India Low Calorie Sweeteners Market Size, Share, Trends and Forecast by Source, Type, Application, and Region, 2025-2033

India Low Calorie Sweeteners Market Overview:

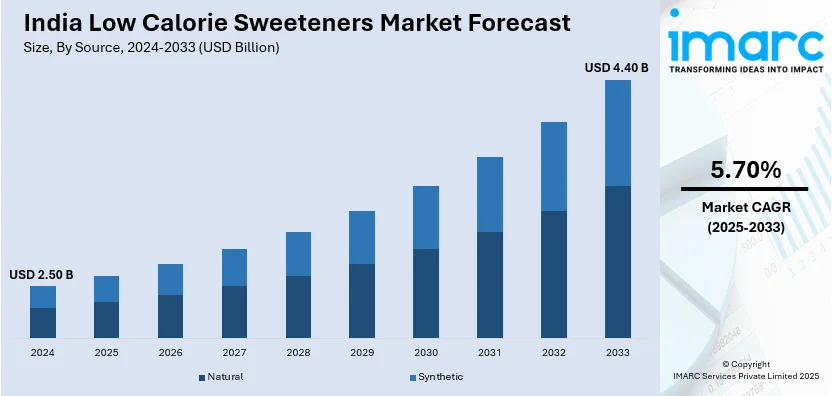

The India low calorie sweeteners market size reached USD 2.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.40 Billion by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The India low-calorie sweeteners market is driven by rising health consciousness, increasing cases of diabetes and obesity, government initiatives promoting sugar reduction, growing demand for natural sweeteners in food and beverages, and the expansion of the nutraceutical and functional food industry, which integrates alternatives like stevia and erythritol for healthier formulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.50 Billion |

| Market Forecast in 2033 | USD 4.40 Billion |

| Market Growth Rate (2025-2033) | 5.70% |

India Low Calorie Sweeteners Market Trends:

Rising Health Consciousness and Prevalence of Lifestyle Diseases

Over the past few years, there has been a significant trend among Indian consumers toward more healthy food options. This trend is mainly because of growing awareness of lifestyle disorders like diabetes and obesity. India, which is also called the "Diabetes Capital of the World," has seen a huge rise in diabetes cases. As per the Food Safety and Standards Authority of India (FSSAI), in 2019, around 72 million Indians suffered from Type-2 diabetes, with estimates suggesting a growth to 134 million by 2025. This disturbing trend has led to higher consumer perception towards consumption of sugar and its linked health concerns. As a result, there is an escalating demand for healthy substitutes, such as low-calorie sweeteners. These sweeteners offer the sweetness of sugar without the linked calories and hence are attractive to those who consider themselves health-conscious and to patients with conditions such as diabetes. The FSSAI has identified several non-sugar sweeteners (NSS), grouping them according to their caloric content. Non-caloric sweeteners, with less than 2% of the caloric content of sucrose, are Erythritol, Steviol glycoside, Aspartame, Sucralose, Neotame, Acesulfame potassium, and Saccharins.

To get more information on this market, Request Sample

Expansion of the Nutraceutical and Functional Foods Industry

The Indian nutraceutical and functional foods industry has been growing on a positive trend, driven heavily by the demand for low-calorie sweeteners. Nutraceuticals, such as dietary supplements and functional foods, tend to use low-calorie sweeteners to add taste without the addition of more calories. This is in line with the preference of the consumer to have health-sustaining products without any compromise on flavor. The COVID-19 pandemic has also sped up the development of this industry. There has been increased emphasis on preventive healthcare, which has resulted in greater consumption of immunity-enhancing supplements and health-related food items. According to reports, the Indian nutraceuticals market was worth USD 3,924.44 million in 2020 and is expected to reach USD 10,198.57 million by 2026, with a compound annual growth rate (CAGR) of 22%. Government policies have also been instrumental in this growth. The FSSAI has laid down standards for health supplements and nutraceuticals, maintaining product quality and safety. These policies have instilled confidence among consumers, which has resulted in wider acceptance of such products. The FSSAI has also defined non-sugar sweeteners and laid down guidelines for their application in different food items, making it easier to incorporate them into the nutraceutical industry. The combination of the growing health awareness among consumers and the widening nutraceutical market has provided a positive setup for India's low-calorie sweeteners market. With consumers rapidly looking for products that offer health benefits while never having to compromise on flavor, the market for low-calorie sweeteners is expected to grow over the next few years.

India Low Calorie Sweeteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on source, type, application, and region.

Source Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the source. This includes natural and synthetic.

Type Insights:

- Sucralose

- Saccharin

- Aspartame

- Neotame

- Advantam

- Acesulfame Potassium

- Stevia

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes sucralose, saccharin, aspartame, neotame, advantam, acesulfame potassium, stevia, and others.

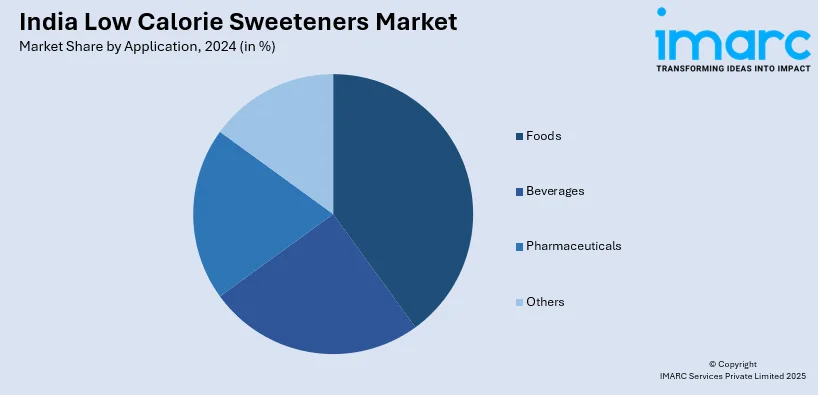

Application Insights:

- Foods

- Bakery

- Frozen Food and Dairy

- Confectionery

- Others

- Beverages

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes foods (bakery, frozen food and dairy, confectionery, and others), beverages, pharmaceuticals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Low Calorie Sweeteners Market News:

- April 2024: Ingredion Incorporated launched the PURECIRCLE™ Clean Taste Solubility Solution (CTSS), a plant stevia alternative having more than 100 times solubility than Reb M stevia, delivering better taste performance. The development caters to India's expanding demand for clean-label and natural low-calorie sweeteners. The enhanced taste and solubility make it a desirable product for food and beverage companies, fueling the growth of the market.

- February 2024: Baskin-Robbins introduced new plant-based, non-dairy ice cream flavors to address India's growing demand for vegan and healthier desserts. With consumers demanding lower-calorie, plant-based options, food companies are adding low-calorie sweeteners to preserve flavor while lowering the sugar level. This change is propelling demand for natural sweeteners, such as erythritol and stevia, and is fueling India's low-calorie sweeteners market growth.

India Low Calorie Sweeteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Natural, Synthetic |

| Types Covered | Sucralose, Saccharin, Aspartame, Neotame, Advantam, Acesulfame Potassium, Stevia, Others |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India low calorie sweeteners market performed so far and how will it perform in the coming years?

- What is the breakup of the India low calorie sweeteners market on the basis of source?

- What is the breakup of the India low calorie sweeteners market on the basis of type?

- What is the breakup of the India low calorie sweeteners market on the basis of application?

- What are the various stages in the value chain of the India low calorie sweeteners market?

- What are the key driving factors and challenges in the India low calorie sweeteners market?

- What is the structure of the India low calorie sweeteners market and who are the key players?

- What is the degree of competition in the India low calorie sweeteners market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India low calorie sweeteners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India low calorie sweeteners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India low calorie sweeteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)