India Life Insurance Market Size, Share, Trends and Forecast by Type, Premium Type, Premium Range, Provider, Mode of Purchase, and Region, 2025-2033

India Life Insurance Market Overview:

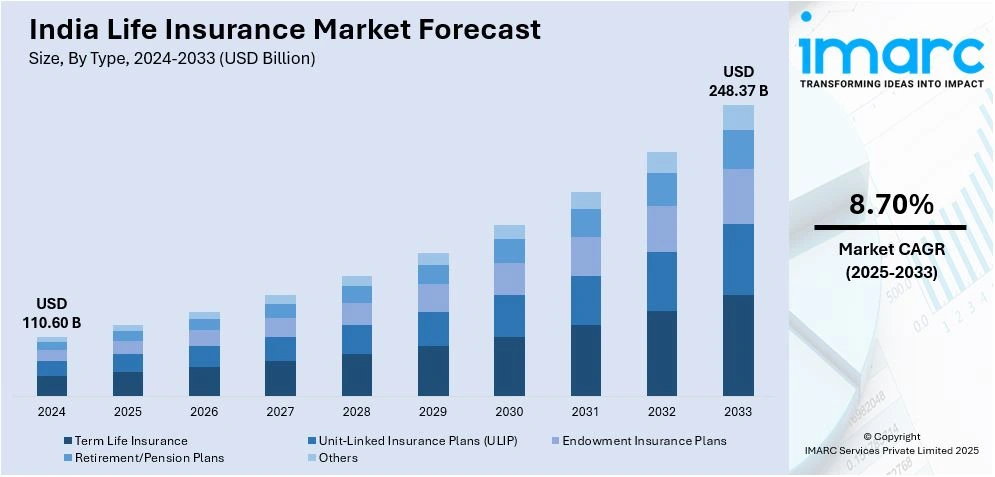

The India life insurance market size reached USD 110.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 248.37 Billion by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. The market is growing with rising financial literacy, digital penetration, term and pension plan demand, government support, and rural penetration, fueled by technological innovation, regulatory encouragement, and changing consumer preferences for safe financial planning and risk protection.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 110.60 Billion |

| Market Forecast in 2033 | USD 248.37 Billion |

| Market Growth Rate 2025-2033 | 8.70% |

India Life Insurance Market Trends:

Rising Adoption of Digital Insurance Platforms

The life insurance business in India is undergoing a digital shift, fueled by deepening smartphone penetration, enhanced internet connectivity, and the desire for convenience among consumers. Players are using artificial intelligence (AI), machine learning (ML), and data analytics to personalize policies, automate claims settlement, and enhance customer care. Mobile apps and online portals are facilitating hassle-free purchase of policies, renewals, and payments of premiums, minimizing reliance on intermediaries. Growth in digital-only insurers is also intensifying competition, making traditional companies go tech-enabled. According to the reports, in October 2024, Jio Financial Services initiated talks with Allianz SE to set up life and general insurance businesses in India, as Allianz considers pulling out of Bajaj Group alliances, marking growing competition in the digital insurance market. Moreover, regulators are even nudging them to go digital by implementing e- know your customer (KYC) and web-based policy check processes, eliminating paperwork and increasing security. Online platforms are also where consumers' hearts now lie, particularly among younger generations, as they are transparent, affordable, and comparison friendly. With growing confidence in online channels, the industry is seeing investments in cybersecurity and data protection swell, providing an efficient and safe digital insurance marketplace.

To get more information on this market, Request Sample

Expanding Demand for Term and Pension Plans

Shifting demographics, increasing life expectancy, and changing financial consciousness are driving demand for term insurance and pension schemes in India. Consumers are highly focusing on financial security, especially post-pandemic, resulting in a boom in demand for high-coverage, affordable term plans. Retirement planning is also picking up pace, with pension and annuity plans seeing greater adoption as people look for financial security after retirement. For instance, in February 2025, LIC introduced the Smart Pension Plan, a one-time premium, non-participating, non-linked pension policy featuring flexible annuity choices for single and joint life annuities to provide retirees with a secure and stable post-retirement income. Further, government moves encouraging pension schemes and tax exemption on life insurance policies are additionally inducing participation. Workers in the gig economy, freelance professionals, and small and medium-sized entrepreneurs are realizing the need for solo financial planning, fueling demand for tailored pension plans. Insurers are launching creative, adjustable policies with highlights such as assured income benefits, longevity cover, and inflation-proof payments. With increasing financial literacy in urban and semi-urban areas, knowledge of life insurance as a risk-reduction tool is propelling the market growth.

Growth of Microinsurance and Rural Penetration

Microinsurance and rural life insurance are emerging as strong growth drivers in India, serving the protection requirement of low-income segments. Owing to an enormous percentage of the population remaining uninsured or underinsured, cost-effective life insurance offerings customized for the rural and semi-urban economies are becoming increasingly popular. Simple products with cheap premiums, minimized documentation needs, and ease in paying premiums are becoming highly viable for low-income segments. Government-sponsored financial inclusion initiatives, rural outreach programs, and collaborations with banking entities and cooperatives are enabling broader distribution. Growing penetration of mobile banking and fintech services is also making policy issuance and claim settlements easier in remote locations. With insurance companies boosting their rural reach through local agents and online platforms, awareness of the advantages of life coverage is enhancing. The sustained focus on inclusive financial security is likely to propel long-term growth in this segment.

India Life Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, premium type, premium range, provider, and mode of purchase.

Type Insights:

- Term Life Insurance

- Unit-Linked Insurance Plans (ULIP)

- Endowment Insurance Plans

- Retirement/Pension Plans

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes term life insurance, unit-linked insurance plans (ULIP), endowment insurance plans, retirement/pension plans, and others.

Premium Type Insights:

.webp)

- Regular

- Single

A detailed breakup and analysis of the market based on the premium type have also been provided in the report. This includes regular and single.

Premium Range Insights:

- Low

- Medium

- High

The report has provided a detailed breakup and analysis of the market based on the premium range. This includes low, medium, and high.

Provider Insights:

- Insurance Companies

- Insurance Agents/Brokers

- Others

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes insurance companies, insurance agents/brokers, and others.

Mode of Purchase Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode of purchase. This includes online, and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Life Insurance Market News:

- In January 2025, Bandhan Life Insurance joined hands with Policybazaar to introduce the iInvest Pension Plan, a market-linked pension plan. Providing with flexibility in investment choices and conversion of annuity at maturity, the plan is geared up to make retirement savings more accessible with no medical tests, tax advantages, and loyalty bonus for lifetime financial security.

- In October 2023, India's Insurance Regulatory and Development Authority (IRDAI) launched Bima Sugam, a digital insurance marketplace that aims to make policy buying, claims, and renewals easier. The platform is intended to increase accessibility, lower paperwork, and foster transparency, which will speed up digital adoption and boost insurance penetration in both life and general insurance segments.

India Life Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Term Life Insurance, Unit-Linked Insurance Plans (ULIP), Endowment Insurance Plans, Retirement/Pension Plans, Others |

| Premium Types Covered | Regular, Single |

| Premium Ranges Covered | Low, Medium, High |

| Providers Covered | Insurance Companies, Insurance Agents/Brokers, Others |

| Mode of Purchase Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India life insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India life insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India life insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The life insurance market in India was valued at USD 110.60 Billion in 2024.

The India life insurance market is projected to exhibit a CAGR of 8.70% during 2025-2033, reaching a value of USD 248.37 Billion by 2033.

As more people are recognizing the importance of financial protection against unforeseen events, the demand for life insurance policies continues to rise across both urban and rural areas. Government initiatives like tax benefits are also supporting greater adoption. The expansion of digital platforms has made policy comparison, purchase, and management easier and more transparent, attracting younger, tech-savvy customers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)