India Low Voltage Capacitors Market Size, Share, Trends and Forecast by Type, Voltage Capacity, Application, and Region, 2025-2033

India Low Voltage Capacitors Market Overview:

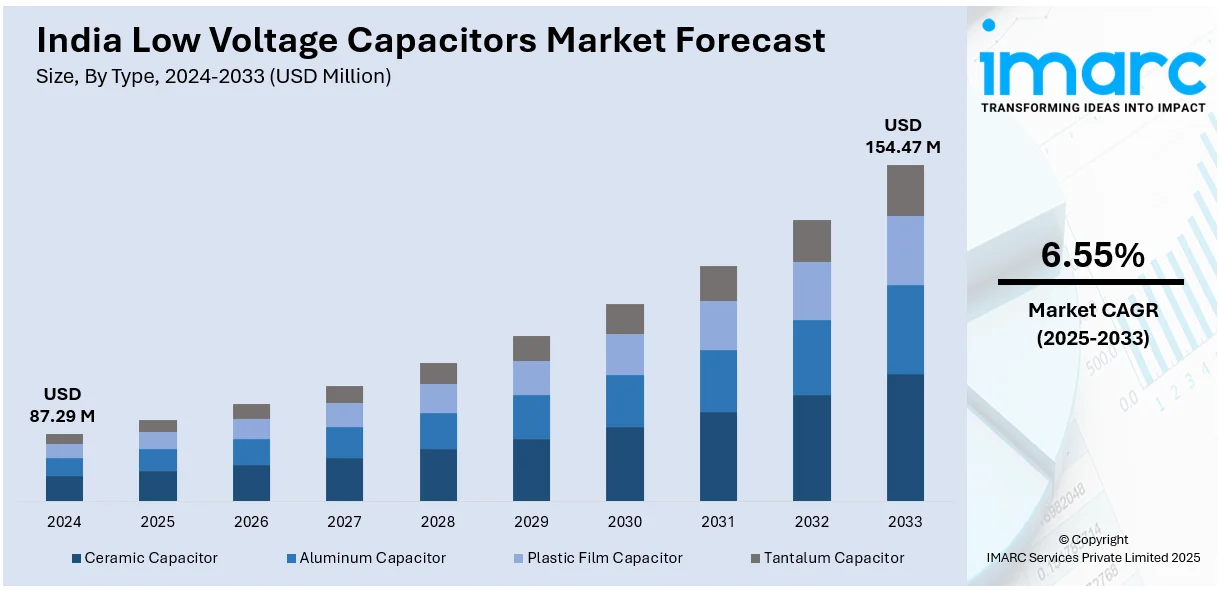

The India low voltage capacitors market size reached USD 87.29 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 154.47 Million by 2033, exhibiting a growth rate (CAGR) of 6.55% during 2025-2033. The India low voltage capacitors market share is expanding, driven by increasing reliance of automated systems on reliable and efficient power management solutions, along with the rising production of electric vehicles (EVs) that require effective devices to stabilize voltage and filter noise.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 87.29 Million |

| Market Forecast in 2033 | USD 154.47 Million |

| Market Growth Rate 2025-2033 | 6.55% |

India Low Voltage Capacitors Market Trends:

Increasing usage of industrial automation

The growing utilization of industrial automation is offering a favorable India low voltage capacitors market outlook. Industries are adopting automated machinery, robots, and control systems to increase productivity, precision, and operational efficiency, necessitating continuous power supply and voltage regulation. Low voltage capacitors improve power factor correction, reduce energy losses, and stabilize voltage variations in automated systems. As these systems incorporate more modern equipment, such as programmable logic controllers (PLCs), motors, and sensors, the demand for capacitors to manage reactive power and maintain smooth operations grows. Furthermore, automated manufacturing lines in industries like automotive, electronics, and pharmaceuticals are driving the demand for capacitors in order to ensure maximum power quality. With the growing reliance on data-driven processes, capacitors are becoming important for protecting automated equipment against voltage spikes and disturbances. The expansion of smart manufacturing facilities, combined with India's growing emphasis on Industry 4.0 and automation, is further catalyzing the demand for low voltage capacitors to ensure stable electrical performance. According to the IMARC Group, the India industrial automation market is set to attain USD 15.96 Billion by 2033, showing a growth rate (CAGR) of 8.60% during 2025-2033.

To get more information on this market, Request Sample

Growing adoption of EVs

The rising adoption of EVs is fueling the India low voltage capacitors market growth. According to the IBEF, in May 2024, India experienced a 20.88% increase in EV sales, reaching 1.39 Million units. With high EV production and charging infrastructure expansion, the need for capacitors in power electronics, charging stations, and vehicle control systems is rising. Low voltage capacitors assist in stabilizing voltage, filtering noise, and improving power factor in EV circuits. As EV components, such as onboard chargers, inverters, and battery management systems, rely on consistent power flow, capacitors are being integrated to ensure electrical stability and minimize power fluctuations. The expansion of fast-charging stations is also driving the demand for capacitors, as these stations require energy-efficient components to handle high current loads and ensure reliable power distribution. Additionally, automakers are wagering on advanced capacitor technologies to enhance EV performance, extend battery life, and improve energy efficiency. With India promoting EV adoption through incentives and infrastructure development, the demand for capacitors in EV systems is increasing.

India Low Voltage Capacitors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, voltage capacity, and application.

Type Insights:

- Ceramic Capacitor

- Aluminum Capacitor

- Plastic Film Capacitor

- Tantalum Capacitor

The report has provided a detailed breakup and analysis of the market based on the types. This includes ceramic capacitor, aluminum capacitor, plastic film capacitor, and tantalum capacitor.

Voltage Capacity Insights:

- Upto 200V

- 200-500V

- More Than 500V

A detailed breakup and analysis of the market based on the voltage capacities have also been provided in the report. This includes upto 200V, 200-500V, and more than 500V.

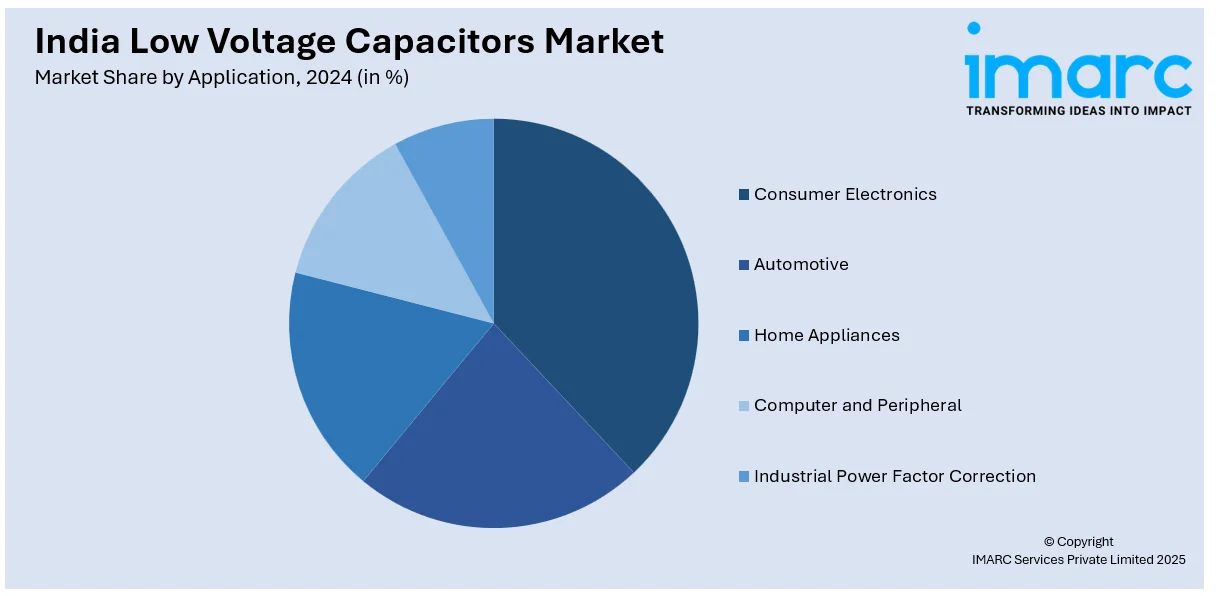

Application Insights:

- Consumer Electronics

- Automotive

- Home Appliances

- Computer and Peripheral

- Industrial Power Factor Correction

The report has provided a detailed breakup and analysis of the market based on the applications. This includes consumer electronics, automotive, home appliances, computer and peripheral, and industrial power factor correction.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Low Voltage Capacitors Market News:

- In January 2025, Amiya Mandal and KL Yadav, two scientists from the Smart Materials Research Laboratory (SMRL) at IIT Roorkee, situated in India, created a novel material for capacitor production that functioned effectively under extremely low electric field circumstances. They noted that sodium niobate (NN) was utilized as a material for energy storage because of its excellent polarization potential, high breakdown strength, less toxicity, and decent permittivity. This hybridization reached an energy density of 18.5 to 4 joules per cubic centimeter, achieving efficiencies of 63% and 80% at 995 and 460 kilovolts per centimeter, respectively.

India Low Voltage Capacitors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ceramic Capacitor, Aluminum Capacitor, Plastic Film Capacitor, Tantalum Capacitor |

| Voltage Capacities Covered | Upto 200V, 200-500V, More Than 500V |

| Applications Covered | Consumer Electronics, Automotive, Home Appliances, Computer and Peripheral, Industrial Power Factor Correction |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India low voltage capacitors market performed so far and how will it perform in the coming years?

- What is the breakup of the India low voltage capacitors market on the basis of type?

- What is the breakup of the India low voltage capacitors market on the basis of voltage capacity?

- What is the breakup of the India low voltage capacitors market on the basis of application?

- What is the breakup of the India low voltage capacitors market on the basis of region?

- What are the various stages in the value chain of the India low voltage capacitors market?

- What are the key driving factors and challenges in the India low voltage capacitors market?

- What is the structure of the India low voltage capacitors market and who are the key players?

- What is the degree of competition in the India low voltage capacitors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India low voltage capacitors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India low voltage capacitors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India low voltage capacitors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)