India Luxury Watch Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2026-2034

India Luxury Watch Market 2025, Size and Analysis:

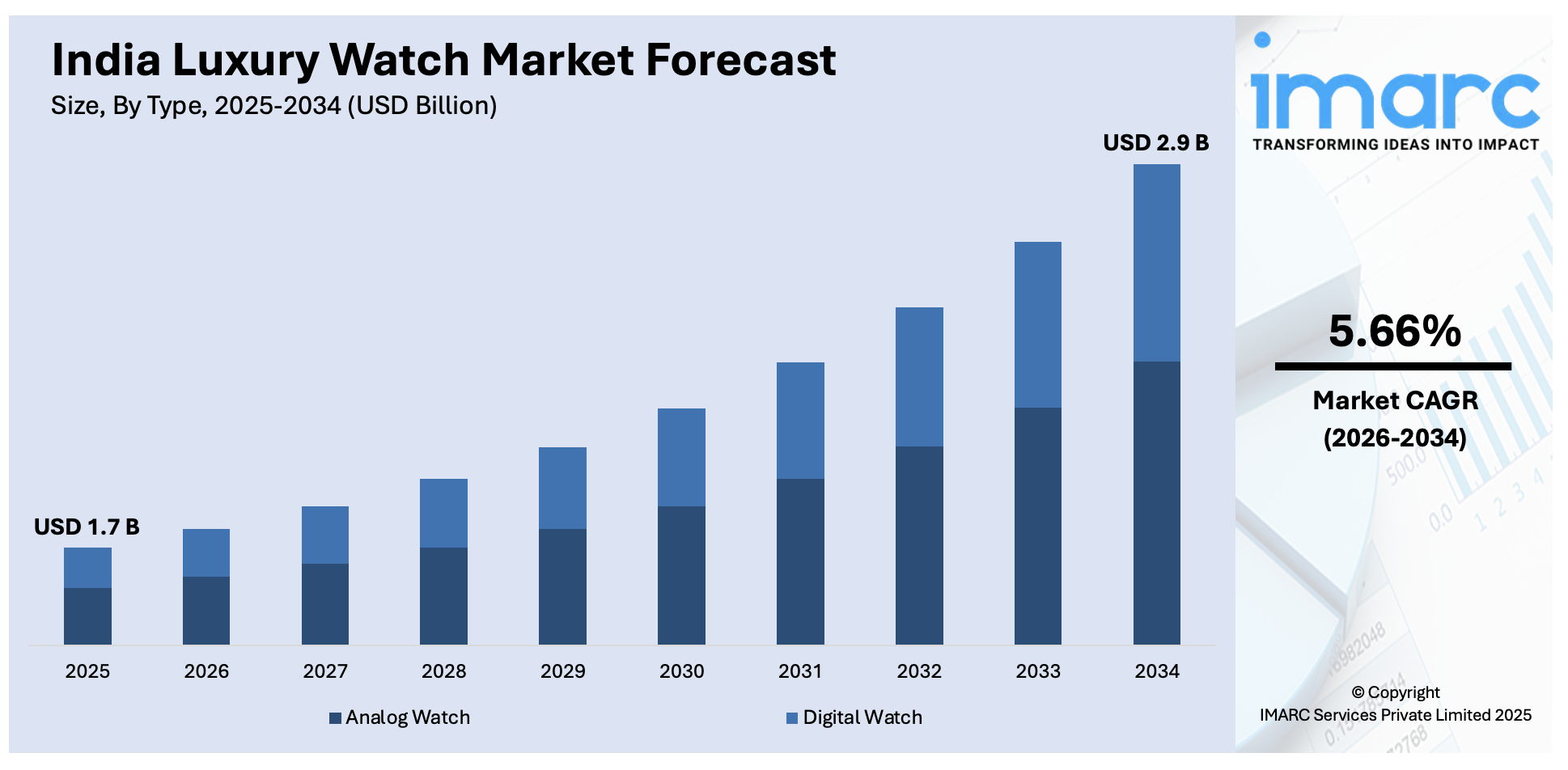

The India luxury watch market size was valued at USD 1.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 2.9 Billion by 2034, exhibiting a CAGR of 5.66% from 2026-2034. The India luxury watch market share is driven by the growing middle and upper-middle-class population, the changing lifestyle and fashion tastes of Indian consumers, and an increasing focus on personal branding and individuality.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.7 Billion |

| Market Forecast in 2034 | USD 2.9 Billion |

| Market Growth Rate (2026-2034) | 5.66% |

The India luxury watch market is growing significantly, with increasing disposable incomes and a higher number of affluent consumers. According to India Brand Equity Foundation, UBS states that the affluent population in India is likely to double by 2028 to 88 Million, thereby increasing demand for luxury goods. Luxury watches are essentially an affluent status symbol of success and taste, hence quite in demand among India's affluent and aspirational buyers. The increasing demand for these prized possessions can be correlated with the country's exponentially rising economic affluence, whereby a lot of people are investing in high-quality, luxury items as an indicator of their growing success. This is due to the expansion of the middle class and also the growing wealthy population who can see beyond the mere ability of luxury watches to tell time. Luxury watches are prized for their prestige, which, in an age that measures material success by the accumulation of goods, is a great advantage for many. The influence of globalization and exposure to international luxury brands through digital platforms and travel has heightened awareness and demand for prestigious watchmakers. The younger demographics are the active participants in shaping the India luxury watch market trends and preferences. Millennials and Gen Z are showing a strong inclination toward luxury watches, appreciating the craftsmanship and heritage of renowned watchmakers and the investment potential they offer. These generations, with their increasing disposable incomes, are more likely to purchase luxury items that combine traditional and modern appeal.

To get more information on this market Request Sample

With easier access to global trends via digital platforms and social media, foreign luxury brands gained appeal. Luxury timepieces have now become more affordable and attractive due to their greater availability. Along with an appreciation of the workmanship, luxury watches are seen by younger buyers as an investment, one that could retain their value or increase over time. Cultural changes and a penchant for luxury lifestyle products have, in turn, pushed the Indian luxury watch market further. For luxury watches, which are usually handed down from one generation to the next or treasured as individual collections, their timeless value makes them an excellent choice for collectors and connoisseurs. Additionally, luxury watches in India have also become an essential gift on wedding days or important anniversaries, mainly due to this tradition of indulging in opulently priced luxury purchases at those events. The act of gifting a luxury timepiece is considered a way to celebrate and honor an individual's success, which makes these watches even more meaningful. This growing affinity for high-end products, coupled with the increasing perception of luxury items as status symbols and investments, is expected to fuel continued growth in the Indian luxury watch market in the coming years.

India Luxury Watch Market Trends:

Growing preference for smart luxury watches

The shift toward smart luxury watches that bring old-world craftsmanship into modern times with technology is a major driver of the India luxury watch market growth. More tech-savvy consumers are now asking for smartwatches with additional features such as fitness tracking, notifications, GPS, and connectivity with their smartphones. Tag Heuer, Garmin, and Montblanc are high-end watchmakers that have entered the smart luxury segment, blending classic designs with state-of-the-art digital capabilities. This trend is gaining popularity among the working population, who seek a combination of luxury, style, and practicality. According to the SBI Census, India's working-age population (15-59) is expected to increase to 65.2% by 2031. As the Indian tech ecosystem continues to grow, it is expected that the integration of cutting-edge technology into luxury timepieces will become more widespread. It includes hybrid watches and appeals to these younger professionals along with the most affluent consumers, where style and function are not necessarily mutually exclusive from each other in the luxury watch market in this country.

Emerging Social Media and Celebrity Promotions

A significant influence on the luxury watch demand in India emerges from social media, with most of the top brands having started using platforms, such as Instagram, YouTube, and TikTok, to market their products to a wider young audience. This shift has been made possible by the expansive internet subscriber base, which now stands at 954.4 Million in 2024, according to Invest India, and allows luxury watch brands to reach a highly connected consumer base. Celebrity endorsements also play a significant role in driving demand, as high-profile influencers promote peculiar luxury watch brands. This digital revolution has enabled even niche, high-end watchmakers to create a strong presence, cultivating a loyal following. The ability to showcase watches in a lifestyle context through posts, videos, and stories has altered the way consumers think, especially the aspirational ones. For the working population who are increasingly finding inspiration and purchasing on digital platforms, luxury watches have become indispensable status symbols and personal style signifiers.

Transformation Toward Sustainability and Ethical Sources

Sustainability is one of the most crucial factors that determine the luxury watch market in India. As consumers are becoming more environmental conscious, many are seeking brands that prioritize ethical sourcing, sustainability, and eco-friendly manufacturing practices. Watchmakers are increasingly incorporating sustainable materials such as recycled metals, eco-friendly leather alternatives, and ethical gemstones into their collections. Furthermore, there is growing interest in timepieces that are designed to last for generations, reducing the need for frequent replacements. This is finding resonance among the environmentally conscious younger buyer, who buys luxury as a way of being seen to fulfill their values. For this reason, many watch brands are acquiring green certifications and becoming transparently sourced to comply with this increasing demand while being socially responsible. This sustainable approach is also transforming luxury watch products. However, its impact is spreading over the luxury watch customers' expectations.

India Luxury Watch Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India luxury watch market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, end user and distribution channel.

Analysis by Type:

- Analog Watch

- Digital Watch

Analog watches have been in high demand in this market due to their classic elegance, intricate craftsmanship, and vast demand among traditionalists and collectors. These watches are used as status symbols, addressing heritage designs with luxury materials like gold, titanium, and diamonds. On the other hand, digital watches appeal to a more tech-savvy audience with advanced features like fitness tracking, heart rate monitoring, and seamless connectivity with smartphones. According to the World Economic Forum, more than half of India's population is below 30, and they are adept at adopting and adapting to new digital technologies, driving the demand for smart and digital watches. Hybrid models, combining analog displays with digital capabilities, have further widened the consumer base by appealing to those seeking a blend of classic design and cutting-edge technology.

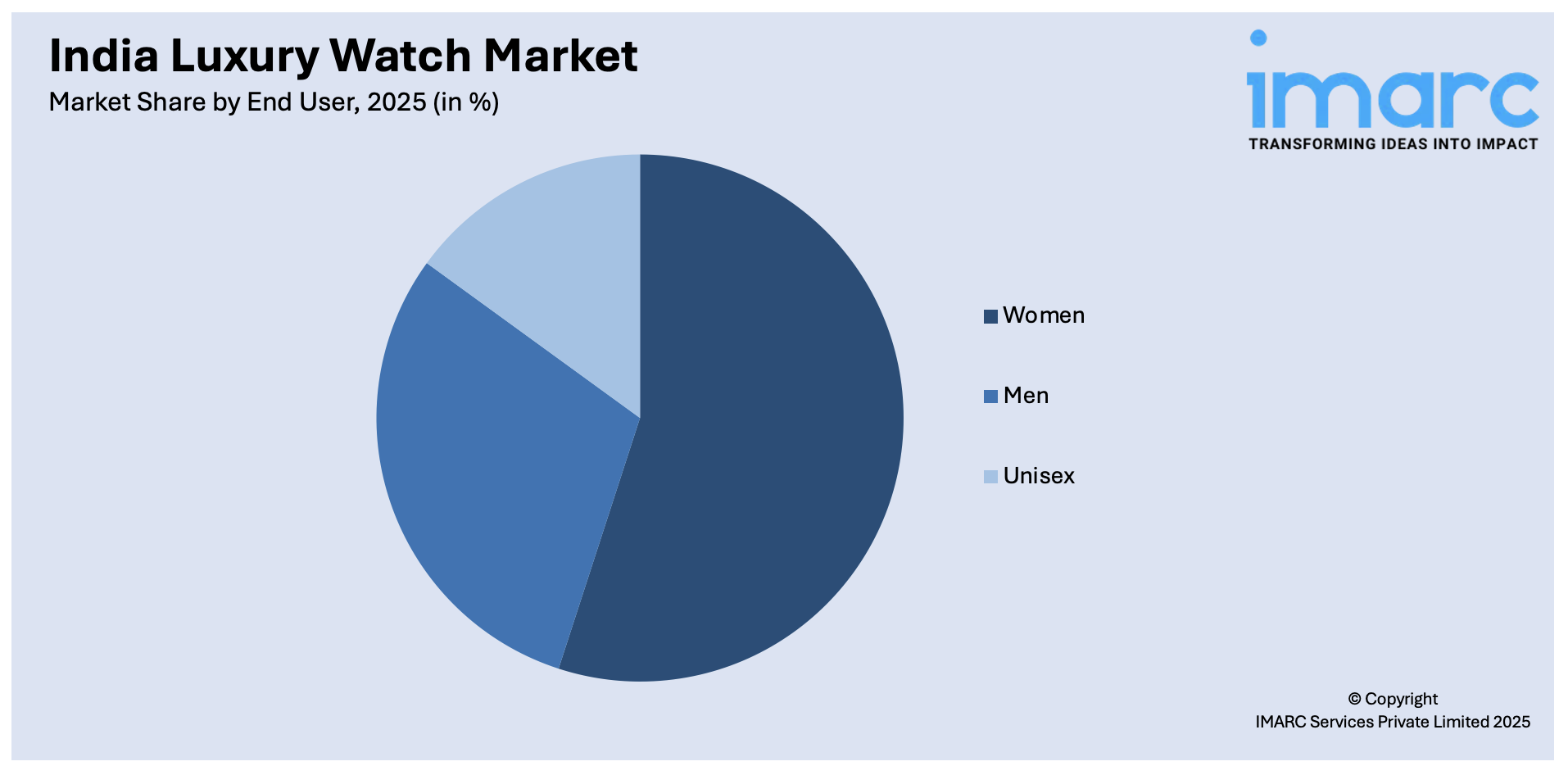

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Women

- Men

- Unisex

Men's luxury watches are always associated with sophistication, power, and style. They often have bold designs and innovative functionalities for the professional or formal wear category. Ladies' luxury watches, however, emphasize grace and attention to craftsmanship, using some ornate elements like diamonds, gold, or elaborate patterns. It is growing steadily, just due to rising purchasing power and simply changing fancies. According to the Ministry of Statistics & Programme Implementation, by 2036, India's population is expected to reach 152.2 crore, with a slightly improved female percentage of 48.8%. This demographic shift indicates an expanding target audience for women-focused luxury watches, enhancing the segment's growth potential. The unisex category is more in demand due to flexible designs, breaking the shackles of the conventional gender concept, and therefore more popular among the youth and working professionals, thus diversifying the market scenario.

Analysis by Distribution Channel:

- Online Stores

- Offline Stores

Offline stores, such as single-brand stores, multi-brand outlets, and luxury houses, still maintain their lead, as most of the customer base finds offline shopping personalized experiences, high-class atmosphere, and also looks before purchasing a product. In contrast, with an increasing percentage of penetration on the internet and smartphones, online stores are quickly taking pace in this retail industry. The Indian Brand Equity Foundation estimates that, by 2030, India's e-commerce market will cross the US$ 325 Million mark, and these online luxury sales of watches in the country indicate enormous scope in the sector. Advanced technologies, for example, augmented reality to offer try-ons and tailored recommendations on e-commerce websites, have amplified customer interactions. This segment has also increased with the increase in digital payment solutions and appealing offers on e-commerce websites, which have made it an essential growth contributor to the overall market.

Regional Analysis:

- South India

- North India

- West & Central India

- East India

South India is a significant market since the economy there is strong, and literacy levels are high. Thus, affinity for premium and luxury goods increases in this region. Cities such as Bengaluru, Chennai, and Hyderabad have major contributions toward the same due to the affluence in the IT workforce and the increasing propensity toward global luxury brands. North India is characterized by high demand for luxury watches in cities like Delhi NCR, Chandigarh, and Jaipur. The region's affluent population, high disposable income, and a penchant for showcasing social status have fueled demand. Festivals and weddings further boost luxury watch sales as gifting options. West & Central India is home to the metropolitan hub-influenced markets of Mumbai and Pune due to the cosmopolitan lifestyle and the wealth of businesses operating there. Central India is also gradually coming of age, catalyzed by urbanization and brand penetration in smaller cities. The Ministry of Statistics & Programme Implementation has reported that more than 40% of India's population will be living in urban setups by 2030, further propelling the demand for luxury products in this region. East India holds a lot of potential. Kolkata and Guwahati are gradually catching up as awareness and access to luxury brands increase. E-commerce and retail presence are driving growth in this region. The urbanization trend will further increase the region's contribution to the market.

Competitive Landscape:

Innovative market strategies are continuously being implemented by market players within the Indian luxury watch industry to capture consumer attention and increase market share. Many brands are entering the market by offering limited editions and partnering with famous designers or celebrities to enhance exclusivity and brand appeal. Companies are tapping into the growth of online consumer bases through direct-to-consumer channels and e-commerce platforms, further adding digital visibility to virtual showrooms and personalized experiences. As per the Indian Brand Equity Foundation, the indigenous e-commerce giant Flipkart is now set to raise US$ 1 Billion in a new funding round, with its parent company Walmart expected to commit US$ 600 Million. This is proof that e-commerce is increasingly crucial in transforming the luxury watch market. Sustainability is also a notable trend, wherein brands are using eco-friendly packaging, ethical sourcing, and even solar-powered models. Another factor is the increasing after-sales service, like warranty and repair, to maintain consumer attachment. These reflect the competitive, dynamic India luxury watch market outlook and its potential for growth in the coming years.

Latest News and Developments:

- On August 2024, Breitling, the Swiss luxury watchmaker, opened a boutique at Phoenix Mall of Asia, Bengaluru, in partnership with Ethos Watch Boutiques. The store showed iconic collections such as Navitimer and SuperOcean, representing Breitling's heritage, innovation, and precision. This marked a milestone in expanding its presence and luxury offerings in India.

- On November 2024, Rolex, in collaboration with Kapoor Watch Company, launched a boutique at DLF Emporio, New Delhi. The store had beautiful interiors inspired by the aesthetics of Rolex and local craftsmanship. The boutique highlighted the heritage of the brand and offered a luxurious experience, marking a 20-year partnership with Kapoor Watch Company.

- On September 2024, Franck Muller opened its northern India boutique with DLF Emporio in New Delhi through its collaboration with Kapoor Watch Company. The company moved forward by aggressively displaying special pieces like Vanguard and Master Square while stressing the star associations, materials innovation, and Indian limited-edition series but didn't announce when a Franck Muller skyscraper might open in Mumbai.

- On September 2024, Titan Helios partnered with Italian premium watchmaker U-BOAT to unveil their watches in India. Helios already operated 240 stores in 95 cities and wanted to strengthen the premium segment by bringing in multiple global brands.

India Luxury Watch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Watch, Digital Watch |

| End Users Covered | Women, Men, Unisex |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India luxury watch market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India luxury watch market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India luxury watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India luxury watch market was valued at USD 1.7 Billion in 2025.

IMARC estimates the India luxury watch market to exhibit a CAGR of 5.66% during 2026-2034.

The market is driven by the growing middle and upper-middle-class population, the changing lifestyle and fashion tastes of Indian consumers, and an increasing focus on personal branding and individuality.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)