India Lactic Acid Market Size, Share, Trends and Forecast by Raw Material, Form, Application, and Region, 2025-2033

India Lactic Acid Market Overview:

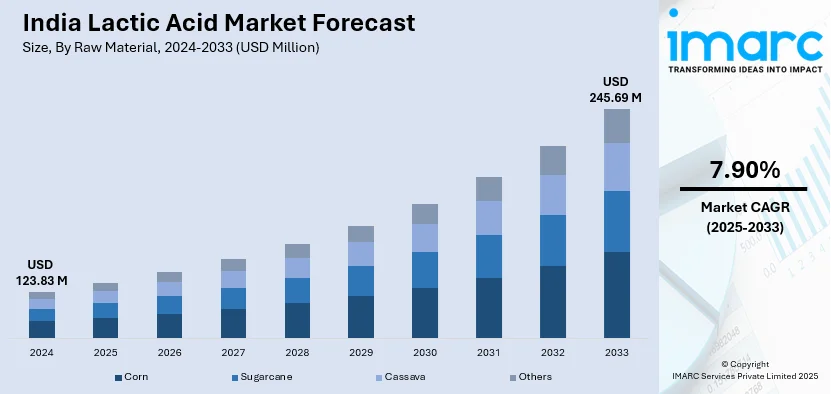

The India lactic acid market size reached USD 123.83 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 245.69 Million by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. The market is driven by rising demand for natural and organic products in food, pharmaceuticals, and personal care, alongside increasing health consciousness. Additionally, the expansion of the biodegradable plastics industry, supported by government regulations and sustainability initiatives, is fueling the India lactic acid market share as industries adopt eco-friendly alternatives to traditional plastics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 123.83 Million |

| Market Forecast in 2033 | USD 245.69 Million |

| Market Growth Rate 2025-2033 | 7.90% |

India Lactic Acid Market Trends:

Increasing Demand for Natural and Organic Products

The rising consumer preference for natural and organic products is majorly driving the India lactic acid market growth. With growing health consciousness and awareness about the harmful effects of synthetic chemicals, consumers are shifting towards clean-label and eco-friendly alternatives. Organic exports from India are expected to reach Rs 20,000 Crore (approximately USD 2,500 Million) by 2028 as against the current levels of Rs 5,000-6,000 Crore (approximately USD 625 Million-USD 750 Million), a 3 to 3.5 fold jump. The country is a global leader in organic farming, with over 1.7 million hectares of organic-certified land and 1.4 million organic farmers. Among the major export items are organic cereals, pulses, oilseed, spices, tea, and coffee, and they are in great demand in foreign markets, too, namely the USA, EU, and Japan. Lactic acid, being a natural organic compound, is widely used in food and beverages, pharmaceuticals, and personal care industries. In the food sector, it serves as a natural preservative, flavor enhancer, and pH regulator, aligning with the demand for minimally processed foods. Similarly, in cosmetics, lactic acid is valued for its moisturizing and exfoliating properties, making it a key ingredient in skincare products. This trend is further supported by government initiatives promoting organic farming and sustainable practices, which are expected to drive the production and consumption of lactic acid in India.

To get more information on this market, Request Sample

Expansion of Biodegradable Plastics Industry

The growing focus on sustainable packaging solutions, particularly biodegradable plastics is creating a positive India lactic acid market outlook. Lactic acid is a primary raw material for polylactic acid (PLA), a biodegradable polymer used to manufacture eco-friendly plastics. With increasing environmental concerns and stringent regulations against single-use plastics, industries are adopting PLA-based packaging to reduce their carbon footprint. The Indian government’s push for a plastic-free economy, coupled with initiatives including the Swachh Bharat Mission, has accelerated the demand for biodegradable alternatives. Additionally, the packaging industry’s shift towards sustainable materials in sectors such as food, beverages, and e-commerce is further propelling the lactic acid market. This trend is expected to continue as businesses and consumers alike prioritize environmental sustainability, creating lucrative opportunities for lactic acid producers in India.

India Lactic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on raw material, form, and application.

Raw Material Insights:

- Corn

- Sugarcane

- Cassava

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes corn, sugarcane, cassava, and others.

Form Insights:

- Liquid

- Solid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid.

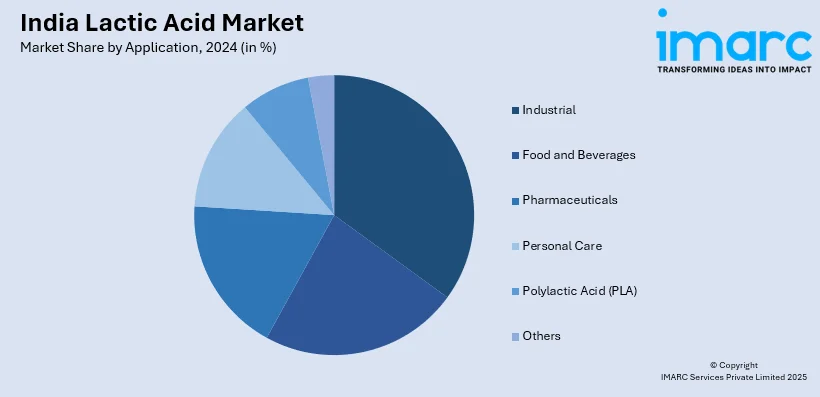

Application Insights:

- Industrial

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Polylactic Acid (PLA)

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes industrial, food and beverages, pharmaceuticals, personal care, polylactic acid (PLA), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Lactic Acid Market News:

- February 22, 2025: Balrampur Chini Mills (BCML) established the foundation for the country's first Polylactic Acid (PLA) biopolymer plant in Kumbhi, Uttar Pradesh, with an investment of Rs. 2,850 Crore (approximately USD 356.25 Million). With an annual production capacity of 80,000 tonnes, this plant will produce fully compostable PLA using renewable energy sources as an environmentally friendly alternative to single-use plastics. This move strengthens India's share in the lactic acid market and aligns with the country's pledge to eco-friendly and sustainable industrialization.

- October 16, 2024: Praj Industries set up India's first biopolymer demonstration plant using indigenous Polylactic Acid (PLA) technology at Jejuri Pune. It was officially opened on October 13, 2024, and is focusing on further promoting the transition towards bio-based products and a circular economy. This development represents a crucial advancement for the expanding Indian lactic acid market, fostering sustainable alternatives to traditional plastics.

India Lactic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Corn, Sugarcane, Cassava, Others |

| Forms Covered | Liquid, Solid |

| Applications Covered | Industrial, Food and Beverages, Pharmaceuticals, Personal Care, Polylactic Acid (PLA), Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India lactic acid market performed so far and how will it perform in the coming years?

- What is the breakup of the India lactic acid market on the basis of raw material?

- What is the breakup of the India lactic acid market on the basis of form?

- What is the breakup of the India lactic acid market on the basis of application?

- What is the breakup of the India lactic acid market on the basis of region?

- What are the various stages in the value chain of the India lactic acid market?

- What are the key driving factors and challenges in the India lactic acid market?

- What is the structure of the India lactic acid market and who are the key players?

- What is the degree of competition in the India lactic acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India lactic acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India lactic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India lactic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)