India Laboratory Automation Market Size, Share, Trends and Forecast by Type, Equipment and Software Type, End User, and Region, 2025-2033

Market Overview:

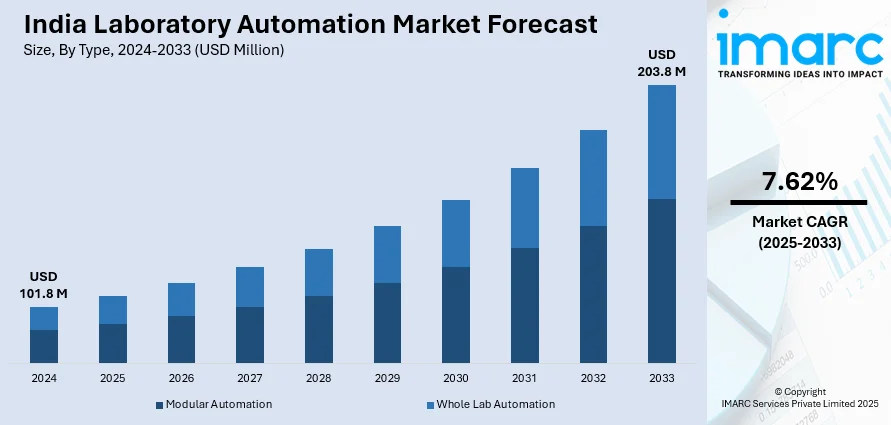

The India laboratory automation market size reached USD 101.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 203.8 Million by 2033, exhibiting a growth rate (CAGR) of 7.62% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 101.8 Million |

| Market Forecast in 2033 | USD 203.8 Million |

| Market Growth Rate (2025-2033) | 7.62% |

Laboratory automation is a process that involves the use of various devices and software to increase the efficiency of scientific research in laboratories through automated systems. These systems consist of robots, conveyor systems, machine vision, and computer hardware and software. They provide safety and accuracy of sample management and assist in the real-time analysis by eliminating human errors. Laboratory automation involves multiple steps like storing, sorting, decapping, recapping, retrieval, accessioning, and centrifugation, which save time and improve the efficacy of the research procedure.

To get more information of this market, Request Sample

The India laboratory automation market is primarily driven by the improving healthcare facilities and the increasing number of medical centers with advanced laboratories. The rising healthcare expenditure is also propelling the growth of the market. Besides this, the technological revolution in the biomedical and pharmaceutical sectors has led to the adoption of modular laboratories, which offer a wide range of economical and reliable solutions. Laboratory automation also facilitates accurate diagnosis, personnel safety, smaller volume reagents, and sample requirement. Along with this, the increasing drug discoveries and the growing number of clinical studies have positively impacted the market growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India laboratory automation market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type, equipment and software type and end user.

Breakup by Type:

- Modular Automation

- Whole Lab Automation

Breakup by Equipment and Software Type:

- Automated Clinical Laboratory Systems

- Workstations

- LIMS (Laboratory Information Management Systems)

- Sample Transport Systems

- Specimen Handling Systems

- Storage Retrieval Systems

- Automated Drug Discovery Laboratory Systems

- Plate Readers

- Automated Liquid Handling Systems

- LIMS (Laboratory Information Management Systems)

- Robotic Systems

- Storage Retrieval Systems

- Dissolution Testing Systems

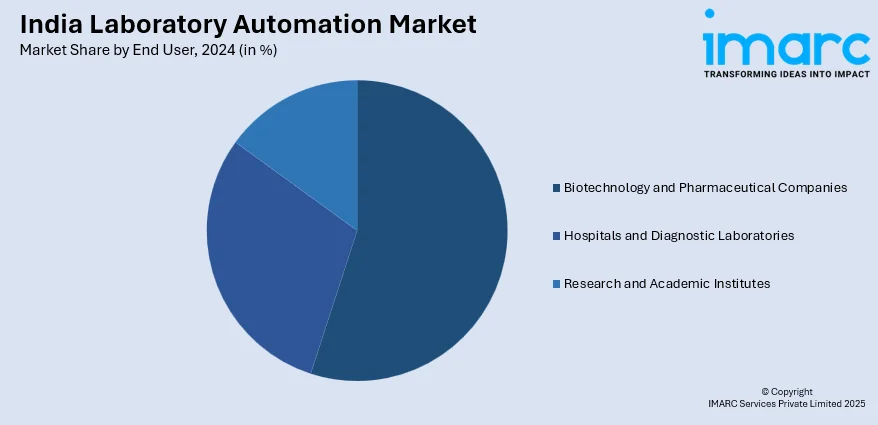

Breakup by End User:

- Biotechnology and Pharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Type, Equipment and Software Type, End User, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India laboratory automation market was valued at USD 101.8 Million in 2024.

We expect the India laboratory automation market to exhibit a CAGR of 7.62% during 2025-2033.

The increasing drug discoveries, growing number of clinical studies, and the rising deployment of laboratory automation, as it facilitates accurate diagnosis, personnel safety, smaller volume reagents, and sample requirement, are primarily driving the India laboratory automation market.

The sudden outbreak of the COVID-19 pandemic has led to the escalating adoption of laboratory automation, as it provides safety and accuracy of sample management for the coronavirus infection and assists in the real-time analysis by eliminating human errors.

Based on the type, the India laboratory automation market can be categorized into modular automation and whole lab automation. Currently, modular automation accounts for the majority of the global market share.

Based on the equipment and software type, the India laboratory automation market has been segregated into automated clinical laboratory systems and automated drug discovery laboratory systems, where automated clinical laboratory systems currently hold the largest market share.

Based on the end user, the India laboratory automation market can be bifurcated into biotechnology and pharmaceutical companies, hospitals and diagnostic laboratories, and research and academic institutes. Among these, biotechnology and pharmaceutical companies exhibit a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)