India Low Voltage DC Circuit Breaker Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

India Low Voltage DC Circuit Breaker Market Overview:

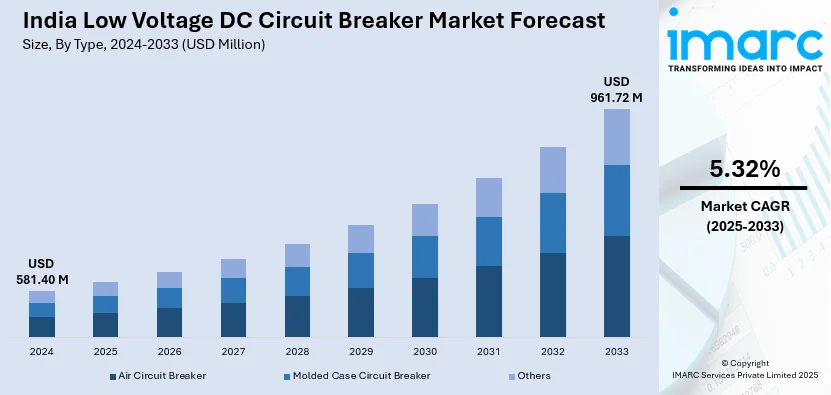

The India low voltage DC circuit breaker market size reached USD 581.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 961.72 Million by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033. The growing adoption of renewable energy, expansion of electric vehicle infrastructure, and increasing investments in data centers are driving the demand for low voltage direct current (DC) circuit breakers, as these sectors require advanced circuit protection, reliable power management, and efficient energy distribution to ensure stability, safety, and operational continuity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 581.40 Million |

| Market Forecast in 2033 | USD 961.72 Million |

| Market Growth Rate 2025-2033 | 5.32% |

India Low Voltage DC Circuit Breaker Market Trends:

Expansion of Renewable Energy and Distributed Power Systems

According to the data provided by the India Brand Equity Foundation (IBEF), as of October 10, 2024, India achieved an important milestone in its renewable energy development, with the nation’s total renewable energy capacity exceeding 200 GW (gigawatts), representing 46.3% of its overall installed capacity. In the overall renewable energy capacity, solar energy comprised 90.76 GW (45.1%), highlighting the country's achievements in enhancing clean energy infrastructure. The growing transition towards renewable energy sources is fueling the demand for low voltage DC circuit breakers. With the expansion of solar and wind installations, DC power systems need enhanced circuit protection to maintain stability and avoid electrical failures. Government initiatives encouraging clean energy usage are boosting investments in renewable infrastructure, thereby enhancing market demand. Distributed power generation, such as microgrids, is growing in both urban and rural regions, heightening the need for dependable DC circuit protection. Energy storage systems are vital for incorporating renewables, necessitating effective safety protocols for power distribution.

To get more information on this market, Request Sample

Growing Demand for Electric Vehicles (EVs) and Charging Infrastructure

The increasing popularity of electric mobility is driving the need for low voltage DC circuit breakers in charging infrastructure and power management systems for vehicles. Government initiatives promoting vehicle electrification are prompting significant investments in charging infrastructures, increasing the need for effective power protection. For instance, in 2025, CESL and the Delhi Development Authority (DDA) signed an agreement to develop electric vehicle (EV) charging and battery swapping stations across DDA sports complexes in Delhi. The collaboration aims to expand Delhi's EV infrastructure and promote sustainable transportation. Such charging stations need sophisticated circuit breakers to guarantee continuous and safe power delivery, especially for high-speed DC charging. The electrification of commercial fleets and public transport is accelerating the need for robust DC circuit protection. Market expansion is also influenced by increasing industrial adoption of electric mobility solutions, reinforcing the need for reliable protection mechanisms in diverse applications.

Rising Investment in Data Centers

Growing investments in data centers and digital infrastructure are increasing the need for low voltage DC circuit breakers. Uninterrupted functioning of servers, storage devices, and networking gear necessitates dependable circuit protection to avoid power interruptions. The growing use of DC power distribution in data centers is boosting energy efficiency, minimizing conversion losses, and enhancing system stability. Intelligent distribution networks and smart power management solutions are catalyzing the demand for sophisticated DC circuit breakers. The rise in data usage, cloud computing, and edge computing implementations is driving the growth of high-density data centers, leading to higher power demands. Investments in future power infrastructure are incorporating cutting-edge circuit protection technologies, securing operational continuity and improving overall energy efficiency in data center settings. In 2025, L&T announced plans to invest Rs 3,600 crore in building three new data centers in India, aiming to expand its capacity from 32 MW to 150 MW by 2027, reinforcing the need for advanced DC circuit breakers.

India Low Voltage DC Circuit Breaker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Air Circuit Breaker

- Molded Case Circuit Breaker

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes air circuit breaker, molded case circuit breaker, and others.

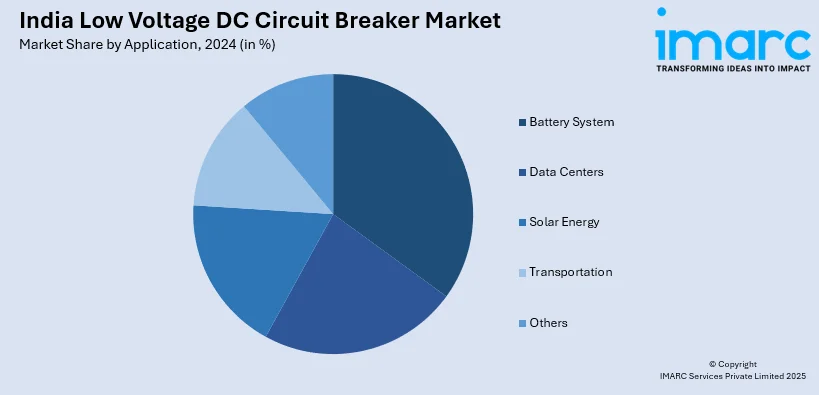

Application Insights:

- Battery System

- Data Centers

- Solar Energy

- Transportation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes battery system, data centers, solar energy, transportation, and others.

End User Insights:

- Industrial

- Commercial

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, commercial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Low Voltage DC Circuit Breaker Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Air Circuit Breaker, Molded Case Circuit Breaker, Others |

| Applications Covered | Battery System, Data Centers, Solar Energy, Transportation, Others |

| End Users Covered | Industrial, Commercial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India low voltage DC circuit breaker market performed so far and how will it perform in the coming years?

- What is the breakup of the India low voltage DC circuit breaker market on the basis of type?

- What is the breakup of the India low voltage DC circuit breaker market on the basis of application?

- What is the breakup of the India low voltage DC circuit breaker market on the basis of end user?

- What is the breakup of the India low voltage DC circuit breaker market on the basis of region?

- What are the various stages in the value chain of the India low voltage DC circuit breaker market?

- What are the key driving factors and challenges in the India low voltage DC circuit breaker market?

- What is the structure of the India low voltage DC circuit breaker market and who are the key players?

- What is the degree of competition in the India low voltage DC circuit breaker market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India low voltage DC circuit breaker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India low voltage DC circuit breaker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India low voltage DC circuit breaker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)