India Leather Goods Market Size, Share, Trends and Forecast by Product, Material, Price, Distribution Channel, and Region, 2025-2033

India Leather Goods Market Overview:

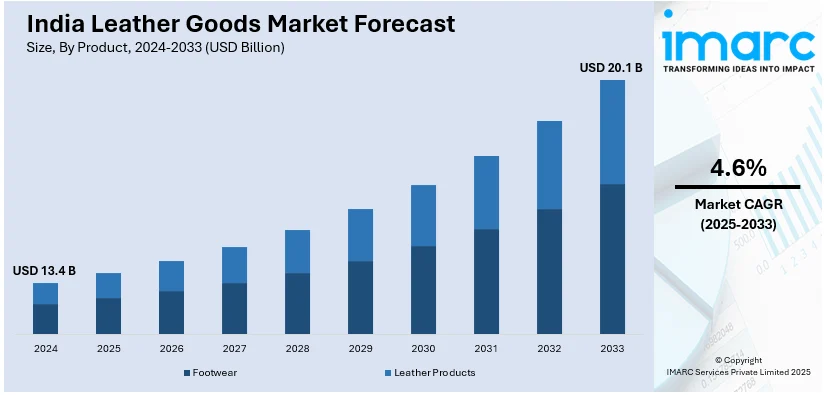

The India leather goods market size reached USD 13.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.6% during 2025-2033. The market is expanding due to rising demand for premium products, increasing exports and growing consumer preference for sustainable and customized leather items. Advancements in leather processing, expanding e-commerce sales and the influence of global fashion trends further drive market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.4 Billion |

| Market Forecast in 2033 | USD 20.1 Billion |

| Market Growth Rate 2025-2033 | 4.6% |

India Leather Goods Market Trends:

Rising Demand for Premium and Luxury Leather Goods

The demand for premium and luxury leather goods in India is increasing as consumers prioritize high-quality craftsmanship, exclusivity and brand recognition. Increasing travel, social media influence and aspirational purchasing behavior further drive the demand for premium leather products strengthening India leather goods market share. In line with this, rising disposable income, urbanization and exposure to international fashion trends contribute to the growing preference for high-end handbags, footwear, wallets and belts. Consumers are shifting toward luxury brands that offer superior materials and intricate designs. For instance, in June 2023, GARRTEN launched a luxury leather accessories collection featuring stylish backpacks and wallets for men and women. The range combines functionality with elegance and includes full-grain and saffiano leather in various colors. Handcrafted by local artisans the brand emphasizes quality and sustainability catering to the growing Indian leather market. As organized retail expands and global brands enter the Indian market accessibility to premium leather products is improving. E-commerce platforms and direct-to-consumer sales further support market penetration by offering personalized designs and limited-edition collections. The rise of sustainable luxury with brands focusing on ethically sourced leather and ecofriendly production is also fueling India leather goods market growth.

To get more information on this market, Request Sample

Increasing Exports of Indian Leather Products

India's leather industry is witnessing strong export growth driven by increasing global demand for high-quality leather goods particularly in Europe and North America. Indian manufacturers benefit from skilled craftsmanship, cost-effective production and a well-established supply chain. Footwear, handbags, wallets and finished leather products from India are gaining traction in international markets due to their superior quality and competitive pricing. Additionally, free trade agreements and government initiatives such as the Make in India program and export incentives further boost the country's leather exports. According to the report published by IBEF, India's leather industry significantly contributes to the economy, employing 4.42 million people and accounting for 13% of global leather production. In 2024-25, exports reached $1.152 billion, with footwear comprising 51.9%. The U.S. leads imports at $240.35 million followed by Germany ($130.21 million) and the UK ($105.68 million). Sustainability is also becoming a key factor with international buyers preferring ecofriendly and ethically sourced leather products. Indian exporters are adapting to these trends by implementing sustainable tanning and production practices. As demand for premium leather goods grows globally India's position as a leading supplier strengthens shaping a positive India leather goods market outlook.

India Leather Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, material, price, and distribution channel.

Product Insights:

- Footwear

- Military Shoes

- Casual Shoes

- Formal Shoes

- Sports Shoes

- Others

- Leather Products

- Upholstery

- Luggage

- Accessories

- Clothing and Apparel

- Bags, Wallets, and Purses

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes footwear (military shoes, casual shoes, formal shoes, sports shoes and others) and leather products (upholstery, luggage, accessories, clothing and apparel, bags, wallets, and purses and others).

Material Insights:

- Genuine Leather

- Top-grain Leather

- Split-grain Leather

- Synthetic Leather

- PU-Based Leather

- PVC-Based Leather

- Bio-Based Leather

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes genuine leather (top-grain leather and split-grain leather) and synthetic leather (PU-based leather, PVC-based leather and bio-based leather).

Price Insights:

- Premium Products

- Mass Products

A detailed breakup and analysis of the market based on the price have also been provided in the report. This includes premium products and mass products.

Distribution Channel Insights:

- Clothing and Sportswear Retailers

- Departmental Stores

- Supermarkets and Hypermarkets

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes clothing and sportswear retailers, departmental stores, supermarkets and hypermarkets, online stores and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Leather Goods Market News:

- In December 2024, the Indian Government announced its plans to launch a leather fashion training center in Kanpur’s Leather Cluster, funded by Exim Bank, to revitalize the local industry. The initiative will create job opportunities for youth, supporting over 2,500 SMEs and 200,000 jobs, generating Rs 9,000 crore annually, primarily through exports.

- In October 2024, Valentino launched an India-exclusive edition of its VSLING bag, featuring intricate hand embroidery on a premium leather base and limited to just 25 pieces. Available in Mumbai and New Delhi since October 24, 2024, each bag requires 18.5 hours of craftsmanship, showcasing a blend of Italian design and Indian artisanal tradition.

India Leather Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Materials Covered |

|

| Prices Covered | Premium Products, Mass Products |

| Distribution Channels Covered | Clothing and Sportswear Retailers, Departmental Stores, Supermarkets and Hypermarkets, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India leather goods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India leather goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India leather goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The leather goods market in India was valued at USD 13.4 Billion in 2024.

The India leather goods market is projected to exhibit a CAGR of 4.6% during 2025-2033, reaching a value of USD 20.1 Billion by 2033.

The market is driven by rising demand for durable accessories, changing fashion preferences, and increased brand consciousness. Consumers are seeking versatile and long-lasting products, especially in bags, wallets, and belts. Domestic manufacturing capabilities and interest in handcrafted styles also support growth, while urban shoppers increasingly view leather goods as both practical essentials and style statements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)