India Laundry Detergent Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, and Region, 2025-2033

India Laundry Detergent Market Overview:

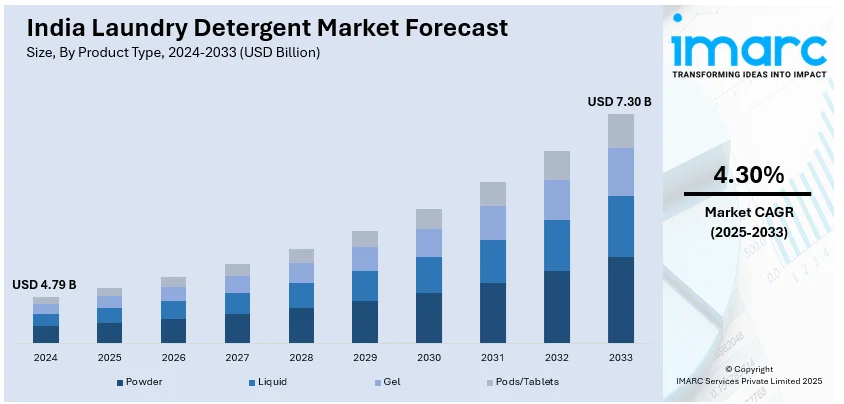

The India laundry detergent market size reached USD 4.79 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.30 Billion by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. The market is expanding due to rising urbanization, increasing washing machine penetration and growing demand for liquid and eco-friendly detergents. Additionally, competitive pricing, premium product offerings and rural market expansion further contribute to the India laundry detergent market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.79 Billion |

| Market Forecast in 2033 | USD 7.30 Billion |

| Market Growth Rate (2025-2033) | 4.30% |

India Laundry Detergent Market Trends:

Rise of Eco-Friendly and Bio-Based Detergents

The rise of ecofriendly and bio-based detergents in India is driven by increasing environmental awareness, regulatory initiatives and changing consumer preferences. With growing concerns about water pollution, harmful chemicals and skin allergies consumers are shifting toward biodegradable, non-toxic and plant-based detergents that minimize environmental impact. Many brands are formulating phosphate-free, sulfate-free and enzyme-based detergents using natural surfactants like soap nuts, coconut extracts and plant-derived cleaning agents. Government regulations promoting sustainable and green cleaning solutions further support this trend with companies investing in eco-certifications and recyclable packaging. Startups and established brands alike are expanding their product lines with organic and hypoallergenic detergents targeting health-conscious and sustainability-focused consumers. This shift is positively impacting India’s laundry detergent market share as eco-conscious consumers increasingly choose green alternatives, encouraging more brands to innovate and expand in the segment. Leading brands are actively expanding their eco-friendly detergent portfolios, leveraging plant-based formulations and sustainable practices to cater to environmentally conscious consumers. For instance, in December 2024, Nirjay Impex Pvt Ltd announced its partnership with Equator Pure Nature to launch the PiPPER STANDARD® line of natural and ecofriendly products in India. The partnership aims to meet growing consumer demand for sustainability with an initial focus on laundry and home care items followed by personal care products after registration. As demand rises, innovation in water-efficient, low-foam and chemical-free formulations is expected to reshape the detergent market making ecofriendly options a mainstream choice in Indian households.

To get more information on this market, Request Sample

Surge in E-commerce and D2C Sales

The India laundry detergent market is witnessing a surge in e-commerce and direct-to-consumer (D2C) sales driven by increasing internet penetration, digital payment adoption and changing shopping preferences. According to the report published by IBEF, India's e-commerce industry is projected to hit US$ 325 billion by 2030. The sector achieved US$ 14 billion in GMV during the 2024 festive season a 12% increase. Online grocery sales may reach US$ 26.93 billion by 2027 while B2B marketplaces could reach US$ 200 billion by 2030. Consumers are increasingly purchasing detergents online through platforms like Amazon, Flipkart and brand-owned websites benefiting from bulk discounts, subscription models and doorstep delivery. Leading detergent brands are enhancing their D2C presence offering exclusive online variants, ecofriendly packaging and customized solutions. The convenience of auto-replenishment services and attractive promotional offers is further boosting online detergent sales reshaping market dynamics as traditional retail faces competition from the fast-growing digital segment. Additionally, regional brands and startups are leveraging social media marketing, influencer collaborations and AI-driven personalization to strengthen their online footprint making ecommerce a critical sales channel for the future of India’s detergent market. These factors are collectively creating a positive India laundry detergent market outlook.

India Laundry Detergent Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, distribution channel and application.

Product Type Insights:

- Powder

- Liquid

- Gel

- Pods/Tablets

The report has provided a detailed breakup and analysis of the market based on the product type. This includes powder, liquid, gel and pods/tablets.

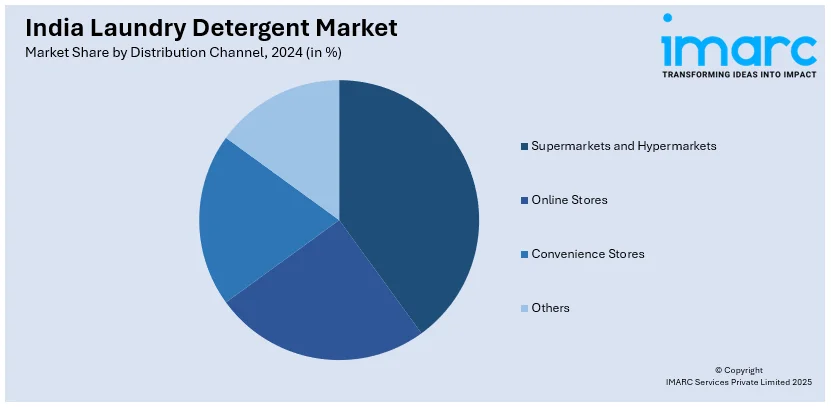

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Online Stores

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, online stores, convenience stores and others.

Application Insights:

- Industrial

- Household

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial and household.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Laundry Detergent Market News:

- In December 2023, Godrej Consumer Products launched ‘Godrej Fab’, a new liquid detergent aimed at mass market consumers in South India. The company aims to capitalize on growing demand for liquid detergents, particularly in southern markets, while focusing on enhancing distribution capabilities and market development.

- In November 2023, Hindustan Unilever announced its plans to pilot the production of near-zero emissions synthetic soda ash in India, which is an essential ingredient in laundry powder. This initiative, in collaboration with TFL and Fertiglobe, aims to significantly reduce greenhouse gas emissions by utilizing green ammonia and renewable energy. This effort supports Unilever's commitment to achieving net-zero emissions by 2039.

India Laundry Detergent Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Powder, Liquid, Gel, Pods/Tablets |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Online Stores, Convenience Stores, Others |

| Applications Covered | Industrial, Household |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India laundry detergent market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India laundry detergent market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India laundry detergent industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India laundry detergent market reached USD 4.79 Billion in 2024.

The India laundry detergent market is expected to grow to USD 7.30 Billion by 2033, with a CAGR of 4.30% during 2025-2033.

Growth is driven by increasing urbanization, rising disposable incomes, and growing consumer awareness about hygiene and cleanliness. The shift towards premium and eco-friendly detergent products, combined with expansion of organized retail and e-commerce channels, is boosting demand. Additionally, innovations in detergent formulations, such as biodegradable and concentrated products, are attracting environmentally conscious consumers. The rise in nuclear families and working professionals is also fueling convenience-focused detergent usage, contributing to steady market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)