India Lobster Market Size, Share, Trends and Forecast by Species, Weight, Product Type, Distribution Channel, and Region, 2026-2034

India Lobster Market Size and Share:

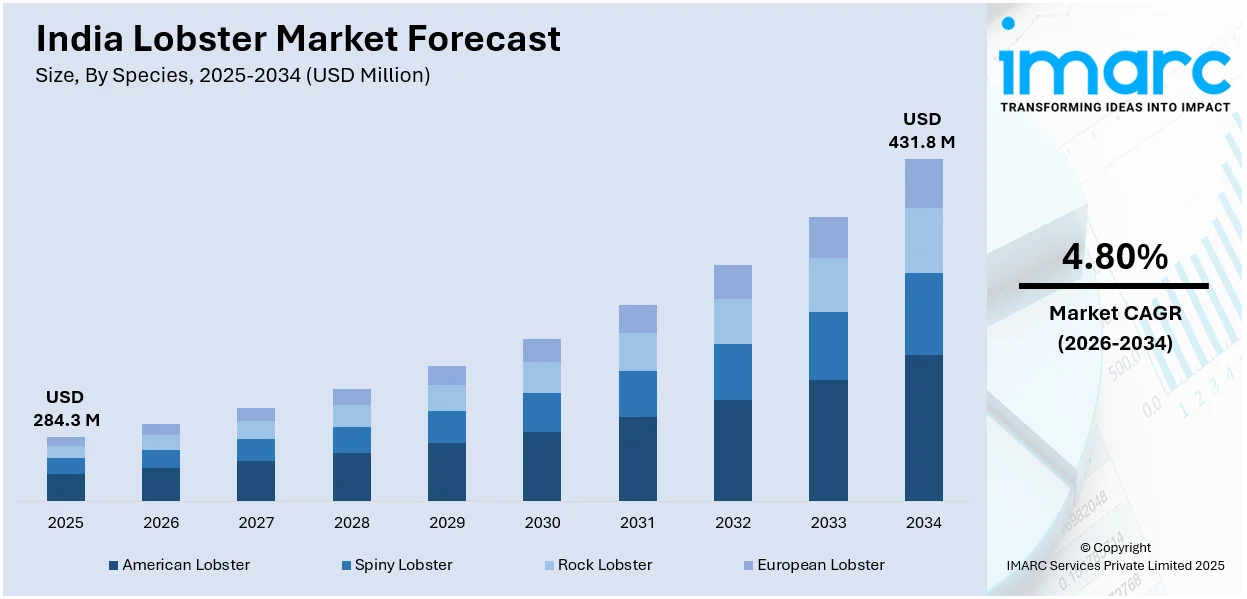

The India lobster market size was valued at USD 284.3 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 431.8 Million by 2034, exhibiting a CAGR of 4.80% from 2026-2034. The market is experiencing steady growth mainly driven by rising domestic consumption and strong export demand. Other factors, such as advancements in aquaculture, improved cold chain logistics and government support for fisheries, are fueling market expansion further across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 284.3 Million |

|

Market Forecast in 2034

|

USD 431.8 Million |

| Market Growth Rate (2026-2034) | 4.80% |

The Indian lobster market is mainly driven by increasing domestic demand fueled by rising disposable incomes and a growing middle-class base. According to the report published by the India Brand Equity Foundation, income levels are shaping the Indian consumer market with per capita disposable income rising from US$ 2.11 thousand in 2019 to US$ 2.54 thousand in 2023, which is projected to reach US$ 4.34 thousand by 2029. As consumers become more health-conscious seafood including lobster is preferred for its nutritional benefits. The rising popularity of seafood in urban areas is increasing the India lobster market share through surged domestic consumption. The emerging retail industry along with structured supermarkets brings lobster to a broader consumer base, which boosts market growth further.

To get more information on this market Request Sample

On the supply side, improvement in aquaculture and sustainable farming practices has significantly increased lobster production in India. Government initiatives and favorable policies supporting fisheries and aquaculture development have created a conducive environment for market expansion, which represent one of the key India lobster market trends. According to the report published by the Press Information Bureau, India's fisheries sector is the 3rd largest fish producer and 2nd in aquaculture that received Rs. 2,584.50 crore for FY 2024-25 a 15% increase. The Pradhan Mantri Matsya Sampada Yojana aims to double fisheries exports to ₹1 lakh crore and boost aquaculture productivity from 3 to 5 tonnes per hectare. The country's strategic coastal location facilitates efficient export opportunities to international markets increasing revenue streams. Technological innovations in processing and cold chain logistics ensure product quality and reduce post-harvest losses, thus strengthening the overall lobster market in India.

India Lobster Market Trends:

Export Market Expansion

The exports of lobsters from India are constantly increasing considering the rising demand from key markets like the United States, China, and Europe. According to the industry reports, India's seafood exports reached a record $7.38 billion (1,781,602 metric tons) in FY24. The US remained the top importer at $2.55 billion followed by China ($1.38 billion) and Japan. Overall exports improved by 2.67% in quantity. Rising global demand for premium seafood along with India's competitive pricing drives this growth. Advanced freezing and packaging technologies enhance the logistics of cold chain thereby delivering fresh lobsters to international buyers. Government support through streamlined export policies and trade agreements has reduced bureaucratic barriers making it easier for exporters to access lucrative markets. Focus on meeting global quality standards and diversifying export destinations continues to strengthen India's position in the international lobster trade.

Rising Demand for Live Lobsters

There is a significant growth in the demand for live lobsters in both domestic and export markets which is driven by consumer preference for fresh and high-quality seafood. Live lobsters are in high demand in China and Southeast Asia where culinary traditions focus on fresh ingredients often displayed live before preparation. India's proximity to these markets and the advancement in live transport technology have enabled exporters to meet this demand effectively. Enhanced aquaculture practices ensure continuous supply of fresh live lobsters and improved logistics involving aerated containers and real-time tracking systems maintains lobster vitality when transported. In turn, such demand is supporting the profitability levels of producers as well as exporters. These factors are creating a positive India lobster market outlook, thus strengthening the industry's growth trajectory.

Government Support

The government has developed several initiatives in support of fisheries and aquaculture thereby contributing to the development of the lobster market. For instance, the Indian government is advancing fisheries and aquaculture through initiatives like the PM Matsya Sampada Yojana aimed at doubling fish production and the Fisheries and Aquaculture Infrastructure Development Fund for infrastructure enhancements. The National Fisheries Digital Platform promotes innovation and market access alongside training programs to boost skills and sustainability. The financial assistance extended to aquaculture practices such as cage farming and hatchery operations encourages sustainable production and relieves pressure on wild stocks. The improvement of infrastructure such as cold storage and transport facilities ensures better handling and preservation of lobsters for both domestic and export markets. Simplified export procedures and improved logistics capabilities have further streamlined access to international markets allowing producers to expand their reach and boost profitability while supporting coastal livelihoods. These measures are instrumental in driving India lobster market growth.

India Lobster Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India lobster market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on species, weight, product type, and distribution channel.

Analysis by Species:

- American Lobster

- Spiny Lobster

- Rock Lobster

- European Lobster

American lobster dominates the market due to its high demand in both domestic and international markets. This species is known for its larger size, meaty claws and superior taste making it a preferred choice among consumers and chefs. Its adaptability to diverse culinary applications further enhances its appeal. The robust supply chain and effective cold storage infrastructure have ensured consistent availability supporting its market share. Increased global demand for high-end seafood products has also added to the increasing demand for American lobster primarily in luxury food markets and for export solidifying its leadership position in the lobster category.

Analysis by Weight:

- 0.5 – 0.75 lbs

- 0.76 – 3.0 lbs

- Over 3 lbs

The 0.5–0.75 lbs weight category holds the largest share in the Indian lobster market due to its ideal size for both domestic and export markets. This weight range is highly preferred by consumers and restaurants for its balance of meat quality and ease of preparation. Export markets particularly in Asia and Europe value lobsters in this range for their suitability in various culinary dishes. Aquaculture practices in India are optimized to produce lobsters within this weight bracket ensuring steady supply. The manageable size also facilitates better packaging, transportation and presentation making it a dominant segment in the lobster market.

Analysis by Product Type:

- Whole Lobster

- Lobster Tail

- Lobster Meat

- Lobster Claw

Whole lobster is the leading product type in the market mainly due to consumer preference for freshness and versatility. The whole presentation appeals to both high-end restaurants and home chefs allowing flexibility in culinary applications while ensuring maximum meat retention. This product type is especially popular in export markets where live or frozen whole lobsters are in high demand especially in regions valuing fresh seafood like Asia and Europe. Enhanced cold chain logistics and packaging solutions ensure that whole lobsters reach their destination without losing quality which further increases their demand. Premium pricing of whole lobsters also contributes to a significant share of market revenue.

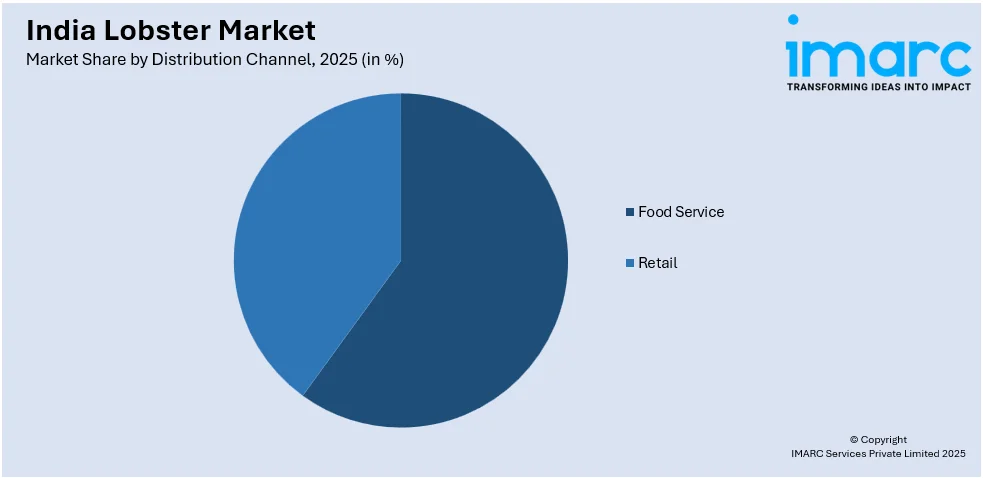

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Food Service

- Retail

Food service is the largest distribution channel in the Indian lobster market as the demand for higher-value seafood products in hotels, higher-end restaurants and catering services is increasing. Lobster is often served as a luxury item in higher-priced menus focusing on catering to high-income consumers and tourists. Urbanization as well as changes in the dining habits of the people increase its sales within the restaurants. The growing popularity of seafood in urban dining has significantly boosted India lobster market demand. The industry also benefits from well-established supply chains that ensure availability of fresh or frozen lobster which ensures consumers' expectations are met.

Regional Analysis:

- South India

- North India

- West and Central India

- East India

South India leads the Indian lobster market due to its extensive coastline and well-established fishing and aquaculture industries. The region benefits from favorable climatic conditions and abundant natural resources supporting large-scale lobster farming and wild capture. Coastal states in South India are also hubs for seafood processing and export contributing significantly to the market. The proximity to major export destinations in Southeast Asia further strengthens its position. High domestic consumption driven by seafood’s cultural significance and strong presence in local cuisines adds to its dominance. Government initiatives in fisheries development and aquaculture further bolster South India's leadership in the lobster market.

Competitive Landscape:

The Indian lobster market is characterized by intense competition among producers, exporters and distributors driven by rising domestic and international demand. Key players focus on improving production efficiency through advanced aquaculture techniques and sustainable practices to ensure a consistent supply of high-quality lobsters. Exporters leverage enhanced cold chain logistics and technological advancements in packaging to maintain product quality for global markets. The market also sees competition from international suppliers necessitating competitive pricing and adherence to global standards. Regional producers often compete on scale and proximity to ports giving them an edge in export logistics. The fragmented nature of the industry allows smaller producers to cater to niche markets adding diversity to the competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the India lobster market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, Burger & Lobster launched its first-ever pop-up in India at Shangri-La Eros New Delhi. Led by Chef Brian Bennet Chong the menu features highlight like the Mayfair Burger and Lobster Roll offering a unique dining experience in an elegant setting.

- In November 2024, Captain Fresh a Tiger Global-backed B2B seafood chain from India aims for profitability this fiscal year with projected revenue of $500-550 million up from $168 million in FY24. The company plans an IPO in FY26 and acquired two seafood firms to strengthen its global supply chain.

- In December 2023, Pravesh Seafood announced the establishment of a significant seafood processing plant in Maharashtra, aiming to enhance its production capacity by 50 tons per day and meet growing market demand. The facility will focus on processing various seafood products, with an estimated cost of INR 18.53 Crores. It aligns with the company's vision to expand its footprint in the seafood industry while adhering to environmental standards.

India Lobster Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | American Lobster, Spiny Lobster, Rock Lobster, European Lobster |

| Weights Covered | 0.5 – 0.75 lbs, 0.76 – 3.0 lbs, Over 3 lbs |

| Product Types Covered | Whole Lobster, Lobster Tail, Lobster Meat, Lobster Claw |

| Distribution Channels Covered | Food Service, Retail |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India lobster market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India lobster market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India lobster industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lobster market was valued at USD 284.3 Million in 2025.

Key drivers include the rising domestic demand fueled by increasing disposable incomes, advancements in aquaculture practices, improved cold chain logistics, and strong export demand to markets like the U.S. and China. Government support for fisheries and aquaculture also boosts market growth.

The India lobster market is projected to exhibit a CAGR of 4.80% during 2026-2034, reaching a value of USD 431.8 Million by 2034.

The 0.5–0.75 lbs weight category accounted for the largest share driven by its high preference in both domestic and export markets.

Yes, lobsters are widely available in India, sourced from both aquaculture farms and wild capture fisheries, especially along the coasts.

India primarily has four types of lobsters: American lobster, Spiny lobster, Rock lobster, and European lobster.

Yes, lobster is consumed in India, particularly in coastal regions and urban areas where seafood is a staple or part of luxury dining.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)