besides this, the magnets in HVAC systems are used in motors and compressors, improving energy efficiency. As India experiences rapid urbanization and climate change-driven temperature variations, the demand for energy-efficient HVAC systems rises. This boosts the magnet market, especially for ferrite magnets used in motors and fans for cooling and heating systems.

Additionally, wind turbines rely on robust permanent magnets to efficiently convert wind energy into electricity. With India’s focus on expanding renewable energy, particularly in wind power, the demand for magnets used in turbine generators is growing. Government policies supporting clean energy are driving this trend, solidifying wind turbines as a major magnet market application.

Along with this, the magnets are used in other applications like medical devices, sensors, and industrial machinery. As industries in India grow and modernize, magnets find increasing use in robotics, automation, and telecommunications, supporting innovation. The "Others" segment continues to expand as technological advances create new applications for magnets across various sectors.

Regional Analysis:

- South India

- North India

- West and Central India

- East India

South India leads in manufacturing and industrial sectors, with significant demand for magnets in electronics, automotive, and renewable energy. Cities like Bengaluru and Chennai are hubs for electronics and EV production, driving the need for high-performance magnets, particularly in automotive and energy sectors.

Additionally, the North India has a strong presence in the automotive, defense, and manufacturing industries, creating a steady demand for magnets, especially in HEVs and industrial applications. Delhi, Gurugram, and Noida are key areas, benefiting from government initiatives aimed at promoting electric mobility and green energy solutions.

Likewise, the West and Central India, with industrial centers like Mumbai and Pune, are crucial for automotive and renewable energy sectors, increasing demand for magnets in EVs, wind turbines, and HVAC systems. The region’s growing industrialization and technological advancements further boost the magnet market, especially in advanced applications.

Alongside this, East India, with major cities like Kolkata and Bhubaneswar, has a developing industrial base, focusing on manufacturing, power, and infrastructure. While magnet demand in this region is growing, particularly in energy and industrial applications, it lags slightly behind other regions but is poised for future expansion due to infrastructure development.

Competitive Landscape:

The competitive landscape in the magnet market has a combination of established players and new companies that are looking to gain market share. Major players in the market have emphasized their product portfolios for establishing quality products, research and development (R&D) spending, and use of advanced manufacturing technologies to improve magnet performance and decrease costs. A bulk of companies are increasingly focusing on producing high-performance magnets for specific applications like electric vehicle, renewable energy systems, and electronic devices. Strategic collaborations, partnerships, and mergers and acquisitions are commonplace for companies to reach out for enhanced market presence as well as more advanced technologies. The market dynamics are further dictated by the world supply chain conditions, which deal with sourcing the rare earth, a critical element to the cost and availability of products, further compounding the nature of the competition.

The report provides a comprehensive analysis of the competitive landscape in the India magnet market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, Cyient expanded its partnership with Allegro MicroSystems by inaugurating a Center of Excellence (CoE) at its Manikonda Campus in Hyderabad, India. Focused on developing advanced magnetic sensors and power semiconductors for automotive applications, the facility will house over 100 engineers specializing in design and validation. This collaboration aims to accelerate Allegro’s product development for EVs, ADAS, and high-power devices, leveraging Cyient’s expertise and India’s skilled talent pool.

- In January 2024, ISRO successfully deployed a six-meter-long magnetometer boom on the Aditya-L1 satellite, 132 days after its launch on January 11. Positioned in the Halo orbit at Lagrange Point L-1, the boom is equipped with two high-precision fluxgate magnetometer sensors designed to measure the interplanetary magnetic field.

- In September 2023, India launched its first Sun observation mission, Aditya-L1, on September 2 from Sriharikota, days after its historic Moon south pole landing. Named after the Hindu Sun god, the spacecraft will travel 1.5 million km to Lagrange Point 1 (L1), where gravitational forces between the Sun and Earth balance, allowing it to "hover." The mission will take four months to reach L1 and marks India's first solar system study mission.

India Magnet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Magnet Types Covered | Ferrite, Neodymium Iron Boron (NdFeB), Aluminum Nickel Cobalt (A1NiCo), Samarium Cobalt (SmCo) |

| Applications Covered | Computer Hard Disk Drives (HDD), CD, DVD, Hybrid Electric Vehicles, Electric Bicycles, Heating, Ventilating and Air Conditioners (HVAC), Wind Turbines, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India magnet market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India magnet market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India magnet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India magnet market was valued at USD 1,440.1 Million in 2025.

The growth of the India magnet market is driven by increasing demand from industries such as EVs, renewable energy, electronics, and HVAC. Government initiatives promoting clean energy, electric mobility, and industrial automation are further boosting market expansion, along with technological advancements in magnet manufacturing for higher efficiency.

IMARC estimates the India magnet market to exhibit a CAGR of 5.38% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)