India Luxury Apparel Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2026-2034

India Luxury Apparel Market Overview:

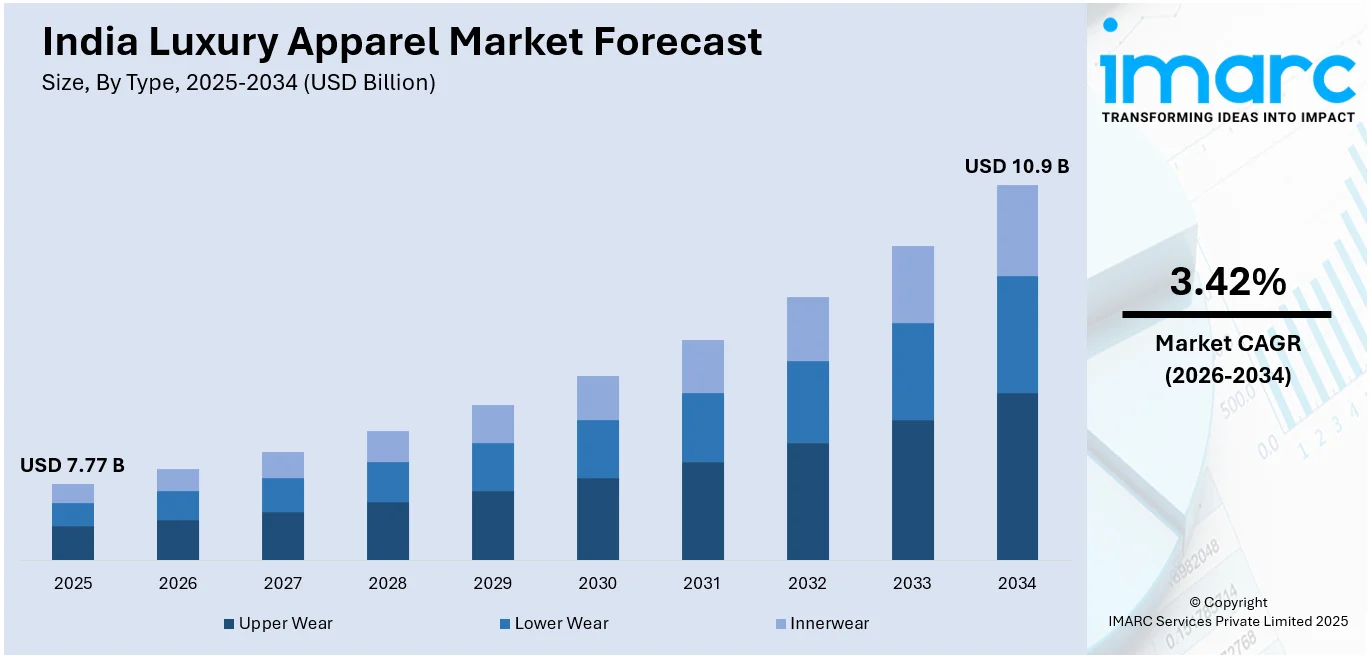

The India luxury apparel market size reached USD 7.77 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.9 Billion by 2034, exhibiting a growth rate (CAGR) of 3.42% during 2026-2034. The India luxury apparel market is driven by rising disposable incomes, growing brand consciousness among affluent consumers, expansion of global luxury brands, strong demand for premium ethnic wear, and government initiatives supporting the textile industry, creating a thriving ecosystem for luxury fashion growth across metropolitan cities and emerging urban centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.77 Billion |

| Market Forecast in 2034 | USD 10.9 Billion |

| Market Growth Rate 2026-2034 | 3.42% |

India Luxury Apparel Market Trends:

Rising Affluent Consumer Base and Economic Growth

India's luxury fashion market is experiencing significant growth, driven mostly by the rise of India's upper-middle classes with growing disposable incomes. India's average growth over the last two decades has stood at 7.3%, ranking it as one of the fastest-growing economies in the world. This surge in the economy has resulted in high disposable incomes among the country's middle and upper-middle class, who can now afford to spend on luxury items. Forecasts suggest that India's wealthier consumer base will hit 100 million by 2027. This demographic change has been a golden opportunity for luxury fashion companies looking to access a market hungry for high-end products. The rising buying power of this segment has seen many international luxury players launch their presence in India, driving the market further. For example, French fashion giant Ladurée has opened several stores in India, focusing on the "ambitious class" that is ready to spend money on luxury products. Additionally, the economic development promotion efforts of the Indian government, including the "Make in India" initiative, have provided a conducive climate for domestic and foreign luxury brands alike. The policies promote local manufacturing and investment, lowering operational expenses and making luxury goods more affordable for Indian consumers. The synergy between an expanding wealthy population and favorable economic policies has provided a fertile ground for the luxury apparel market to grow in India.

To get more information on this market Request Sample

Cultural Affinity for Luxury and High-Quality Textiles

India's heritage of rich culture and the age-old tradition of prioritizing quality fabrics have gone a long way in fueling the development of the luxury fashion industry. India's history is synonymous with the production and consumption of high-quality fabric, ornate embroidery, and handicrafts. This cultural connection has raised a sensitive buyer base that will pay premium for luxury fashion. The Indian fashion sector has exploited this cultural legacy by combining indigenous craftsmanship with modern designs, attracting both local and foreign markets. Top Indian designers such as Sabyasachi Mukherjee have become globally renowned for their success in integrating Western silhouettes with genuine Indian craftsmanship. Sabyasachi's recent show at the Mumbai Jio World Convention Centre, marking his 25th year of fashion, saw more than 150 looks from his previous collections, updated for the modern era. In addition, the initiatives by the Indian government to support the textile and apparel industry have supported the luxury market. During the fiscal year 2021-22, Indian textiles and apparel exports totaled a record US$ 44 billion, a remarkable rise compared to earlier years. This inflation indicates the demand for Indian textiles in the international market and the ability of the country to sustain luxury standards. The intersection of cultural affinity for high-end fibers and aggressive industry marketing has established a strong platform for India's luxury apparel market. As customers continue to hunt for items that both speak quality and culture, the market is well-positioned for long-term growth.

India Luxury Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Upper Wear

- Lower Wear

- Innerwear

The report has provided a detailed breakup and analysis of the market based on the type. This includes upper wear, lower wear, and innerwear.

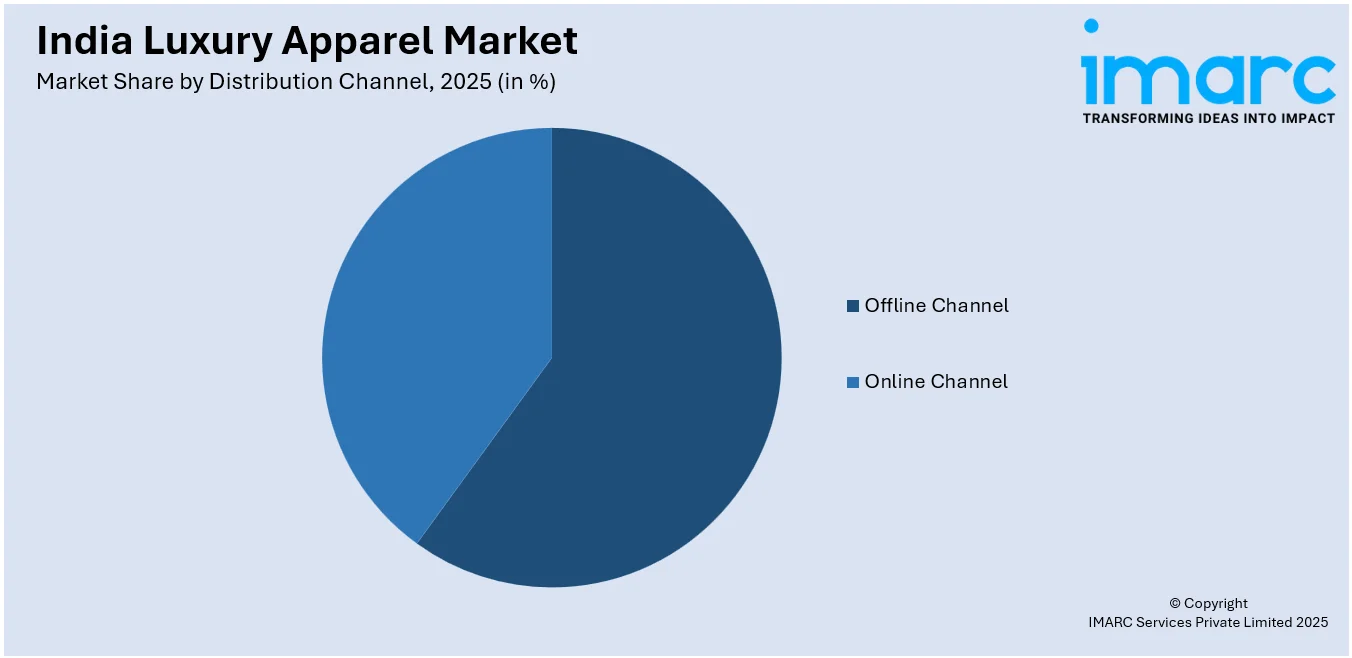

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline Channel

- Online Channel

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline channel and online channel.

End User Insights:

- Men

- Women

- Children

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and children.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Luxury Apparel Market News:

- February 2025: Culture Circle is solving trust problems in India's luxury resale market by providing verified luxury clothing, sneakers, and streetwear through AI authentication and KYC-verified sellers. This platform builds consumer confidence in second-hand luxury fashion, opening up high-end brands to a larger audience. The India luxury clothing market is growing with a robust resale ecosystem.

- January 2025: Isha and Mukesh Ambani-led Reliance Retail tied up with international luxury brands like Versace and Balenciaga to launch them in the Indian market. This move makes the brands more accessible and visible, pulling in high-end consumers and fueling growth in India's luxury apparel market. Moreover, Reliance's foray into tier 2 and tier 3 cities expands the consumer base for luxury fashion, expanding market demand even further.

- January 2025: Reliance Retail signed a franchise agreement with Saks Fifth Avenue to bring the American luxury department store to India with the aim of addressing the super-luxury segment. The alliance is likely to improve the availability and accessibility of high-end fashion, thus driving growth in India's luxury apparel market. By partnering with a globally well-known luxury retailer, Reliance Retail is positioning itself for a strategic reach-out to high-end consumers, thereby fueling growth in the luxury segment in India further.

India Luxury Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Upper Wear, Lower Wear, Innerwear |

| Distribution Channels Covered | Offline Channel, Online Channel |

| End Users Covered | Men, Women, Children |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India luxury apparel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India luxury apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India luxury apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India luxury apparel market was valued at USD 7.77 Billion in 2025.

The India luxury apparel market is projected to exhibit a CAGR of 3.42% during 2026-2034, reaching a value of USD 10.9 Billion by 2034.

The India luxury apparel market is driven by rising disposable incomes, urbanization, and a growing fashion-conscious population. Increased exposure to global trends, expansion of premium retail outlets, and celebrity endorsements also fuel demand. E-commerce platforms and interest from younger consumers further contribute to the market’s rapid growth across urban centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)